- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- How to manually migrate House Banks during a syste...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

05-02-2022

8:46 PM

If you are currently using house bank accounts in your ECC system, you will be able to continue to use these house bank accounts in SAP S/4HANA after a system conversion. During the system conversion the existing house bank accounts (from table T012K) will need to be migrated into the bank account master data (in table FCLM_BAM_AMD).

After the technical conversion process is completed (facilitated by the Software Update Manager (“SUM”) process) the IMG is updated with a new task node named: “Conversion of Accounting to SAP S/4HANA”. Within these tasks you have the option to decide which of two potential migration programs to use to migrate house bank accounts into bank account master data. The two migration options for House Bank Accounts are:

Using the automated migration option (CM1 step in the Migration Monitor) all house banks accounts are migrated. There is no ability to control or filter which house banks accounts are migrated.

Manual migration provides an alternative process that allows selection of specific house bank accounts that will be migrated.

In this blog post we will explore the manual process and share some tips that I found valuable during the process.

Finance data migration defaults to automatic migration of all House Bank accounts via the CM1 step in the Migration Monitor.

To redirect the logic to perform a manual migration process, execute the following activities:

1. Select the IMG customizing task node Conversion of Accounting to SAP S/4HANA and locate the task “Switch Migration Program for House Bank Accounts”

Tip! Check the documentation associated to this activity to get more familiar with the process.

2. Select “new entries”

3. From the dropdown list select “Manual Migration” and click <SAVE>.

Tip! This setting will notify the system that during the execution of the automated migration programs in the Migration Monitor, the CM1 step (migration of House Bank Accounts) will be redirected to use the manual selection process.

4. Define the Customizing activity “Define Basic Settings” and click <SAVE>

Tip! Decide whether you want to enable the bank account contract types and set the Enable Bank Account Contract Types indicator accordingly. For more information about the use and the impacts of this setting, see the implementation guide.

When the migration of the house banks has finished, you can alter the above settings according to your business needs.

5. Execute transaction FCLM_BAM_MIGRATION to define which House Bank Accounts are to migrated

6. Generate a list of House Bank Accounts that are available as of a specific a date in the Opened On field and click <EXECUTE>

7. Select the house bank accounts that you want to migrate and then choose “Set Account Type”

For more information about the use and the impacts of this setting, see IMG documentation under Preparations for Migration of House Bank Accounts> Define Settings for Bank Account Master Data

Tips!

8. Select the house bank entries and click migrate

Tip! Be sure that the only records selected are the ones that you want to process.

9. The system generates bank accounts based on selected house bank accounts.

Tip! House bank accounts with an identical house bank, bank account number and currency are migrated to one bank account master record. The bank account lists all the house bank accounts on the House Bank Account Connectivity tab. However, if there are differences between the house bank accounts in terms of the house bank account description, account type, and the Opened On date, the system uses the data of the first house bank account to create the bank account master data.

You can monitor the migration status using the status icon displayed at the end of each house bank account entry.

10. After migration, bank accounts are generated with house bank accounts linked to them. You can view the generated bank accounts in the Manage Bank Accounts app. The house bank accounts are linked to bank account on the House Bank Account Connectivity tab.

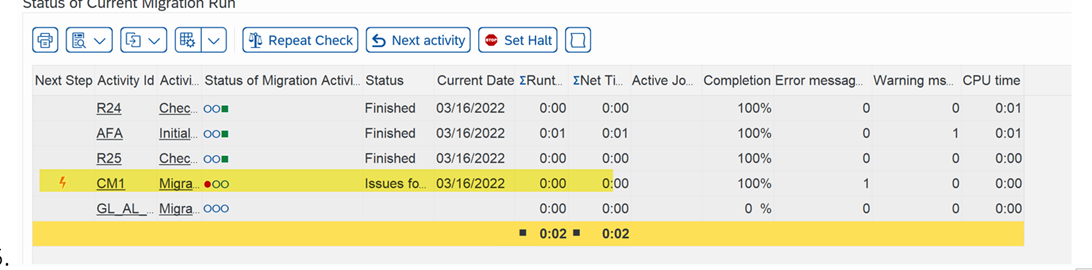

11. Even though the bank migration had been set to be “Manual Migration”, during the Start and Monitor Migration (FIN_MIG_STATUS) you will still receive an error in the CM1 activity.

Tip! This error is just as a “friendly reminder” for you to execute the manual migration.

12. Accept the error to allow the Data Migration to continue.

In conclusion, during a system conversion house bank accounts in your source system can be migrated selectively into your converted target SAP S/4HANA system. The process described migrates existing house bank accounts data (from table T012K) into the bank account master data (in table FCLM_BAM_AMD). This blog post described the switch to a manual migration process, the use of transaction FCLM_BAM_MIGRATION, and provided some useful tips from my experience working the process.

Hopefully this blog was helpful!

Please add in the comment section any other topics you think are valuable to have included in this blog post.

– Brought to you by the S/4HANA RIG

After the technical conversion process is completed (facilitated by the Software Update Manager (“SUM”) process) the IMG is updated with a new task node named: “Conversion of Accounting to SAP S/4HANA”. Within these tasks you have the option to decide which of two potential migration programs to use to migrate house bank accounts into bank account master data. The two migration options for House Bank Accounts are:

- Run Start and Monitor Migration (transaction FIN_MIG_STATUS). The migration step activity CM1 migrates house banks accounts

- Run transaction FCLM_BAM_MIGRATION to migrate them manually.

Using the automated migration option (CM1 step in the Migration Monitor) all house banks accounts are migrated. There is no ability to control or filter which house banks accounts are migrated.

Manual migration provides an alternative process that allows selection of specific house bank accounts that will be migrated.

In this blog post we will explore the manual process and share some tips that I found valuable during the process.

How to perform manual migration

Finance data migration defaults to automatic migration of all House Bank accounts via the CM1 step in the Migration Monitor.

To redirect the logic to perform a manual migration process, execute the following activities:

1. Select the IMG customizing task node Conversion of Accounting to SAP S/4HANA and locate the task “Switch Migration Program for House Bank Accounts”

Tip! Check the documentation associated to this activity to get more familiar with the process.

2. Select “new entries”

3. From the dropdown list select “Manual Migration” and click <SAVE>.

Tip! This setting will notify the system that during the execution of the automated migration programs in the Migration Monitor, the CM1 step (migration of House Bank Accounts) will be redirected to use the manual selection process.

4. Define the Customizing activity “Define Basic Settings” and click <SAVE>

Tip! Decide whether you want to enable the bank account contract types and set the Enable Bank Account Contract Types indicator accordingly. For more information about the use and the impacts of this setting, see the implementation guide.

When the migration of the house banks has finished, you can alter the above settings according to your business needs.

5. Execute transaction FCLM_BAM_MIGRATION to define which House Bank Accounts are to migrated

6. Generate a list of House Bank Accounts that are available as of a specific a date in the Opened On field and click <EXECUTE>

7. Select the house bank accounts that you want to migrate and then choose “Set Account Type”

For more information about the use and the impacts of this setting, see IMG documentation under Preparations for Migration of House Bank Accounts> Define Settings for Bank Account Master Data

Tips!

- Confirm with business which house banks account to include. In many cases some of the house accounts in the system are closed or no longer active

- Use tables T012K to check that the bank account master data is complete to avoid problems during the migration.

8. Select the house bank entries and click migrate

Tip! Be sure that the only records selected are the ones that you want to process.

9. The system generates bank accounts based on selected house bank accounts.

Tip! House bank accounts with an identical house bank, bank account number and currency are migrated to one bank account master record. The bank account lists all the house bank accounts on the House Bank Account Connectivity tab. However, if there are differences between the house bank accounts in terms of the house bank account description, account type, and the Opened On date, the system uses the data of the first house bank account to create the bank account master data.

You can monitor the migration status using the status icon displayed at the end of each house bank account entry.

Green | The house bank account entry is linked to a bank account master record, and the house bank is assigned to the bank account in the master record. The bank account master record acquires the active status |

Yellow | The yellow light indicates either of the following cases: a) The house bank account has been migrated, but the bank account master record is created with the inactive status. This is often caused by issues such as missing bank account numbers, incorrect bank account number length or duplicate records. b) The house bank account has been migrated to a bank account that is linked to more than one central house bank accounts. The bank account is created with the active status, but an error message will appear when you edit the bank account, because you should link only one house bank account to one bank account with the connectivity ID category Central System: House Bank Account. You can check the migration log for more information. To access the log, call transaction SLG1 and specify object BAM_MIGRATE. |

Red | The house bank account entry is not yet linked to a bank account master record. If the status of a house bank account remains red after you have executed the program for it, you can check the migration log for more information. To access the log, call transaction SLG1 and specify object BAM_MIGRATE. |

10. After migration, bank accounts are generated with house bank accounts linked to them. You can view the generated bank accounts in the Manage Bank Accounts app. The house bank accounts are linked to bank account on the House Bank Account Connectivity tab.

11. Even though the bank migration had been set to be “Manual Migration”, during the Start and Monitor Migration (FIN_MIG_STATUS) you will still receive an error in the CM1 activity.

Tip! This error is just as a “friendly reminder” for you to execute the manual migration.

12. Accept the error to allow the Data Migration to continue.

In conclusion, during a system conversion house bank accounts in your source system can be migrated selectively into your converted target SAP S/4HANA system. The process described migrates existing house bank accounts data (from table T012K) into the bank account master data (in table FCLM_BAM_AMD). This blog post described the switch to a manual migration process, the use of transaction FCLM_BAM_MIGRATION, and provided some useful tips from my experience working the process.

Hopefully this blog was helpful!

Please add in the comment section any other topics you think are valuable to have included in this blog post.

– Brought to you by the S/4HANA RIG

- SAP Managed Tags:

- SAP S/4HANA,

- SAP S/4HANA Finance,

- SAP S/4HANA Private Cloud

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

22 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

157 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

218 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- COR6N Yield UoM in Enterprise Resource Planning Q&A

- Should I update materail master after MRP area customize in Enterprise Resource Planning Q&A

- SAP Fiori for SAP S/4HANA - Technical Catalog Migration – How the migration process works in Enterprise Resource Planning Blogs by SAP

- SAP Fiori for SAP S/4HANA - Technical Catalog Migration – Why and Getting Ready for Migration in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 1 in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 13 | |

| 11 | |

| 10 | |

| 8 | |

| 7 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 3 |