- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Withholding Tax (WHT) Calculation

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

06-30-2021

8:59 AM

During a time period, the system accumulates the tax base for each business partner or business groups that belong to the same legal entity. If the tax base doesn't exceed the threshold, the system calculates the withholding tax and meanwhile creating a negative correction entry as a correction tax supplement. The total amount of the tax is zero in this case. On the other hand, if the tax base exceeds the threshold, the withholding tax is calculated and posted.

Examples of Calculation

The conditions for calculations are set up as below:

- Threshold limit = 5000 INR

- Tax rate = 10 %

- Threshold Limit is not reached in a given period

You post a document (D1) with an amount of 1000 INR. The tax base is 1000 INR, which is below the threshold limit, so the withholding tax is zero. The system calculates the withholding tax as 100 INR (10 % of the 1000 INR). Meanwhile, it also creates a negative correction entry as a correction tax supplement. The calculated tax (100 INR) and tax base (1000 INR) are saved in the database. When a new document is posted in the same time period, the saved tax and base amount will be considered. - Threshold Limit is reached in a given period

You further post a document (D2) with an amount of 6000 INR. The tax base is 7000 INR (1000 + 6000), which is beyond the threshold limit. The system adds the catch-up tax amount 100 INR (document D1) to reverse the accumulated amount of correction tax supplement. It calculates the withholding tax as 700 INR (10 % of 6000 INR + 100 INR catch-up).

In other words, the tax calculated for the document D1 (100 INR) is withheld in the document D2. Since the threshold limit for the given time period has been reached, the tax will be posted for all further documents.

Prerequisites

The new functionality enables to accumulate withholding tax for a given Business Partner using event 177 (function module FKKID_WHT_EVENT_0177).

To use the new functionality:

- Make all the settings described in the below chapter Customizing

- Register function module FKKID_WHT_EVENT_0177 in Customizing for Contract Accounts Receivable and Payable (FI-CA) under Program Enhancements > Define Customer-Specific Function Modules (transaction FQEVENTS)

Customizing

To customize the system for the withholding tax calculation, make the following settings:

- To customize Financial Accounting under Contract Accounts Receivable and Payable > Organizational Units > Set Up Company Codes for Contract Accounts Receivable and Payable, please activate the extended withholding tax.

Select the Extended Withholding Tax Active checkbox for your company code entry as marked below.

- To customize Financial Accounting under Contract Accounts Receivable and Payable > Basic functions > Withholding Tax, please make settings as follows:

- In the Check Subtransactions for Withholding Tax Relevance customizing activity, activate the withholding tax deduction for the main and subtransactions during document posing. Choose the ‘We can withhold value’ under the column of the Withholding Tax Amount.

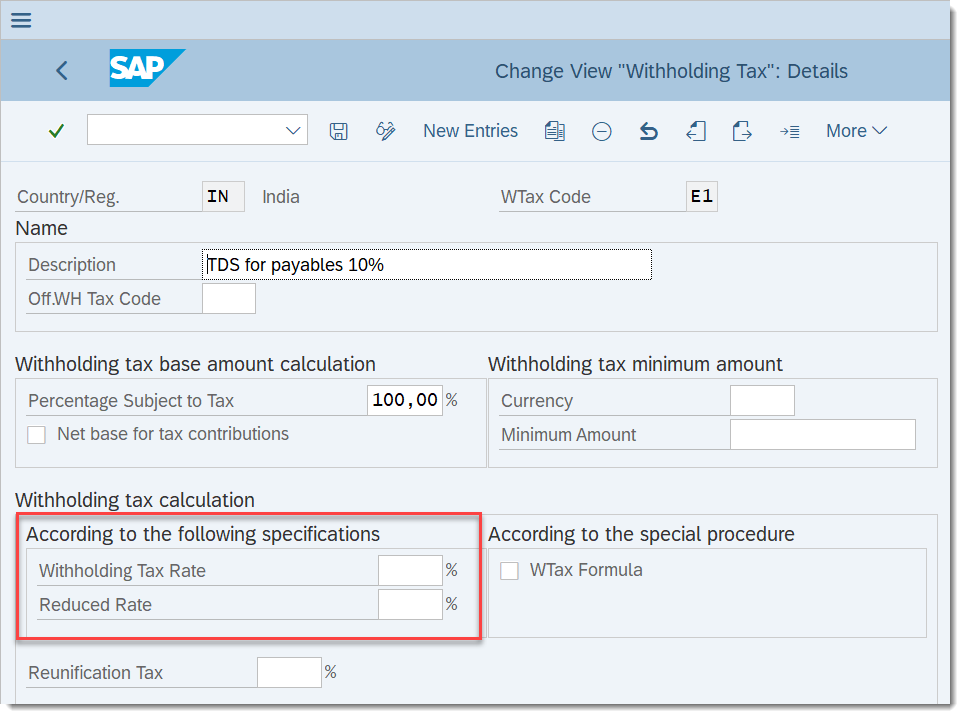

- In the Define Withholding Tax Codes customizing activity, you will choose a withholding tax code. The tax rate shall be set to zero, or leave the field empty, as the tax rate is maintained at tax supplement level.

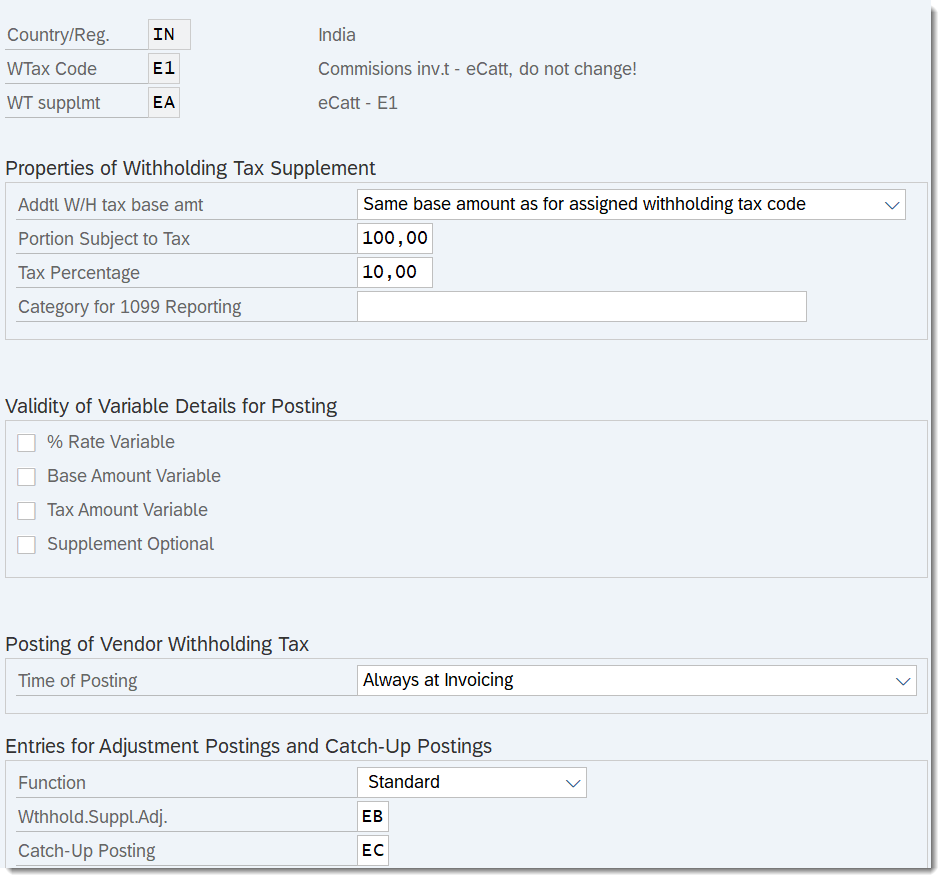

- Define withholding tax supplements in the Define Withholding Tax Supplements customizing activity: one for tax, one for adjustments, and one for catch-up.

- Define the allowed entries in the Define Allowed Entries for Withholding Tax Supplements customizing activity for each withholding tax supplement.

For tax supplement:

For adjustment supplement:

For adjustment supplement:

For catch-up supplement:

For catch-up supplement:

- Define assignments of withholding tax account in the Account Assignments for Withholding Tax Postings with Outgoing Payments customizing activity.

- Define assignments of withholding tax supplement in the Account Assignments for Withholding Tax Supplements with Outgoing Payments customizing activity.

- In the Check Subtransactions for Withholding Tax Relevance customizing activity, activate the withholding tax deduction for the main and subtransactions during document posing. Choose the ‘We can withhold value’ under the column of the Withholding Tax Amount.

- To customize Financial Accounting under Contract Accounts Receivable and Payable > Withholding Tax > Country-Specific Settings for India > Define Threshold for Withholding Tax Calculation, please define a threshold limit of the tax base. Meanwhile, assign a validity period by entering a start and end date.

- In transaction OB29, you will define the variants of time period. The time period is determined by the posting date of the document for the accumulation and threshold limit calculation.

Mass Activity: Post withholding tax (India)

Mass Activity: Post Withholding Tax transaction (transaction code: FKKID_WTCAM) is a country-specific solution created for India. It is used to post withholding tax at the end of a fiscal period when the total amount of accumulated documents doesn't exceed the threshold.

The system checks if the amount of documents (tax base) is below or above the threshold whenever a document is created in a fiscal period. The calculated withholding tax is only collected and stored in the Individual Records for Withholding Tax Report (DFKKQSR) database table if the amount is below the threshold.

At the end of the fiscal period, when the accumulated document amount doesn't exceed the threshold limit, run this transaction so that:

- The withholding tax collected and stored in the DFKKQSR database table is calculated and posted for the given fiscal period.

- A catch-up tax supplement is created to reverse the accumulated correction supplement tax amount.

- The withholding tax entries in the DFKKQSR database table are updated.

In India, the WHT is applicable for payments made to non-resident Indians and for Indian residents the Tax deduction at source (TDS) is applicable. In other words, if an income is paid outside India, the withholding Tax will be deducted. Whereas TDS is deducted as income tax when making specific payments within India.

For more information about TDS, please check the blog post Tax Deducted at Source (TDS) in India.

Is this blog post useful? Do you have any further comments regarding this topic? Do not hesitate to share your thoughts in the comment section below.

- SAP Managed Tags:

- SAP Contract Accounts Receivable and Payable,

- SAP S/4HANA Finance,

- FIN (Finance)

Labels:

2 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

23 -

Expert Insights

114 -

Expert Insights

151 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

205 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

85

Related Content

- How do I write a PCR to accumulate the rate values from certain wage types in the arrears table? in Enterprise Resource Planning Q&A

- Fixed Assets - Change the base value to the beggining of the first adquisition - MACRS depreciation in Enterprise Resource Planning Q&A

- How to check the calculation for "Actual Cost Rate Calculation - Cost Centers (KSII)"? in Enterprise Resource Planning Q&A

- TCODE CO43 - Overhead Calculation not displaying in Enterprise Resource Planning Q&A

- Introducing the market standard of electronic invoicing for the United States in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 |