- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- SAP Purchasing Process - Simplified Overview

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

abdellah_khebba

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

12-02-2021

11:10 PM

SAP Purchasing Process - Simplified Overview

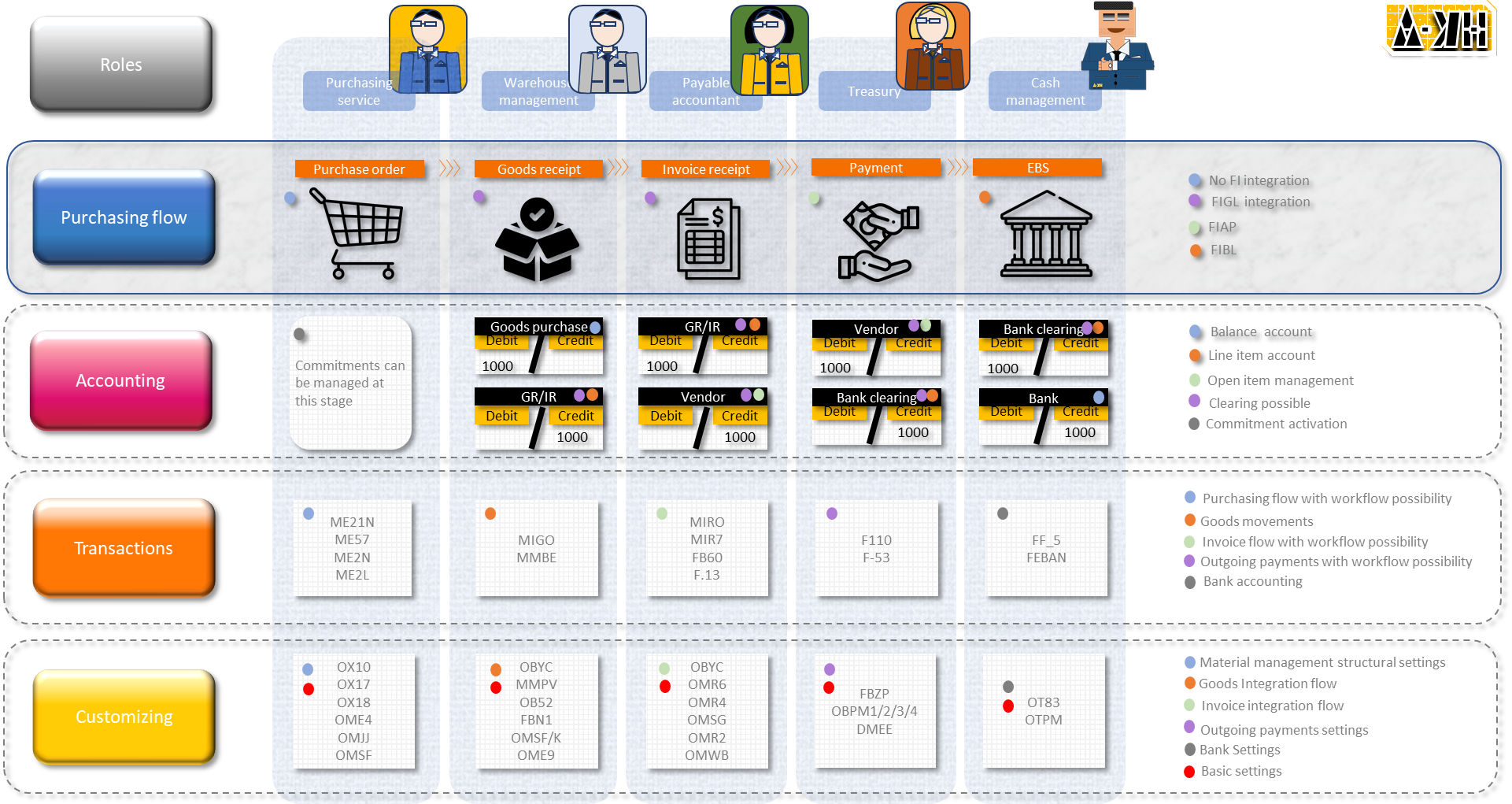

In order to give a simplified overview about the accounting movements related to the purchasing process, let 's explain in 5 steps the impact:

1- Purchase Order

In case of replenishment needs, purchasing department formalize its requirement by creating purchase requisition or directly purchase orders (MM module). If needed, a workflow validation can be applied to purchase orders. At this stage of the process, no accounting document is created. Commitments can be activated for a follow-up of orders. Reports can be used to display order history like ME2N, ME2L or ME2K in case of contracts.

If the SAP MM module is not activated, Accountants can create a direct vendor invoice by the Tcode FB60.

Below some useful customizing tcodes:

2-Goods receipt

After the reception of the Purchase order form, the vendor will deliver the goods accordingly to the terms of the PO. When goods will be received, the goods recipient will materialize this by the creation of Goods reception Tcode MIGO.

Accounting document related to the good receipt will be created based on a combination of characteristics. The combination of Valuation group, Material valuation class and transaction are used to drive the Account to use. This integration between Finance and logistic is ensured by integration table accessible by the Tcode OBYC (table T030).

The accounting document created at this step is like following

While creating this movement, we can for example: Confirm quantities received, Use appropriate Movement code (101 & 103 example) & Check your stock status in MMBE

Below some useful customizing tcodes:

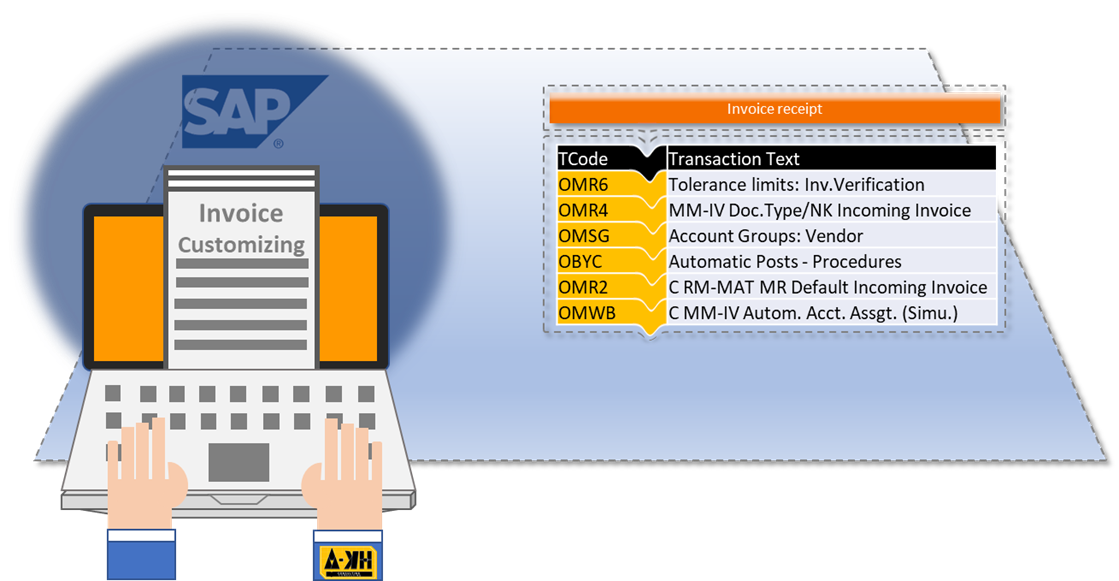

3- Invoice receipt

Like for goods, when the accountant receive the vendor invoice after the goods receipt confirmation, he will create the vendor invoice. The vendor invoice can be with reference to purchase order or to material document. Accounting document related to the invoice receipt will be created based on a combination of characteristics. The combination of Valuation group, Material valuation class and transaction are used to drive the Account to use. This integration between Finance and logistic is ensured by integration table accessible by the Tcode OBYC (table T030).

The accounting document created at this step is like following

While creating this movement, accountant can for example: Fill amount and in case of gaps he will choose the appropriate action based on the firm polities, Fill appropriate tax code, Fill terms and conditions, Fill appropriate payment method (optional) & Fill house bank (optional)

Below some useful customizing tcodes:

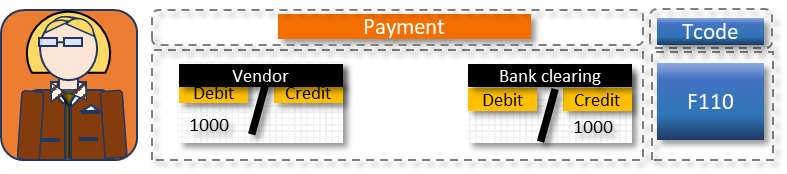

4- Vendor Payment

Accordingly to the terms and condition filled in the invoice, the treasury department can create manual payment (F-53) or automatic payment (F110). For manual payment, the accountant should enter all the required information like banking details. For automatic payment, a mass payment can be managed. If the vendor invoice is illegible for payment, the automatic program will retrieve it. The bank details are not required, the system will determine the bank details based on the settings related to payment method on FBZP.

The accounting document created at this step is like following

While creating this movement, accountant can for example: Fill amount and in case of gaps he will choose the appropriate action based on the firm polities, Fill appropriate tax code, Fill due date, Fill appropriate payment method (optional), & Fill house bank (optional)

Below some useful customizing tcodes:

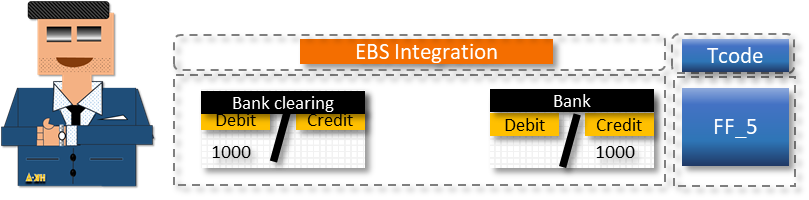

5- EBS Integration

After electronic bank statement integration, Accounting document is created based on the configuration done in OT83.

The accounting document created at this step is like following

The tcode FEBAN can allow the Cash management accountant to process this flow

Below some useful customizing tcodes:

Basic settings

Prior any process run in SAP, some basic accounting customizing are required. A list of the main steps are listed here, but not all the customizing tcodes are mentioned. The customizing is module dependent. So, if you want to implement SAP COPA (profitability analysis), many steps should be performed before running profitability analysis reporting. Example: Creation of operating concern, COPA Characteristics..etc

Remark:

If you are implementing SAP COPA during a S4HANA project, please keep in mind that COPA Characteristics will be inserted like a column in the universal journal (ACDOCA table) after the regeneration of the operating concern. This is very important for reporting purpose.

Below some main tcodes for Accounting settings:

Conclusion

At the end, if we want to draw a simple picture of the logistic flow, the figure below can be a good match!

:

- SAP Managed Tags:

- FIN (Finance)

4 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Enterprise Portfolio and Project Management in SAP S/4HANA Cloud, Private Edition 2023 FPS1 in Enterprise Resource Planning Blogs by SAP

- What’s New in SAP Central Business Configuration 2403 in Enterprise Resource Planning Blogs by SAP

- Advanced WIP reporting in S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Inventory Split Valuation in Enterprise Resource Planning Blogs by Members

- Lean Service Enablement for Project Networks in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |