- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Event-Based Revenue Recognition Contract Usage Cas...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Business Requirement

The customer get one year maintenance service contract, the revenue is 1800 USD, according to the requirements of the audit and the provisions of the financial accounting rule, the revenue need split into per months.

And the Customer refused to use partial billing (Billing Plan), because they don't want handle so much billing documents.

Implementation Requirement

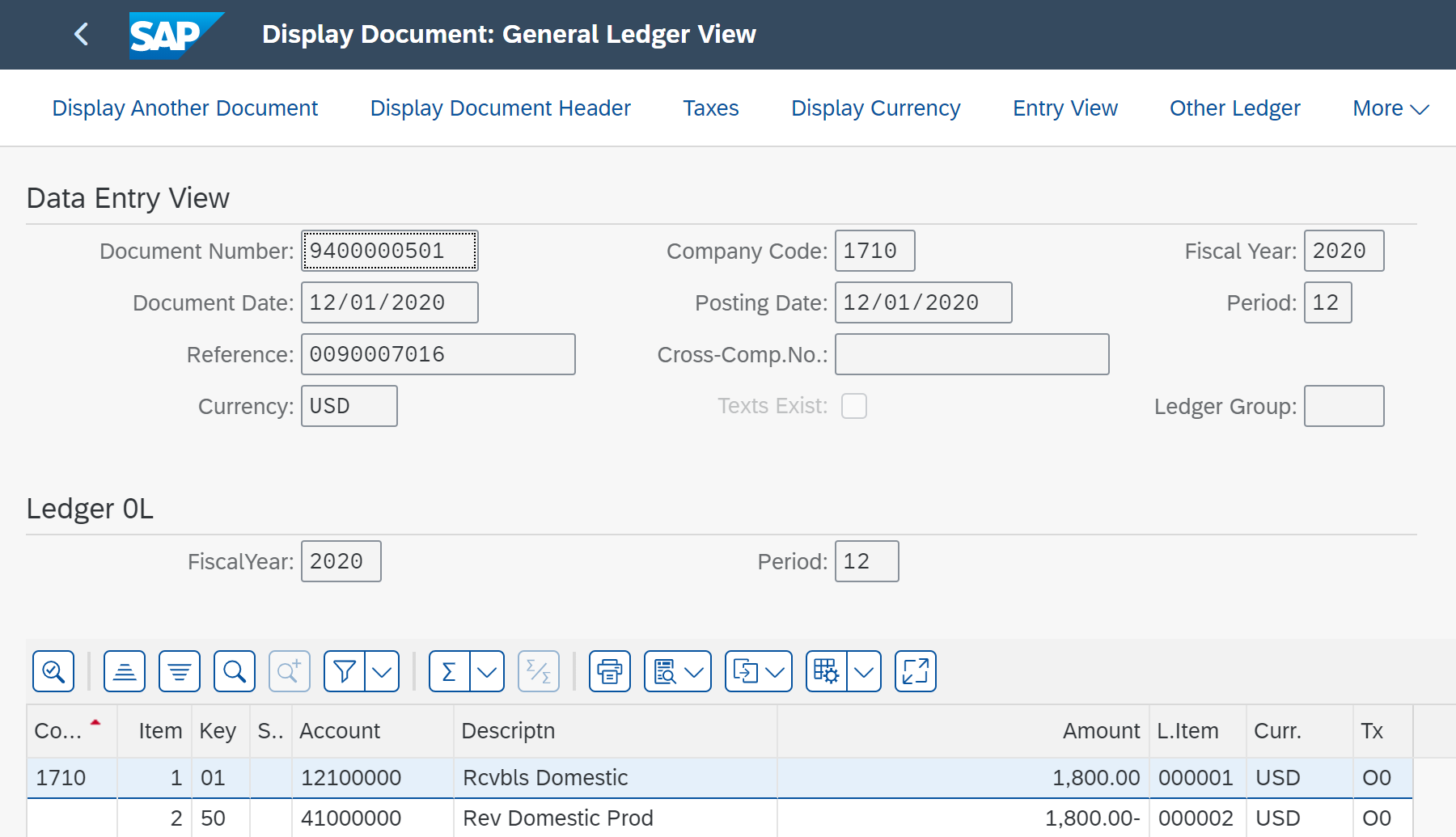

1. Created one billing 1800 USD on date 2020.1.1, synchronous created one deferred income financial document ( Debit: Account Receivable, Credit: Incoming Billing - Deferred Revenue )

2. Create monthly billing 150 USD, 12 financial document (Debit: Incoming Billing - Deferred Revenue, Credit: Main Business Income)

S/4 HANA CLOUD Workaround

Using Event-Based Revenue Recognition Contract, delivered standard scope Item 3MO + 3M3 example:

1. Create one service contract:

Select settlement period: Yearly (Settlement Period), Billing Date: To First of the Month (Billing Date)

2. Schedule Billing Document Request:

3. Billing

4. Monitor Revenue Recognition (Event-Based): Service Documents

Customizing

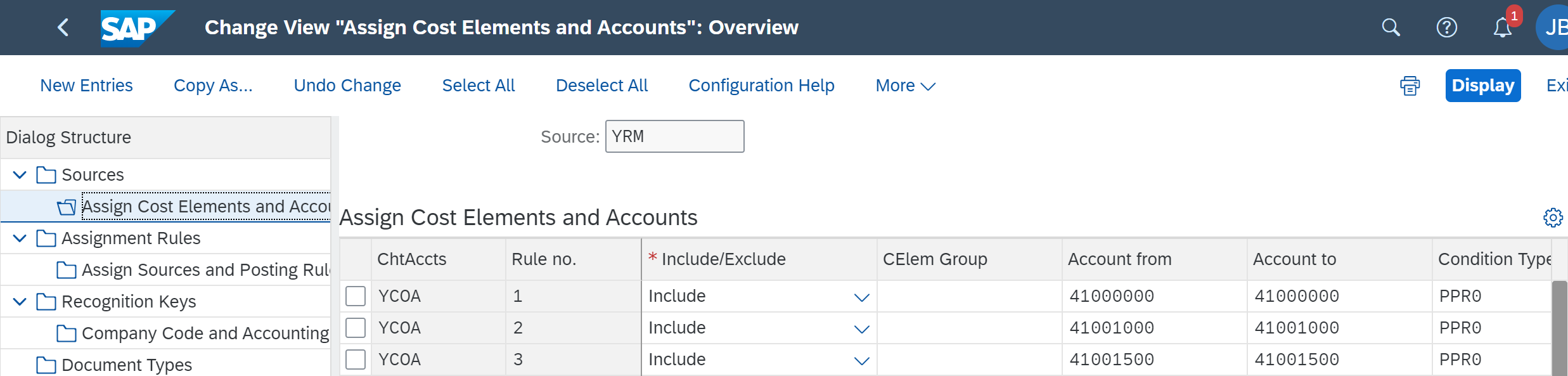

Event-Based Revenue Recognition (EB RR): Sources and Assignment Rules

SSCUI: Maintain Settings for Event-Based Revenue Recognition

In the overview “Sources” select a “Source” and go to the next level “Assign Cost Elements and Accounts”; e.g. “YRM” – Revenue-Manufacturing/Trade.

In the overview “Assign Cost Elements and Accounts” the relevant sources can be maintained. Possible sources to include are single account, range of accounts, condition types and cost element groups. An additional feature is that sources can also be excluded for the process.

- SAP Managed Tags:

- SAP S/4HANA Cloud for Service

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

152 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

208 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

88

- Intercompany Execution of Services (aka "Dual Order") in Enterprise Resource Planning Blogs by SAP

- Service with Advanced Execution and Resource-related Billing in Enterprise Resource Planning Blogs by SAP

- Service with Advanced Execution and Fixed Price Billing in Enterprise Resource Planning Blogs by SAP

- Advanced WIP reporting in S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Ad-hoc Service with Fixed Price billing or Billing Plan in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 8 | |

| 6 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 |