- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Automation of Inter-company AR/AP Netting

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member23

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

06-11-2021

1:37 PM

Background

Large number of companies operate in multiple countries. There are good number of inter-company transactions between two countries. Due to inter-company transactions purchase and sale between two inter-company, Accounts Receivables and Account payable netting becomes a herculean task. There could be huge number of payable and receivables transaction standing in both companies. One option is to receive / pay the inter-company transaction using external banks. In this blog we discuss how to process inter-company AR / AP using virtual bank In-House Cash Center functionality of SAP.

User Story

Jessy INC is a one of the largest pharma company in UK which manufactures the vaccines for different types of flu. Lenin is Finance Head of Subsidiary 1 (Co Code 1000) which is based out of Japan. Subsidiary 1 (Co Code 1000) is into manufacturing of input chemical which is used manufacturing the vaccines. Sean is Finance head of Subsidiary 2 (Co Code 5100) which is based out of Germany. Subsidiary 2 (Co Code 5100) is into manufacturing of vaccine for COVID-19. Subsidiary 2 (Co Code 5100) receives the raw material from Subsidiary 1 (Co Code 1000) and processes a product a vaccine for COVID-19.

In Subsidiary 1 (Co Code 1000) and Subsidiary 2 (Co Code 5100) are both purchase and sale transaction happening between both companies which result Inter-company receivables and payable s. Netting AR/AP transactions and paying to other subsidiary is huge task for accounts departments in both the Companies. As-IS process, both the companies pay each other the AP part from an external bank which leads to an impact on available Cash for external vendors and others. To use the available funds diligently, both Sean and Lenin wanted a solution which will avoid inter-company payment using external banks.

Business Requirement

SAP Solution

Option 1: - Company codes (0001, 1000 & 5100) are available in same SAP landscape

Solution Process Step

Fig: - 3

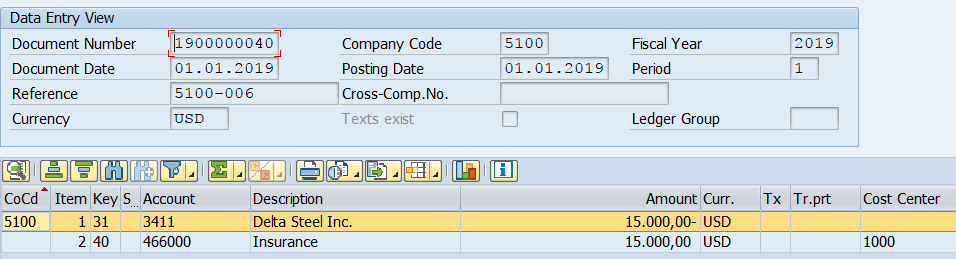

Customer Invoice in company code 1000

Vendor Invoice in company code 5100. Automation possible from Sales & Distribution module using output type (RD04) AP Vendor invoice IDOC can be triggered.

Payment in company code 5100 (Payment run in background)

Payment order create for inter-company transaction in In House cash Center DBKE. Posting for Dr and Cr within the IHC internal current accounts

In House cash internal bank statement posted in Company code 5100

In House cash internal bank statement posted in Company code 1000

Customer open item cleared in Company Code 1000

Option 2: - AP/AR Netting in Central Finance using In House Cash Center in Central Finance System

Process Steps

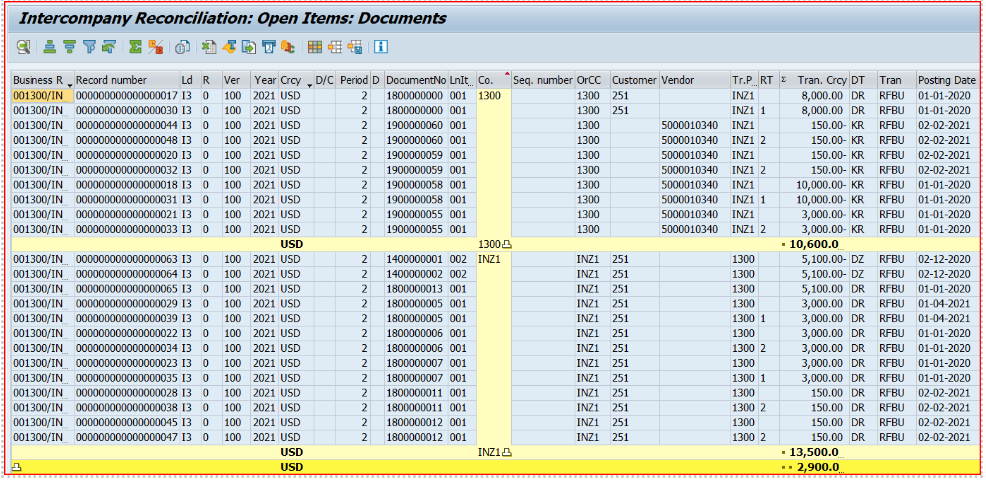

Inter-company Reconciliation: Open items: Document – Report in S4 HANA Fig: - 12 (t-code FBIC025: Inter-company reconciliation open items: Document level)

Fig: - 12 (t-code FBIC025: Inter-company reconciliation open items: Document level)

Inter-company Reconciliation: Open items: Total Summary – Report in S4 HANA Fig: - 13 (t-code FBIC026: Inter-company reconciliation open items: total data)

Fig: - 13 (t-code FBIC026: Inter-company reconciliation open items: total data)

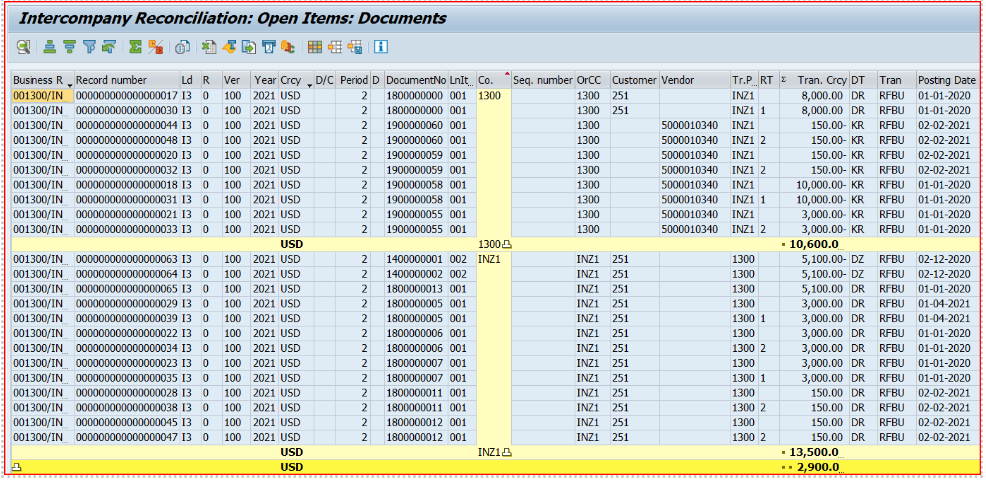

Inter-Company reconciliation report in S4 HANA will report figure net of Accounts Receivable (AR) and Accounts Payable (AP) against the same trading partner per combination of company codes (such as 001300/INZ1 company codes pair) and per company code for inter-company posting.

As shown in option 1, accounting for customer receipts will be posted from bank statements in source systems (SE1 & EH8).

Disclaimer

Conclusion

Entire process of inter-company reconciliation can be automated using In House Cash Solution. Solution can be implemented in a Central Finance system using In House Cash Center manual payment orders. Other option, where both the company codes are in a standalone system using IHC center netting can be fully automated.

Large number of companies operate in multiple countries. There are good number of inter-company transactions between two countries. Due to inter-company transactions purchase and sale between two inter-company, Accounts Receivables and Account payable netting becomes a herculean task. There could be huge number of payable and receivables transaction standing in both companies. One option is to receive / pay the inter-company transaction using external banks. In this blog we discuss how to process inter-company AR / AP using virtual bank In-House Cash Center functionality of SAP.

User Story

Jessy INC is a one of the largest pharma company in UK which manufactures the vaccines for different types of flu. Lenin is Finance Head of Subsidiary 1 (Co Code 1000) which is based out of Japan. Subsidiary 1 (Co Code 1000) is into manufacturing of input chemical which is used manufacturing the vaccines. Sean is Finance head of Subsidiary 2 (Co Code 5100) which is based out of Germany. Subsidiary 2 (Co Code 5100) is into manufacturing of vaccine for COVID-19. Subsidiary 2 (Co Code 5100) receives the raw material from Subsidiary 1 (Co Code 1000) and processes a product a vaccine for COVID-19.

In Subsidiary 1 (Co Code 1000) and Subsidiary 2 (Co Code 5100) are both purchase and sale transaction happening between both companies which result Inter-company receivables and payable s. Netting AR/AP transactions and paying to other subsidiary is huge task for accounts departments in both the Companies. As-IS process, both the companies pay each other the AP part from an external bank which leads to an impact on available Cash for external vendors and others. To use the available funds diligently, both Sean and Lenin wanted a solution which will avoid inter-company payment using external banks.

Business Requirement

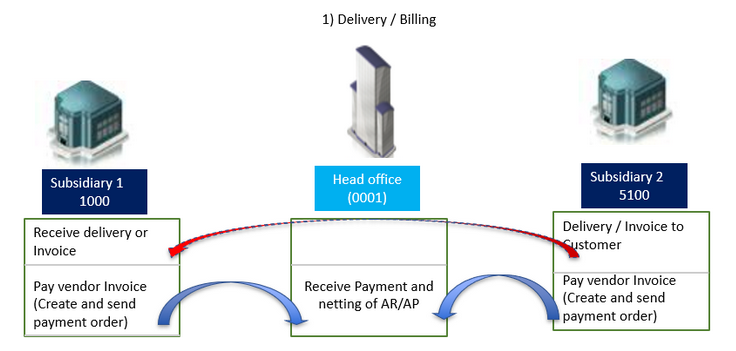

Fig: - 1

Fig: - 1

- Subsidiary 1 (1000) receives and post a billing document

- Subsidiary 2 (5100) pays invoice to subsidiary 2

- Subsidiary 2 (5100) creates and sends a payment to Head Office 0001

- Subsidiary 0001 will process the receipt from Subsidiary 5100 on behalf of Subsidiary 1000

- Likewise receipts and payments are netted at head office (Co Code 0001)

SAP Solution

Option 1: - Company codes (0001, 1000 & 5100) are available in same SAP landscape

Fig: - 2

Fig: - 2

Solution Process Step

Fig: - 3

Customer Invoice in company code 1000

Fig: - 4

Fig: - 4

Vendor Invoice in company code 5100. Automation possible from Sales & Distribution module using output type (RD04) AP Vendor invoice IDOC can be triggered.

Fig: - 5

Fig: - 5

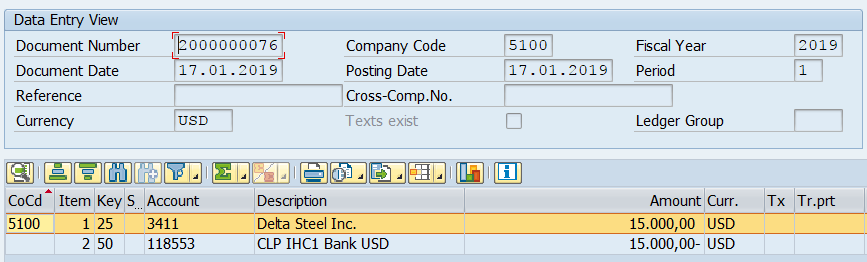

Payment in company code 5100 (Payment run in background)

Fig: - 6

Fig: - 6

Payment order create for inter-company transaction in In House cash Center DBKE. Posting for Dr and Cr within the IHC internal current accounts

Fig: - 7

Fig: - 7

In House cash internal bank statement posted in Company code 5100

Fig: - 8

Fig: - 8

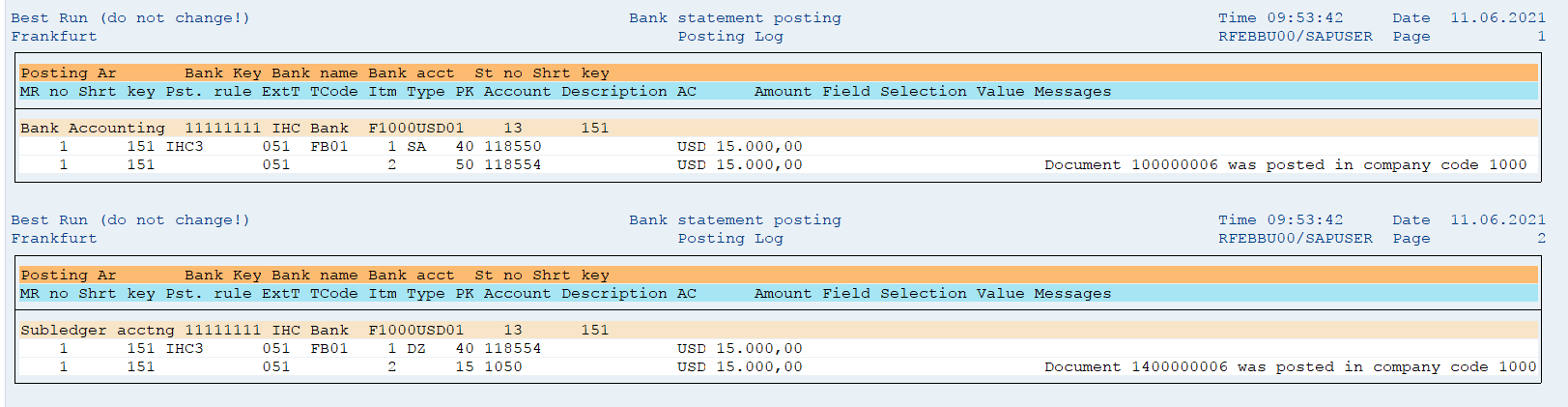

In House cash internal bank statement posted in Company code 1000

Fig: - 9

Fig: - 9

Customer open item cleared in Company Code 1000

Fig: - 10

Fig: - 10

Option 2: - AP/AR Netting in Central Finance using In House Cash Center in Central Finance System

Fig: - 11

Fig: - 11

Process Steps

- Accounts Receivable invoice is posted in Co code 1100 in EH8 system; interfaced to Central Finance system using SLT

- Accounts payable invoice is posted in Co Code 1000 in SE1 system; interfaced to Central Finance system using SLT

- Manually post a IHC payment order (refer Fig: 7) is for net amount (Net of A/R and A/P) will be posted (Netting) based on the net amount from Inter-company Reconciliation: Open items: Document/Total data (please see Fig: 12 & Fig: 13)

- IHC internal bank statement will be triggered and posts accordingly in Central Finance system.

- FINSTA IDOC (enhancement) and sent to source systems (SE1 and EH8).

- SPROXY BAPI for FB01 is called (enhancement) posting to AP/AR and to IHC bank account; interfaced to Central Finance system using SLT

Inter-company Reconciliation: Open items: Document – Report in S4 HANA

Fig: - 12 (t-code FBIC025: Inter-company reconciliation open items: Document level)

Fig: - 12 (t-code FBIC025: Inter-company reconciliation open items: Document level) Inter-company Reconciliation: Open items: Total Summary – Report in S4 HANA

Fig: - 13 (t-code FBIC026: Inter-company reconciliation open items: total data)

Fig: - 13 (t-code FBIC026: Inter-company reconciliation open items: total data)Inter-Company reconciliation report in S4 HANA will report figure net of Accounts Receivable (AR) and Accounts Payable (AP) against the same trading partner per combination of company codes (such as 001300/INZ1 company codes pair) and per company code for inter-company posting.

As shown in option 1, accounting for customer receipts will be posted from bank statements in source systems (SE1 & EH8).

Disclaimer

- Vendor invoice posting can be automated using Billing output type RD04. Please check with Sales & Distribution module.

- Inter Company Reconciliation Open Item Reconciliation (FBICR3) can also be used for netting in S4 HANA (1709 and above versions)

Conclusion

Entire process of inter-company reconciliation can be automated using In House Cash Solution. Solution can be implemented in a Central Finance system using In House Cash Center manual payment orders. Other option, where both the company codes are in a standalone system using IHC center netting can be fully automated.

- SAP Managed Tags:

- SAP S/4HANA Finance,

- FIN Accounts Receivable and Payable,

- FIN Treasury

3 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Deletion of Master and Transactional Data (ILM) in SAP S/4HANA Cloud,Public Edition-Link Collection in Enterprise Resource Planning Blogs by SAP

- What's new with SAP S/4HANA Cloud 2308 and S/4HANA 2023 in Finance in Enterprise Resource Planning Blogs by SAP

- My take at why you may be interested in SAP's Finance-Led ERP offering. in Enterprise Resource Planning Blogs by SAP

- Finance for SAP S/4HANA Cloud, Private Edition 2023 in Enterprise Resource Planning Blogs by SAP

- Financial Management Series Blog #4: Intercompany Matching and Reconciliation in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |