- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Finance for SAP S/4HANA Cloud 2208

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

08-02-2022

8:04 AM

In this blog I would like to share my selection of finance innovations with you in the brand new release of SAP S/4HANA Cloud 2208:

In addition my colleagues Katrin Deissner plans to provide a release blog on selected innovations in the space of GRC.

https://youtu.be/-UnwPbTLzak

Video 1: Release Video for Finance in SAP S/4HANA Cloud 2208

In-house Banking for Corporations

In-house banking for S/4HANA Cloud for advanced payment management is an embedded capability of advanced payment management that drives a most efficient payment factory solution. In-house banking allows you to create an internal bank on the corporate side. Within this internal bank, subsidiaries that are part of the group can open or maintain internal bank accounts. From the subsidiary perspective, these accounts are house bank accounts and can be used in the same way as the external house bank accounts. You can centralize and streamline all payment transactions within the group, such as intercompany payments, payments on behalf of, and central incoming payments, for example, from external cash pools. This minimizes the number of external bank accounts and saves bank connectivity costs. You can settle intercompany payments without using cash. And the solution allows you to monitor all payments and the cash situation centrally with user friendly dashboards.

Value Proposition

With in-house banking, you can:

Capabilities

Demo 1: Account Creation

Demo 2: Bank Account Management Integration

Demo 3: Payment Processes

Demo 4: Analytical Apps

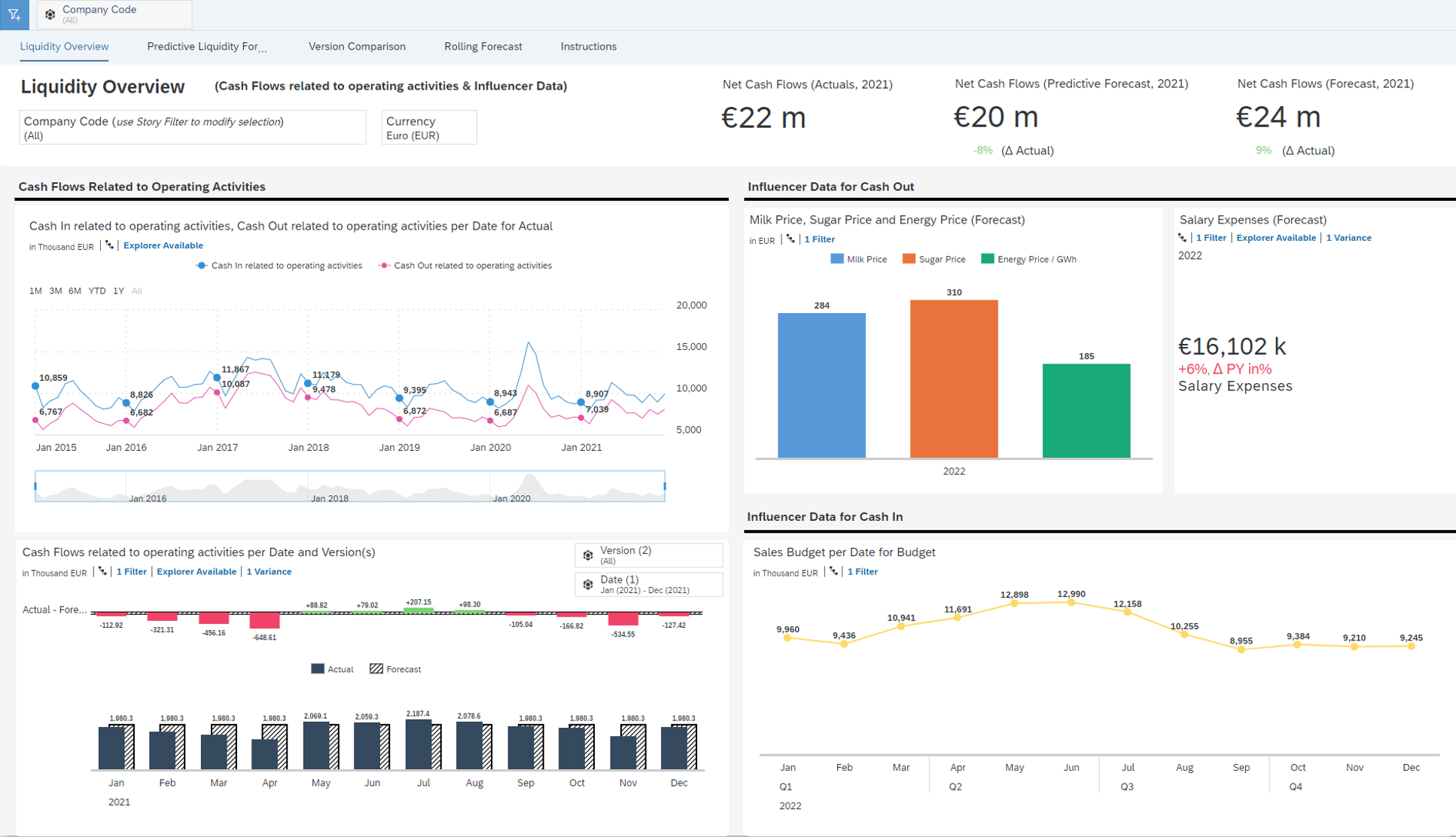

Predictive Liquidity Planning (SAP Analytics Cloud Release 2022.3)

Predictive Liquidity Planning is a tool that can automatically predict future long term (next 12 months) operative cashflows based on existing planning and historical data.

Value Proposition

Figure 1: Predictive Liquidity Planning Showing Influencers

Capabilities

Universal Parallel Accounting - Alternative Fiscal Years Variants

Companies operating in different countries/regions may be legally required to use different fiscal years for their local reporting and for their central reporting on group level. The foundation that is provided by universal parallel accounting now enables you to fulfill such reporting requirements: In addition to the fiscal year variant that is assigned to the leading ledger, you can now assign alternative fiscal year variants to the company codes of the non-leading ledger. You then have the parallel representation of different sets of accounting standards and – if desired – also different fiscal year variants end-to-end, for example, for the usage of input materials, the provision of manufacturing activities, or the assignment of overhead, together with the valuation of work-in-process and finished goods inventories.

Value Proposition

Figure 2: Reporting Alternative Fiscal Year Variant V3 of a Company Code

Capabilities

Predictive Accounting Integration with Integrated Financial Planning Content (SAP Analytics Cloud 2022.3)

When performing sales and profitability planning, the planner can define control parameters that are then performed for each product and each customer. In this way, you can create planning proposals that apply different calculation methods, such as methods based on rolling average, growth rate, or previous month.

In addition to the control parameters, you can specify a percentage for a growth rate that the system takes into account when applying the control parameter. For example, you know from experience that, in a certain period, there was typically a peak in sales, and you want to take this growth rate into account.

In addition to existing control parameters, you can now also use values from SAP S/4HANA Predictive Accounting as a basis. With the detailed steering capabilities, you can choose for which combination of sales dimensions, accounts, and periods the control parameter is applied.

Value Proposition

Demo 4: Predictive Accounting Integration with Integrated Financial Planning Content

Capabilities

Use of financial planning content in SAP Analytics Cloud through integration with consumer sales planning (SAP Analytics Cloud Release 2022.3)

At SAP, we are working on a holistic, interconnected enterprise planning framework incorporating the idea of extended Planning & Analysis (xP&A) while covering and aligning different perspectives on planning across the enterprise.

SAP offers this integration between SAP Analytics Cloud content “Integrated Financial Planning for SAP S/4HANA and SAP S/4HANA Cloud” (IFP) and the “Consumer Products (CP) Sales Planning” content, which is designed to facilitate the sales quota and trade budget allocation process. This content allows sales management, such as a Global VP of Sales, Regional Sales Managers, and/or Trade Marketing Managers, to allocate corporate financial goals (revenue and volume) as well as investment budget (trade budget) by disaggregating across sales and product hierarchies. This process facilitates an iterative top-down and bottom up comparison of versions.

When planning is completed, the sales quantities can be transferred to profitability planning in the IFP content. Using this input, the net revenue and the costs of goods sold are calculated.

Value Proposition

Capabilities

Automatic Payment Advice Processing

The system can process your payment advices and find matching open items automatically. Furthermore, if the system cannot automatically process some bank statement items or lockbox items, you can process them manually in an enhanced UI while viewing the payment advice items at the same time.

Value Proposition

Figure 4: Payment Advice Asignment

Capabilities

For more information, see: Overview on Automatic Payment Advice Processing, How to Match Payment Advice Items with Open Items and Automatic Processing of Payment Advices.

Managing Withholding Tax Items

The Manage Withholding Tax Items app allows you to include documents in a reporting period or exclude documents from a reporting period if you have posted them incorrectly. You can move documents between reporting periods by changing the withholding tax reporting date.

Value Proposition

Capabilities

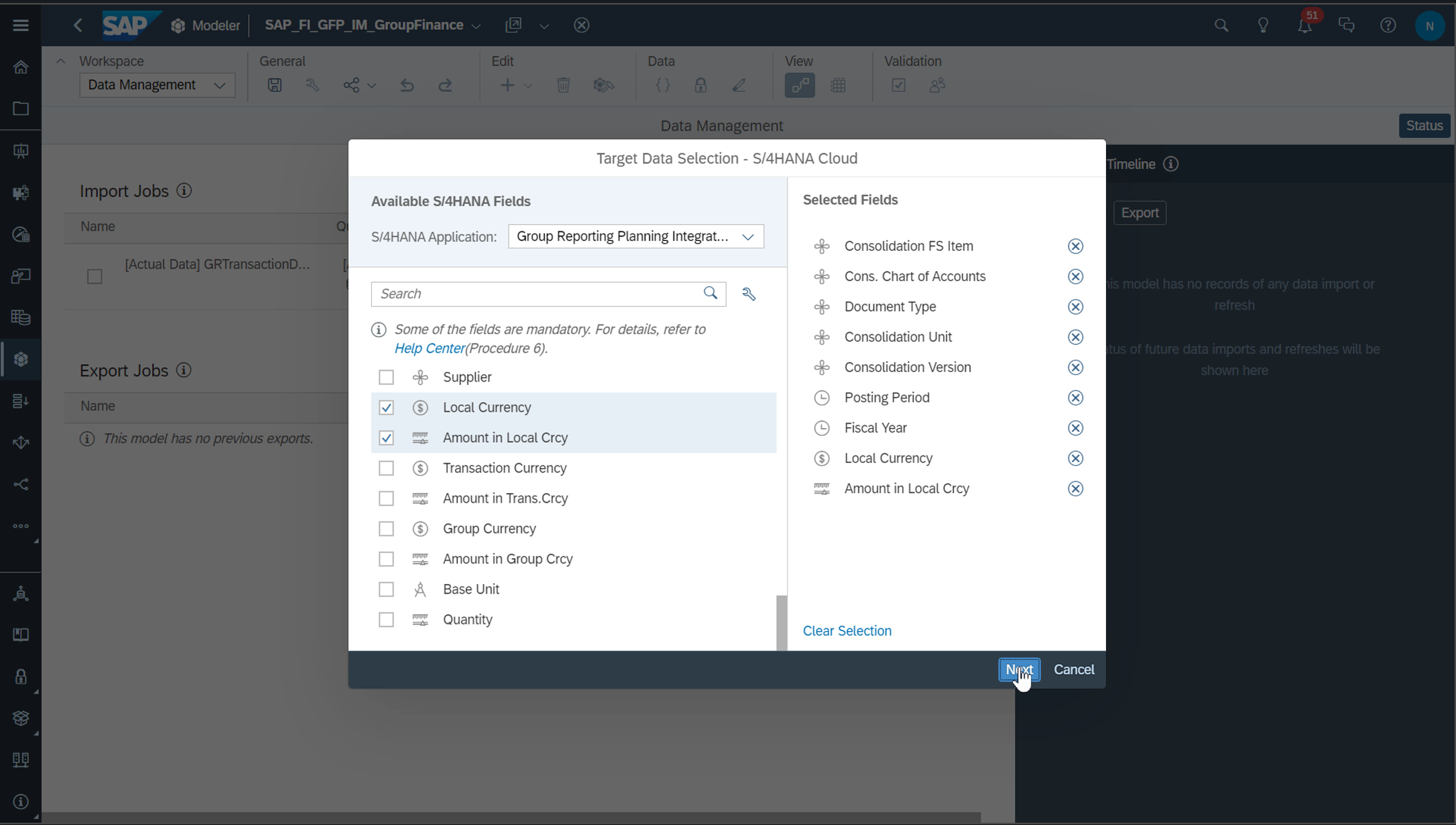

Ability to Integrate Planning Data from SAP Analytics Cloud with Group Reporting Consolidation

Enhance integration of group reporting with SAP Analytics Cloud, for planning consolidation scenarios:

Value Proposition

Capabilities

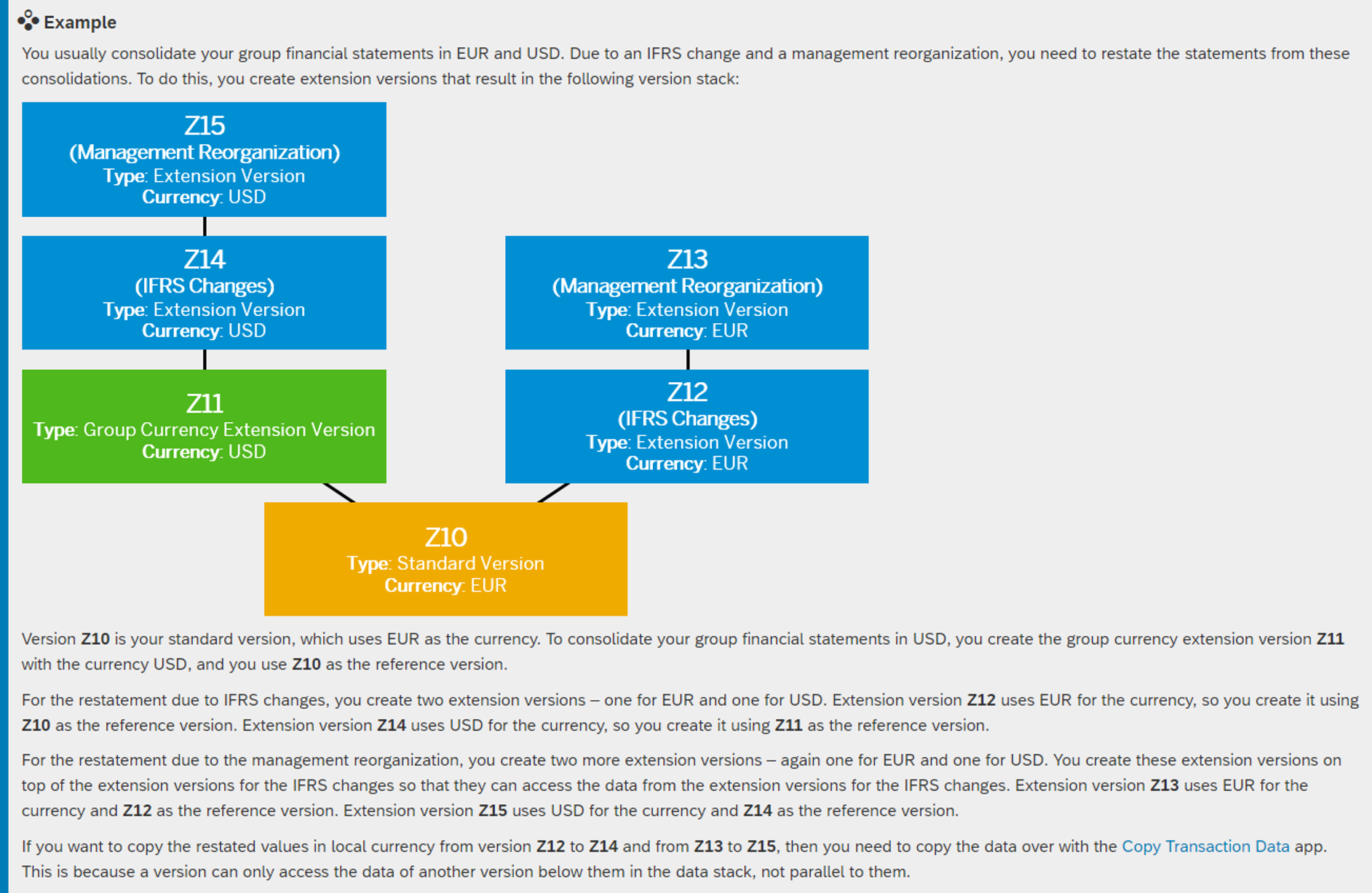

Restatements and Simulations – Transparent Changes on Past Closings

Restate existing consolidation financial statements and simulate different consolidation cases by adjusting data in separate extension versions that access data from underlying reference versions.

Value Proposition

Figure 7: Change Control With Versions

Capabilities

Registration of Indirect Tax Abroad

SAP Registration for Indirect Tax Abroad (RITA) enables legal entities to step out of national / jurisdictional borders and extend business abroad. It is the solution in SAP S/4HANA Cloud enabling a single legal entity to perform indirect tax calculation in multiple countries.

A dedicated SAP Early Adopter Care Program has been started with SAP S/4HANA Cloud 2111 to enable RITA with the possibility to create a foreign plant. This means you can create a plant in a country/region that differs from the company code country/region. Interested customer that need this functionality can register here SAP Early Adopter Care. The program registration has been now extended until February, 1, 2023.

More Information on SAP S/4HANA Cloud:

Follow us via @Sap and #S4HANA, or myself via @HaukeUlrich and LinkedIn

- Treasury Management: In-house banking for corporations

- Treasury Management: Using predictive liquidity planning to understand the future long term cash flows

- Universal Parallel Accounting: Standardized automation for legally required parallel fiscal years

- Financial Planning and Analysis: Predictive accounting integration with integrated financial planning content

- Financial Planning and Analysis: Use of financial planning content in SAP Analytics Cloud through integration with consumer sales planning

- Finance Operations: Automatic payment advice processing

- Finance Operations: Managing withholding tax items

- Group Reporting: Ability to integrate planning data from SAP Analytics Cloud with group reporting consolidation

- Group Reporting: Restatements and simulations in group reporting

- Registration of indirect tax abroad: create a plant in a country/region that differs from the company code country/region

In addition my colleagues Katrin Deissner plans to provide a release blog on selected innovations in the space of GRC.

https://youtu.be/-UnwPbTLzak

Video 1: Release Video for Finance in SAP S/4HANA Cloud 2208

In-house Banking for Corporations

In-house banking for S/4HANA Cloud for advanced payment management is an embedded capability of advanced payment management that drives a most efficient payment factory solution. In-house banking allows you to create an internal bank on the corporate side. Within this internal bank, subsidiaries that are part of the group can open or maintain internal bank accounts. From the subsidiary perspective, these accounts are house bank accounts and can be used in the same way as the external house bank accounts. You can centralize and streamline all payment transactions within the group, such as intercompany payments, payments on behalf of, and central incoming payments, for example, from external cash pools. This minimizes the number of external bank accounts and saves bank connectivity costs. You can settle intercompany payments without using cash. And the solution allows you to monitor all payments and the cash situation centrally with user friendly dashboards.

Value Proposition

With in-house banking, you can:

- Keep internal bank accounts for subsidiaries. The internal bank accounts have the same capabilities as external house bank accounts, such as bank statements, account settlement, and so on.

- Minimize the number of external bank accounts

- Settle intercompany payments without using cash

- Save bank connectivity costs

- Monitor all payments centrally

- Monitor the cash situation centrally, while considering internal limits

Capabilities

- Maintenance of internal bank accounts for subsidiaries including conditions and limits

- Processing of intercompany payments, payments on behalf of, and central incoming payments, for example, from external cash pools

- Reporting of balances and volumes of payments among internal bank accounts

Demo 1: Account Creation

Demo 2: Bank Account Management Integration

Demo 3: Payment Processes

Demo 4: Analytical Apps

Predictive Liquidity Planning (SAP Analytics Cloud Release 2022.3)

Predictive Liquidity Planning is a tool that can automatically predict future long term (next 12 months) operative cashflows based on existing planning and historical data.

Value Proposition

- A Cash Manager can know the future cash flow to understand whether the company/group would need to search funding or has surplus cash flows, even if the forecasting cash flows from existing invoices and orders cannot cover long term.

- A Risk Manager can know the currency exposure derived from future sales and purchases and other activities not yet booked in any system to understand what needs to be hedged according to the company policy.

Figure 1: Predictive Liquidity Planning Showing Influencers

Capabilities

- Smart Predict makes a prediction of future liquidity based on historic data, existing budgets and influencers.

- Fetch existing data from different sources as planning reference.

- Review planning data indifferent hierarchies such as by planning currencies or aggregation currency view.

- Track the planning status of subsidiaries.

Universal Parallel Accounting - Alternative Fiscal Years Variants

Companies operating in different countries/regions may be legally required to use different fiscal years for their local reporting and for their central reporting on group level. The foundation that is provided by universal parallel accounting now enables you to fulfill such reporting requirements: In addition to the fiscal year variant that is assigned to the leading ledger, you can now assign alternative fiscal year variants to the company codes of the non-leading ledger. You then have the parallel representation of different sets of accounting standards and – if desired – also different fiscal year variants end-to-end, for example, for the usage of input materials, the provision of manufacturing activities, or the assignment of overhead, together with the valuation of work-in-process and finished goods inventories.

Value Proposition

- Gain transparency and accuracy for your local and group-level accounting and reporting

- Fewer manual processes when working with different fiscal years

- Simple to configure, powerful and easy to use

Figure 2: Reporting Alternative Fiscal Year Variant V3 of a Company Code

Capabilities

- Assign multiple fiscal year variants for local and legal reporting purposes

- Process accounting data for different fiscal year variants in parallel

- Use different fiscal year variants end-to-end by company code

Predictive Accounting Integration with Integrated Financial Planning Content (SAP Analytics Cloud 2022.3)

When performing sales and profitability planning, the planner can define control parameters that are then performed for each product and each customer. In this way, you can create planning proposals that apply different calculation methods, such as methods based on rolling average, growth rate, or previous month.

In addition to the control parameters, you can specify a percentage for a growth rate that the system takes into account when applying the control parameter. For example, you know from experience that, in a certain period, there was typically a peak in sales, and you want to take this growth rate into account.

In addition to existing control parameters, you can now also use values from SAP S/4HANA Predictive Accounting as a basis. With the detailed steering capabilities, you can choose for which combination of sales dimensions, accounts, and periods the control parameter is applied.

Value Proposition

- When creating proposal values for planning, you sometimes need to differentiate by using different calculation methods for different combinations of data. Predictive Accounting is now also available as a potential data source.

- Predictive Accounting provides bottom-up predictions by integrating predicted documents with an individual business process and its document flow.

Demo 4: Predictive Accounting Integration with Integrated Financial Planning Content

Capabilities

- Import of SAP S/4HANA Predictive Accounting values to SAP Analytics Cloud into a dedicated planning version

- Option of selecting SAP S/4HANA Predictive Accounting values as a source for calculating planning proposals

- Dedicated app offering an optimized UX for all parameter steering tasks

Use of financial planning content in SAP Analytics Cloud through integration with consumer sales planning (SAP Analytics Cloud Release 2022.3)

At SAP, we are working on a holistic, interconnected enterprise planning framework incorporating the idea of extended Planning & Analysis (xP&A) while covering and aligning different perspectives on planning across the enterprise.

SAP offers this integration between SAP Analytics Cloud content “Integrated Financial Planning for SAP S/4HANA and SAP S/4HANA Cloud” (IFP) and the “Consumer Products (CP) Sales Planning” content, which is designed to facilitate the sales quota and trade budget allocation process. This content allows sales management, such as a Global VP of Sales, Regional Sales Managers, and/or Trade Marketing Managers, to allocate corporate financial goals (revenue and volume) as well as investment budget (trade budget) by disaggregating across sales and product hierarchies. This process facilitates an iterative top-down and bottom up comparison of versions.

When planning is completed, the sales quantities can be transferred to profitability planning in the IFP content. Using this input, the net revenue and the costs of goods sold are calculated.

Value Proposition

- For a company, it is essential to integrate different planning processes, for example, between sales planning and financial planning.

- Integration helps companies to react more quickly to changes and assess their impact. In addition, the integration contributes to a better alignment and even collaboration between the different planning areas.

Figure 3: Sales Planning Target Revenue and Target Budget

Figure 3: Sales Planning Target Revenue and Target Budget

Capabilities

- Enrichment of CP Sales Planning data to ensure compatibility with Integrated Financial Planning

- Transfer of sales quantities from CP Sales Planning to Profitability Planning as part of IFP content

Automatic Payment Advice Processing

The system can process your payment advices and find matching open items automatically. Furthermore, if the system cannot automatically process some bank statement items or lockbox items, you can process them manually in an enhanced UI while viewing the payment advice items at the same time.

Value Proposition

- Automatic matching of open items and payment advice items

- Automatic clearing of open items, bank statement items and lockbox items

- Enhanced automation in the lifecycle management of payment advices

- More transparency in the process

- Less time-consuming manual work in assigning open items to payment advice items

Figure 4: Payment Advice Asignment

Capabilities

- Periodic job of searching for payment advices that match the bank statement items or lockbox items

- Periodic job of assigning matching open items to payment advice items

- New feature in the Reprocess Bank Statement Items and Reprocess Lockbox Items app: manually assign payment advice items to open items

For more information, see: Overview on Automatic Payment Advice Processing, How to Match Payment Advice Items with Open Items and Automatic Processing of Payment Advices.

Managing Withholding Tax Items

The Manage Withholding Tax Items app allows you to include documents in a reporting period or exclude documents from a reporting period if you have posted them incorrectly. You can move documents between reporting periods by changing the withholding tax reporting date.

Value Proposition

- Correction of errors in legal reporting, which helps to avoid huge penalties

- Easy process that replaces time-consuming manual work to reverse and post documents again

- Flexibility to move incorrect documents to the next reporting period, even after the current posting period ends

Figure 5: Manage Withholding Tax Items

Figure 5: Manage Withholding Tax Items

Capabilities

- Exclude withholding tax items from a reporting period

- Include withholding tax items in a reporting period

- Hold off withholding tax items from the current reporting period

- View information at the document and tax item levels

- View the total base amount and total tax amount of tax items in the current reporting period

- Variances are calculated immediately and by ledger

Ability to Integrate Planning Data from SAP Analytics Cloud with Group Reporting Consolidation

Enhance integration of group reporting with SAP Analytics Cloud, for planning consolidation scenarios:

Value Proposition

- Allow direct integration of data from SAP Analytics Cloud into SAP S/4HANA for Group Reporting removing the need to transfer the data first into Accounting (ACDOCP) and release to GR (ACDOCU). With this improve conveniences and efficiencies planning scenarios such as:

- Group-level planning with no integration in company-level planning

- Planning of consolidation units that are not represented in accounting and need to be consolidated

Figure 6: Target Selection to Transfer Planning Data from SAP Analytics Cloud to SAP S/4HANA Cloud Group Reporting

Figure 6: Target Selection to Transfer Planning Data from SAP Analytics Cloud to SAP S/4HANA Cloud Group Reporting

Capabilities

- Write data back from SAP Analytics Cloud to SAP S/4HANA Cloud for group reporting by pushing data from SAP Analytics Cloud to SAP S/4HANA Cloud for group reporting

- Integrate with the status of the data collection task in the group reporting monitor

Restatements and Simulations – Transparent Changes on Past Closings

Restate existing consolidation financial statements and simulate different consolidation cases by adjusting data in separate extension versions that access data from underlying reference versions.

Value Proposition

- Increased efficiency and improved quality in scenarios such as:

- Restatements

- Simulations

- Enable the comparison of data between different years and periods

Figure 7: Change Control With Versions

Capabilities

- Creation of new extensions version on top of a reference version for simulation or restatement purposes

- Extension version carries the delta amount to the underlying reference version

- Process of the extension version includes:

- Reading data from extension and reference version

- Writing delta amounts to extension version

- Asynchronous task processing of extension version and reference version with status consistency support for (open and close) periods

Registration of Indirect Tax Abroad

SAP Registration for Indirect Tax Abroad (RITA) enables legal entities to step out of national / jurisdictional borders and extend business abroad. It is the solution in SAP S/4HANA Cloud enabling a single legal entity to perform indirect tax calculation in multiple countries.

A dedicated SAP Early Adopter Care Program has been started with SAP S/4HANA Cloud 2111 to enable RITA with the possibility to create a foreign plant. This means you can create a plant in a country/region that differs from the company code country/region. Interested customer that need this functionality can register here SAP Early Adopter Care. The program registration has been now extended until February, 1, 2023.

More Information on SAP S/4HANA Cloud:

- Finance Collection Blog (roadmap, quarterly release highlights, microlearnings) here

- openSAP Microlearnings for SAP S/4HANA for Finance and GRC here

- SAP S/4HANA Cloud Customer Community for Finance here

- SAP S/4HANA Cloud release info: http://www.sap.com/s4-cloudrelease

- SAP S/4HANA PSCC Digital Enablement Wheel here

- Early Release Webinar Series here

- Inside SAP S/4HANA Podcast here

- Best practices for SAP S/4HANA Cloud here

- SAP S/4HANA Cloud Community: here

- Feature Scope Description here

- What’s New here

- Help Portal Product Page here

- Implementation Portal here

Follow us via @Sap and #S4HANA, or myself via @HaukeUlrich and LinkedIn

- SAP Managed Tags:

- SAP S/4HANA Cloud for Finance,

- SAP S/4HANA Public Cloud

Labels:

2 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

20 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

23 -

Expert Insights

114 -

Expert Insights

150 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,687 -

Product Updates

202 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

85

Related Content

- Unable to add the event filters in the Event Enablement Channel in Enterprise Resource Planning Q&A

- How to check if a note is applied in S4HANA Public Cloud? in Enterprise Resource Planning Q&A

- The Role of SAP Business AI in the Chemical Industry. Overview in Enterprise Resource Planning Blogs by SAP

- Ariba to SAP S4HANA Cloud Integration Supplier Masterdata Standard Field Mapping in Enterprise Resource Planning Q&A

- Introducing the GROW with SAP, core HR add-on in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 |