- SAP Community

- Products and Technology

- Human Capital Management

- HCM Blogs by Members

- ESS - Withholding Taxslip for Japan in SuccessFact...

Human Capital Management Blogs by Members

Gain valuable knowledge and tips on SAP SuccessFactors and human capital management from member blog posts. Share your HCM insights with a post of your own.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

ajaynudurupati1

Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

12-20-2020

4:35 AM

Introduction

Every customer wants to provide Self-Service capabilities to their employees like

- update Personal details - Address, Dependents, Status etc.,

- access Paystubs

- update W4 (US) information etc.,

As year end approaching, employees at some point need access to their tax statements.

In this blog, I shall focus on how we can enable self-service capability especially for Japan employees, which allows them to access and download "Withholding Taxslip" from SuccessFactors Employee Central via mashups.

Prerequisites

- SAML (SSO) should be enabled between Employee Central and Employee Central Payroll - SAP KBA 2253359 provides more info on how to configure SAML.

- Access to Employee Central Payroll system is setup via "Payroll Unified Configuration"

- Role based permissions needs to be enabled in Employee Central for employees to access Pay Statement and Tax Form applications.

- Tax form must be generated in Employee Central Payroll prior to accessing them in Employee Central by employees.

Now let's continue with configuration steps in Employee Central payroll:

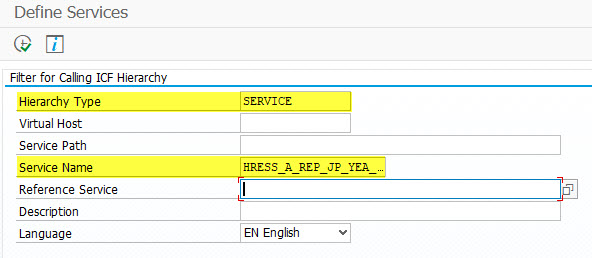

- Access service HRESS_A_REP_JP_YEA_WTS via transaction SICF

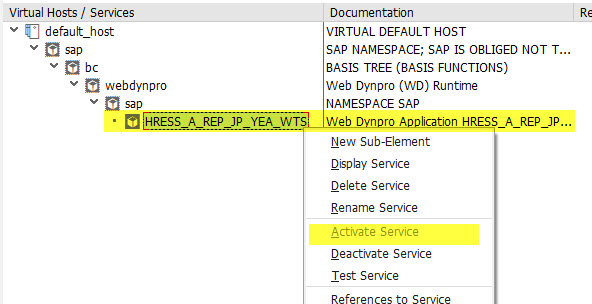

- Activate Service "HRESS_A_REP_JP_YEA_WTS"

- Make sure the following properties are set correctly

- check box is selected under "SAML Configuration"

- Authentication should be set to "Standard SAP User" if Employee Central and Employee Central Payroll uses same User ID's. if not, then select "Internet User" for aliases.

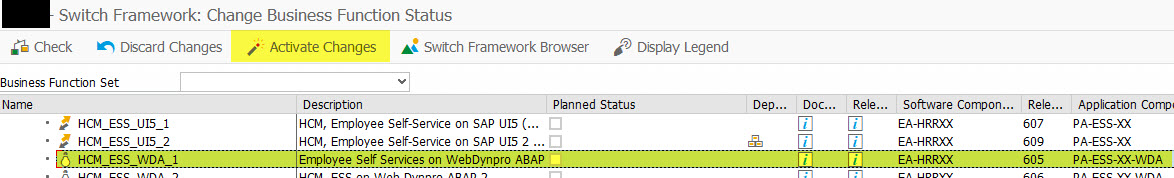

- Check and activate business function "HCM_ESS_WDA_1" using transaction SFW5 (refer SAP KBA 1641394 for more info on how to activate business functions)

- capture the URL of webdynpro application which needs to be configured in Employee Central by accessing the application HRESS_A_REP_JP_YEA_WTS via transaction SE80

Now, lets jump into Employee Central configuration steps:

- access transaction "Payroll Unified Configuration" - select Country/Region "Japan" and make sure the status of the system configuration is "Active"

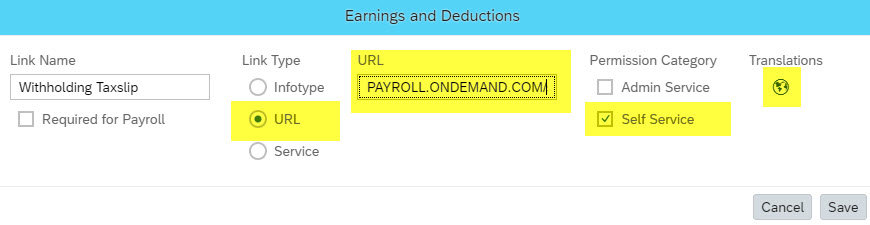

- Now create a link under "Portlets" by clicking on "Add Link"

- as the service is a webdynpro based application we need to choose the Link Type as "URL"

- Permission Category = Self Service"

- maintain translations in Japanese

- use the URL captured from Employee Central Payroll system and save the configuration

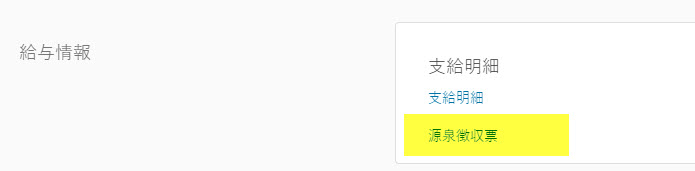

Let’s check the form now

- login to Employee Central and proxy as any "Japan Employee"

- click on "Payroll" portlet

- access Withholding Taxslip by clicking on the link

Conclusion

Employees can now access their year end tax forms directly from Employee Central using mashups.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

2H 2023 Product Release

1 -

ACCRUAL TRANSFER

1 -

Advanced Workflow

1 -

Anonymization

1 -

BTP

1 -

Business Rules

1 -

Career Development

1 -

Certificate-Based Authentication

1 -

Cloud Platform Integration

1 -

Compensation Information Management

1 -

Compensation Management

1 -

Compliance

2 -

Content

1 -

Conversational AI

2 -

Custom Data Collection

1 -

Data & Analytics

1 -

Data Integration

1 -

Dayforce

1 -

Delimiting Pay Components

1 -

Deprecation

1 -

Employee Central

1 -

Employee Central Global Benefits

1 -

Employee Central Payroll

1 -

Employee Rehires

1 -

external terminal

1 -

external time events

1 -

Generative AI

2 -

Getting Started

1 -

Global Benefits

1 -

H2 2023

1 -

HR

2 -

HR Data Management

1 -

HR Transformation

1 -

Incentive Management Setup (Configuration)

1 -

Integration Center

2 -

Integration Suite

1 -

internal mobility

1 -

Introduction

1 -

learning

2 -

LMS

2 -

LXP

1 -

Massively MDF attachments download

1 -

Mentoring

1 -

Metadata Framework

1 -

Middleware Solutions

1 -

OCN

1 -

OData APIs

1 -

ONB USA Compliance

1 -

Onboarding

2 -

Opportunity Marketplace

1 -

Pay Component Management

1 -

Platform

1 -

POSTMAN

1 -

Predictive AI

2 -

Recruiting

1 -

recurring payments

1 -

Role Based Permissions (RBP)

2 -

SAP CPI (Cloud Platform Integration)

1 -

SAP HCM (Human Capital Management)

2 -

SAP HR Solutions

2 -

SAP Integrations

1 -

SAP release

1 -

SAP SuccessFactors

5 -

SAP SuccessFactors Customer Community

1 -

SAP SuccessFactors OData API

1 -

SAP-PAYROLL

1 -

Skills Management

1 -

Stories in People Analytics

2 -

SuccessFactors

1 -

SuccessFactors Employee central home page customization.

1 -

successfactors onboarding i9

1 -

talent

1 -

Talent Intelligence Hub

2 -

talents

1 -

Tax

1 -

Tax Integration

1 -

Time Accounts

1 -

Workflows

1 -

XML Rules

1

Related Content

- Automatic Hire in Human Capital Management Blogs by SAP

- AI shaping the future of HR: Is your organisation ready to embrace the change? in Human Capital Management Blogs by Members

- reporting on succession gaps in Human Capital Management Q&A

- Late Coming and Early Departure Detection for Double Shifts on the same day - SF Time Tracking in Human Capital Management Blogs by Members

- List of Employee Central & Employee Central Payroll Guide Updates for the 1H 2024 Release in Human Capital Management Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |