- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by Members

- Trade Finance Letter of Credit (Buy & Sell) in SAP...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

A letter of credit, or "credit letter" is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. If the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase. It may be offered as a facility.

Due to the nature of international dealings, including factors such as distance, differing laws in each country, and difficulty in knowing each party personally, the use of letters of credit has become a very important aspect of international trade.

(Source Investopedia)

This blog explains the Letter of Credit (Buy and Sell) process in SAP and accounting in SAP using SAP Treasury & Risk Management process. SAP has standard solution for letter of credit “Trade Finance”. SAP Trade Finance is available from SAP 6.0 EHP8 onward. In this blog the scenario used is Commercial letter of credit directly paid by banks.

User Story

Lee is procurement manager responsible for placing Purchase Order for raw material involved in manufacturing of Copper insulated wires. At times Lee had to raise purchase order for procuring raw material Copper from distant vendor. As copper is a commodity which is traded in commodity markets such as LME (London Metal Exchange), COMEX and Shangai Futures Exchange. As the rates of copper is driven by market rates, Lee has to ensure that the rate and quantity of purchase is fixed. As the vendor is from another country, to avoid the vendor payment risk and vendor country’s legal requirements, Lee enters into a Letter of Credit agreement with the business partner.

Lee approached his finance counter part (Rohan). Rohan explain Lee the IFRS standard requirement

- Disclosure of Letter Credit as Contingent Liability (IFRS 4-Financial guarantee contracts and credit insurance)

Business Requirement

As per business requirement, Lee raises a purchase order against an LC payment and approaches Rohan to negotiate and process the Letter of credit with CITIBANK. The payment against the purchase order will be done based on the delivery of goods at Munich port.

On receipt of bill of lading and Invoice, payment will be released (LC payment). Payment will be done to the issuing/obligatory bank which will forward the payment to recipient bank. Recipient bank pays the vendor. On next bank statement, CITIBANK debits (payment against LC to the receiving bank). Vendor should be credited once the LC payment is debited on bank statement.

Letter of credit details to be sent to bank and confirmation to be sent via SWIFT message.

Fig: 1 Source: - International Chamber of Commerce

LC accounting process should compile as per IFRS accounting standards

- Disclosure of Letter Credit as Contingent Liability (IFRS 4-Financial guarantee contracts and credit insurance)

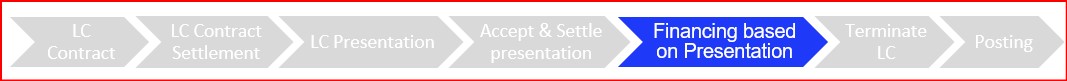

SAP Solution

Fig: 2

Letter of Credit Process in SAP Trade Finance

Fig: 3

Contract with Issuing Bank – Issue of LC

Fig: 4

Fig: 4

Fig: 5

Fig: 5

Credit limit check of counterparty (CITIBANK)

Fig: 6

Fig: 6Presentation of LC with Issuing bank

Fig: 7 (Standard SAP Workflow can be used for settling the contract)

Fig: 7 (Standard SAP Workflow can be used for settling the contract)

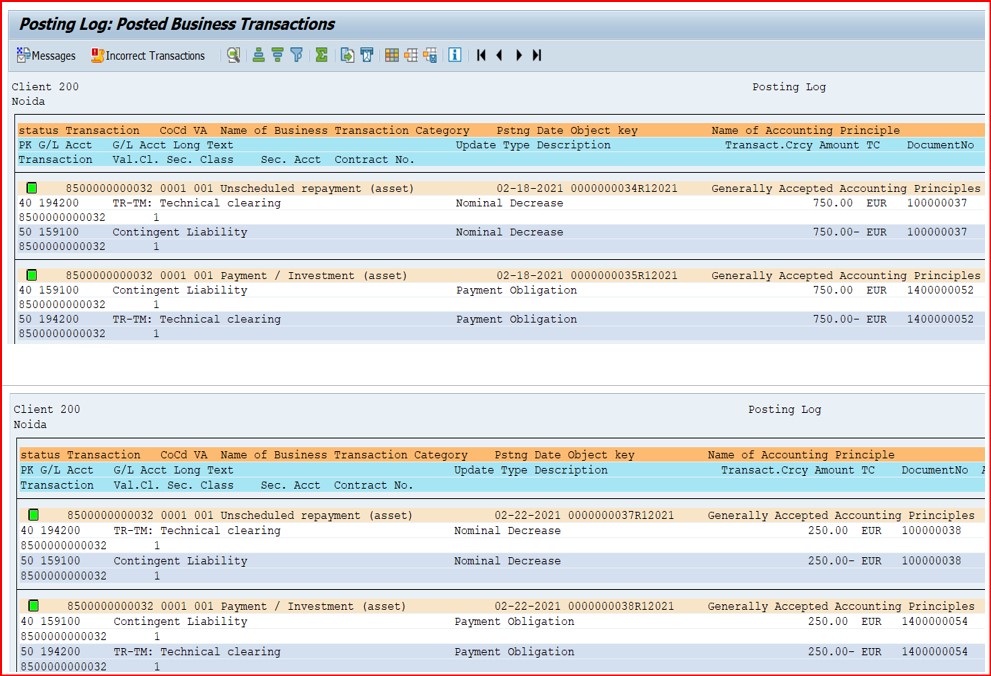

Contingent Liability is created

Dr 194200 – TR-TM Clearing A/c

Cr 159100 - Contingent Liability

Fig: 8

Fig: 8

Presentation of LC with Issuing bank

Fig:9

Presentation of LC

Fig:10

Fig:10

LC Presentation to bank (Payment obligation)

Fig: 11

Fig: 11

Fig:12

Fig:12

LC Presentation to bank (Acceptant Payment)

Fig:13

Fig:13

LC Presentation to bank (Acceptant Payment)

Fig:14 (Issuing bank is CITIBANK and Advising/Recipient bank is JP Morgan considered as example in this blog)

Fig:14 (Issuing bank is CITIBANK and Advising/Recipient bank is JP Morgan considered as example in this blog)

On Due date LC payments

Note: - All the dates represented only for demonstration purpose.

Fig:15 (Counterparty CITIBANK is linked with customer 5000010099)

Fig:15 (Counterparty CITIBANK is linked with customer 5000010099)

On Due date Vendor payment

Fig:16 (Vendor payment accounting based on the bank statement received on next day of payment processing to Recipient bank)

Fig:16 (Vendor payment accounting based on the bank statement received on next day of payment processing to Recipient bank)

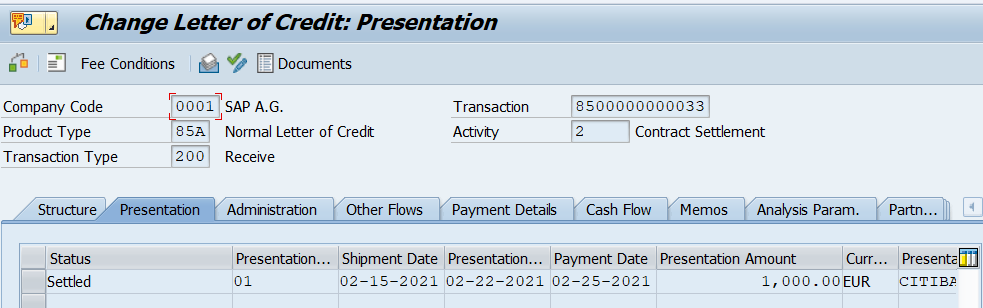

Letter of Credit (Sales Process)

Fig:17

Fig:17

Presentation of LC with bank

Fig:18

Fig:18

Presentation of LC with Advising bank

Fig:19

Fig:19

Intimation to issuing bank

PDF document can be generated and automatically send the email address maintained on Business partner master data.

Fig:20 (Sample used for this blog, Prior initiation to bank for entering into a LC contract)

Fig:20 (Sample used for this blog, Prior initiation to bank for entering into a LC contract)

LC Accounting in Treasury system

Fig:21

Fig:21

LC Presentation to bank (Acceptant Payment)

Fig:22

Fig:22

On Due date LC payments

Fig:23 (Counterparty CITIBANK linked with customer 5000010099. LC Sales is against ABC Forwarder)

Fig:23 (Counterparty CITIBANK linked with customer 5000010099. LC Sales is against ABC Forwarder)

Fig:24 (Payment credited to Customer based on the bank statement, LC payment received by issuing bank)

Fig:24 (Payment credited to Customer based on the bank statement, LC payment received by issuing bank)

Additional Information

- Integration with SWIFT/Open Text/Block Chain for communication with Counterparty

- Correspondence (MT700* as per ISO standards) for following can be triggered

- LC Contract

- Settlement

- Presentation

- Presentation acceptance

- Payments via SWIFT

- Full automation of accounting entries (Bank statements/Treasury module)

- LC Fee accounting can be integrated

- Limit Management of SAP can be extended to counterparty limits

Disclaimer:

Accounting entries might change based on the client requirements. All the accounting entries depicted in the blog are for representation to align with LC standard process.

Conclusion

SAP Trade Finance covers the complete solutions for Letter of Credit process both Buy & Sell. Entire process is automated using standard SAP workflow process, automatic matching of contracts using SWIFT MT format for communication with the banks to avoid risk of manipulation using workflow and with full automation of Letter of Credit Process.

- SAP Managed Tags:

- SAP Treasury and Risk Management,

- FIN Accounts Receivable and Payable,

- MM Purchasing,

- SD Sales

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

2023 Upgrade

1 -

Accounting & Financial Close

1 -

Accounting and Financial Close

1 -

Assign Missing Authorization Objects

1 -

Bank Reconciliation Accounts

1 -

CLM

1 -

EAM

1 -

Emergency Access Management

1 -

FFID

1 -

FI-AA

1 -

FIN Asset Management

1 -

FIN-CS

1 -

FINANCE

2 -

GRIR

1 -

Group Reporting

1 -

Invoice Printing Lock

2 -

Mapping of Catalog & Group

1 -

Mapping with User Profile

1 -

matching concept and accounting treatment

1 -

Oil & Gas

1 -

Parameter 4026

1 -

Payment Batch Configurations

1 -

Public Cloud

1 -

Revenue Recognition

1 -

review booklet

1 -

S4 HANA

1 -

S4 HANA 2022

1 -

S4 HANA On-Premise

1 -

S4HANA

1 -

SAP BRIM

1 -

SAP CI

1 -

SAP FICO

1 -

SAP RAR

1 -

SAP S4HANA

1 -

SAP S4HANA Cloud

1 -

SAP S4HANA Cloud for Finance

1 -

SAP Treasury Hedge Accounting

1 -

Z Catalog

1 -

Z Group

1

- ACH/ WIRE RETURN Process in S/4 Hana in Financial Management Blogs by Members

- Digital Banking Add-on Package for RISE and GROW with SAP in Financial Management Blogs by SAP

- Don't miss out! SAP Financials Forum (WENFIT), April 22-24, virtual event | Webinar on Apr 3 in Financial Management Blogs by SAP

- SAP Treasury Hedge Accounting , Matching concept and Accounting treatment in Financial Management Blogs by Members

- SAP Treasury: Trade Finance Accounting Entries in Financial Management Q&A