- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Active Budget Control in SAP Business ByDesign - B...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Overview

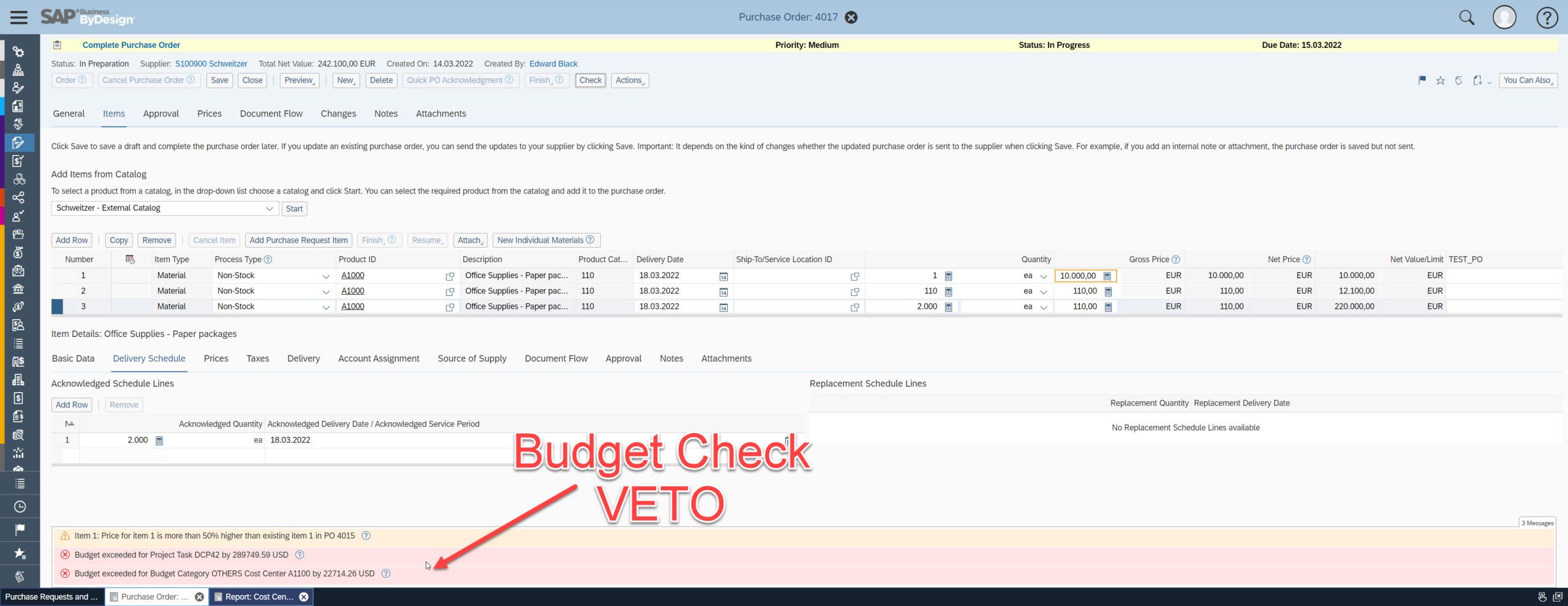

The emphasis of this blog post is to stress the differences in detail how the budget check is implemented. With simple examples the rationale behind these different implementations is explained. But before explaining the details I would like to show how the activated budget check veto’s the order or change of a purchase order if the budget is exceeded. Upfront, it is not spectacular but a very effective means to control spending behavior.

Example Budget Check - Budget Exceeded

Cost centers and supported project types (in overhead cost management)

The budget check is available for purchasing and supplier invoice scenarios with an account assignment to:

- Cost centers and assigned cost collector projects that automatically settle against the cost center

- Direct cost projects

- All other project types are not supported

Supported Project Types

Please note that SAP has implemented a different logic dependent on the industry and account assignment. The following tables illustrate these differences

All industries - except public sector edition

| Account Assignment | Budget Check Logic | Comment |

| Cost Center* | Released budget YTP – (actuals** + encumbrances**) | Default Release Version At granularity of budget category**full year |

| Cost Collector Project* | Released budget YTP – (actuals** + encumbrances**) | The check is conducted against the budget of the cost center against which the postings will be settled to. If a project cost estimate exists it is not relevant for budget check. Default Release Version At granularity of budget category **full year |

| Direct Cost Project* | Project cost estimate on project task level - (actuals + encumbrances) | The check does not use budget category. It is assumed that the project manager is authorized to substitute certain categories as long as the entire spent is below the project cost estimate. Note: there is no constraint on accounting periods. In case a financial planning and budget release for direct cost projects exist it will be ignored. |

| Free cost object | Not supported | |

| Any type of customer projects | Not supported |

*The budget check must be activated on cost center level. Cost collector projects are subject to budget check if the cost center is subject budget check to which the cost will be settled. The direct cost projects are subject to budget check if the responsible cost center is subject to budget check. An explicit budget check activation by project is not supported.

Public sector edition

| Account Assignment | Budget Check Logic | Comment |

| Cost Center* | Released budget YTP – (actuals** + encumbrances**) | Default Release Version At granularity of budget category**full year |

| Cost Collector Project* | The check is conducted against the budget of the cost center against which the postings will be settled to. If a project cost estimate exists it is not relevant for budget check. Default Release Version At granularity of budget category **full year | |

| Direct Cost Project* | Released budget YTP - (actuals** + encumbrances**) | The check is conducted against the released budget of the direct cost project. If a project cost estimate exists it is not relevant for budget check. Default Release Version At granularity of budget category **full year |

| Free cost object | Not supported | |

| Any type customer projects | Not supported |

*The budget check must be activated on cost center level. Cost collector projects are subject to budget check if the cost center is subject budget check to which the cost will be settled. The direct cost projects are subject to budget check if the responsible cost center is subject to budget check. An explicit budget check activation by project is not supported.

Direct cost projects and budget check (except public sector edition)

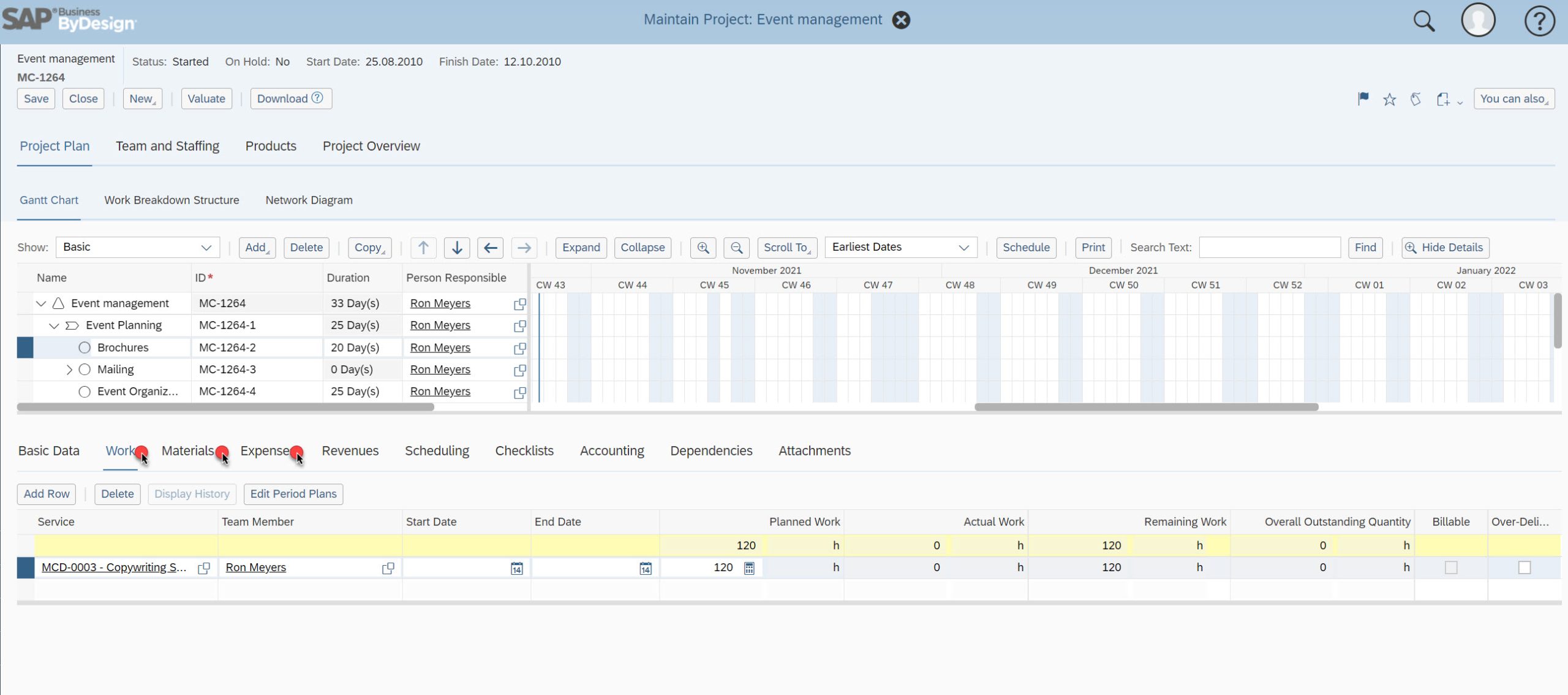

The basic idea that has been implemented is that in case budget check is enabled for projects it is the project managers responsibility on project task level to execute the task within budget defined by the project cost estimate. The project responsible though can switch between different expense types if the overall project task cost estimate is not exceeded. This assures a good balance between budget control and giving the project responsible room to adjust during execution.

The budget against which the budget check is performed is based on the entire project task planning consisting of planning

- Work

- Materials

- Expenses (Other)

- including overhead calculation

Project Cost Estimate on Project Task Level

I’m using the report ‘Project Plan Values’ to illustrate against which estimated cost the budget check will be executed.

Direct Cost Project - Plan Values

The budget check rule on project task level is pretty simple:

Available Budget = Project Task Cost Estimate - (Actuals + Encumbrances)

Please note:

- No usage of budget category

- No time constraints (like year to period or alike)

- The budget check is only applied if on the responsible cost center of the project is budget check enabled (So if the responsible cost center is not budget check enabled the related projects are not subject to budget check as well

- You have to have project task cost estimates in place. Otherwise, procurement of services for example will be blocked.

The implications:

- Overhead costs are included in available budget

- The project manager can decide for example to substitute internal labor by procuring 3rd party resources if available budget allows to.

Cost centers and budget check

Before I explain the budget check rules in more detail, I would like to spend a few words of the objective to introduce a budget for cost centers.

The cost center responsible has to manage to stay in the budget boundary on a periodical basis (e.g. quarterly) set by the company. And usually also the entire cost center budget is subdivided into smaller budget categories that are usually not to be interchanged by the cost center responsible. So, for example travel costs are not to be ‘traded’ against 3rd consultancy - unless explicitly approved. Therefore, the new dimension ‘budget category’ has been introduced since the G/L account level seemed to be too granular. Moreover, the concept to ‘release’ planned budget has been introduced. This allows the accounting team to define which portion of the planned budget is released when for which type of spending. By this for example the ‘burning’ of yearly budget in the initial quarters can be avoided and blocked.

So, the rules for budget check relevant for an account assignment 'cost center' is significantly different than the rule for the budget check of a direct cost project.

Available Budget (by budget category) = Released budget YTP – (Actuals Full Fiscal Year + Encumbrances Full Fiscal Year)

Please note:

- Granularity of budget check at level of cost center and budget category

- There is an aspect of the current period in the budget check for cost centers

- Released Budget YTP (year to period). That means that released budget in future periods is NOT considered in the currently available budget calculation

- All actuals referring to the budget category and cost center posted in the fiscal year are considered.

- All encumbrances of the current fiscal year are taken into consideration.

Encumbrances that refer to the next fiscal year are not taken into consideration.

Cost collecting projects and budget check

The key question is: “What is the basis of the budget check if the purchase order item account assignment is for a project task of this project type?”

The answer: "The budget check will be executed against the cost center where the cost collector project settles its costs and the respective budget category.

Please note:

- The project task cost estimate has no relevance for the budget check of this project type

- The account assignment in the purchase order is still the project task – but the budget check will be conducted against the responsible cost center.

Budget check affecting purchase order and supplier invoice creation

So, after you finally put all prerequisites into place by establishing a released budget, switching on the budget check for the respective cost centers or having project cost estimates in place for direct cost projects now it is time to see how the budget check affects the purchase order and/or the supplier invoice creation.

Budget Check is available in following scenarios

- ordering of purchase order – not at save. Approve and order

- changing quantity or purchase price of an ordered purchase order

- entering a deviation in the supplier invoice

- entering multiple items affecting the same cost center/project task and/or budget category

- manual suppler invoice without purchase order invoice

The budget check veto will prompt in which combination the budget is exceeded. It also will notify how by how much the budget is exceeded. This amount is shown in company currency.

In case there is a budget check veto the order or change cannot be saved. The budget check cannot be bypassed. To resolve the issue the customer has to establish processes that suite his needs:

- order less, other resources that potentially affect another budget category

- request process (for example the generic tasks could be used) to request to increase released budget, to move from one budget category to other budget category or adjust project cost estimate.

- In very critical cases: switch off budget control on the respective cost center.

No budget check will be in place. Be aware that these changes on the cost center master data are tracked and can be traced.

Please note: This is a known limitation in the approval case of a change of an already released purchase order. I'll try to share a tangible example:

A purchase order item had been released

purchase order 4711

#1 10 ea 100,00 EUR -> available budget after purchase order has been released 50,00 -> encumbrances 100,,00 EUR

Change the purchase order after it had been released.

#1 14 ea 140,00 EUR -> the delta of 40,00 EUR is checked -> no budget veto o.k.

In case now the purchase order change is sent for approval the information of the delta is not stored. In case the approval takes place the entire amount of 140,00 would be subject to be checked and the budget check would raise an error that budget is exceeded. To avoid this it would be preferred to create a new purchase order item(#2 with 4 ea 40,00 EUR representing the adjustment after the release. In this case everything works fine.

Special case: Fixed Asset Acquisition

This type of procurement scenario requires a special treatment in terms of budget check. It is clear that a to be acquired fixed asset (example new small transport vehicle 25.000 USD) does not affect the consumed budget. Only the depreciation will do so over time.

I will share the practice we recommend:

- Create a purchase order with items for the acquisition of the fixed asset and assure already that individual materials are assigned. By this the system will know it is a fixed asset acquisition and skip the budget check. If individual materials are not created the system has to assume it a regular procurement and assigned to consumption incl. budget check.

- Use a dedicated budget category and product category for fixed asset acquisition

- Encumbrances for the acquisition are still created. If they are shown on a dedicated budget category it is clear that this is about a pending fixed asset acquisition. At goods and service receipt the fixed asset will be capitalized, and the encumbrances be reduced or cancelled out.

- In case you enter a manual supplier invoice with item type IMAT it will also be interpreted as a fixed asset acquisition and the budget check will be skipped

Summary

In this blog post the budget check rules are explained and how the budget check is activated. Moreover, the differences in implementation between public sector and non-public sector were highlighted. Finally, also the special treatment for fixed asset acquisition is illustrated.

Have you implemented active budget control? Are you intending to use it? Please share your thoughts and experiences.

Back to main blog post: Active Budget Control in SAP Business ByDesign

- SAP Managed Tags:

- SAP Business ByDesign

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

29 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

27 -

Expert Insights

114 -

Expert Insights

178 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,682 -

Product Updates

261 -

Roadmap and Strategy

1 -

Technology Updates

1,500 -

Technology Updates

96

- Why YCOA? The value of the standard Chart of Accounts in S/4HANA Cloud Public Edition. in Enterprise Resource Planning Blogs by SAP

- Notify SAP Business ByDesign Users when there is any changes done via Adaptation mode in Enterprise Resource Planning Q&A

- SAP Business Bydesign in Enterprise Resource Planning Q&A

- Adding Custom Fields to Migration Objects in SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Insights from the SAP ByDesign Partner SME Summit 2024: Exploring GEN AI Opportunities in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 11 | |

| 6 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |