- SAP Community

- Products and Technology

- Human Capital Management

- HCM Blogs by SAP

- Accrual Calculation based on age limit for each ch...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Hello Everyone

This is regarding calculating accruals based on dependent age. I have seen many such questions floating around the customer and partner community. Hence wanted to share a possible solution for now.

Let’s look at a sample requirement “A customer's requirement is, that Vacation days are added for each child under 12 years of age”. For example, if there are 3 children and only 2 are below 12 years, the accrual should be 20 (2 * 10 days per child). “

We have two ways of handling this. You can follow the approach you like

Option 1: Using Custom field and Integration Center

Coming to this solution, you can follow the below steps and check the results yourself. Further, you can adapt

Procedure

1. Create a custom field in Dependents “IsEligibleForAccrual” using BCUI.

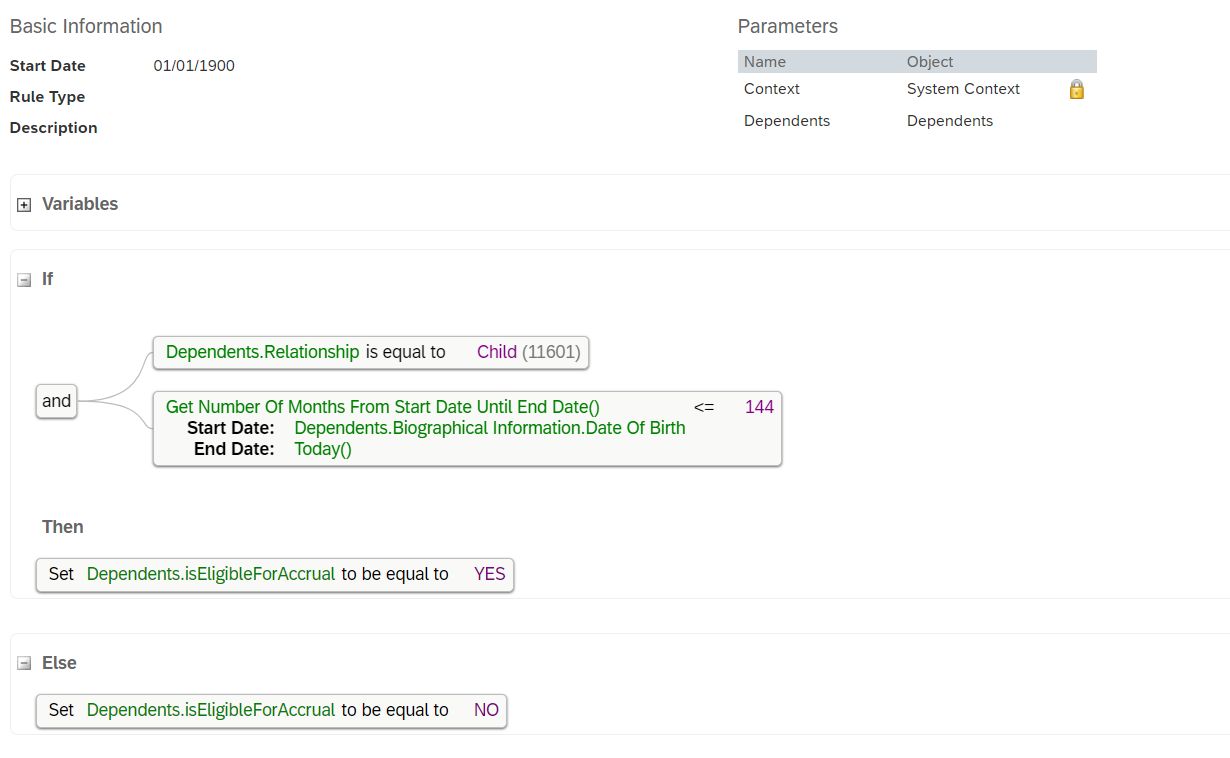

2. Create a new on Save rule on the same dependent portlet to set this custom field based on your requirement of 12 years (144 months)

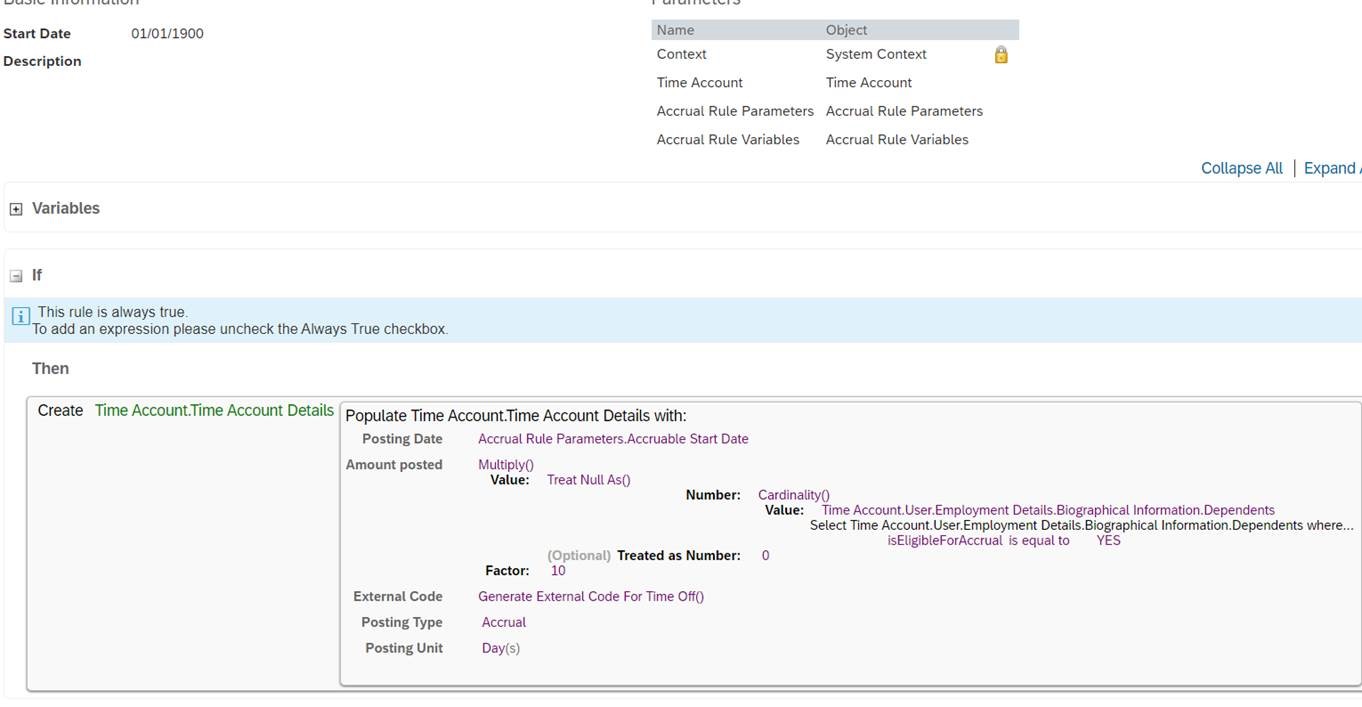

3. In the accrual rule use the cardinality rule function to check the number of dependents matching this field as “YES”

Testing

The current employee has two eligible dependent Childs

In my sample rule, I am providing 10 days per dependent matching the criteria

The accrual granted is 20 days which is correct in this case

Integration Center to update dependents in subsequent years

The eligibility of existing dependents which were added after the employee is hired can change in subsequent years. For example, If there is a child born in 2008 would become 13 years in 2021. As a result, at beginning of 2021, we need to update this eligibility field to “NO” so that the accruals for 2021 can consider this

To achieve this consider the below design

Create a outbound integration to output the current dependents in system into a csv file in SFTP folder

Example:

Add a calculated field named “Years” and add the following calculation

This gives the difference between the date of birth of dependent and today (Jan 1st of every year)

Sample file extracted

Create an inbound integration to read the csv file (exported in above step) from SFTP folder

Map the fields Person ID External , Related Person ID External

Make Start date as calculated field which is resolved to today or NOW

Also make the isEligibleForAccrual as calculated field with below calculation by using "Choose" Operator

It is a switch case where if the Years field from CSV is between 1 to 12 , it will be set to YES

Otherwise NO

Small Test

After I run the integration centre report, the dependent who is now 13 years in 2021 is updated

You can schedule these integrations every year (Beginning of Jan) if your accrual calendar year is Jan - Dec. This would ensure that the dependent's eligibility is set as per their age at that moment.

Post this, you can run the accrual calendars for this time account type

Other considerations

- Instead of years if you want months, you need to add numbers from 1 to 144 in your switch case, as in IC the if else condition does not provide filters less than currently

- You can add additional time based filters to prevent reading all dependents. This can depend on your use case

Option 2:

You can use the below rule and rule function to check if a child is less than 15 years or 180 months as of accrual date

What this rule does? It basically sorts the employee's dependents with relationship child (external code =2) as per their DOB. And it checks the position/rank of the first child meeting the criteria of less than <= 180 months. . For example say there are 5 children and the first child meeting the criteria of<=180 months is at rank 3, this means the first 2 children are above>= 180 months and all children below 3rd position i.e child 4 and 5 are <=180 months. So in total, we have 5-2 = 3 children meeting these criteria. Hence you can then use this number 3 to further calculate the accruals

You can also embed this logic in accrual rule directly instead of using it via custom MDF. Below is the snippets of rule to do the same. Extend the pattern for any number of children you need. The below logic also takes into consideration any new children born during the year. Hence we check the dependent count at beginning of accrual period and also end of accrual period.

Also in below example, we provide 1 day per child who is less than 180 months or 15 years

We have implemented this for Best practices Time Off Croatia. If you are interested to look at complete rule, you can also run best practices for time off Croatia (HRV) in your successfactors instance

This is a simpler way instead of option 1. Further, the rule is limited to only 3 children in the picture but you can extend it to any number of children. Just continue the pattern and logic

Option 3:

Recently one of our colleagues @SoraiaLatif came up with another innovative and creative way of handling this requirement. You can have a look at her blog too

SuccessFactors Time Off Accruals: Calculation base... - SAP Community

You could go through all three options and adopt the one that suits your needs

Disclaimer:

The current solution does not cover accrual recalculation for ex: when a new eligible child is added. But such challenges can be overcome by scheduling periodically the time off calendars.

If I get a way to automate this step as well, Will enhance this blog or create a new one.

Also please evaluate this with your customer, before adopting the solution.

Thanks

Neelesh

- SAP Managed Tags:

- SAP SuccessFactors Employee Central

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

1H 2023 Product Release

3 -

2H 2023 Product Release

3 -

Business Trends

104 -

Business Trends

4 -

Cross-Products

13 -

Event Information

75 -

Event Information

9 -

Events

5 -

Expert Insights

26 -

Expert Insights

17 -

Feature Highlights

16 -

Hot Topics

20 -

Innovation Alert

8 -

Leadership Insights

4 -

Life at SAP

67 -

Life at SAP

1 -

Product Advisory

5 -

Product Updates

499 -

Product Updates

29 -

Release

6 -

Technology Updates

408 -

Technology Updates

7

- How to do the accrual recalculation based on the work schedule change in employee time information? in Human Capital Management Q&A

- HCM Brasil: Atualizações e novidades de Março 2024 in Human Capital Management Blogs by SAP

- SuccessFactors Time Off Accruals: Calculation based on dependents age in Human Capital Management Blogs by SAP

- Fetching Dependents information in Benefits for reimbursements and allowances in Human Capital Management Blogs by Members

- Unfortunately, our vacation business rule does not round to 0.5 days in Human Capital Management Q&A

| User | Count |

|---|---|

| 5 | |

| 4 | |

| 4 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |