- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Perform Foreign Currency Valuation with the new Ad...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member57

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

04-20-2022

10:32 AM

Welcome the blog series on the Advanced Valuation Processes as announced in the Releaseblog SAP S/4HANA Cloud 2202 for Finance . Today the topic would be covered is the advanced foreign currency valuation.

Business Context

As part of period-end closing, when preparing the financial statement, accounting conventions require that the foreign currency revaluation should be performed to present the true value of foreign currency open items and foreign currency assets/liabilities at closing date in presentation currency. This remeasurement considers the changing value of payables/receivables/assets due to varying exchange rates between currencies. The valuation process generates the valuation difference postings to induce the valuated account balances in presentation currency and the related effect on the financial result.

The Advanced Foreign Currency Valuations as the new cloud offering supports you performing the foreign currency revaluation in an easy and consistent way with the Advanced Valuation solution. As part of the intelligent closing processes, the Advanced Valuation processes are integrated with SAP S/4HANA Cloud for Advanced Financial Closing as the tasks in closing activities.

Capabilities

New and Benefits in Advanced Foreign Currency Valuations

💡Note

Advanced Valuations are provided as optional scope in S/4HANA Cloud Accounting and Financial Close. Once Advanced Foreign Currency Valuation is activated, the following apps cannot be used:

Besides that, the following job templates cannot be used as well

Current restrictions

The Configuration Steps

Preliminary steps:

Activate Advanced Valuation Processes:

Activate Advanced Valuation (SSCUI 103315)

Configure Foreign Currency Valuation:

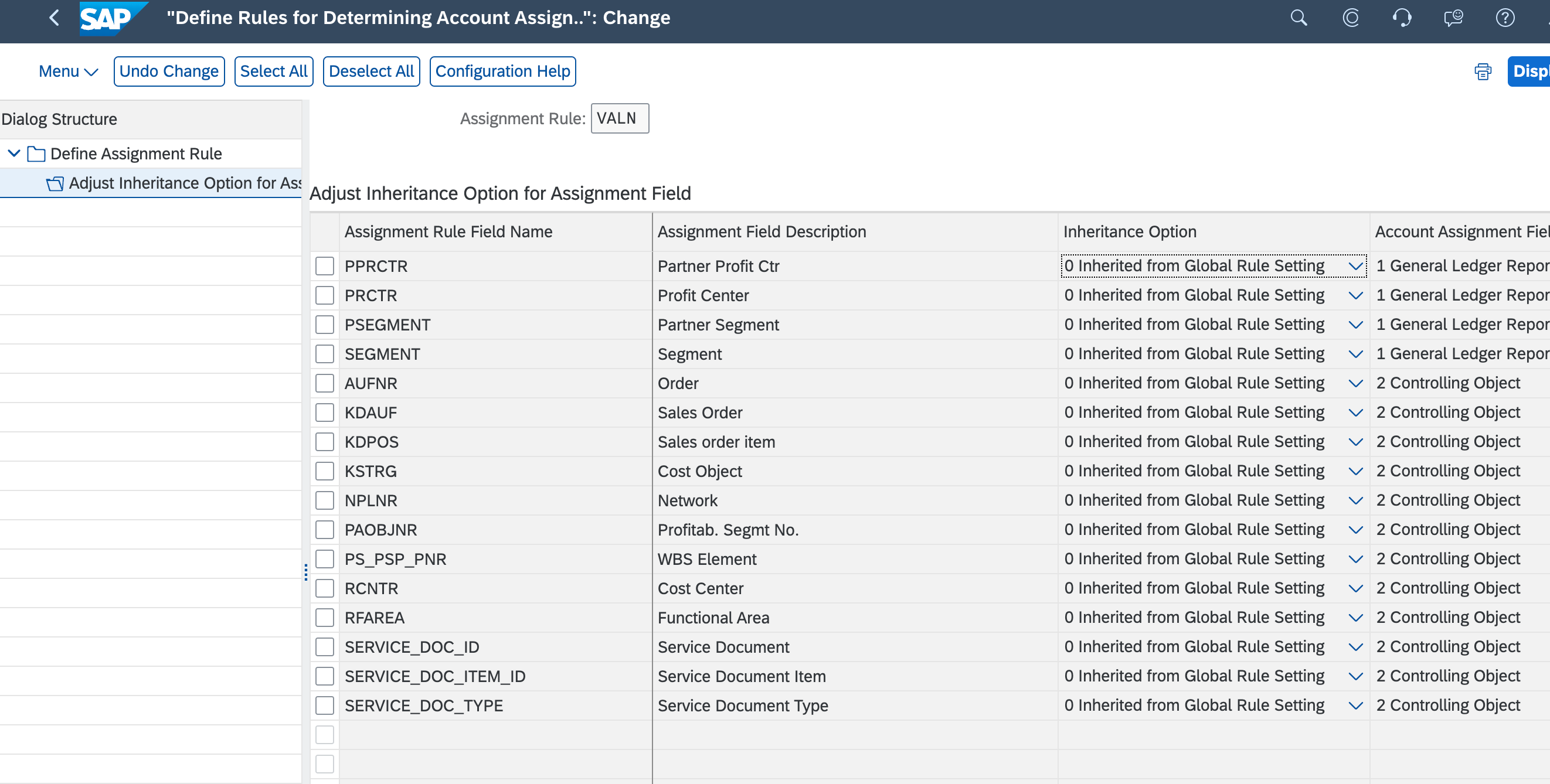

1) Define rules for determine account assignment and assign to Advanced Foreign Currency valuation

2) Define valuation rules for Advanced Foreign Currency per account principle

Perform Foreign Currency Valuation with the Advanced FCV

💡Note:

[Ledger]

If you want to run advanced foreign currency valuation for a different ledger (such as 2L (IFRS) or 3L (USGP)), you must create a financial statement version for IFRS/USGP (based on YCOA) first, then assign it and YCOA to the IFRS/USGP accounting principle together.

[Multi-currency]

Advanced foreign currency valuation uses the balance transaction currency for valuations into functional currency. If you have not defined a functional currency, then the valuation is done into company code currency. Further currency types, like group currency or free defined currency, can be translated from either company code currency or document currency upon customizing.

For the required settings to support Multiple Currencies in Advanced Foreign Currency Valuation, you can follow the guidance in help portal.

[Job Execution]

As mentioned, you have two options to perform the advanced foreign currency valuation:

Grouping Rules

the default rule will not group any journal entry line item, except for the ones which are partial payments and credit memos. For partial payments and credit memos, the journal entry will inherit the group ID from the related invoice.

Default grouping rule example for open-item managed accounts:

the amounts will be grouped by G/L account and currency according to the default grouping rule.

Default grouping rule example for accounts not managed on an open item basis:

Job Execution Step – App Schedule General Ledger Jobs

You can find a demo here: https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_q3wgndlb

Business Context

As part of period-end closing, when preparing the financial statement, accounting conventions require that the foreign currency revaluation should be performed to present the true value of foreign currency open items and foreign currency assets/liabilities at closing date in presentation currency. This remeasurement considers the changing value of payables/receivables/assets due to varying exchange rates between currencies. The valuation process generates the valuation difference postings to induce the valuated account balances in presentation currency and the related effect on the financial result.

The Advanced Foreign Currency Valuations as the new cloud offering supports you performing the foreign currency revaluation in an easy and consistent way with the Advanced Valuation solution. As part of the intelligent closing processes, the Advanced Valuation processes are integrated with SAP S/4HANA Cloud for Advanced Financial Closing as the tasks in closing activities.

Capabilities

- Valuation rules can be configured per accounting principle

- Selection of the items relevant for Foreign Currency Revaluation

- Determination of open items and balances

- Valuation of open items and balances

- Posting of valuation differences: value changes as delta to previous run - no reversal postings needed

- Support the valuation of open items, non-open items for G/L balances

New and Benefits in Advanced Foreign Currency Valuations

- Support Parallel Accounting and valuation posting in functional currency, company code currency, and group currency

- Financial statement version used to decide the account to be valuated via the semantic tagging concept

- Automatic posting and correction: 1) Simple Account Determination: Gain and Loss accounts only; 2) Post to original B/S account (even if open item managed or a reconciliation account)

- Consideration of the cleared items in the period-end valuation processes

💡Note

Advanced Valuations are provided as optional scope in S/4HANA Cloud Accounting and Financial Close. Once Advanced Foreign Currency Valuation is activated, the following apps cannot be used:

- Perform Foreign Currency Valuation (FAGL_FCV)

- Regroup Receivables/Payables (FAGLF101)

- Perform Further Valuations (F107)

Besides that, the following job templates cannot be used as well

- Foreign Currency Valuation

- Regroup Receivables/Payables

- Provisions for Doubtful Receivables

Current restrictions

- If the customer activated extended open item management, there is no foreign currency valuation for the Unbilled Good receipt

The Configuration Steps

Preliminary steps:

- Setup Chart of Account

- Define Financial Statement Versions and assign to Accounting Principle

- For users whom use classic FSV, define and Assign Semantic Tags to Financial Statement Versions. For users using app Manage Global Hierarchy for FSV, define the semantic tag in manage Global Hierarchy - * For Advanced Foreign Currency Valuations this step must be performed for deciding the account for valuation.

- Determination of Foreign Exchange Rates at Key Date: App Currency Exchange Rates (App ID F3616) and (SSCUI 102568)

Activate Advanced Valuation Processes:

Activate Advanced Valuation (SSCUI 103315)

Configure Foreign Currency Valuation:

1) Define rules for determine account assignment and assign to Advanced Foreign Currency valuation

- Define Rules for Determining Account Assignments in G/L Processes (SSCUI 104827)

- Assign Account Assignment Rules to Advanced Valuations (SSCUI 104826)

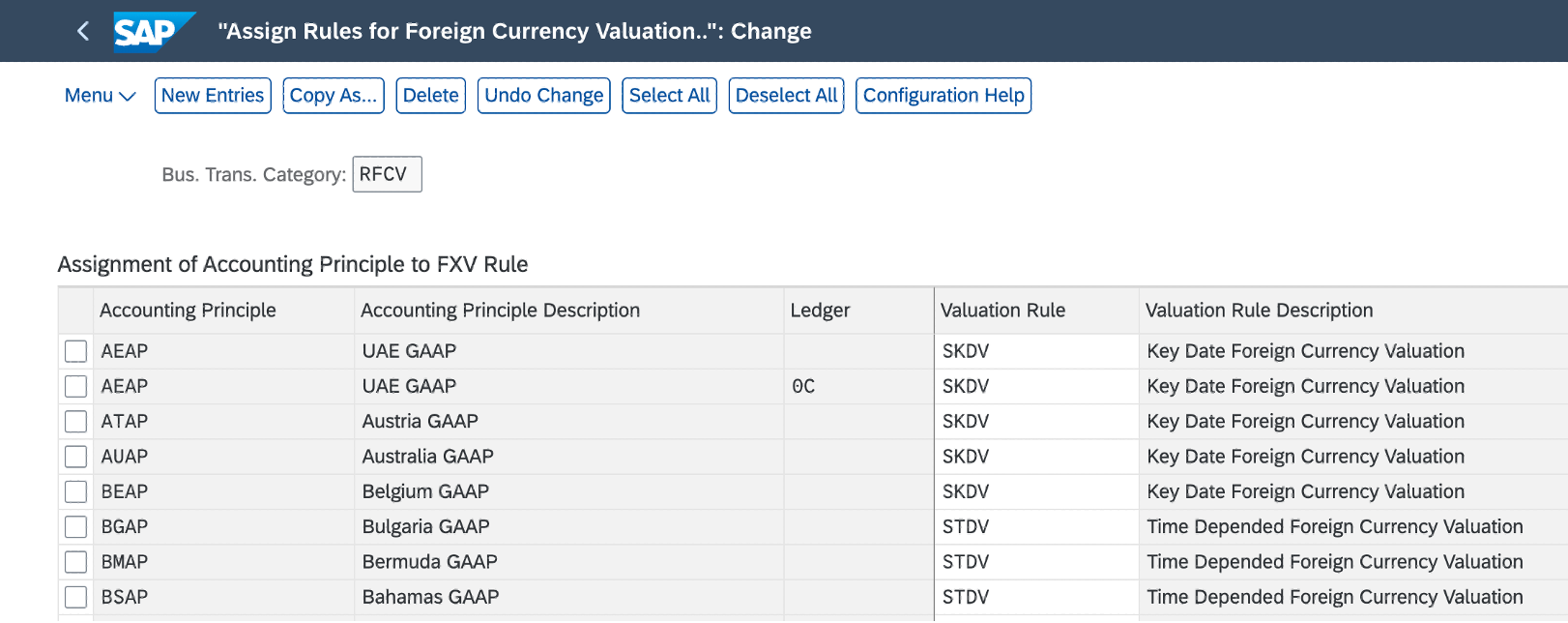

2) Define valuation rules for Advanced Foreign Currency per account principle

- Define valuation rules for Advanced Foreign Currency (SSCUI 105450)

- Definition of Valuation rule

- Define Steps of a FCV Rule

- Assign Semantic tag for FCV rule -In this step, the semantic tag (FX) need to be assigned to the FXV Rule

- Assign GL Accounts for Automatic Posting - Only Gain and Loss accounts need to be configured here. The valuation difference posting addresses two target accounts: a) The original balance sheet account; b) Configured unrealized exchange rate Gain/Loss (P&L account)

- Assign Rules for Foreign Currency Valuation to Accounting Principles (SSCUI 105451)

Perform Foreign Currency Valuation with the Advanced FCV

💡Note:

[Ledger]

If you want to run advanced foreign currency valuation for a different ledger (such as 2L (IFRS) or 3L (USGP)), you must create a financial statement version for IFRS/USGP (based on YCOA) first, then assign it and YCOA to the IFRS/USGP accounting principle together.

[Multi-currency]

Advanced foreign currency valuation uses the balance transaction currency for valuations into functional currency. If you have not defined a functional currency, then the valuation is done into company code currency. Further currency types, like group currency or free defined currency, can be translated from either company code currency or document currency upon customizing.

For the required settings to support Multiple Currencies in Advanced Foreign Currency Valuation, you can follow the guidance in help portal.

[Job Execution]

As mentioned, you have two options to perform the advanced foreign currency valuation:

- Execute the procedure below.

- Run it as part of Advanced Financial Closing using the Task Template - Advanced Foreign Currency Valuation.

Grouping Rules

- For accounts managed on an open item basis:

the default rule will not group any journal entry line item, except for the ones which are partial payments and credit memos. For partial payments and credit memos, the journal entry will inherit the group ID from the related invoice.

Default grouping rule example for open-item managed accounts:

Group ID | Journal Entry ID | Booking Reference | Original Amount USD | Original Amount EUR | Valuated Amount EUR | Gain/Loss Posted to account |

| ****1/2020/USD | ****1 | Invoice | 100 | 90 | 80 | -10 (Loss) Posted to Loss Account |

| ****1/2020/USD | ****2 | Credit Memo | -20 | -18 | -16 | 2 (Gain) Posted to Loss Account |

| Group Aggregated | -8 (Loss) | |||||

| ****3/2020/USD | ****3 | Invoice | 90 | 81 | 72 | -9 (Loss) Posted to Loss Account |

- For accounts not managed on an open item basis:

the amounts will be grouped by G/L account and currency according to the default grouping rule.

Default grouping rule example for accounts not managed on an open item basis:

Group ID | G/L Account | Original Amount USD | Original Amount EUR | Valuated Amount EUR | Gain/Loss Posted to account |

| 11001000/USD | 11001000 | 100 | 90 | 80 | -10 (Loss) Posted to Loss Account |

Job Execution Step – App Schedule General Ledger Jobs

- Step 1 : Template Selection

- Step 2 : Scheduling Options - It is possible for a single run starting at some time point, or a recurring run, which takes place with a preferred frequency upon setting.

- Step 3: Parameters - Select the company code and ledger to be valuated, test run is supported.

- Valuation Result List

Demo

You can find a demo here: https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_q3wgndlb

More Information on SAP S/4HANA Cloud:

- Finance Collection Blog (roadmap, quarterly release highlights, microlearnings) here

- Group Financial Statement Review Booklet here

- openSAP Microlearnings for SAP S/4HANA for Finance and GRC here

- SAP S/4HANA Cloud Customer Community for Finance here

- SAP S/4HANA Cloud release info: http://www.sap.com/s4-cloudrelease

- SAP S/4HANA PSCC Digital Enablement Wheel here

- Early Release Webinar Series here

- Inside SAP S/4HANA Podcast here

- Best practices for SAP S/4HANA Cloud here

- SAP S/4HANA Cloud Community: here

- Feature Scope Description here

- What’s New here

- Help Portal Product Page here

- Implementation Portal here

- SAP Managed Tags:

- SAP S/4HANA Cloud for Finance

Labels:

13 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

22 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

156 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

217 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- Explanation of the Delta Posting Logic in Advanced Foreign Currency Valuation in Enterprise Resource Planning Blogs by SAP

- Improvements to manage treasury position in SAP Treasury and Risk Management in Enterprise Resource Planning Blogs by SAP

- valuation area not defined what should i Do for it in Enterprise Resource Planning Q&A

- Valuation area not definedMessage No. ME059 in Enterprise Resource Planning Q&A

- Automate [Inventory Valuation Simulation Report] in SAP Business One in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 12 | |

| 11 | |

| 8 | |

| 8 | |

| 7 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 3 |