- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Understanding Consolidation of Investment (COI) in...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member61

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

01-28-2022

6:35 AM

Purpose

Purpose of this blogpost is to provide overview on the Consolidation of Investment (COI) in SAP S/4HANA Finance for group reporting solution.

SAP S/4HANA Finance for group reporting supports below approaches for COI

In this blogpost we shall understand more on the Activity based consolidation - direct share without cross holding scenario

What will you learn from this blogpost

Introduction

During the consolidation process the Group must eliminate all the transactions that has occurred during the period between different entities within the same group e.g intercompany sales, intercompany purchases etc.

Similarly, the group is also supposed to eliminate any investment between entities within the group i.e Consolidation of Investment (COI)

In the process, a parent company's investments are eliminated against the stockholder’s equity of a subsidiary.

Different Accounting techniques used for Consolidation

There are 2 popular methods of consolidation that are widely used across all industries

1.Purchase method

In this method the Financial statement of the subsidiary is combined with the group. Each line from assets and liabilities are considered and added to the group BS

e.g : Unit A and Unit B are part of the Group ABC

Unit A is the parent unit investing 70 % in subsidiary Unit B via Purchase method

Below you can see the Financial statements of each unit individually and of group ABC where Unit B is consolidated using Purchase method

2. Equity method

In this method the Financial statement of the subsidiary is NOT combined with the group. Instead changes in subsidiary equity or equity holdings adjustments for the equity-method investee unit result in an adjustment of investment book values in the consolidation of investments. The equity units are not displayed in reporting.

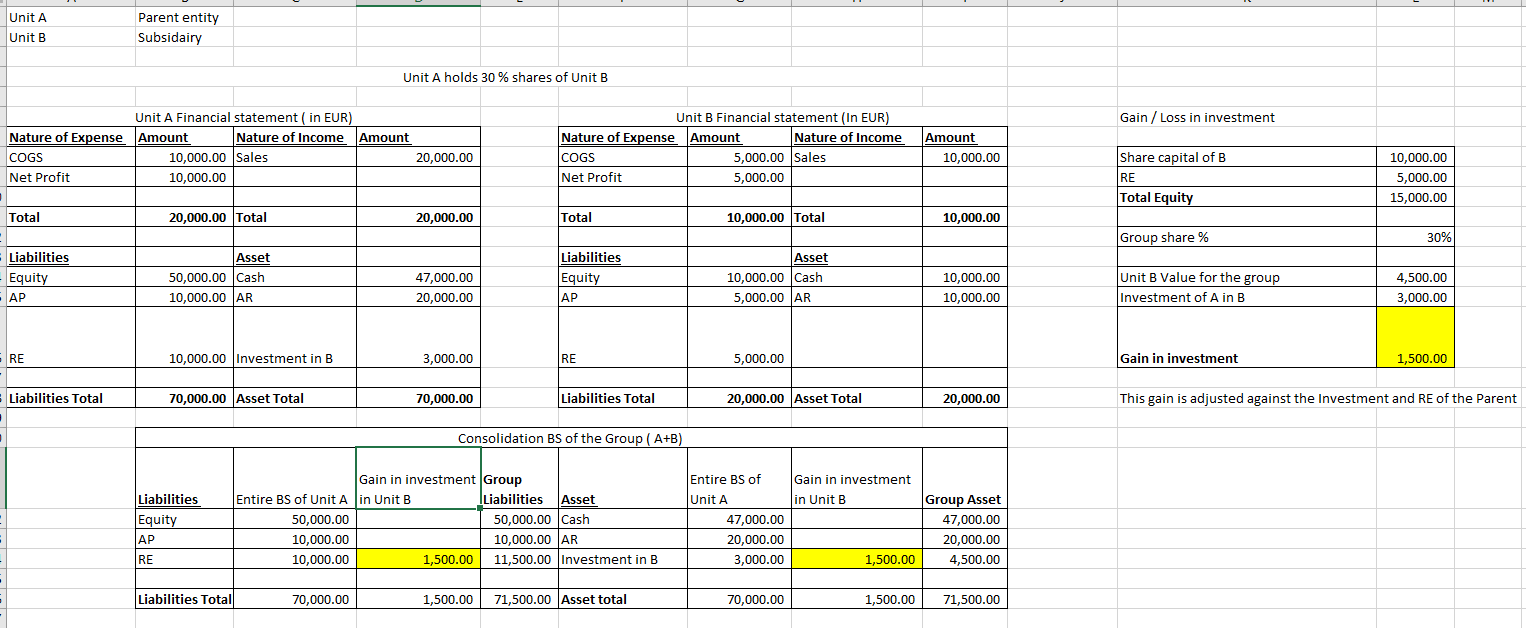

e.g : Unit A and Unit B are part of the Group ABC

Unit A is the parent unit investing 30 % in subsidiary Unit B via Equity method

Below you can see the Financial statements of each unit individually and of group ABC where Unit B is consolidated using Equity method

Note: Some organization also use Proportionate method of consolidation. We are not covering this method in this blogpost

Introduction to Activity based consolidation in SAP S/4HANA Finance for group reporting

During the time span of the investment relationship between different entities in the group, different activities (events) can occur that require elimination and adjustments in consolidation. The following activities are supported by SAP S/4HANA Finance for group reporting for the consolidation of investments:

Consolidation Methods and Scenarios supported by SAP S/4HANA Finance for group reporting

SAP S/4HANA Finance for group reporting supports both direct share method and group share method. Within both these methods it supports with cross holding and without cross holding scenarios

In this blogpost we cover only direct share method without / with cross holding scenario.

Configuration and Fiori activities for COI

1.Configuration settings for COI is part of below SPRO node.

2.Consolidation task group mapped to the version should be S21. S21 task group has task for Activity based consolidation. You can verify same in below SPRO nodes

(NOTE: For examples used in this blogpost we are using standard best practice delivered setting.)

3.Create Consolidation Group. Ensure field for consolidation frequency is updated.

4. Create Consolidation units

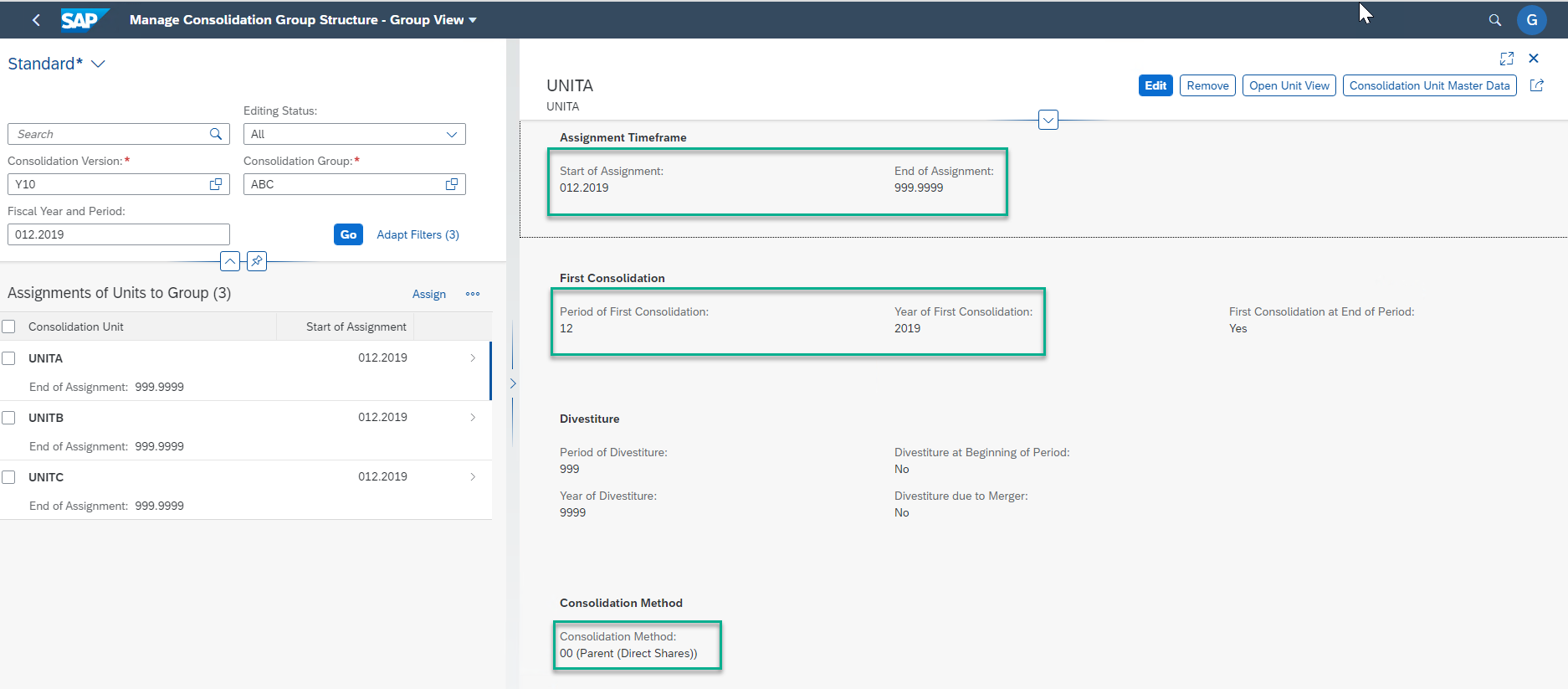

5. Assign consolidation units to Consolidation Group indicating consolidation method, start date of first assignment, period for first consolidation etc

Parent Unit e.g

Subsidiary with Purchase method e.g

Subsidiary with Equity method e.g

Note: SAP gives below options for consolidation methods. In this blog we emphasize more on the direct share options highlighted in green

Data specifications to be considered for using COI

Below is an example of upload file which contains additional information for COI

Note: For First Consolidation, activity type 01 should be mentioned against the Equity FS item 311000 in the investee unit so that Equity / Share Capital information is also considered for Consolidation

Note: In case of integrated units where investment / equity amounts are flowing from underlying S4 system, you need to only supplement the information for holding % and activity type. This can be done by posting a manual journal entry via Post group journal entry app or also via flat file as well

Note: It is recommended to use GRDC to upload data into Group reporting.

2. Ensure FS items has correct FS item roles, Break down category to allow % entry, NCI target attribute and all selections are available to support COI related postings.

Below are some of the FS items from standard consolidation chart of account Y1 that are used in all our examples and are relevant for COI

Refer to below link from sap help for more details:

https://help.sap.com/viewer/4ebf1502064b406c964b0911adfb3f01/2021.000/en-US/cc8f7d8e0ee14ff7bfad7875...

Example for COI without cross holding

Scenario for period 01 (period 012.2019)

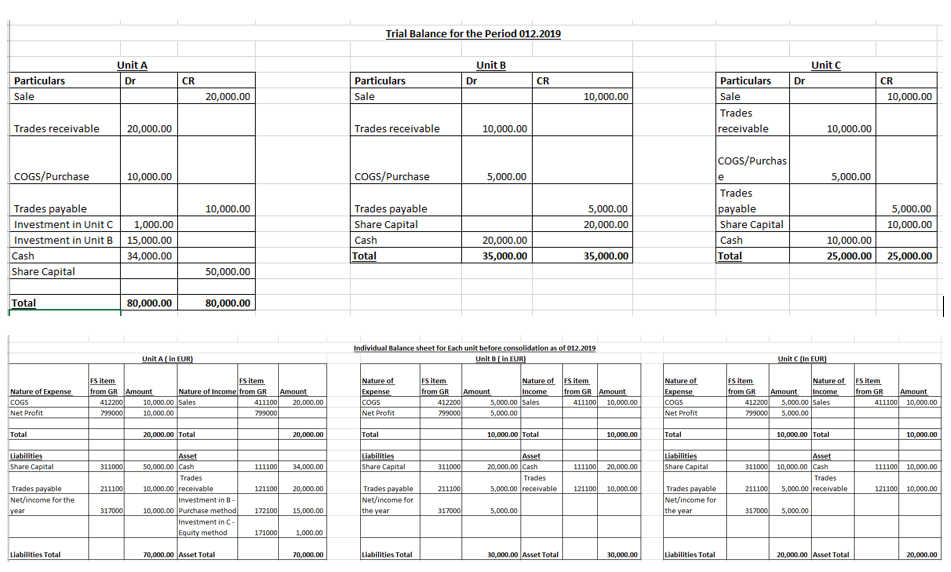

Below sample data was used for period 012.2019

Upload above transaction data with activity type, percentage holding and equity details and execute data monitor tasks (in the example we have loaded all the data in EUR hence CT task is not executed)

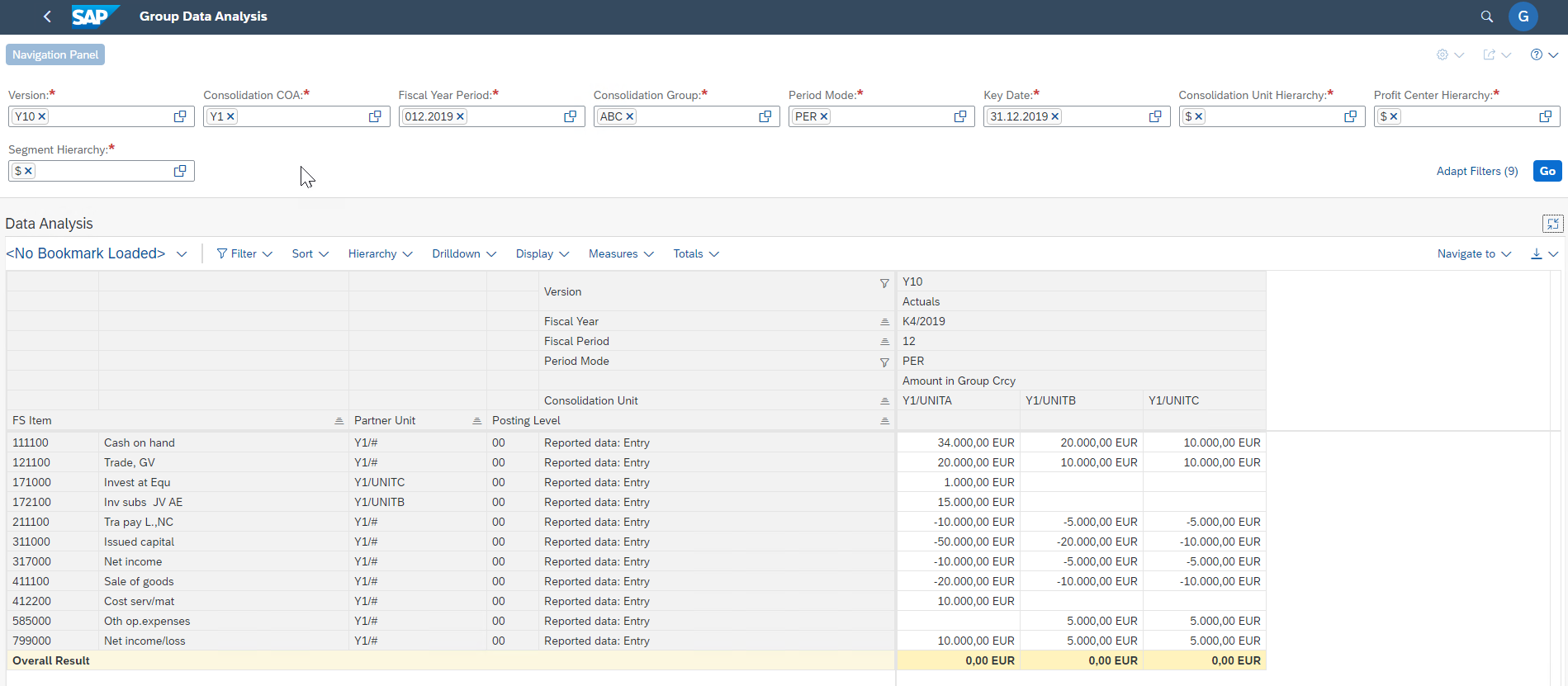

Below is the individual BS for each unit before executing any of the Consolidation tasks. The calculation for net income can be verified against the manual BS screen shot shared above

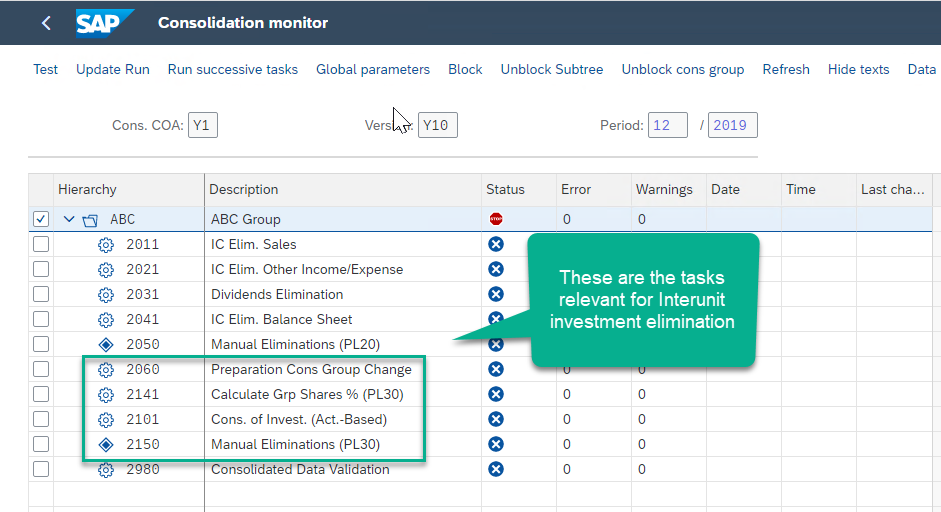

We proceed to execute tasks in Consolidation monitor to elimination inter unit investments

a) Task 2060 – Preparation Consolidation Group Change

Task log below indicates that since this is the first consolidation the record type A (acquisition) is used.

Refer below link from SAP help for more details on this task

https://help.sap.com/viewer/4ebf1502064b406c964b0911adfb3f01/2020.000/en-US/1cb4def471234e1ab0c039d2...

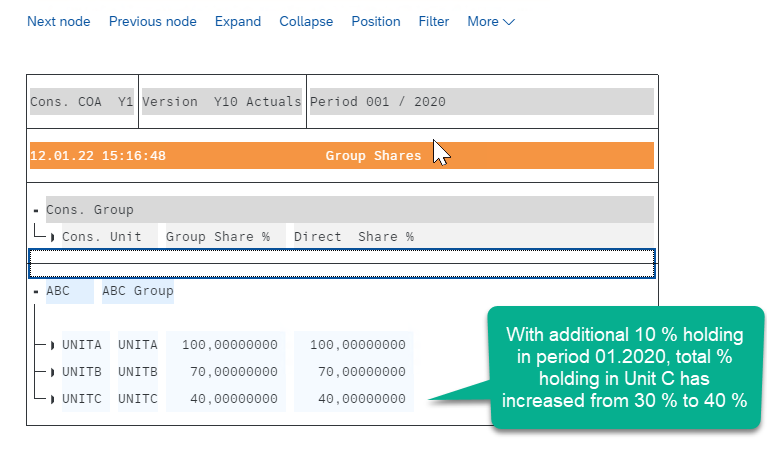

b) Task 2141 – Calculate Group share %

This task calculates Group share for each Unit. Since this example doesn’t have any cross holding the direct share and group share % is same

Refer below link from SAP help for more details on this task

https://help.sap.com/viewer/4ebf1502064b406c964b0911adfb3f01/2020.000/en-US/79940df720e24c29b1569dda...

c) Task 2101 – Consolidation of Investment (Activity Based)

This task calculates goodwill/ capital reserve & NCI on investment via purchase method and any gain/loss of investment for investment via Equity method.

The task log shows postings that would be made along with the calculations for each subsidiary, each investment method and each activity. Since this is first consolidation there is only 1 activity type i.e First consolidation

Details from log for investment in Unit C

https://help.sap.com/viewer/4ebf1502064b406c964b0911adfb3f01/2020.000/en-US/9453a9b45c1a41f08f16924f...

Each task is updated with the date and time of execution and user can always refer back to task log later for reference

The consolidated Balance sheet for Group ABC for period 12.2019 after First consolidation shows below values

Asset:

Liabilities:

Scenario for period 02 (period 001.2020)

Before loading data in period 01.2020, we executed Balance carry forward to get opening balances for the period.

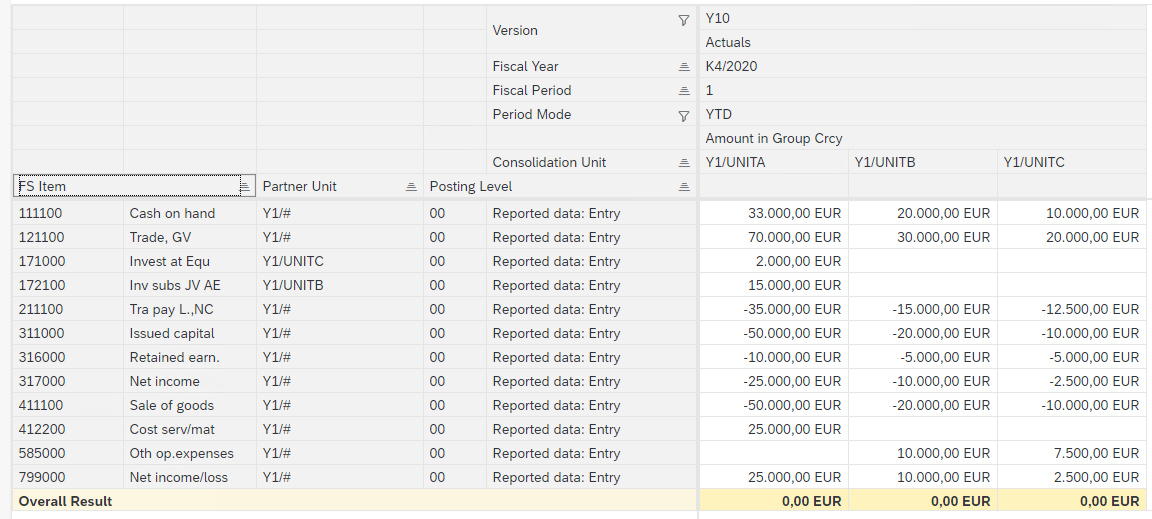

Trial balance for the sample data used for period 001.2020 and Manual BS as of 001.2020 after considering transaction for period 001.2020 is as below

Upload file had below values for the Step acquisition in Unit C and subsequent acquisition for Unit B

After uploading the data for period 01.2020 and completing all the steps from data monitor, we get below information for Balance sheet for period 001.2020. This can be compared with the manual BS above

We executed Consolidation Monitor for period 001.2020 and below are the logs from different tasks

1) Task 2060 – Preparation for Cons Group Change

2) Task 2141 – Calculate Group Shares % (PL30)

3) Task 2101 – Consolidation of Investment (Activity based)

Details of Unit C

Consolidated BS for group ABC as of period 001.2020 is as below

Assets:

Liabilities:

Manual Calculation for consolidated BS as of 001.2020 is as below

Benefits and Limitations of SAP S/4HANA Finance for group reporting

Benefits

Limitations

Final note:

This is not an exhaustive list of scenarios however a small attempt to give some insight on how few different Consolidation of Investment scenarios can be achieved in SAP S/4HANA Finance for group reporting.

In the next part of this blogpost we shall cover Activity Based COI - direct share approach with cross holding scenario.

You can refer below link to understand Consolidation of Investment via Rule based approach

https://help.sap.com/viewer/4ebf1502064b406c964b0911adfb3f01/2021.000/en-US/5ce06895106a463ca073fdda...

Lastly I would like to thank my colleague prasadatmakuri who persuaded me to write this blogpost and our mentor gayathrikrish for her valuables inputs and guidance.

Part II :

Understanding Consolidation of Investment (COI) in SAP S/4HANA Finance for group reporting – part II

https://blogs.sap.com/2022/03/01/understanding-consolidation-of-investment-coi-in-sap-s-4hana-financ...

Purpose of this blogpost is to provide overview on the Consolidation of Investment (COI) in SAP S/4HANA Finance for group reporting solution.

SAP S/4HANA Finance for group reporting supports below approaches for COI

- Rule Based Consolidation

- Activity Based Consolidation (supported from 1909 release)

In this blogpost we shall understand more on the Activity based consolidation - direct share without cross holding scenario

What will you learn from this blogpost

- Introduction to the concept of Consolidation of investment (COI)

- Different accounting techniques used for consolidation

- Introduction to Activity based consolidation in SAP S/4HANA Finance for group reporting

- Configuration and Fiori activities for COI in SAP S/4HANA Finance for group reporting

- Benefits and Limitation from SAP S/4HANA Finance for group reporting

Introduction

During the consolidation process the Group must eliminate all the transactions that has occurred during the period between different entities within the same group e.g intercompany sales, intercompany purchases etc.

Similarly, the group is also supposed to eliminate any investment between entities within the group i.e Consolidation of Investment (COI)

In the process, a parent company's investments are eliminated against the stockholder’s equity of a subsidiary.

Different Accounting techniques used for Consolidation

There are 2 popular methods of consolidation that are widely used across all industries

1.Purchase method

In this method the Financial statement of the subsidiary is combined with the group. Each line from assets and liabilities are considered and added to the group BS

e.g : Unit A and Unit B are part of the Group ABC

Unit A is the parent unit investing 70 % in subsidiary Unit B via Purchase method

Below you can see the Financial statements of each unit individually and of group ABC where Unit B is consolidated using Purchase method

2. Equity method

In this method the Financial statement of the subsidiary is NOT combined with the group. Instead changes in subsidiary equity or equity holdings adjustments for the equity-method investee unit result in an adjustment of investment book values in the consolidation of investments. The equity units are not displayed in reporting.

e.g : Unit A and Unit B are part of the Group ABC

Unit A is the parent unit investing 30 % in subsidiary Unit B via Equity method

Below you can see the Financial statements of each unit individually and of group ABC where Unit B is consolidated using Equity method

Note: Some organization also use Proportionate method of consolidation. We are not covering this method in this blogpost

Introduction to Activity based consolidation in SAP S/4HANA Finance for group reporting

During the time span of the investment relationship between different entities in the group, different activities (events) can occur that require elimination and adjustments in consolidation. The following activities are supported by SAP S/4HANA Finance for group reporting for the consolidation of investments:

| Activity Number | Description |

| 01 | First consolidation |

| 02 | Subsequent consolidation |

| 05 | Increase in capitalization |

| 06 | Decrease in capitalization |

| 07 | Step acquisition |

| 08 | Partial transfer |

| 09 | Total transfer |

| 10 | Partial divestiture |

| 11 | Total divestiture |

| 16 | Horizontal merger |

| 24 | Update of retained earnings merger |

Consolidation Methods and Scenarios supported by SAP S/4HANA Finance for group reporting

SAP S/4HANA Finance for group reporting supports both direct share method and group share method. Within both these methods it supports with cross holding and without cross holding scenarios

In this blogpost we cover only direct share method without / with cross holding scenario.

Configuration and Fiori activities for COI

1.Configuration settings for COI is part of below SPRO node.

2.Consolidation task group mapped to the version should be S21. S21 task group has task for Activity based consolidation. You can verify same in below SPRO nodes

(NOTE: For examples used in this blogpost we are using standard best practice delivered setting.)

3.Create Consolidation Group. Ensure field for consolidation frequency is updated.

4. Create Consolidation units

5. Assign consolidation units to Consolidation Group indicating consolidation method, start date of first assignment, period for first consolidation etc

Parent Unit e.g

Subsidiary with Purchase method e.g

Subsidiary with Equity method e.g

Note: SAP gives below options for consolidation methods. In this blog we emphasize more on the direct share options highlighted in green

Data specifications to be considered for using COI

1.Supplement below additional detail for COI against investment FS items (171000 for Equity method and 172100 for Purchase method)

- Investee unit (Field from ACDOCU – COICU)

- Activity type (Field from ACDOCU– COIAC)

- Percentage of Investment (Field from ACDOCU – MSL)

- Base Unit as PRC ((Field from ACDOCAU– RUNIT)

Below is an example of upload file which contains additional information for COI

Note: For First Consolidation, activity type 01 should be mentioned against the Equity FS item 311000 in the investee unit so that Equity / Share Capital information is also considered for Consolidation

Note: In case of integrated units where investment / equity amounts are flowing from underlying S4 system, you need to only supplement the information for holding % and activity type. This can be done by posting a manual journal entry via Post group journal entry app or also via flat file as well

Note: It is recommended to use GRDC to upload data into Group reporting.

2. Ensure FS items has correct FS item roles, Break down category to allow % entry, NCI target attribute and all selections are available to support COI related postings.

Below are some of the FS items from standard consolidation chart of account Y1 that are used in all our examples and are relevant for COI

Refer to below link from sap help for more details:

https://help.sap.com/viewer/4ebf1502064b406c964b0911adfb3f01/2021.000/en-US/cc8f7d8e0ee14ff7bfad7875...

Example for COI without cross holding

Scenario for period 01 (period 012.2019)

- In group ABC, Unit A is the Parent unit. Unit B & Unit C are subsidiary units

- Unit A has 70 % holding in Unit B via Purchase Method

- Unit A has 30% holding in Unit C via Equity Method

- Since this is first period of consolidation the activity type will be 01- First consolidation

- We cover both Purchase and Equity method of consolidation

Below sample data was used for period 012.2019

Upload above transaction data with activity type, percentage holding and equity details and execute data monitor tasks (in the example we have loaded all the data in EUR hence CT task is not executed)

Below is the individual BS for each unit before executing any of the Consolidation tasks. The calculation for net income can be verified against the manual BS screen shot shared above

We proceed to execute tasks in Consolidation monitor to elimination inter unit investments

a) Task 2060 – Preparation Consolidation Group Change

Task log below indicates that since this is the first consolidation the record type A (acquisition) is used.

Refer below link from SAP help for more details on this task

https://help.sap.com/viewer/4ebf1502064b406c964b0911adfb3f01/2020.000/en-US/1cb4def471234e1ab0c039d2...

b) Task 2141 – Calculate Group share %

This task calculates Group share for each Unit. Since this example doesn’t have any cross holding the direct share and group share % is same

Refer below link from SAP help for more details on this task

https://help.sap.com/viewer/4ebf1502064b406c964b0911adfb3f01/2020.000/en-US/79940df720e24c29b1569dda...

c) Task 2101 – Consolidation of Investment (Activity Based)

This task calculates goodwill/ capital reserve & NCI on investment via purchase method and any gain/loss of investment for investment via Equity method.

The task log shows postings that would be made along with the calculations for each subsidiary, each investment method and each activity. Since this is first consolidation there is only 1 activity type i.e First consolidation

Details from log for Investment in Unit B

Details from log for Investment in Unit B

Details from log for investment in Unit C

Refer below link from SAP help for more details on this task:

Refer below link from SAP help for more details on this task:

https://help.sap.com/viewer/4ebf1502064b406c964b0911adfb3f01/2020.000/en-US/9453a9b45c1a41f08f16924f...

Each task is updated with the date and time of execution and user can always refer back to task log later for reference

The consolidated Balance sheet for Group ABC for period 12.2019 after First consolidation shows below values

Asset:

Liabilities:

Manual Calculation for consolidated BS

Manual Calculation for consolidated BS

Scenario for period 02 (period 001.2020)

- Subsequent consolidation

- Step Acquisition

Before loading data in period 01.2020, we executed Balance carry forward to get opening balances for the period.

Trial balance for the sample data used for period 001.2020 and Manual BS as of 001.2020 after considering transaction for period 001.2020 is as below

Upload file had below values for the Step acquisition in Unit C and subsequent acquisition for Unit B

After uploading the data for period 01.2020 and completing all the steps from data monitor, we get below information for Balance sheet for period 001.2020. This can be compared with the manual BS above

We executed Consolidation Monitor for period 001.2020 and below are the logs from different tasks

1) Task 2060 – Preparation for Cons Group Change

2) Task 2141 – Calculate Group Shares % (PL30)

3) Task 2101 – Consolidation of Investment (Activity based)

Details for Unit B

Details for Unit B

Details of Unit C

Consolidated BS for group ABC as of period 001.2020 is as below

Assets:

Liabilities:

Manual Calculation for consolidated BS as of 001.2020 is as below

Benefits and Limitations of SAP S/4HANA Finance for group reporting

Benefits

- SAP S/4HANA Finance for group reporting covers most of the types of COI scenarios

- With introduction of activity based consolidation this tool simplifies the approach for consolidation of investment

- With introduction of flat group structure consolidation process for different sub group becomes more flexible. This design is more scalable and provides for organization changes.

Limitations

- SAP S/4HANA Finance for group reporting has Out of the Box solution for Purchase method and Equity method however for Proportionate consolidation a new re-classification has to be created as per customer requirement

- Currently no out of box solution available for change in method of consolidation from Purchase to Equity or vice versa. Could be part of future releases. Please keep checking roadmap for further updates on this point

Final note:

This is not an exhaustive list of scenarios however a small attempt to give some insight on how few different Consolidation of Investment scenarios can be achieved in SAP S/4HANA Finance for group reporting.

In the next part of this blogpost we shall cover Activity Based COI - direct share approach with cross holding scenario.

You can refer below link to understand Consolidation of Investment via Rule based approach

https://help.sap.com/viewer/4ebf1502064b406c964b0911adfb3f01/2021.000/en-US/5ce06895106a463ca073fdda...

Lastly I would like to thank my colleague prasadatmakuri who persuaded me to write this blogpost and our mentor gayathrikrish for her valuables inputs and guidance.

Part II :

Understanding Consolidation of Investment (COI) in SAP S/4HANA Finance for group reporting – part II

https://blogs.sap.com/2022/03/01/understanding-consolidation-of-investment-coi-in-sap-s-4hana-financ...

- SAP Managed Tags:

- SAP S/4HANA Finance for group reporting,

- SAP S/4HANA,

- SAP S/4HANA Finance

Labels:

35 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

152 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

208 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

88

Related Content

- SAP "EHS" Product Structure / R/3 <=> S/4 in Enterprise Resource Planning Blogs by Members

- Speeding up your SAP HCM move to the cloud in 2024 in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Finance for group reporting - Multi level consolidation in Enterprise Resource Planning Q&A

- Machine Learning in SAP Master Data Governance | Rule Mining for Business Partners in Enterprise Resource Planning Blogs by Members

- It is Almost Here! Innovating to Future Proof Financial Services: SAP and SAP Fioneer Forum Americas in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 8 | |

| 6 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 |