- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- SAP SD: Reverse Tax Calculation, Tax amount roundi...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Case company suggested retail price/Assessed price includes tax amount and freight value. The suggested material prices are region wise based on customer registered 17% tax and non-registered (further 3%) meaning 20% tax status. Now client requirements are to first calculate the freight and GST from suggested retail price. Freight determines at the time of delivery based on gross weight. So, freight will calculate through shipment cost and not part of this post. After subtracting freight amount system should subtract the GST amount. Then from value exclusive of tax if there is any discount that applies. Then on discounted price applies Tax 17% for register and further 3% on non-registered. After that withholding tax applies on total amount. Furthermore, to avoid hassle with FBR (federal board of revenue) Tax amount must round-off. In the end compare result “if sale price is less than cost price send message at the time of creating sales order”.

The solution of this scenario is below in three parts.

Part 1- Reverse Tax Calculation

If material price is let say Material-01= 100 PKR, then reverse sales tax works in following way

Step 1: take the total price and divide it by one plus the tax rate

Step 2: multiply the result from step one by the tax rate to get the value of tax

Step 3: subtract the value of tax from step 2 from the total price

Reverse tax calculation based on 17% = 100 *100/117 or 100/1.17 = 85.47 *17%=14.52

Reverse tax calculation based on 20% = 100 *100/120 or 100/1.20 = 83.33*20%=16.66

How to achieve this

Price condition PR00 should be statistical and maintain prices based on region and customer status. You can make any access sequence based on parameters like sales org/dist.ch/division/material/country/region/customer group (for register/non-register) to maintain registered and non-registered customer prices.

price condition

For calculation GST make another Discount condition should be statistical with calculation type should be on H.

This condition maintains the condition record of 17% or 20% based on customer status and material.

Now in pricing procedure maintain Alt. calculation type =82 and Alt. condition base value= 6.

pricing procedure

From Sales order demo

material price Pr00 =11323.40

Tax reversal = 11323.40 x 100/ 120 = 9436.16*20% =1887.23

value exclusive of tax =11323.40-1887.23=9436.17

Part 2- Tax rounding

In your pricing procedure put Alt. calculation type 17 against your tax condition. This will resolve your problem of rounding tax value.

From Sales order demo

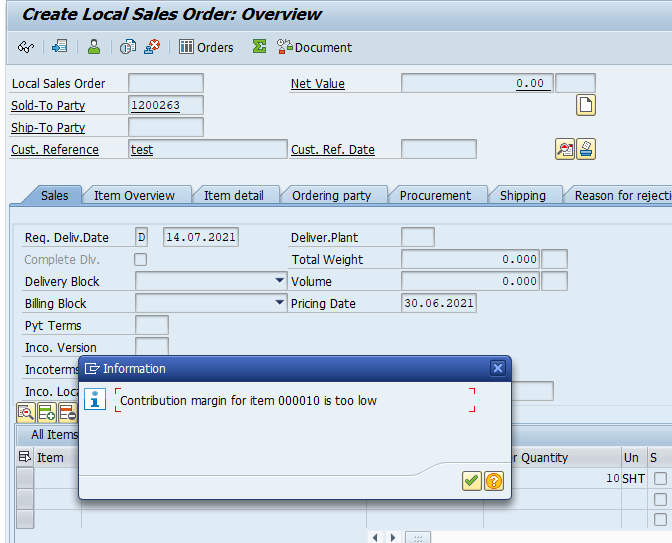

Part 3- message when sales price is less than cost price

In your pricing procedure maintain against VPRS condition (Subtotal B, Requirement 4 and Alt. Calculation type 5). This will through message at the time of sales order if sales price is lower than cost price.

from sales order demo

Please share your feedback for further improvement to tackle the problem.

Thanks, Cheers

- SAP Managed Tags:

- SAP S/4HANA,

- SD (Sales and Distribution),

- SD Billing,

- SD Sales

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Rounding Profile is not coming up in Enterprise Resource Planning Q&A

- New Installation of SAP S/4HANA 2023 FPS1 – Part 3 – Best Practices Content Activation in Enterprise Resource Planning Blogs by SAP

- There is a difference between the document total and its components. [ORDR.DocTotal][line: 1] in Enterprise Resource Planning Q&A

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 1 in Enterprise Resource Planning Blogs by SAP

- Supply Chain in SAP S/4HANA Cloud Public Edition 2402 in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |