- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Migration of Lease Contracts in SAP Business ByDes...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Currently, a migration of lease contracts within the standard Migration of Financial Accounting Data in SAP Business ByDesign is not supported. In general, there are two options how you can take over existing lease contracts during a migration.

Option 1

You can choose Transition Type 1 - Retrospective for your company to calculate the lease contract values at the migration date based on historical information. The relevant activity in the business configuration is called Lease Management Accounting. To set the transition type for a company open Define Transition Type.

To define the migration date, you need to set the Lease Contract Transition Date for the company. Go to work center General Ledger and open the Companies view under Master Data. To set the transition date for a company select the corresponding line and click Actions > Set Lease Contract Transition Date. For more information about maintaining the lease contract transition date at company level, see Companies Quick Guide.

When these settings are done, you can either manually create existing lease contracts or import them by the Migration Tool (Migration Workbench). For more information about using the migration tool for lease contracts, see Configuration: Transition of Lease Contracts section Migrate Data Using the Migration Tool (Migration Workbench).

Note

- Due to different approaches in the calculation of the present value, interest and depreciation amounts (for example interest usance used) the calculated values in the system may not fit exactly the values in the legacy system.

- The system will post the opening balances on the transition date.

- In the current design the retrospective approach will post the right-of-use asset opening balance on the transition date as one value (remaining book value) and will not separate the values of historical acquisition cost and accumulated depreciation to different g/l accounts, see also my comment on 29.03.2022 in my blog post.

- If you choose this approach, you need to exclude the corresponding g/l account balances from the Migration of Account Balances or create a manual journal entry voucher to reverse the balances. In addition, the corresponding fixed assets of these lease contracts need to be excluded from the Migration of Fixed Assets.

Example

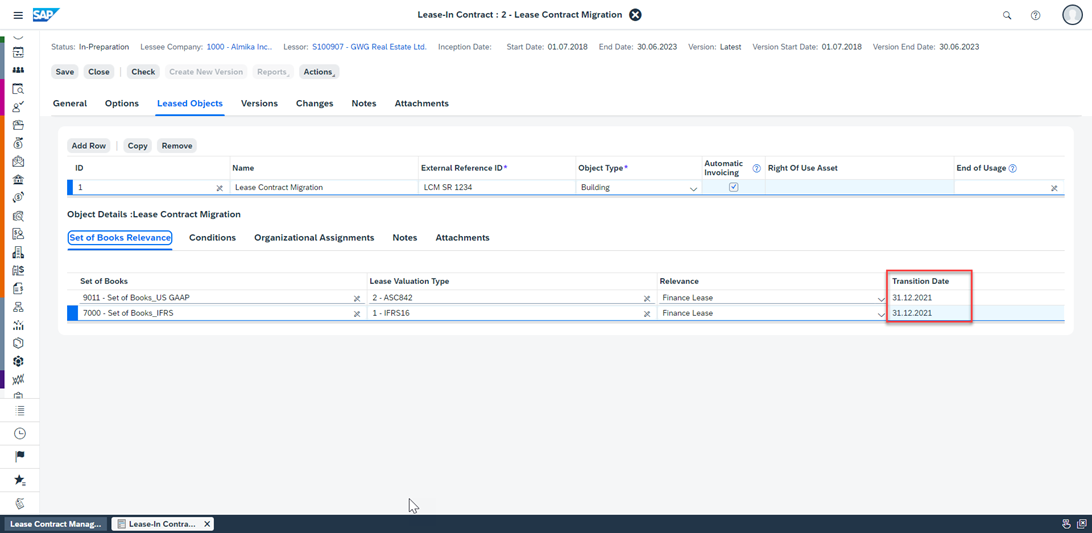

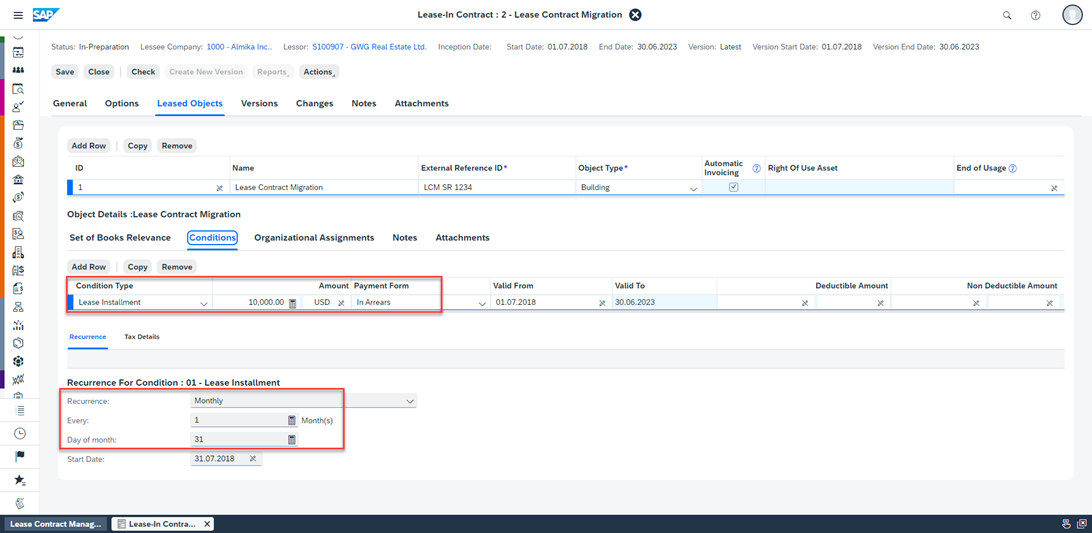

Let’s assume, you want to migrate a lease contract on 31.12.2021 with the following details.

- Interest: 1,5%

- Start Date: 01.07.2018

- Lease Term in Months: 60

- Transition Type: Retrospective

- Lease Installment: 10.000 USD

- Payment Form: In Arrears

- Recurrence: Monthly

- Day of month: 31

The screenshots below show how to enter this lease contract in the system.

The following valuation cash flow is generated based on the lease contract details.

On the transition date (migration date) 31.12.2021 the system will post the Opening Balance for the Right-of-Use Asset of 182.598,59 USD as acquisition cost, and 187.631,38 USD as the Opening Balance for the Lease Liability. The difference of 5.032,79 USD will be posted to Retained Earnings.

Option 2

The only other way to handle existing lease contracts is to create manual postings in the system. In this case, you need to create a Fixed Asset for the Right-of-Use Asset, Supplier Invoices and Journal Entry Vouchers manually to reflect such a lease contract on balance sheet.

When using this option, the relevant amounts for all postings must be calculated outside SAP Business ByDesign.

This information shall help you to select the right approach for the migration of lease contracts.

- SAP Managed Tags:

- SAP Business ByDesign

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

153 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

212 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

- Data migration approach for Open PO and Contract in Public Cloud in Enterprise Resource Planning Q&A

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 1 in Enterprise Resource Planning Blogs by SAP

- SAP Business ByDesign 2023 year-end review and outlook 2024 in Enterprise Resource Planning Blogs by SAP

- Deletion of Master and Transactional Data (ILM) in SAP S/4HANA Cloud,Public Edition-Link Collection in Enterprise Resource Planning Blogs by SAP

- Data Migration Strategy in S/4 HANA Projects in Enterprise Resource Planning Blogs by Members

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 7 | |

| 7 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 3 | |

| 3 |