- SAP Community

- Products and Technology

- CRM and Customer Experience

- CRM and CX Blogs by Members

- SAP Customer Checkout localization for Portugal

CRM and CX Blogs by Members

Find insights on SAP customer relationship management and customer experience products in blog posts from community members. Post your own perspective today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

nelson_e_soares

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

12-14-2021

5:34 PM

The solutions that SAP offers its customers, through its partners, generally cover all existing business needs. However, until some time ago it was not possible to use SAP Customer Checkout in Portugal.

Since June 23, 2010, all software for processing invoices and other fiscal relevant documents in Portugal are required by the tax authority to comply with a set of technical requirements with the main objective of combating the underground economy, fraud, and tax evasion. To this extent, mechanisms are foreseen to reinforce the control of operations carried out by taxable persons, through the identification of the invoicing programs marketed, the establishments where invoicing terminals are installed and the obligation for the invoices issued to contain a single document code.

Decree-Law No. 28/2019, of February 15, consolidated all the legislation that was dispersed, to simplify its consultation and provide greater legal certainty to taxpayers and software producers. Not being the only ones, the main technical requirements that the software is bound to are:

As an SAP Business One partner, we have a strong, complete, robust and extensibility solution to meet the requirements set by our customers. However, we lacked a small piece in this huge puzzle to meet a set of specific requirements, we needed a solution:

After a detailed analysis of existing solutions, we felt that it would make sense that the solution should be found within the SAP ecosystem, and that SAP Customer Checkout would be the natural choice. It complied with all the business requirements that were required of us to be the missing piece of the puzzle and to leverage SAP Business One in Portugal. The only problem we found was that the SAP Customer Checkout was not fiscalized or certified to be used in Portugal, so we decided to start this project.

The process began in March 2021 with internal research, analysis of the product's extensibility, analysis of the gap between what the solution offered and what would be necessary to comply with the legal requirements required by the tax authority, and this is the case where we recognized the advantage of belonging to an ecosystem so rich in partners that it allowed us to meet Robert Zieschang and hokona. Together we developed a fantastic plug-in that allowed us to localize and certify SAP Customer Checkout for Portugal

This plug-in allows SAP Customer Checkout to comply with all legal requirements required by the Tax Authority of Portugal and, in summary, offers:

About me:

My name is nelson.e.soares you can follow my profile for more news.

You can find more information about SAP Customer Checkout here .

ATTENTION PARTNERS - THAT IS NO LONGER A PROBLEM!!!!!

We are pleased to announce that it is now possible to use SAP Customer Checkout in Portugal.

Legal background

Since June 23, 2010, all software for processing invoices and other fiscal relevant documents in Portugal are required by the tax authority to comply with a set of technical requirements with the main objective of combating the underground economy, fraud, and tax evasion. To this extent, mechanisms are foreseen to reinforce the control of operations carried out by taxable persons, through the identification of the invoicing programs marketed, the establishments where invoicing terminals are installed and the obligation for the invoices issued to contain a single document code.

Decree-Law No. 28/2019, of February 15, consolidated all the legislation that was dispersed, to simplify its consultation and provide greater legal certainty to taxpayers and software producers. Not being the only ones, the main technical requirements that the software is bound to are:

- You should be able to export the tax audit file provided for in Article 123(8) of the IRC Code, known as SAFT-PT.

- The numbering sequence shall respect the evolution of the date and time of issuing the documents and shall be continuous within each document type.

- It shall have a system to identify the recording of the document record by means of an asymmetric cipher algorithm and a private key of exclusive knowledge of the program producer.

- Registration of a barcode - QR Code - and a single document code on invoices and other tax-relevant documents.

- Mandatory tax information, not existing in the standard data model

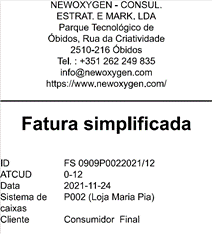

Simplified invoice - Sample

The solution

As an SAP Business One partner, we have a strong, complete, robust and extensibility solution to meet the requirements set by our customers. However, we lacked a small piece in this huge puzzle to meet a set of specific requirements, we needed a solution:

- Designed specifically for retail

- With simple integration with SAP Business One and other SAP ERPs

- Offline and online operating capability, transparently and continuously

- Simple to install and configure

- Regardless of software and hardware

After a detailed analysis of existing solutions, we felt that it would make sense that the solution should be found within the SAP ecosystem, and that SAP Customer Checkout would be the natural choice. It complied with all the business requirements that were required of us to be the missing piece of the puzzle and to leverage SAP Business One in Portugal. The only problem we found was that the SAP Customer Checkout was not fiscalized or certified to be used in Portugal, so we decided to start this project.

The process began in March 2021 with internal research, analysis of the product's extensibility, analysis of the gap between what the solution offered and what would be necessary to comply with the legal requirements required by the tax authority, and this is the case where we recognized the advantage of belonging to an ecosystem so rich in partners that it allowed us to meet Robert Zieschang and hokona. Together we developed a fantastic plug-in that allowed us to localize and certify SAP Customer Checkout for Portugal

Portuguese tax authority

But what offers this plug-in?

This plug-in allows SAP Customer Checkout to comply with all legal requirements required by the Tax Authority of Portugal and, in summary, offers:

- Issuing invoice-receipt, simplified invoices, and credit notes.

- Predefined (80 mm) print template for Portugal with all the mandatory legal information

- Digital signature with asymmetric cipher algorithm that ensures chronological sequence of document numbering

- Export of an audit file to the tax authority (SAFT-PT)

Conclusion

With these features of the Portuguese localization, customers and partners around the world can choose SAP Customer Checkout as a retail solution in Portugal. Please feel free to add any comments and questions.

About me:

My name is nelson.e.soares you can follow my profile for more news.

You can find more information about SAP Customer Checkout here .

- SAP Managed Tags:

- Retail,

- SAP Business ByDesign,

- SAP Business One,

- SAP Business One, version for SAP HANA,

- SAP Customer Checkout

1 Comment

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

ABAP

1 -

API Rules

1 -

c4c

1 -

CAP development

1 -

clean-core

1 -

CRM

1 -

Custom Key Metrics

1 -

Customer Data

1 -

Determination

1 -

Determinations

1 -

Introduction

1 -

KYMA

1 -

Kyma Functions

1 -

open SAP

1 -

RAP development

1 -

Sales and Service Cloud Version 2

1 -

Sales Cloud

1 -

Sales Cloud v2

1 -

SAP

1 -

SAP Community

1 -

SAP CPQ

1 -

SAP CRM Web UI

1 -

SAP Customer Data Cloud

1 -

SAP Customer Experience

1 -

SAP CX

1 -

SAP CX extensions

1 -

SAP Integration Suite

1 -

SAP Sales Cloud v2

1 -

SAP Service Cloud v2

1 -

SAP Service Cloud Version 2

1 -

Service and Social ticket configuration

1 -

Service Cloud v2

1 -

side-by-side extensions

1 -

Ticket configuration in SAP C4C

1 -

Validation

1 -

Validations

1

Related Content

- SAP Customer Checkout 2.0 FP16 for USA integrated with SAP BusinessOne - Part 1 in CRM and CX Blogs by SAP

- SAP Customer Checkout 2.0 FP16 for USA integrated with SAP BusinessOne – Part 2 in CRM and CX Blogs by SAP

- This is for information " US localization been added to the Sap Customer Checkout V2.0 FP14 onward" in CRM and CX Questions

- Key Considerations for Launching Successful Multi-Country eCommerce Channels in CRM and CX Blogs by SAP

- License Key installation has failed CCOM in CRM and CX Questions