- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by Members

- Central Payment in SAP Treasury for Non-Central Fi...

Financial Management Blogs by Members

Dive into a treasure trove of SAP financial management wisdom shared by a vibrant community of bloggers. Submit a blog post of your own to share knowledge.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member23

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

03-17-2021

6:36 AM

Background

Central payments functionality is available in Central Finance 1909 version onward. In this blog, we can see how Central payment functionality can be done, without Central Finance SAP landscape. In this blog, we can see two different SAP landscapes (SE1 and BABUEHP7) use single SAP Central Payments system (ECCEHP8). This blog will restrict the solution using In-house Cash center in Source system and target (Central Payment system).

User Story

Tom is Head of Treasury department in an Organization which is in US and its operation worldwide from different countries. Tom’s organization had implemented a Global template for Finance & Treasury process in SAP system which up and running since 2018. Tom’s organization had recently acquired a new company in Europe. The company, which was acquired, was also using SAP system which was up and running for last 5 years. Tom wants to ensure the Treasury process of newly acquired company to follow existing template. However, as the system landscapes were different and due to large group of users using the existing landscape any change would have an impact on the business. Tom meets his IT architecture Neeraja to give solution, to use global template by newly acquired company without disrupting business operation.

Business Requirement

Tom wanted the existing system to be used with few enhancements on either of the systems. Tom has a budget constraint for going with new S4 HANA offering Central Finance with Central payments. Tom wants S4 HANA system to latest version with Central Finance functions in next coming years.

Newly acquired company used SAP In-House Cash Solution in two different SAP landscapes (SE1 & BABUEHP7). Internal & external payments are used. Company also used payment on behalf of (POBO) process.

Tom wanted to use POBO process and use existing payment files formats (DMEE) and BCM approval process which are currently used in the existing global template (ECCEHP8).

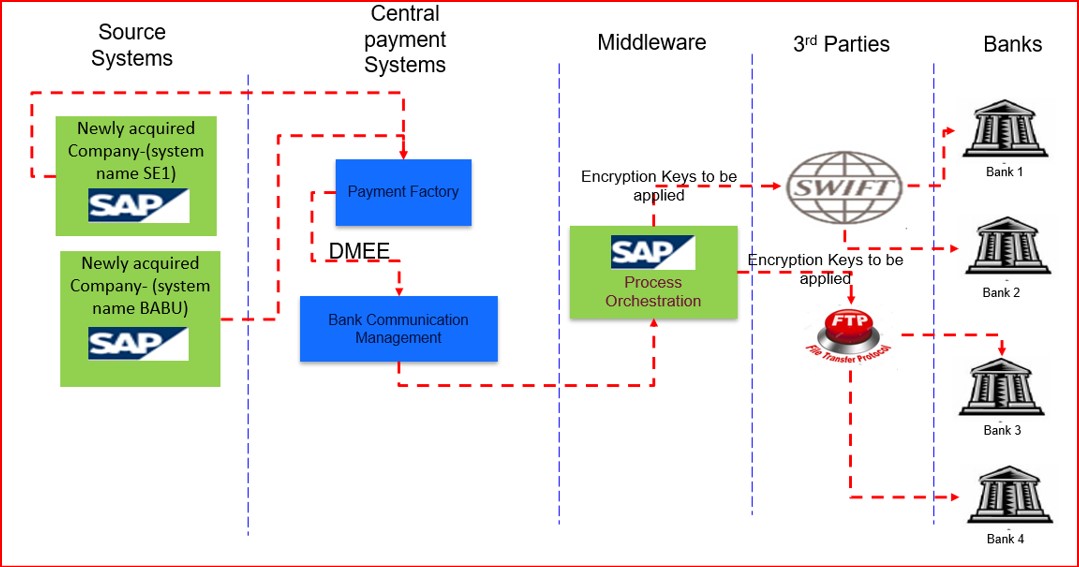

Fig: 1 Expected System Architecture of Central Payment Factory

SAP Solution

Neeraja IT architecture has come up with a solution. The two new system landscapes (SE1 & BABUEHP7) will connect to Central system ECCEHP8 using remote function call (RFC). The vendor/customer payments are accounted in the books of sources systems (SE1 & BABUEHP7). Payment to vendor through the external banks will be done from Central Payment system ECCEHP8 using existing global template payment file structure and BCM approval process. Accounting for payment will be done in Central system ECCEHP8.

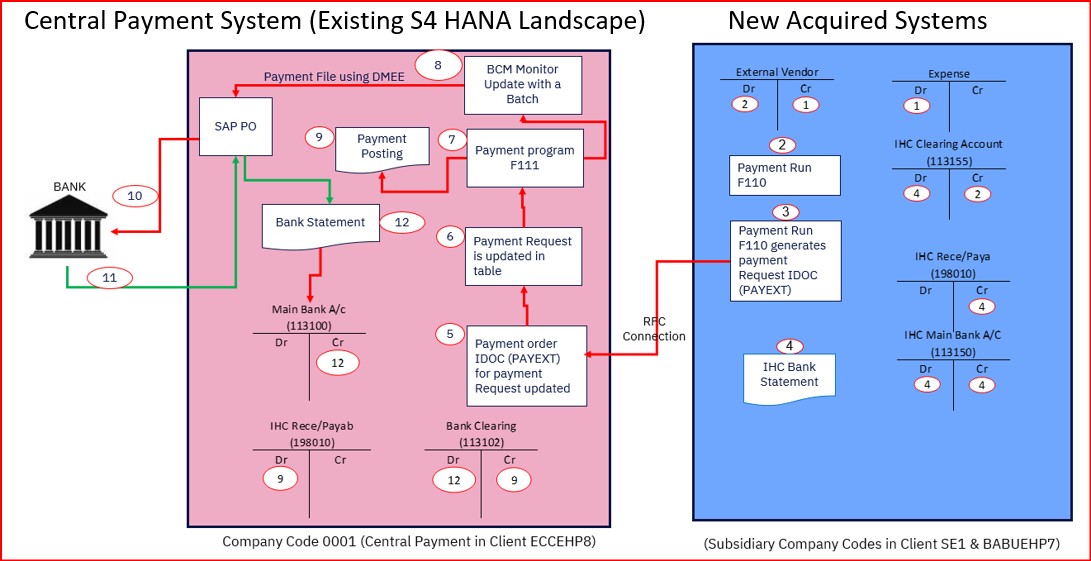

Process steps and Accounting in sending system & Central payment system

Expense Dr

To Vendor Account Cr

IHC account clearing account Dr

To Vendor Account Cr

IHC Clearing account (113155) Dr

To IHC Main bank account (113150) Cr

IHC Main bank account (113150) Dr

To IHC Receivable/payable account (198010) Cr

RFC will connect the source system and Central payment system. Payment request (PAYEXT) IDOCs will be transferred from source system to Central payment system.

IHC Receivables/payable (198010) Dr.

To Bank Clearing Account (113102) Cr.

Bank clearing account (113102) Dr.

To Main bank account (113100) Cr

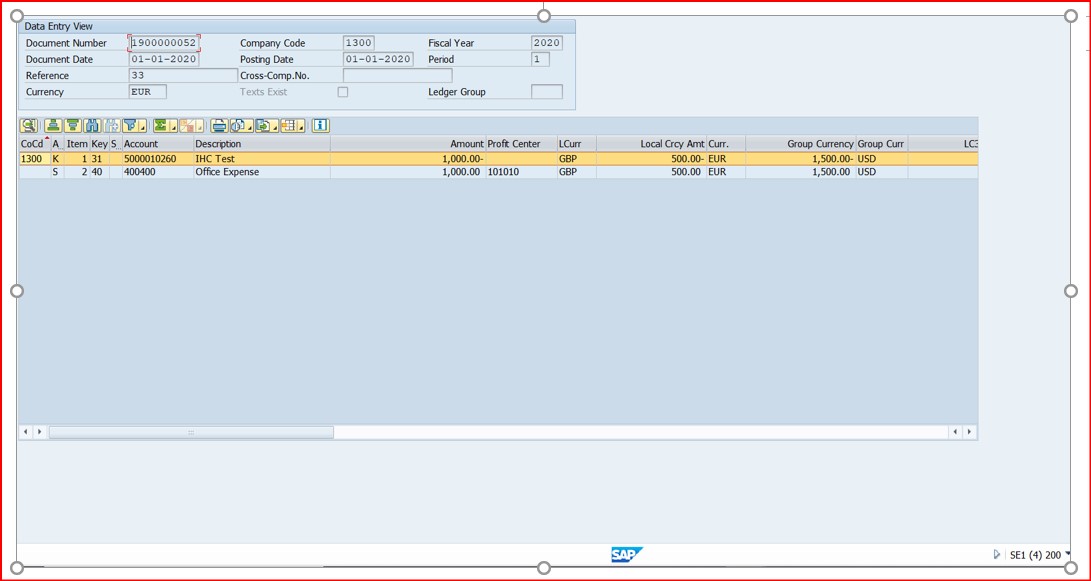

Fig: 3 (Vendor invoice in Company code 1300 in client SE1)

Fig: 5 (Payment order is created in client SE1 in In House Cash Center “2000”)

Fig: 7(IDoc)

Fig: 8(Payment request of client SE1 created in ECCEHP8)

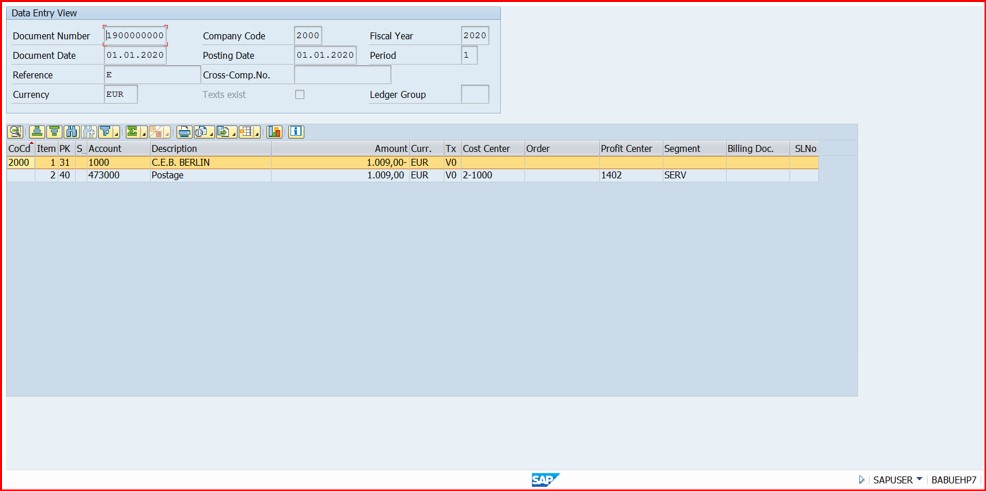

Fig: 10 (Vendor payment in client BABUEHP7)

Fig: 11 (Payment request 110 is created in client BABUEHP7 in In House Cash Center “DBKE”)

Fig: 12 (Payment request from client BABUEHP7)

Fig:13 (Payment request from client BABUEHP7 transferred as payment request IDOC in client ECCEHP8)

Fig:14 (Payment request from client SE1 payment request payment processing in client ECCEHP8)

Fig:15 (IHC Bank statement posting in SE1 client)

Fig:16 (IHC Bank statement posting in SE1 client)

Fig:17 (IHC Bank statement posting in SE1 client)

Fig:18 (GL bank clearing Account balance in client SE1)

Fig:19 (GL Main bank Account balance in client SE1)

Fig:20 (GL Receivables/Payables Account balance in client SE1)

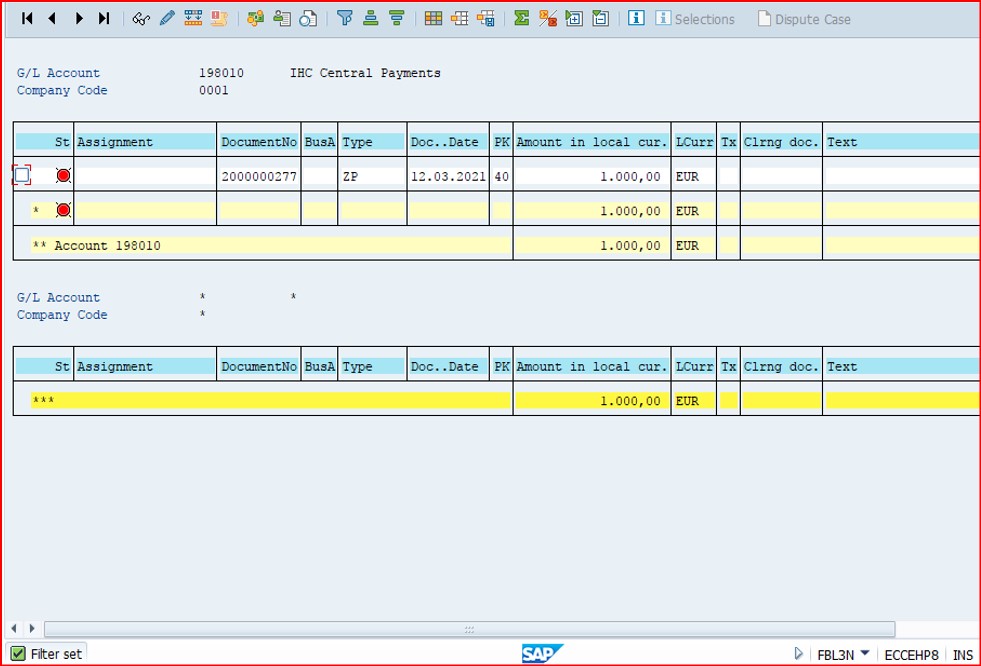

Fig:21 (GL Receivables/Payables Account balance in Central payment system ECCEHP8)

Fig:22 (payment in ECCEHP8)

Fig:23(Payment updated in payment batch in bank monitor in ECCEHP8)

Disclaimer:

Accounting entries might change based on the client requirements. All the accounting entries depicted in the blog are for representation to align with central payment processing considering payment request processed from different client.

This solution is not a replacement to Central payments functionality of S4 HANA Central Finance solution. Central payment functionality of S4 HANA Central Finance solution has many more features (such as open item clearing options). Solution as per this blog can be considered a preparatory step before implementing SAP Central payments functionality of S4 HANA Central Finance.

SAP systems depicted in the blog are sandbox systems such as SE1, BABUEHP7 & ECCEHP8 which are not related to any client.

Conclusion

Payments can be processed in an SAP client using In House Cash process and forward the payment request to another Central SAP client. Payment request can be processed in the receiving SAP system (making use of single instance connections with external banks). Following benefits with central payments received from multiple SAP systems

Central payments functionality is available in Central Finance 1909 version onward. In this blog, we can see how Central payment functionality can be done, without Central Finance SAP landscape. In this blog, we can see two different SAP landscapes (SE1 and BABUEHP7) use single SAP Central Payments system (ECCEHP8). This blog will restrict the solution using In-house Cash center in Source system and target (Central Payment system).

User Story

Tom is Head of Treasury department in an Organization which is in US and its operation worldwide from different countries. Tom’s organization had implemented a Global template for Finance & Treasury process in SAP system which up and running since 2018. Tom’s organization had recently acquired a new company in Europe. The company, which was acquired, was also using SAP system which was up and running for last 5 years. Tom wants to ensure the Treasury process of newly acquired company to follow existing template. However, as the system landscapes were different and due to large group of users using the existing landscape any change would have an impact on the business. Tom meets his IT architecture Neeraja to give solution, to use global template by newly acquired company without disrupting business operation.

Business Requirement

Tom wanted the existing system to be used with few enhancements on either of the systems. Tom has a budget constraint for going with new S4 HANA offering Central Finance with Central payments. Tom wants S4 HANA system to latest version with Central Finance functions in next coming years.

Newly acquired company used SAP In-House Cash Solution in two different SAP landscapes (SE1 & BABUEHP7). Internal & external payments are used. Company also used payment on behalf of (POBO) process.

Tom wanted to use POBO process and use existing payment files formats (DMEE) and BCM approval process which are currently used in the existing global template (ECCEHP8).

Fig: 1 Expected System Architecture of Central Payment Factory

SAP Solution

Neeraja IT architecture has come up with a solution. The two new system landscapes (SE1 & BABUEHP7) will connect to Central system ECCEHP8 using remote function call (RFC). The vendor/customer payments are accounted in the books of sources systems (SE1 & BABUEHP7). Payment to vendor through the external banks will be done from Central Payment system ECCEHP8 using existing global template payment file structure and BCM approval process. Accounting for payment will be done in Central system ECCEHP8.

Process steps and Accounting in sending system & Central payment system

- Vendor invoice accounted in source system, Accounting Entry

Expense Dr

To Vendor Account Cr

- Payment runs are posted, and the Accounting entry will be posted

IHC account clearing account Dr

To Vendor Account Cr

- Payment run generates IDOC PAYEXT and payment order is posted in In-house cash center and payment request is generated against the payment order.

- IHC will generate In-House Cash banks statements as day end processing. Accounting entry will be posted

IHC Clearing account (113155) Dr

To IHC Main bank account (113150) Cr

IHC Main bank account (113150) Dr

To IHC Receivable/payable account (198010) Cr

RFC will connect the source system and Central payment system. Payment request (PAYEXT) IDOCs will be transferred from source system to Central payment system.

- PAYEXT IDOC will be updated in the Central Payment system

- Payment Request is updated in the table “PAYRQ”

- Payment Program F111 will process the payment against the payment request. Payment request will carry the details such as

- Vendor bank details for payment

- Vendor invoice reference

- Source system payment reference

- BCM payment batch is updated in bank monitor

- Payment process is accounted in the Central Payment system

IHC Receivables/payable (198010) Dr.

To Bank Clearing Account (113102) Cr.

- Payment file creation as per Banks requirement (Based on DMEE in Central Payment system)

- Bank statement received from external bank

- Post bank statements in Central Payment system accounting entry in Central payment system

Bank clearing account (113102) Dr.

To Main bank account (113100) Cr

Fig: 3 (Vendor invoice in Company code 1300 in client SE1)

Fig: 5 (Payment order is created in client SE1 in In House Cash Center “2000”)

Fig: 7(IDoc)

Fig: 8(Payment request of client SE1 created in ECCEHP8)

Fig: 09 (Vendor Invoice in client BABUEHP7)

Fig: 10 (Vendor payment in client BABUEHP7)

Fig: 11 (Payment request 110 is created in client BABUEHP7 in In House Cash Center “DBKE”)

Fig: 12 (Payment request from client BABUEHP7)

Fig:13 (Payment request from client BABUEHP7 transferred as payment request IDOC in client ECCEHP8)

Fig:14 (Payment request from client SE1 payment request payment processing in client ECCEHP8)

Fig:15 (IHC Bank statement posting in SE1 client)

Fig:16 (IHC Bank statement posting in SE1 client)

Fig:17 (IHC Bank statement posting in SE1 client)

Fig:18 (GL bank clearing Account balance in client SE1)

Fig:19 (GL Main bank Account balance in client SE1)

Fig:20 (GL Receivables/Payables Account balance in client SE1)

Fig:21 (GL Receivables/Payables Account balance in Central payment system ECCEHP8)

Fig:22 (payment in ECCEHP8)

Fig:23(Payment updated in payment batch in bank monitor in ECCEHP8)

Disclaimer:

Accounting entries might change based on the client requirements. All the accounting entries depicted in the blog are for representation to align with central payment processing considering payment request processed from different client.

This solution is not a replacement to Central payments functionality of S4 HANA Central Finance solution. Central payment functionality of S4 HANA Central Finance solution has many more features (such as open item clearing options). Solution as per this blog can be considered a preparatory step before implementing SAP Central payments functionality of S4 HANA Central Finance.

SAP systems depicted in the blog are sandbox systems such as SE1, BABUEHP7 & ECCEHP8 which are not related to any client.

Conclusion

Payments can be processed in an SAP client using In House Cash process and forward the payment request to another Central SAP client. Payment request can be processed in the receiving SAP system (making use of single instance connections with external banks). Following benefits with central payments received from multiple SAP systems

- Central system relates to external banks such as connectivity (avoid multiple connections with banks)

- Single DMEE (payment file structure) in Central payment system

- BCM approval process can be centralized

3 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Assign Missing Authorization Objects

1 -

Bank Reconciliation Accounts

1 -

CLM

1 -

FIN-CS

1 -

Finance

2 -

GRIR

1 -

Group Reporting

1 -

Invoice Printing Lock

2 -

Mapping of Catalog & Group

1 -

Mapping with User Profile

1 -

matching concept and accounting treatment

1 -

Oil & Gas

1 -

Payment Batch Configurations

1 -

Public Cloud

1 -

Revenue Recognition

1 -

review booklet

1 -

SAP BRIM

1 -

SAP CI

1 -

SAP RAR

1 -

SAP S4HANA Cloud

1 -

SAP S4HANA Cloud for Finance

1 -

SAP Treasury Hedge Accounting

1 -

Z Catalog

1 -

Z Group

1

Related Content

- Digital Banking Add-on Package for RISE and GROW with SAP in Financial Management Blogs by SAP

- Don't miss out! SAP Financials Forum (WENFIT), April 22-24, virtual event | Webinar on Apr 3 in Financial Management Blogs by SAP

- SAP Treasury: Trade Finance Accounting Entries in Financial Management Q&A

- 3 Ways CFOs can Capitalize on AI in Finance in Financial Management Blogs by SAP

- SAP In-House Banking in Financial Management Blogs by SAP