- SAP Community

- Products and Technology

- Technology

- Technology Blogs by SAP

- SAP S/4HANA 2021 – E-invoicing and statutory repor...

Technology Blogs by SAP

Learn how to extend and personalize SAP applications. Follow the SAP technology blog for insights into SAP BTP, ABAP, SAP Analytics Cloud, SAP HANA, and more.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-13-2021

8:51 AM

As the latest digitalization trends are transforming compliance regulations, tax departments are facing new challenges to keep the business running smoothly. With SAP S/4HANA and SAP S/4HANA Cloud, SAP can support you in the topic of tax compliance while transforming a perceived tax burden into value-adding transformation opportunities.

Legal authorities continuously evolve mandates for corporations with the goal to increase tax controls, prevent tax evasion and maximize efficiency of tax collection.

In the past decades, many changes in the legal requirements have continuously increased the complexity of compliance for enterprises, potentially putting at risk operational efficiency. Yet, all these changes to tax processes have been incremental. For example, authorities have increased the amount of detailed data to be disclosed, while they have continued to rely on periodic ‘tax bills’ (returns prepared and paid periodically).

As a more recent trend, changes to tax legislations are more disruptive: companies are required to alter their well-known business processes, that might have been optimized for long periods of time, as well as the way they handle tax compliance. While some countries still require only periodic aggregated data, another trend is clearly gaining momentum: with the introduction of electronic business documents, the world has been evolving toward continuous transaction controls (business processes extended with an additional step that sends business documents to the tax authorities for registration / approval). These translate to tax authorities becoming gatekeepers controlling, validating, or even approving tax transactions before they can take place and, as a result, tax authorities becoming the source of truth of the tax liabilities to be settled.

The digitalization of tax clearance not only translates into tighter controls with higher risks of business disruptions, it also forces a paradigm shift with inversion of traditional roles in compliance: enterprises, as a taxable party, will find themselves transitioning from preparation of periodic reports to audit the draft returns prepared by authorities. And they will need to do this in no-time within the existing or even decreasing operational capacity.

While it might sound simple, audit activities can involve the analysis of thousands or even millions of records, so automation and technology are quickly becoming essential to prevent unacceptable explosion of tax compliance costs.

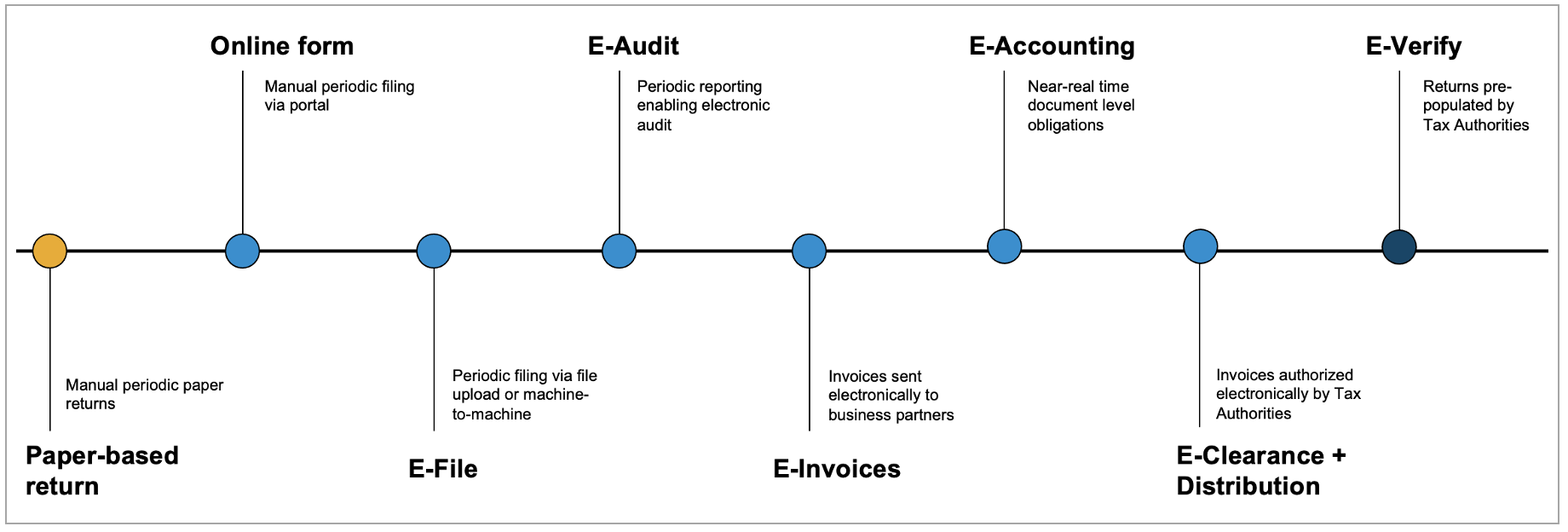

Fig. 1: The journey of business compliance

To provide enterprises with an arsenal of abilities to address these challenges, SAP has combined SAP Document Compliance and SAP solutions for Advanced Compliance Reporting into one holistic solution: SAP Document and Reporting Compliance.

It is one SAP solution to fulfil all types of mandates from real time electronic business documents to statutory reports, and enables enterprises to address the emerging number of continuous transaction controls. A holistic approach to address all types of mandates is a key pre-requisite to facilitate reconciliation and guarantee consistency between real time, business document submissions and statutory reports as this becomes the new operating standard.

Fig. 2: The end-to-end compliance process enabled by SAP Document and Reporting Compliance

SAP Document and Reporting Compliance is brought to life with an integrated dashboard that, for the first time, allows to manage all types of mandates in one place. This is a stepping-stone to enable seamless transition from real time electronic documents to statutory reports, so tax accountants can easily ensure they are fully in sync and run compliance effectively. Check out this video for more details.

SAP Document and Reporting Compliance enables enterprises to stay compliant in the digital world, and it goes beyond. With its streamlined approach to tax compliance and embedded automation, the solution allows also to re-think compliance processes maximizing efficiency, reducing both compliance risks and costs, and increasing sustainability of tax operations.

For more details on SAP Document and Reporting Compliance, read this blog from Elvira Wallis which includes valuable recordings, spanning from live demonstrations to working sessions where SAP customers shared insightful use cases for the solution.

And, if you want to learn more about the business value of the finance innovations as part of the SAP S/4HANA and SAP S/4HANA Cloud releases, read this blog from Benno Eberle which includes several product update videos.

Labels:

50 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

ABAP CDS Views - CDC (Change Data Capture)

2 -

AI

1 -

Analyze Workload Data

1 -

BTP

1 -

Business and IT Integration

2 -

Business application stu

1 -

Business Technology Platform

1 -

Business Trends

1,661 -

Business Trends

86 -

CAP

1 -

cf

1 -

Cloud Foundry

1 -

Confluent

1 -

Customer COE Basics and Fundamentals

1 -

Customer COE Latest and Greatest

3 -

Customer Data Browser app

1 -

Data Analysis Tool

1 -

data migration

1 -

data transfer

1 -

Datasphere

2 -

Event Information

1,400 -

Event Information

64 -

Expert

1 -

Expert Insights

178 -

Expert Insights

270 -

General

1 -

Google cloud

1 -

Google Next'24

1 -

Kafka

1 -

Life at SAP

784 -

Life at SAP

11 -

Migrate your Data App

1 -

MTA

1 -

Network Performance Analysis

1 -

NodeJS

1 -

PDF

1 -

POC

1 -

Product Updates

4,578 -

Product Updates

323 -

Replication Flow

1 -

RisewithSAP

1 -

SAP BTP

1 -

SAP BTP Cloud Foundry

1 -

SAP Cloud ALM

1 -

SAP Cloud Application Programming Model

1 -

SAP Datasphere

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Migration Cockpit

1 -

Technology Updates

6,886 -

Technology Updates

395 -

Workload Fluctuations

1

Related Content

- SAP Document and Reporting Compliance - 'Colombia' - Contingency Process in Technology Blogs by SAP

- CAP LLM Plugin – Empowering Developers for rapid Gen AI-CAP App Development in Technology Blogs by SAP

- Understanding the Data Review steps in Onboarding and the impact on Employee Central in Technology Blogs by SAP

- SAP Secure Login Service for SAP GUI Now Supports Custom Certificate Authorities on AWS in Technology Blogs by SAP

- SAP BTP SDK for Android 24.4.0 is now available in Technology Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 10 | |

| 10 | |

| 8 | |

| 7 | |

| 7 | |

| 7 | |

| 7 | |

| 6 |