- SAP Community

- Products and Technology

- Technology

- Technology Blogs by SAP

- News from e-invoicing and e-reporting in France

Technology Blogs by SAP

Learn how to extend and personalize SAP applications. Follow the SAP technology blog for insights into SAP BTP, ABAP, SAP Analytics Cloud, SAP HANA, and more.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-05-2021

3:52 PM

2024 Update !

On 29 December 2023, the French authorities published the legislation on the 2024 budget, which included the updated timelines for the e-invoicing and e-reporting mandate.

Following this legislation, the entry into force of B2B e-invoicing obligation is as following:

Please note that both dates can be postponed by the government with a maximum of 3 months via a decree (i.e. 1 December 2026 and 2027 respectively).

2023 Update : New timeline.

The new timeline of the French e-invoicing and e-reporting mandate has proposed an amendment to the Finance Bill of 2024, suggesting that the French e-invoicing and e-reporting mandate will start on 1 September 2026 (and 1 September 2027 for small companies)

This publication provides details of:

Ordinance No. 2021-1190 of September 15, 2021 provided the following details regarding the generalization of electronic invoicing in transactions between taxable persons with regard to value added tax and the transmission of transaction data:

All companies must be able to receive electronic invoices as of July , 2024 (instead of January , 2023).

The obligation to issue and transmit in the form of electronic invoices shall begin:

The obligation to transmit information and payment data applies to companies according to the same timetable depending on the size of the undertakings.

The terms and conditions of application are set by decree in the Conseil d'État (end of 2021, beginning of 2022).

Cristalized specification, version 2.2, was provided by the authorities:

https://www.impots.gouv.fr/portail/specifications-externes-b2b

SAP Legal Change Notification:

o SAP S/4HANA Cloud, public edition: link.

o SAP S/4HANA Cloud, private edition, SAP S/4HANA, SAP ERP: link.

Details of the involved parties and the main schemes for the transmission of invoices:

All businesses established in France will be affected, as well as certain foreign companies registered solely for VAT, for their VAT transactions.

Document and Reporting Compliance

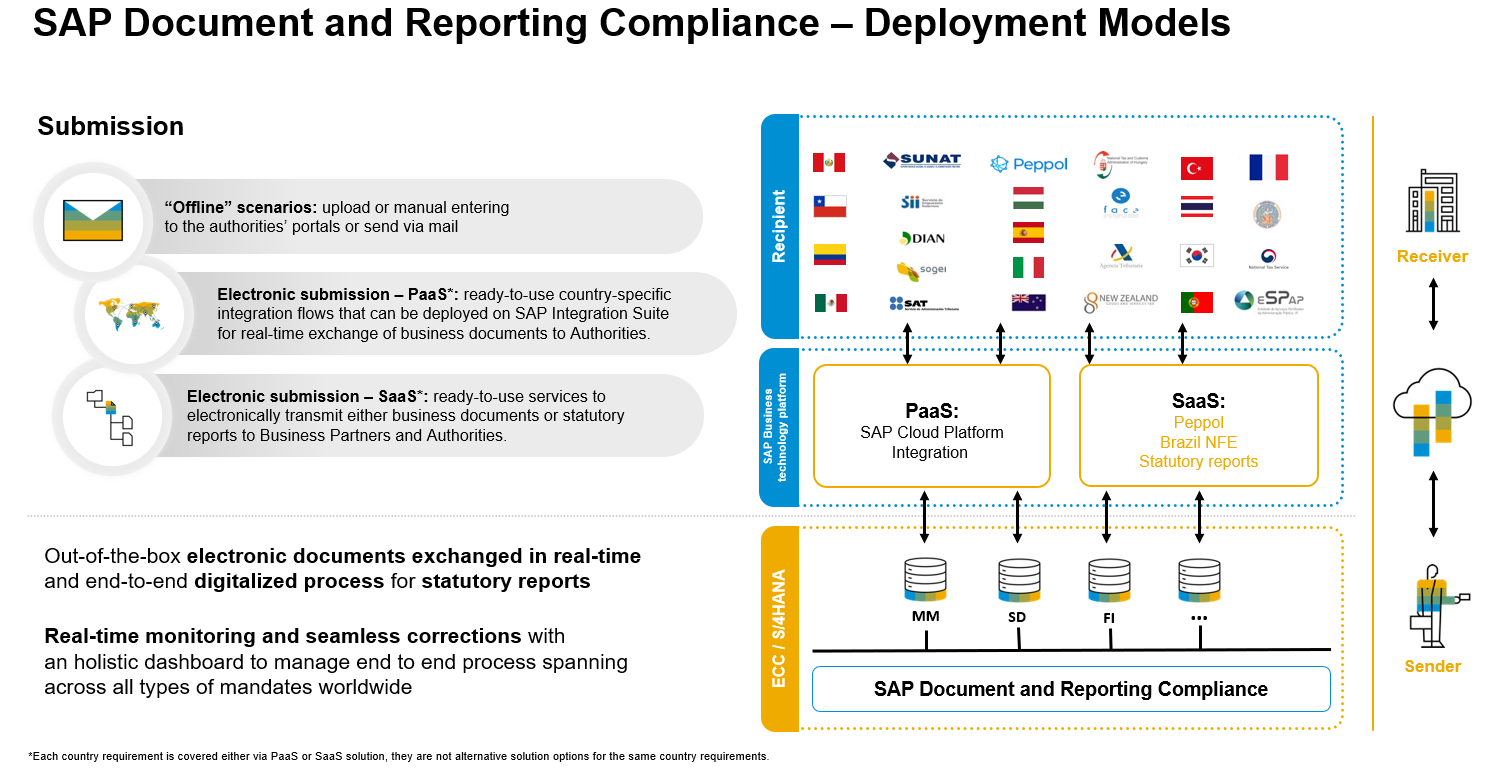

At the E-Invoicing and Reporting Compliance Virtual Summit 2021, SAP introduced a new product: SAP Document and Reporting Compliance. It provides an end-to-end solution for e invoicing and e-reporting through a cockpit as well as new functionality.

SAP plans to provide solutions to support e-invoicing and e-reporting adoption across the globe.

SAP Document and Reporting Compliance will be the preferred tool for communicating with partners and the public billing portal.

For invoicing, outgoing (or issued) electronic documents are automatically transmitted to business partners or tax authorities (as specified).

Incoming (or receiving) electronic documents are automatically integrated with any supplier invoice management solution for processing. The status of the documents is updated in real time, the allowed actions are checked accordingly.

All of this enables process orchestration with the necessary efficiency and audit trail.

A centralized cockpit enables you to automatically track potential failures, check errors, access reference transactions to enable transparent corrections, and communicate rejections to relevant stakeholders.

A harmonized central dashboard enables the monitoring of all mandates, from electronic documents to periodic reports.

A Comprehensive View allows you to review open electronic documents and control reporting at all stages, from preparation to submission.

The solution benefits from a complete audit trail, from business operations to related rejects and corrections. All preparation activities and manual adjustments are automatically recorded and can be viewed.

In conclusion, SAP has the vision, the tools, the solutions, and the desire to support companies towards the digitalization needed by tax authorities.

For France, the deployment model will be confirmed once government decrees and specifications have been finalized. Solutions are there!

For further requests and collaboration, please register to workzone : Link

On 29 December 2023, the French authorities published the legislation on the 2024 budget, which included the updated timelines for the e-invoicing and e-reporting mandate.

Following this legislation, the entry into force of B2B e-invoicing obligation is as following:

- 1 September 2026: obligation to receive e-invoices for all taxpayers and issuing B2B e-invoicing becomes mandatory for large enterprises (‘GE’) and intermediate-sized enterprises (‘ETI’);

- 1 September 2027: issuing B2B e-invoicing becomes mandatory for mid-sized (‘PME’) and micro companies (‘TPE’).

Please note that both dates can be postponed by the government with a maximum of 3 months via a decree (i.e. 1 December 2026 and 2027 respectively).

2023 Update : New timeline.

The new timeline of the French e-invoicing and e-reporting mandate has proposed an amendment to the Finance Bill of 2024, suggesting that the French e-invoicing and e-reporting mandate will start on 1 September 2026 (and 1 September 2027 for small companies)

This publication provides details of:

- The new implementation schedule for electronic invoicing in France,

- The involved parties and the billing flows,

- The announcement of the new SAP Document and Reporting Compliance product,

- Specifications issued by the government in version 2.0.

Ordinance No. 2021-1190 of September 15, 2021 provided the following details regarding the generalization of electronic invoicing in transactions between taxable persons with regard to value added tax and the transmission of transaction data:

All companies must be able to receive electronic invoices as of July , 2024 (instead of January , 2023).

The obligation to issue and transmit in the form of electronic invoices shall begin:

- July , 2024 for large companies

- January , 2025 for midsize companies

- January 2026 for small and medium-sized enterprises and micro-enterprises

The obligation to transmit information and payment data applies to companies according to the same timetable depending on the size of the undertakings.

The terms and conditions of application are set by decree in the Conseil d'État (end of 2021, beginning of 2022).

Cristalized specification, version 2.2, was provided by the authorities:

https://www.impots.gouv.fr/portail/specifications-externes-b2b

SAP Legal Change Notification:

o SAP S/4HANA Cloud, public edition: link.

o SAP S/4HANA Cloud, private edition, SAP S/4HANA, SAP ERP: link.

Details of the involved parties and the main schemes for the transmission of invoices:

Source : working document - AIFE - DGFIP - FNFE

All businesses established in France will be affected, as well as certain foreign companies registered solely for VAT, for their VAT transactions.

Document and Reporting Compliance

At the E-Invoicing and Reporting Compliance Virtual Summit 2021, SAP introduced a new product: SAP Document and Reporting Compliance. It provides an end-to-end solution for e invoicing and e-reporting through a cockpit as well as new functionality.

SAP plans to provide solutions to support e-invoicing and e-reporting adoption across the globe.

SAP Document and Reporting Compliance will be the preferred tool for communicating with partners and the public billing portal.

For invoicing, outgoing (or issued) electronic documents are automatically transmitted to business partners or tax authorities (as specified).

Incoming (or receiving) electronic documents are automatically integrated with any supplier invoice management solution for processing. The status of the documents is updated in real time, the allowed actions are checked accordingly.

All of this enables process orchestration with the necessary efficiency and audit trail.

A centralized cockpit enables you to automatically track potential failures, check errors, access reference transactions to enable transparent corrections, and communicate rejections to relevant stakeholders.

A harmonized central dashboard enables the monitoring of all mandates, from electronic documents to periodic reports.

A Comprehensive View allows you to review open electronic documents and control reporting at all stages, from preparation to submission.

- Real-time Transaction Data Reporting and periodic reporting are synchronized.

- With embedded analytics, you can establish consistency checks.

The solution benefits from a complete audit trail, from business operations to related rejects and corrections. All preparation activities and manual adjustments are automatically recorded and can be viewed.

In conclusion, SAP has the vision, the tools, the solutions, and the desire to support companies towards the digitalization needed by tax authorities.

For France, the deployment model will be confirmed once government decrees and specifications have been finalized. Solutions are there!

For further requests and collaboration, please register to workzone : Link

If you need access, please send an email to gsworkzone@sap.com with subject "Access to SAP Document and Reporting Compliance for France”. Link

- SAP Managed Tags:

- SAP Document and Reporting Compliance

Labels:

6 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

ABAP CDS Views - CDC (Change Data Capture)

2 -

AI

1 -

Analyze Workload Data

1 -

BTP

1 -

Business and IT Integration

2 -

Business application stu

1 -

Business Technology Platform

1 -

Business Trends

1,658 -

Business Trends

92 -

CAP

1 -

cf

1 -

Cloud Foundry

1 -

Confluent

1 -

Customer COE Basics and Fundamentals

1 -

Customer COE Latest and Greatest

3 -

Customer Data Browser app

1 -

Data Analysis Tool

1 -

data migration

1 -

data transfer

1 -

Datasphere

2 -

Event Information

1,400 -

Event Information

66 -

Expert

1 -

Expert Insights

177 -

Expert Insights

294 -

General

1 -

Google cloud

1 -

Google Next'24

1 -

Kafka

1 -

Life at SAP

780 -

Life at SAP

13 -

Migrate your Data App

1 -

MTA

1 -

Network Performance Analysis

1 -

NodeJS

1 -

PDF

1 -

POC

1 -

Product Updates

4,577 -

Product Updates

341 -

Replication Flow

1 -

RisewithSAP

1 -

SAP BTP

1 -

SAP BTP Cloud Foundry

1 -

SAP Cloud ALM

1 -

SAP Cloud Application Programming Model

1 -

SAP Datasphere

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Migration Cockpit

1 -

Technology Updates

6,873 -

Technology Updates

419 -

Workload Fluctuations

1

Top kudoed authors

| User | Count |

|---|---|

| 36 | |

| 25 | |

| 16 | |

| 13 | |

| 7 | |

| 7 | |

| 6 | |

| 6 | |

| 6 | |

| 6 |