- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by SAP

- Climate Change and Its Impact on Regulations - Int...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Introduction

Hi dear readers, my name is Shuang. As part of the sustainability family in SAP Profitability and Performance Management content development team, I have accumulated experience on sustainable finance and have been studying, among others, the impact of climate change on business.

Climate-related risk is no longer a purely non-financial risk, or at least it should not be treated as such. While research on positive relation between company's environmental, social and governance (ESG) risk management and financial performance are continuously being published, we can spot the trends that companies tackling the sustainable issues can not only have positive long-term impacts on environment and society, but also accrue advantages and benefits for themselves. However, how should companies disclose their practices on evaluating and preparing for climate risk? Is there a reporting landscape that connects standards across sustainable and financial frameworks?

The answer is, yes! Task Force on Climate-related Financial Disclosures, commonly named TCFD, has been developed just for that.

What is TCFD

With the support from G20 members, TCFD was initially set up by Financial Stability Board (FSB) in 2015 and released in 2017 in the hope of promoting global financial stability and transparency. TCFD focuses on the effects of climate change on companies, assesses the physical and transition risks from climate change on businesses and embeds the resulting financial risk into disclosure of decision-useful, climate-related financial information. To give an example, many companies are facing increased carbon pricing, in a form of e.g. Emission Trading Systems (ETS) or carbon taxes, which is one of the transition risks of climate change. The financial implication behind that would be increased operating costs. TCFD encourages to provide this kind of information in financial terms, so that investors, lenders, insurers and other stakeholders will be able to make well-informed decisions.

The Task Force developed its recommendations across four pillars that represent core elements of organizations’ operation: governance, strategy, risk management, and metrics and targets.

- Governance example information includes whether the board considers climate-related issues when reviewing and guiding the company’s strategy and risk management policies etc.

- Strategy examples information includes climate scenario analysis results on how resilient a company’s strategies is to climate-related risks under different climate-related scenarios, including 2° C above pre-industrial level or even more ambitious scenarios.

- Risk management example information includes the processes of assessing the potential size and scope of identified climate-related physical risks.

- Metrics & targets example information includes company’s Scope 1 and Scope 2 greenhouse gas (GHG) emissions and, if available, Scope 3 GHG emissions.

Information on TCFD recommendations’ fulfillment can be turned into a standalone report, but it can also be mapped to indicators from other reporting standards such as Carbon Disclosure Project (CDP), Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB), and can be incorporated into companies’ sustainability reports. Such flexibility and compatibility help decrease the reporting as well as auditory burden.

Why stakeholders need TCFD reporting

As I mentioned in the previous section, TCFD encourages the quantification of climate-related financial risks and by doing so, it increases consistency and comparability of data across companies.

From the companies’ perspective, granular targets and metrics as well as qualitative financial impact indicators can assist them in setting effective long-term strategies while showing phased performance promptly.

From investors’ point of view, if organizations are not transparent on their governance structures, business strategies and risk management practices, investors may incorrectly price the assets and misallocate their capitals due to inaccurate information. On the other hand, If TCFD recommendations are more broadly adopted, investors can seek to invest in companies that are committed to adequately addressing the long-term climate risks to their business.

How can we leverage SAP Profitability and Performance Management to incorporate TCFD reporting?

TCFD reporting is now incorporated in SAP Profitability and Performance Management Financing and Investment Sustainability Management sample content as well as the Value Chain Sustainability Management sample content.

In the Financing and Investment Sustainability Management sample content, climate-related financial information from invested companies, including, but not limited to low carbon transition degree, fossil fuel exposure, climate regulation by region and management board’s oversight on climate issue, are collected from invested companies’ public filing and maintained in specific model table. Screenshot below provides a view of the interface and available fields of TCFD model table in Financing and Investment Sustainability Management sample content:

As some of our climate-related information are descriptive and qualitative, they need to go through a simple transformation to be analyzed quantitatively. Let’s take low carbon transition degree as an example. This field represents the level of exposure to the opportunities rising in the transition process to low carbon economy. Economic activities that have low level transition degree rely heavily on high carbon energy (e.g. coal, oil, natural gas and other fossil energies) while economic activities having high level transition degree utilize low carbon energy (e.g. wind, solar, hydro and nuclear power) and can potentially benefit from the low carbon transition process. Invested companies’ economic activities are evaluated and categorized into high-level, medium-high-level, medium-level and low-level of low carbon transition degree based on their carbon footprint. Attribute, as shown in the screenshot, stands for the percentage of turnover generated by each economic activity of each invested company.

After grouping activities at same “low carbon transition degree” level, percentage of turnover coming from high-level, medium-high-level, medium-level and low-level low carbon transition degree economic activities can be derived. This briefly explains how we tackle the company level climate-related information.

Then we calculate the potential carbon emission of each economic activity. Potential carbon emission in our case is the likely future emissions of carbon (in the form of CO2 and CH4) that is currently stored in fossil fuel but is expected to be released once those fuel products are combusted. Our calculation of the potential carbon emission is conducted in a separated calculation function and therefore, it allows for the flexibility of changing the calculation formula handily based on users’ expertise and in-house research.

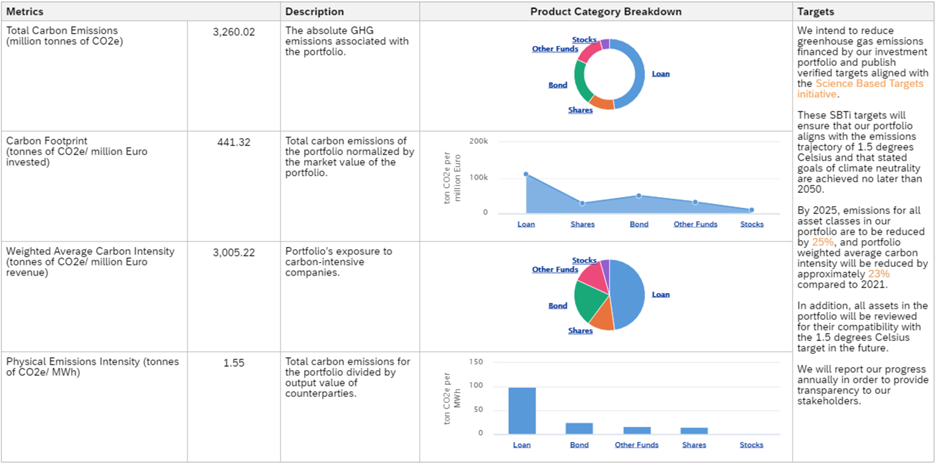

In order to disclose the portfolio level climate-related risk and opportunities, we multiply company level information with the weight of company’s asset in portfolio, and aggregate the results to get the portfolio’s exposure to companies facing declined market demand or high transition risk etc. Portfolio level carbon emission, carbon footprint, weighted average carbon intensity and physical emission intensity are also calculated in line with the Global GHG Accounting and Reporting Standard for the Financial Industry developed by the Partnership for Carbon Accounting Financials (PCAF Standard).

Our TCFD report is displayed in tables with mixture of description and charts, as presented in screenshots.

What's next?

A lot of progress has been made, but some obstacles on the road to full implementation of TCFD reporting by companies still exist. Data limitation and cumbersome data extraction process have hindered many companies from disclosing all necessary information based on recommendations. However, TCFD indeed took a huge step with emphasizing financial implication of climate risk and recognizing the need of comprehensive climate change strategy for companies to become climate resilient. From here we will head for the next steps – conduct climate scenario analysis, consolidate the results and build more robust TCFD reports – by now we have already implemented corporate-side TCFD reporting template in our Value Chain Sustainability Management sample content, so stay tuned for more TCFD-related sample contents in SAP Profitability and Performance Management.

- SAP Managed Tags:

- SAP Profitability and Performance Management

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- SAP ECC Conversion to S/4HANA - Focus in CO-PA Costing-Based to Margin Analysis in Financial Management Blogs by SAP

- SAP User Access Reviews: Best practices in Financial Management Blogs by Members

- Summer SAP Cloud Security Articles You May Have Missed in Financial Management Blogs by SAP

- Security Safeguards for SAP Cloud Services: Addressing the Threats to Cloud Computing in Financial Management Blogs by SAP

- Intrastat 301 - Intrastat and Plants Abroad/Foreign Plant in Financial Management Blogs by SAP

| User | Count |

|---|---|

| 3 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |