- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Country Version - Japan (Finance)

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

jyothi_patil

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

01-25-2022

8:15 AM

Introduction

This article is intended to provide a quick overview of the finance functions specific to Japan which are available as part of Country Version. This will be useful for consultants who are analyzing the benefits of using the country version Japan in order to set up the local business and legal requirements of companies operating in Japan.

Country Version Japan

This component supports the functionalities specific to Japan. These functions are intended to support the local business practices and legal reporting requirements as per country’s law and regulations.

Japan localization – Finance

Asset Accounting

This component largely covers the country specific COD and Property Tax requirements including the reporting part.

- Depreciation calculation

It comes with specific functions for calculating depreciation according to Japanese requirements (specific dep keys, activating the country specific Asset master data)

- Depreciation calculation after impairment

Legal requirement to calculate the depreciation after Asset impairment using the specific rates and base values.

- Property Tax Report

Under Tax Law 383, a property tax declaration is required to be filed with each municipal tax office each year

- Annex 16 Report

SAP Note 1736835 provides the detail information. Companies having offices and owns fixed assets in Japan must submit Annex 16 forms to the National Tax Agency.

Note – Requires the activation of country specific Asset master data and customizing of depreciation keys, settings required for Reports.

Tax – VAT, Withholding Tax Requirements

The local tax reporting requirements of Japan are addressed.

- Withholding Tax calculation (Generic customizing in std SAP)

- VAT (consumption) Tax calculation

- Advanced Compliance Reporting

Notes –

- In case of foreign currency invoices, the WH Tax to be calculated using the TTB bank selling rate and not the average M rate.

- In case of cross company code transfer postings, tax amounts to be calculated and displayed separately for each company code.

Advanced Compliance Reporting

ACR is enabled to address the local legal reporting requirements of Japan. It supports the Tax legal reporting requirements for Withholding Tax, VAT Return, B/S and P&L statements monthly and quarterly.

Withholding Tax Reports

- Withholding Tax using White Return (Payment-Based)

- Withholding Tax using Blue Return (Invoice - Based)

Notes -

- Withholding tax amounts are rounded down according to the Japanese rounding rule

- Withholding tax can be reported using the blue return or white return system

VAT Reports

- You can use the App - Run Compliance Report to generate the VAT Return report in the TXT file.

- Japan VAT Return report can be executed repeatedly to generate the output. It will generate the files for -

- Japan VAT detail

- Japan VAT summary

- Japan VAT summary Analysis

- Form 4-(2) and 4-(6), Form 3-(2), and Form 3-(1)

Notes - Pre-requisite is to maintain the necessary settings for VAT return

Financial Accounting >Advanced Compliance Reporting > Setting Up Your Compliance Reporting

Payments /Receivables

This component covers the business practices adopted in Japan. Facilitates the functions for making bank transfers in the Japanese Bankers Association formats (zenginkyo), and for printing correspondence.

- Electronic Monetary Claims

Japan uses EMC in place of traditional payment methods. An EMC refers to a monetary claim whose electronic records are stored in a registry prepared by the EMC organization.

- Invoice Summary

This process is unique to Japanese business practice. It provides functions to perform the required process steps for invoice summary for invoices, credit memos, and down payment requests. (parked and cleared docs are out of scope)

- Import Bank Statement

This report - RFEBJP00 is being used to read EBS in the format prescribed by the Japanese Bankers Association. It reads the statement and makes the appropriate accounting postings.

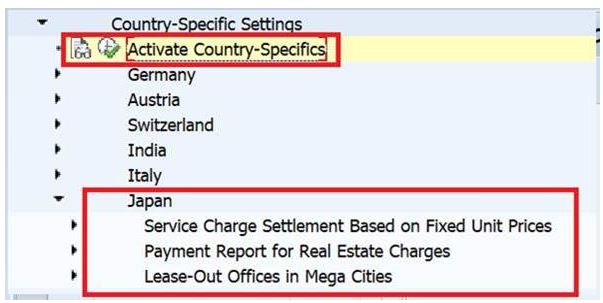

Real Flexible Estate Management (RE-FX)

This component covers the important laws and business practices specific to Japan for managing the real estate contracts.·

Service charge settlement based on fixed unit process

Real Estate Payment charges

Lease-out Offices in Mega cities

Note - Pre-requisite to use this component is to activate the program code for Japan. Country-Specific Settings - Activate Country- Specifics

In summary we can make use of these functions specific to Japan to in order to meet the local and legal requirements of Japan and accordingly set up the business processes. These country version add-ons are available as part of standard SAP installations and does not require any specific activation.

For more information feel free to visit the SAP library for Country Version Japan. Follow the link provided here :

https://help.sap.com/viewer/26b08c9979fa435faafcf6033ca0cf93/2021.000/en-US/756ad0531d8b4208e1000000...

- SAP Managed Tags:

- SAP S/4HANA

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- SAP Signavio Process Navigator turning 1-year old today! in Enterprise Resource Planning Blogs by SAP

- FAQ on Upgrading SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- What is the "standard" in Fit-to-Standard? in Enterprise Resource Planning Blogs by SAP

- Readiness for Universal Parallel Accounting in Enterprise Resource Planning Blogs by SAP

- Continuous Influence Session SAP S/4HANA Cloud, private edition: Results Review Cycle for Q4 2023 in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |