- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Discounting of Long-Term Assets and Liabilities in...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

02-04-2022

7:04 AM

Introduction

Discounting of Long- Term Assets and Liabilities function used to calculate the discounting on Long- Term Assets and Liabilities based on International Financial Reporting Standards (IFRS) 9, 15, 16.

You treat this as a loan and system use below formula for calculating discounting.

Formula for Discounting

Configuration

User needs to maintain below configuration in Manage Your Solution app, under Configure Your Solution:

- Define interest rates under Finance Accounts Receivable Item Interest Calculation Define Interest Rates . Make sure that you define interest rates for all the currencies that you use in discounting.

- Define interest rate indicator under Finance Accounts Receivable Item Interest Calculation Define Interest Indicator . Make sure that the interest indicator that you want to use for discounting has the type D.

- Activate advanced valuation under Finance General Ledger Ledgers and Valuation Activate Advanced Valuation.

- Define an aging and aging increments for discounting under Finance General Ledger Ledgers and Valuation Define Aging Increments for Advanced Valuation.

- Define Discounting Rules step, you´ve defined a discounting rule for your requirements. User should assign interest indicator and risk class to Ageing Increments.

- Assign Discounting Rules to Accounting Principles step, User must assign the discounting rule to an accounting principle.

Process

User can Schedule General Ledger Job app and Select the Post Discounting of Long-Term Assets and Liabilities template to schedule the job.

Step 1 : Template Selection

Go to Schedule General Ledger Job app and click on Create button. Select Post Discounting of Long-Term Assets and Liabilities template to schedule the job.

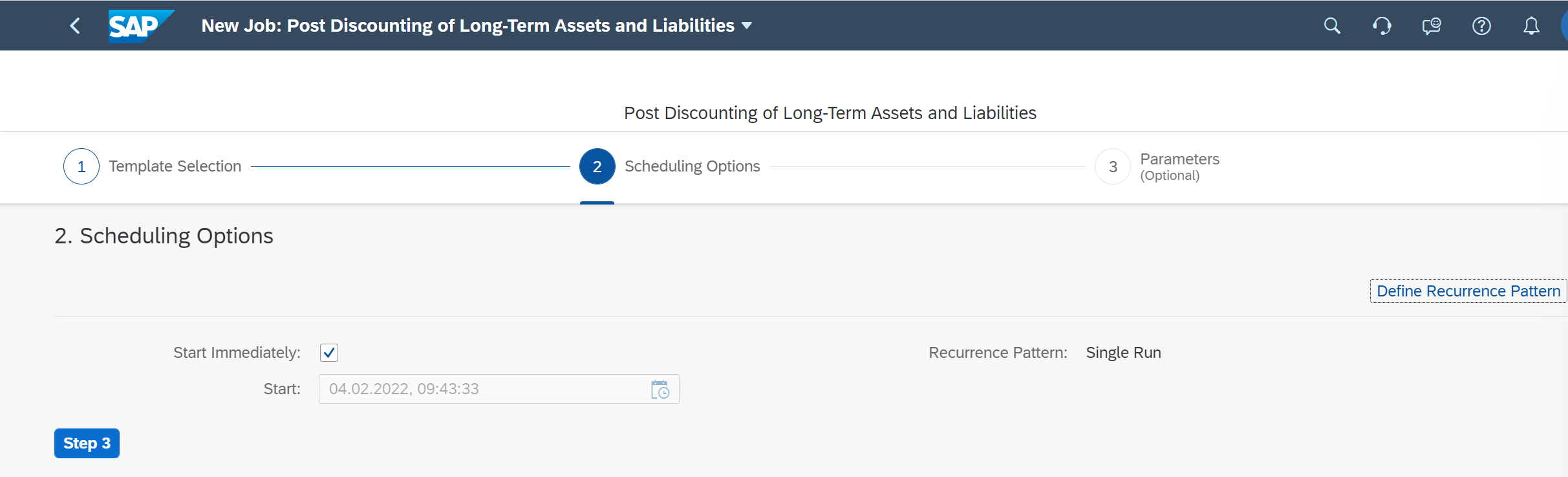

Step 2 : Scheduling Options

User can define recurring pattern, If user want to run this job just once or specific interval.

Step 3: Parameters

User can specify a company code, ledger, Valuation key date. User can also decide to run this on test run or update run.

Click on Check and Schedule button.

Example

Open customer invoice posted with 50USD and Due date is more than 12 months and, Interest rate maintained 2% against Interest indicator.

Accounting Entry during Invoice posting

| Head | Indicator | Amount |

| Customer | Dr | 50 |

| Billed Revenue | Cr | 50 |

Accounting Entry Posted from Discounting of Long- Term Assets and Liabilities function.

Result has been posted as Interest income and discounted present value.

| Head | Indicator | Amount |

| Billed Revenue | Dr | .99 |

| Customer | Cr | .99 |

| Head | Indicator | Amount |

| Customer | Dr | .08 |

| Interest Income | Cr | .08 |

Business Benefits

This function calculates the discounting of long-term assets and liabilities and post the net present value adjustments and the interest income or interest expense to the designated accounts based on International Financial Reporting Standards (IFRS) 9, 15, 16.

Reference SAP Best practice : J58 Available as of SAP S/4HANA CLOUD 2108

Thanks for reading this blog post. I would like to see your comments and would like to answer questions which u can post at Q&A tag area : https://answers.sap.com/tags/66233466-fcd6-45d2-a9ae-2cba38c72e19

- SAP Managed Tags:

- SAP S/4HANA Cloud for Finance,

- SAP S/4HANA Public Cloud

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

153 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

211 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- Readiness for Universal Parallel Accounting in Enterprise Resource Planning Blogs by SAP

- Introduction into Advanced Foreign Currency Valuation in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Public Edition - Implementation Need2Know for Finance in Enterprise Resource Planning Blogs by SAP

- Discounting of Long-Term Assets and Liabilities in SAP S/4HANA Public Cloud in Enterprise Resource Planning Blogs by Members

- Balance Sheet Reclassification and Regrouping in S/4HANA Cloud in Enterprise Resource Planning Blogs by Members

Top kudoed authors

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 6 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 |