- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- How to configure and setup Results Analysis Valuat...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

vinodasharma

Discoverer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

11-13-2020

10:39 AM

Introduction

This blog is a continuation of the trilogy where I describe the working of some of the more advanced Results Analysis techniques. In my last blog I had described how Cost Of Sales is determined based on the cost mapping from GL accounts to the Sales Order line item using the DIP (Dynamic Insertion Profile)

You can refer to the detail around RA Valuation Method 14 “derive cost of sales from resource related billing of dynamic items” here

https://blogs.sap.com/2020/10/27/results-analysis-using-method-14-derive-cost-of-sales-from-resource...

In this blog, I’ll describe in detail the other Valuation Method based on the Dynamic Insertion Profile functionality namely Valuation Method 15 “Derive Revenue from Resource-Related Billing and Simulation of Dynamic Items”

The valuation Method 15 derives revenue linked to the costs booked to specific WBS lines that roll-up to a billing WBS element which in turn is linked to a Sales Order or more specifically a Sales Order line item.

Details

In a typical project setup where RA is used to derive revenue based on costs incurred, billing WBS elements are mapped to a set of cost WBS elements ( and further to network activities that tie into those cost WBS elements) . And the billing WBS element is mapped to a Sales Order. This setup is required to trigger the revenue posting related to specific work packages (cost WBSes) that are technically completed and linked to a billing WBS element that is linked a Sales Order via the account assignment related to the relevant sales order item.

To establish the link between the costs incurred and billing items SAP uses the dynamic insertion profile (DIP) functionality. In the DIP profile, the costs are linked to the service materials via cost elements. The detail of the configuration required to setup the Dynamic Insertion Profile are in the earlier blog related to RA valuation method 14, the link for which is above at the beginning of this blog.

The same DIP profile can be used for both RA valuation method 14 & 15.

The steps to setup the RA KEY for valuation method 15 are same as other RA Keys, the details are in the earlier blog that I have referenced

Let’s take a look at a typical requirement that can be addressed by the RA Valuation Method 15

In our example, we have a project for two months, in month 1 the design is planned for completion and billing. Part of the build cost is incurred in month 1 but not billed. In month 2 the build is completed and billed.

At the end of month 1, costs are incurred for both design and some parts of the build work. The design work is considered as one work package and the build work is another work package. At the of month two all costs are considered as COS (cost of sales) .

Here we are looking to eventually post the unbilled revenue to the books on the basis of work completed. Revenue for the period is the billing amount from the Sales Order that is linked to the work package which is completed i.e. the billing WBS element which linked to the cost WBSes marked as TECO and account assigned to the Sales Order related to the design.

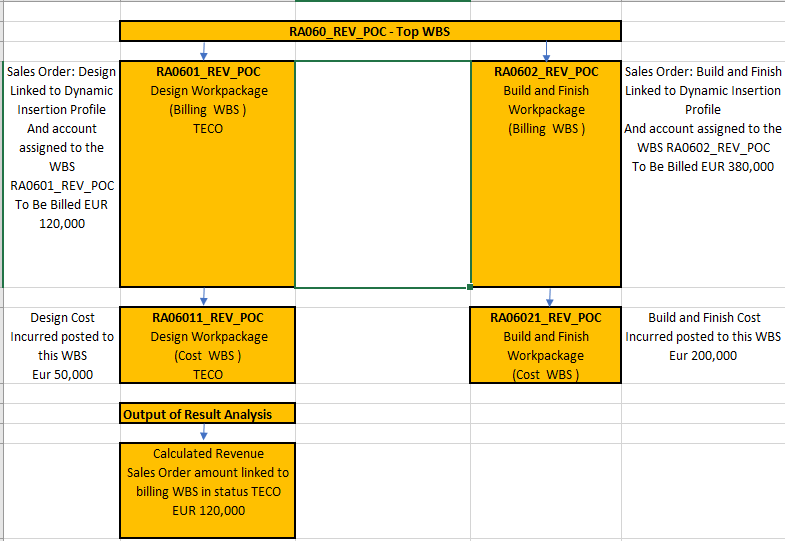

Here is what a typical setup should look like.

In the SAP instance I have setup a simplified Project with the top WBS being the billing WBS with two Cost WBS subordinates, one for design and the other for the build and finish phase. Costs are incurred on the design WBS but not on the build and finish WBS.

On the billing side I have created a SO account assigned to the top WBS that is linked to both the design and build & finish cost WBS elements.

This is just to make the point that there are different ways to design the process around the RA functionality, I have setup a different process. In this instance around the time the build is completed (WBS is in status TECO), say in month two, and terms for revenue recognition fulfilled, the Sale Order can be created and account assigned to the top WBS.

As a result when the RA is run for the WBS in month two, the revenue calculation is triggered to the extent of amount of the Sale Order related to build and finish.

Conclusion

The RA method 15 which is used to calculate revenue from Resource-Related Billing of Dynamic Items is one of the more advanced RA methods used to address the principle of matching between costs and revenue. The calculated revenue is not an estimate as in other methods but is identical to the amount of billing that links back to billing WBS. However, this method has integration points with other modules that need to be addressed such as DIP profile setup, which drives the linkage between costs incurred and the amounts billed, that needs careful consideration and testing for the Results Analysis calculation and posting to work as expected.

This blog that I put together will hopefully help those of you to quickly setup and test this solution when you need to address the requirement to matching costs and revenues for customers in the service industry

The last in this series will be another advanced technique in Results Analysis, where I plan to detail Valuation Methods 07; POC Method on Basis of Project Progress Value Determination. Be on the look out for that blog.

Btw – In case you have questions please post them here in Q&A

This blog is a continuation of the trilogy where I describe the working of some of the more advanced Results Analysis techniques. In my last blog I had described how Cost Of Sales is determined based on the cost mapping from GL accounts to the Sales Order line item using the DIP (Dynamic Insertion Profile)

You can refer to the detail around RA Valuation Method 14 “derive cost of sales from resource related billing of dynamic items” here

https://blogs.sap.com/2020/10/27/results-analysis-using-method-14-derive-cost-of-sales-from-resource...

In this blog, I’ll describe in detail the other Valuation Method based on the Dynamic Insertion Profile functionality namely Valuation Method 15 “Derive Revenue from Resource-Related Billing and Simulation of Dynamic Items”

The valuation Method 15 derives revenue linked to the costs booked to specific WBS lines that roll-up to a billing WBS element which in turn is linked to a Sales Order or more specifically a Sales Order line item.

Details

In a typical project setup where RA is used to derive revenue based on costs incurred, billing WBS elements are mapped to a set of cost WBS elements ( and further to network activities that tie into those cost WBS elements) . And the billing WBS element is mapped to a Sales Order. This setup is required to trigger the revenue posting related to specific work packages (cost WBSes) that are technically completed and linked to a billing WBS element that is linked a Sales Order via the account assignment related to the relevant sales order item.

In typical high-volume environment, batch jobs are setup with a variant that triggers RA calculation and posting of those billing WBS elements that are in status “TECO” . As a result, the revenue of an amount equal to the amount in the Sales Order item for billing is the amount of calculated revenue

The calculated revenue less the amount actually billed is posted when the settlement transaction is triggered, this is the unbilled revenue recognized in the books.

RA Key configuration

To establish the link between the costs incurred and billing items SAP uses the dynamic insertion profile (DIP) functionality. In the DIP profile, the costs are linked to the service materials via cost elements. The detail of the configuration required to setup the Dynamic Insertion Profile are in the earlier blog related to RA valuation method 14, the link for which is above at the beginning of this blog.

The same DIP profile can be used for both RA valuation method 14 & 15.

The steps to setup the RA KEY for valuation method 15 are same as other RA Keys, the details are in the earlier blog that I have referenced

Let’s take a look at a typical requirement that can be addressed by the RA Valuation Method 15

In our example, we have a project for two months, in month 1 the design is planned for completion and billing. Part of the build cost is incurred in month 1 but not billed. In month 2 the build is completed and billed.

At the end of month 1, costs are incurred for both design and some parts of the build work. The design work is considered as one work package and the build work is another work package. At the of month two all costs are considered as COS (cost of sales) .

Here we are looking to eventually post the unbilled revenue to the books on the basis of work completed. Revenue for the period is the billing amount from the Sales Order that is linked to the work package which is completed i.e. the billing WBS element which linked to the cost WBSes marked as TECO and account assigned to the Sales Order related to the design.

Here is what a typical setup should look like.

WBS Structure

In the SAP instance I have setup a simplified Project with the top WBS being the billing WBS with two Cost WBS subordinates, one for design and the other for the build and finish phase. Costs are incurred on the design WBS but not on the build and finish WBS.

On the billing side I have created a SO account assigned to the top WBS that is linked to both the design and build & finish cost WBS elements.

This is just to make the point that there are different ways to design the process around the RA functionality, I have setup a different process. In this instance around the time the build is completed (WBS is in status TECO), say in month two, and terms for revenue recognition fulfilled, the Sale Order can be created and account assigned to the top WBS.

As a result when the RA is run for the WBS in month two, the revenue calculation is triggered to the extent of amount of the Sale Order related to build and finish.

Conclusion

The RA method 15 which is used to calculate revenue from Resource-Related Billing of Dynamic Items is one of the more advanced RA methods used to address the principle of matching between costs and revenue. The calculated revenue is not an estimate as in other methods but is identical to the amount of billing that links back to billing WBS. However, this method has integration points with other modules that need to be addressed such as DIP profile setup, which drives the linkage between costs incurred and the amounts billed, that needs careful consideration and testing for the Results Analysis calculation and posting to work as expected.

This blog that I put together will hopefully help those of you to quickly setup and test this solution when you need to address the requirement to matching costs and revenues for customers in the service industry

The last in this series will be another advanced technique in Results Analysis, where I plan to detail Valuation Methods 07; POC Method on Basis of Project Progress Value Determination. Be on the look out for that blog.

Btw – In case you have questions please post them here in Q&A

- SAP Managed Tags:

- SAP S/4HANA Finance

Labels:

1 Comment

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

152 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

206 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

87

Related Content

- Unplanned Delivery Cost of Purchasing in S4HANA Cloud, Public Edition in Enterprise Resource Planning Blogs by SAP

- Driving Corporate Sustainability: Greenhouse Gas Emission Planning along Cloud ERP Financials in Enterprise Resource Planning Blogs by SAP

- Deletion of Master and Transactional Data (ILM) in SAP S/4HANA Cloud,Public Edition-Link Collection in Enterprise Resource Planning Blogs by SAP

- Automatic Account Determination for without material master in SAP S/4HANA On premise 2021 in Enterprise Resource Planning Blogs by Members

- Optimizing Real Estate Management with REFX and Funds Management (FM) Integration in SAP in Enterprise Resource Planning Blogs by Members

Top kudoed authors

| User | Count |

|---|---|

| 7 | |

| 5 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 |