- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- FLSA Overtime Valuation Over Non-Discretionary Bon...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member87

Active Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

11-10-2020

1:18 PM

++New Updates++

February 16, 2022 - The following SAP Note has been released:

3104785 - FLSA: NDB overtime premium not calculated when bonus reference dates are inside the curren...

FAQ section has been updated (14 question added)

February 15, 2022 - The following SAP Notes have been released:

3055390 - FLSA: option to choose Adjustment Rate ID used in the NDB calculation

3061765 - FLSA: New processing class 85 option 6 and changes to non-discretionary bonus overtime cal...

FAQ section has been updated (9-13 questions added)

April 1st, 2021 – The following SAP Notes have been released:

The FLSA (Fair Labor Standards Act) is the law regulating minimum wage, overtime pay, equal pay for equal work, child labor, and record keeping. It applies to all non-exempt employees, from the public and private sectors.

According to the FLSA standards, employers must pay the employee covered by the Act overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay (unless they are exempt).

To comply with this legal change, SAP has delivered updates to address to relevant technical changes to prepare for the following requisites:

What you need to know about the FLSA?

For more information on the legal change specifications, visit https://www.dol.gov/agencies/whd/flsa.

What you need to know about the FLSA in SAP system?

1 – Standard Calculation

The system uses processing class 85 of the wage types to calculate a single Regular Rate of Pay (stored in wage type /R00), which represents the hourly rate of pay of the employee in the given week. Depending on the value assigned to the processing class 85, the wage type contributes with the amount and hours to wage type /R00. Then, the system uses /R00 to reevaluate the relevant wage types, also based on the value assigned to processing class 85.

According to the values set in processing class 85 (see below), RGRTE determines the so-called 'Regular Rate of Pay' for each work week, and valuates the relevant wage types with this rate.

Processing class 85 values are:

0 = No influence from or to Regular Rate (RR)

1 = Contributes to RR with number and amount, not valuated with RR

2 = Contributes to RR with amount only, not valuated with RR

3 = Contributes to RR with number and amount, is valuated with RR

4 = Contributes to RR with amount only, is valuated with RR

5 = Does not contribute to RR, is valuated with RR

Wage types configuration

To have valid wage types for overtime and non-discretionary bonus calculation in the function Regular Rate of Pay (FLSA Overtime Valuation) (RGRTE), you need to ensure the following wage type configuration:

Standard calculation:

2 – FLSA adjustment rate for overtime hours (FAOH)

You can use this processing mode for payroll function RGRTE. When Subapplication FAOH - FLSA adjustment of overtime hours is activated, the system allows you to create and use multiple adjustments rates instead of only /R00. The processing enables you to configure a set of wage types that will be used to calculate an adjustment rate using adjustment IDs. For example, you can have an adjustment rate considering only regular and overtime payments, while having another one considering only bonus and overtime payments. These IDs consist of a grouping of wage types that will work together during the FLSA overtime calculation.

By default, SAP delivers the following Adjustment Rate IDs:

After selecting the adjustment rate ID you want to adjust, enter the wage types relevant for the processing of the adjustment and select how they are going to contribute to the adjustment rate. The possible values are:

3 – FLSA NDB adjustment rate for overtime hours (NDB)

The payroll function RGRTE has three processing modes. One of them is Adjusting the regular rate according to non-discretionary bonus, which is a function call with the parameter NDB (FLSA NDB adjustment rates for overtime hours). This function calculates the difference between the originally calculated FLSA overtime and the FLSA overtime calculated with the non-discretionary bonus.

In order to do that you just have to go through the following steps:

After enabling the processing with non-discretionary bonus, you can enter the bonus in infotypes Additional Payments (0015) and Additional Off-Cycle Payments (0267). When entering the bonus, you also enter the bonus reference period. You can learn more about how to set up your system correctly in Help Portal .

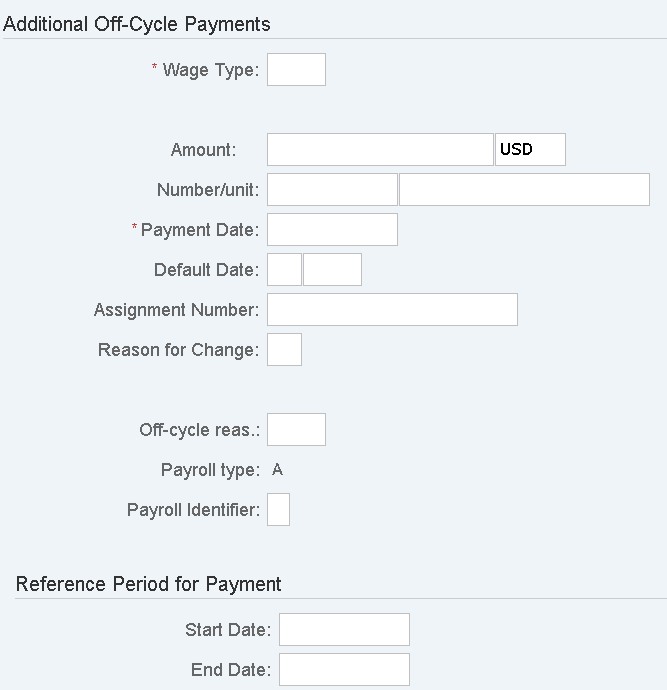

PA30 – Additional Payments (0015) and Additional Off-Cycle Payments (0267) infotypes

When editing Additional Payments (0015) and Additional Off-Cycle Payments (0267) infotypes for an employee, you must enter the amount of the bonus payment with the start and end dates defined in the Reference Period for Payment group box.

In Additional Payments (0015) infotype, you enter a non-discretionary bonus related to work done and usually is paid in the next payroll run.

In Additional Off-Cycle Payments (0267) infotype, you enter an off-cycle payment that is related to a bonus, but different from infotype 0015, you can run an off-cycle payroll on any day.

The data you enter in both infotypes is read by payroll function RGRTE, when called with parameter NDB.

You can learn more about the infotypes in our documentation in SAP Help Portal under: Overtime Valuation According to FLSA Standards, choose Additional Payments Infotype (0015): Features for United States or Additional Off-Cycle Payments Infotype (0267): Features for United States . You can also find the calculation examples and how infotypes are used in the FLSA: How to Configure Overtime Pay Calculation Over Non-Discretionary Bonus video in FAQ of this blog as well as in system documentation.

Important SAP Notes:

All SAP Notes with changes related to FLSA must be applied. You can refer to the SAP One Support Launchpad to see the complete list of SAP Notes.

Prerequisites

As a prerequisite, you must have the following SAP Notes installed and their manual steps performed:

Frequently Asked Questions – FAQ

1- How to calculate FLSA using RGRTE function?

See sections 1,2 and 3 of this blog.

2- How can I make settings for FLSA calculation using the three possible processing modes?

For more information on how to configure FLSA, you can watch the following videos:

Watch this video - SAP ERP HCM US - FLSA: How to Configure Your System to Process Overtime According to FLSA Standards

Watch this video - SAP ERP HCM US - FLSA: How to Configure Overtime Pay Calculation Over Non-Discretionary Bonus

3 - How to use 0015 and 0267 infotypes for FLSA Non-discretionary bonus?

Just fill in the Reference period for payment dates in case of a Bonus payment. For more details, watch the videos linked in question 3.

4 - What's the difference between 0015 and 0267 infotypes?

Both infotypes can be used for Bonus payments. The only difference is that Infotype 0267 (Additional Off-Cycle Payments) is, in general used for specific off-cycles.

5- Is the reference period fields available only for bonus wage types or all wage types?

For all wage types. Payroll checks if the WT corresponds to bonus payment, depending on its processing class. If it does, the Reference Period for payment dates will be used.

6- Would the dates on IT0015 and 0267 be able to be done in a prior year?

Yes, as long as you have FLSA relevant wage types for that reference period. It's also necessary to have valid configuration for RGRTE during all the bonus reference period. Check how to configure it in the videos linked in FAQ - Question 3 or the Help Prdocumentation linked in section 3 - FLSA NDB adjustment rate for overtime hours (NDB).

7- When RGRTE calculates the overtime, can we assign different overtime wage types to gather the total hours of overtime, or is it reading a standard wage type?

Yes. The relevant wage types that will impact the total hours of overtime in RGRTE can be customized in the view according to customer’s needs. The overtime wage types can be considered as overtime wage types, as long as they are configured in the views with the Variable Split (V0 Split) of type ‘W’.

8- Which report was the one that will create the dates on IT0015 and 0267 at the bottom please?

When you install the SAP Notes/SP, you need to run report RPUPAV00 to create the secondary infotype entries. This is a one-time process.

9- What if the number of worked hours exceed 100 hours?

The RGRTE NDB Wage Types Reevaluation log displays the number of worked hours up to 3 digits (For example: 105.10 worked hours). See SAP Note 3061765.

10- How does the system calculate the regular rate of pay contributing with the number of hours and reevaluation at the same time?

A new wage type processing class 85 option (6 - Contributes to RR with number only, is valuated with RR) allows a wage type to contribute with the number of hours to the regular rate of pay calculation and be reevaluated at the same time. This option can be used in any RGRTE calculation.

Example:

An employee in a given week:

*Note that these are fictional wage types used to exemplify the calculation.You may have your own wage types configured, according to your business requirements.

Consider the following wage type “/WRK” configuration in view V_512W_D:

Consider the following wage type “/OVR” configuration in view V_512W_B:

Now, consider the following Adj. ID configuration in view V_T596J_US_NDB:

Considering the configuration above, in payroll, the RGRTE NDB function will be calculated as follows:

11- How is the NDB overtime pay calculated over the bonus amount only?

The NDB overtime pay is calculated over the bonus amount only, allowing different NDB overtime pay calculation formulas to be used for the same FAOH Adjustment Rate ID.

Example:

An employee in a given week:

*Note that these are fictional wage types used to exemplify the calculation.You may have your own wage types configured, according to your business requirements.

Previous behavior

In the scenario below, the non-discretionary bonus overtime premium is the difference between the original regular overtime calculated in the bonus reference period and the overtime plus the bonus amount.

Consider the following Adj. ID configuration in view V_T596J_US_FAOH:

Consider the following wage type "/WRK" configuration in view V_512W_D:

Consider the following wage type "/OVR" configuration in view V_512W_B:

Considering the configuration above, in payroll, the RGRTE FAOH function was calculated as follows:

The original overtime calculated was USD 112.50.

Now, consider the following Adj. ID configuration in view V_T596J_US_NDB:

Considering the configuration above, in payroll, the RGRTE NDB function will be calculated as follows:The configuration for /WRK in view V_512W_D and /OVR in view V_512W_B remains the same.

The RGRTE NDB overtime will be the original overtime (FAOH), plus the bonus amount.

The function output is the difference between the original overtime (FAOH) and the original overtime, plus bonus amount, as calculated above.

New behavior

After SAP Note 3061765, the non-discretionary bonus overtime is calculated over the bonus amount only.

Now, consider the following Adj. ID configuration in view V_T596J_US_NDB:

Considering the configuration above, in payroll, the RGRTE NDB function will be calculated as follows:The configuration for /WRK in view V_512W_D and /OVR in view V_512W_B remains the same.

The new behavior allows the NDB overtime premium to be calculated for two different formulas for the same original overtime.

12- How can I configure NDB overtime premium calculation for employees with different requirements?

For users who rely on a screen reader, the screenshot shows the payroll schema where function RGRTE is called with Par1 = NDB.

For users who rely on a screen reader, the screenshot shows the payroll schema where function RGRTE is set with the Adjustment Rate ID in Par2 (example RRAB)

Note: If no Adjustment Rate ID is set in Par2, all the Adjusment Rate IDs configured in view V_T596J_US_NDB will be used in the calculation.

Example:

Employee A: from Work Area 1

Employee B: from Work Area 2

For example, Adjustment Rate ID for Work Area 1, configured as follows in view V_T596J_US_NDB, uses 43 worked hours in the regular rate of pay calculation:

In payroll, the RGRTE NDB function for adjustment ID for Work Area 1 is calculated as follows:

And Adjustment Rate ID for Work Area 2, configured as follows in view V_T596J_US_NDB, uses the 40 regular worked hours in the regular rate of pay calculation:

In payroll, the RGRTE NDB function for adjustment ID for Work area 2 is calculated as follows:

The payroll schema must be configured to indicate whether the RGRTE NDB must use all worked hours or the regular worked hours in the regular rate of pay by choosing one Adjustment Rate ID or another.

13- 'The NDB overtime will be calculated over the bonus amount only.' and 'For Adjustment ID ****, the following wage types will not contribute with amount:' messages:

These messages may appear in the payroll log. The RGRTE NDB payroll function log can display all wage types which were configured to contribute with the amount but are not considered in the regular rate of pay calculation.

14- How does RGRTE funcion handle the NDB overtime premium when the bonus reference dates are inside my current pay period?

Before SAP Note 3104785, that bonus overtime premium would be calculated only in the next payroll period.

After SAP Note 3104785, that bonus overtime premium is calculated in the current payroll period.For this scenario, since there is no payroll results saved in the cluster yet for the current payroll period, the wage types and amounts that will be used in the calculation are the ones present in payroll tables RT and IT at the time the function is called in the payroll schema.

We want this content to be available and helpful to all users. So, please share it with your peers that don’t know this yet!

Did you enjoy this blog post? Choose “Like” and share the content with your colleagues.

Feel free to leave your feedback, comments or questions in the space provided below. And don’t forget to follow the tag HCM Payroll USA in SAP Community to stay tuned on the Payroll USA blogs.

You can also leave questions in our Q&A platform https://answers.sap.com/index.html

All the best, and happy reading!

Virginia Soares

User Assistance Developer

February 16, 2022 - The following SAP Note has been released:

3104785 - FLSA: NDB overtime premium not calculated when bonus reference dates are inside the curren...

FAQ section has been updated (14 question added)

February 15, 2022 - The following SAP Notes have been released:

3055390 - FLSA: option to choose Adjustment Rate ID used in the NDB calculation

3061765 - FLSA: New processing class 85 option 6 and changes to non-discretionary bonus overtime cal...

FAQ section has been updated (9-13 questions added)

April 1st, 2021 – The following SAP Notes have been released:

- 2993226 - FLSA: Issue in bonus log if periods without overtime exist

- 3026139 - FLSA: Incorrect amounts when RGRTE FAOH has multiple configs with non-default currency

- 3026672 - FLSA:Incorrect rate and amount when using RGRTE NDB with non-default currency

The FLSA (Fair Labor Standards Act) is the law regulating minimum wage, overtime pay, equal pay for equal work, child labor, and record keeping. It applies to all non-exempt employees, from the public and private sectors.

According to the FLSA standards, employers must pay the employee covered by the Act overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay (unless they are exempt).

To comply with this legal change, SAP has delivered updates to address to relevant technical changes to prepare for the following requisites:

- Separation of bonus and regular rate of pay for overtime adjustments.

- Overtime pay calculation over non-discretionary bonus.

What you need to know about the FLSA?

For more information on the legal change specifications, visit https://www.dol.gov/agencies/whd/flsa.

What you need to know about the FLSA in SAP system?

1 – Standard Calculation

- In the standard system, the FLSA overtime is calculated by payroll function Regular Rate of Pay (FLSA Overtime Valuation) (RGRTE). The RGRTE function enables the overtime calculation when schema UT00 is updated according to FLSA regulations. Learn how to make the required calculation settings in Help Portal.

For users who rely on a screen reader, the two screenshots show the schema UT00 configured with FLSA and UTR0 where function RGRTE is called with FAOH in Par1

The system uses processing class 85 of the wage types to calculate a single Regular Rate of Pay (stored in wage type /R00), which represents the hourly rate of pay of the employee in the given week. Depending on the value assigned to the processing class 85, the wage type contributes with the amount and hours to wage type /R00. Then, the system uses /R00 to reevaluate the relevant wage types, also based on the value assigned to processing class 85.

According to the values set in processing class 85 (see below), RGRTE determines the so-called 'Regular Rate of Pay' for each work week, and valuates the relevant wage types with this rate.

Processing class 85 values are:

0 = No influence from or to Regular Rate (RR)

1 = Contributes to RR with number and amount, not valuated with RR

2 = Contributes to RR with amount only, not valuated with RR

3 = Contributes to RR with number and amount, is valuated with RR

4 = Contributes to RR with amount only, is valuated with RR

5 = Does not contribute to RR, is valuated with RR

- In transaction SPRO go to Payroll USA Fair > Labor Standards Act (FLSA) and execute its activities. For more information, such as dependencies and examples, refer to the documentation of the Customizing activities in your system.

For users who rely on a screen reader, the screenshot shows the Payroll USA, under Fair Labor Standards Act (FLSA) node structure in SPRO transaction

Wage types configuration

To have valid wage types for overtime and non-discretionary bonus calculation in the function Regular Rate of Pay (FLSA Overtime Valuation) (RGRTE), you need to ensure the following wage type configuration:

Standard calculation:

- Wage types with processing class 85 configurated to contribute with amount, number and be evaluated.

- Wage types with a variable split (V0 split) of type W in V0 table.

- Both only in the current period.

FAOH:

- Wage types configurated in view V_T596J_US_FAOH to contribute with amount, hours, be reevaluated and an output wage type.

- Wage types with a variable split (V0 split) of type W in V0 table.

- Both only in the current period.

NDB:

- Wage types configurated in view V_T596J_US_NDB to contribute with amount, hours, be reevaluated and an output wage type.

- Wage types with a variable split (V0 split) of type W in V0 table.

- Both for all the non-discretionary bonus reference dates.

2 – FLSA adjustment rate for overtime hours (FAOH)

You can use this processing mode for payroll function RGRTE. When Subapplication FAOH - FLSA adjustment of overtime hours is activated, the system allows you to create and use multiple adjustments rates instead of only /R00. The processing enables you to configure a set of wage types that will be used to calculate an adjustment rate using adjustment IDs. For example, you can have an adjustment rate considering only regular and overtime payments, while having another one considering only bonus and overtime payments. These IDs consist of a grouping of wage types that will work together during the FLSA overtime calculation.

By default, SAP delivers the following Adjustment Rate IDs:

- RRAB - Regular Rate with aggregated bonus method

- RRSB - Regular Rate with separated bonus method

- BRSB - Bonus Rate with separated bonus method

After selecting the adjustment rate ID you want to adjust, enter the wage types relevant for the processing of the adjustment and select how they are going to contribute to the adjustment rate. The possible values are:

- Determined by Processing Class 85: when this option is selected, the system will use the value configured in processing class 85 of the chosen wage type.

- Contributes with Amount: when this option is selected, the wage type will contribute with the adjustment rate with the amount, ignoring the hours

- Contributes with Hours: when this option is selected, the wage type will contribute with the adjustment rate with the hours, ignoring the amount

- Output Only (Does Not Contribute): when this option is selected, the wage type will not participate in the rate calculation. However, the total amount and total hours used in the calculation will be stored in this wage type. You can only have one output wage type per adjustment rate ID.

- Reevaluation Only (Does Not Contribute): when this option is selected, the wage type will not participate in the rate calculation. However, the calculate rate will be used to reevaluate this wage type.

3 – FLSA NDB adjustment rate for overtime hours (NDB)

The payroll function RGRTE has three processing modes. One of them is Adjusting the regular rate according to non-discretionary bonus, which is a function call with the parameter NDB (FLSA NDB adjustment rates for overtime hours). This function calculates the difference between the originally calculated FLSA overtime and the FLSA overtime calculated with the non-discretionary bonus.

In order to do that you just have to go through the following steps:

- Activate the non-discretionary bonus processing in schema UAP0.

- Maintain overtime adjustment using non-discretionary bonus processing.

- Activate the Sub application NDB and enter the start and end dates for which you want the new processing to take effect. You do this in table view V_T596D.

After enabling the processing with non-discretionary bonus, you can enter the bonus in infotypes Additional Payments (0015) and Additional Off-Cycle Payments (0267). When entering the bonus, you also enter the bonus reference period. You can learn more about how to set up your system correctly in Help Portal .

PA30 – Additional Payments (0015) and Additional Off-Cycle Payments (0267) infotypes

When editing Additional Payments (0015) and Additional Off-Cycle Payments (0267) infotypes for an employee, you must enter the amount of the bonus payment with the start and end dates defined in the Reference Period for Payment group box.

In Additional Payments (0015) infotype, you enter a non-discretionary bonus related to work done and usually is paid in the next payroll run.

For users who rely on a screen reader, the screenshot shows the Additional Payments (0015) infotype screen

In Additional Off-Cycle Payments (0267) infotype, you enter an off-cycle payment that is related to a bonus, but different from infotype 0015, you can run an off-cycle payroll on any day.

For users who rely on a screen reader, the screenshot shows the Additional Off-Cycle Payments (0267) infotype screen

The data you enter in both infotypes is read by payroll function RGRTE, when called with parameter NDB.

You can learn more about the infotypes in our documentation in SAP Help Portal under: Overtime Valuation According to FLSA Standards, choose Additional Payments Infotype (0015): Features for United States or Additional Off-Cycle Payments Infotype (0267): Features for United States . You can also find the calculation examples and how infotypes are used in the FLSA: How to Configure Overtime Pay Calculation Over Non-Discretionary Bonus video in FAQ of this blog as well as in system documentation.

Important SAP Notes:

All SAP Notes with changes related to FLSA must be applied. You can refer to the SAP One Support Launchpad to see the complete list of SAP Notes.

- 2929225 - FLSA: Overtime Pay Calculation Over Non-Discretionary Bonus (Payroll changes)

Prerequisites

As a prerequisite, you must have the following SAP Notes installed and their manual steps performed:

- 2637755 - FLSA: Separation of Bonus and Regular Rate of Pay for overtime adjustments

- 2923573 - FLSA: Overtime Pay Calculation over Non-Discretionary Bonus (Infotypes)

- 2941894 - FLSA: Prerequisite objects for SAP Note 2929225

- 2947032 - US Infotype Reader & Primary-Secondary Infotype Pairing

- 2993226 - FLSA: Issue in bonus log if periods without overtime exist

- 3026139 - FLSA: Incorrect amounts when RGRTE FAOH has multiple configs with non-default currency

- 3026672 - FLSA:Incorrect rate and amount when using RGRTE NDB with non-default currency

Frequently Asked Questions – FAQ

1- How to calculate FLSA using RGRTE function?

See sections 1,2 and 3 of this blog.

2- How can I make settings for FLSA calculation using the three possible processing modes?

For more information on how to configure FLSA, you can watch the following videos:

Watch this video - SAP ERP HCM US - FLSA: How to Configure Your System to Process Overtime According to FLSA Standards

Watch this video - SAP ERP HCM US - FLSA: How to Configure Overtime Pay Calculation Over Non-Discretionary Bonus

3 - How to use 0015 and 0267 infotypes for FLSA Non-discretionary bonus?

Just fill in the Reference period for payment dates in case of a Bonus payment. For more details, watch the videos linked in question 3.

4 - What's the difference between 0015 and 0267 infotypes?

Both infotypes can be used for Bonus payments. The only difference is that Infotype 0267 (Additional Off-Cycle Payments) is, in general used for specific off-cycles.

5- Is the reference period fields available only for bonus wage types or all wage types?

For all wage types. Payroll checks if the WT corresponds to bonus payment, depending on its processing class. If it does, the Reference Period for payment dates will be used.

6- Would the dates on IT0015 and 0267 be able to be done in a prior year?

Yes, as long as you have FLSA relevant wage types for that reference period. It's also necessary to have valid configuration for RGRTE during all the bonus reference period. Check how to configure it in the videos linked in FAQ - Question 3 or the Help Prdocumentation linked in section 3 - FLSA NDB adjustment rate for overtime hours (NDB).

7- When RGRTE calculates the overtime, can we assign different overtime wage types to gather the total hours of overtime, or is it reading a standard wage type?

Yes. The relevant wage types that will impact the total hours of overtime in RGRTE can be customized in the view according to customer’s needs. The overtime wage types can be considered as overtime wage types, as long as they are configured in the views with the Variable Split (V0 Split) of type ‘W’.

8- Which report was the one that will create the dates on IT0015 and 0267 at the bottom please?

When you install the SAP Notes/SP, you need to run report RPUPAV00 to create the secondary infotype entries. This is a one-time process.

9- What if the number of worked hours exceed 100 hours?

The RGRTE NDB Wage Types Reevaluation log displays the number of worked hours up to 3 digits (For example: 105.10 worked hours). See SAP Note 3061765.

10- How does the system calculate the regular rate of pay contributing with the number of hours and reevaluation at the same time?

A new wage type processing class 85 option (6 - Contributes to RR with number only, is valuated with RR) allows a wage type to contribute with the number of hours to the regular rate of pay calculation and be reevaluated at the same time. This option can be used in any RGRTE calculation.

Example:

An employee in a given week:

- Works 40 regular hours (Wage Type "/WRK")

- Works 3 overtime hours (Wage Type "/OVR")

- Earns a non-discretionary bonus of USD 100.00 (Wage Type "/NDB")

*Note that these are fictional wage types used to exemplify the calculation.You may have your own wage types configured, according to your business requirements.

Consider the following wage type “/WRK” configuration in view V_512W_D:

| Wage Type | Processing Class 85 Option |

| /WRK | 6 - Contributes to RR with number only, is valuated with RR |

Consider the following wage type “/OVR” configuration in view V_512W_B:

| Wage Type | Valuation basis | % Rate |

| /OVR | 01 | 150.00 |

Now, consider the following Adj. ID configuration in view V_T596J_US_NDB:

| Wage Type | Wage Type Participation on Adjustment Rate |

| /NDB | Contributes with Amount |

| /WRK | Determined by Processing Class 85 |

| /OVR | Reevaluation Only (Does Not Contribute) |

| /OUT | Output Only (Does Not Contribute) |

Considering the configuration above, in payroll, the RGRTE NDB function will be calculated as follows:

- Regular rate of pay = USD 100.00 / (40h+3h)

- Regular rate of pay = 2.33

- NDB overtime premium = 3h * 1.5 * 2.33

- NDB overtime premium = USD 10.45

- /OUT = USD 10.45

11- How is the NDB overtime pay calculated over the bonus amount only?

The NDB overtime pay is calculated over the bonus amount only, allowing different NDB overtime pay calculation formulas to be used for the same FAOH Adjustment Rate ID.

- The wage types configured in view V_T596J_US_NDB to contribute with the amount in the regular rate of pay calculation other than the bonus wage type are not considered in the calculation. Those wage types are displayed in the RGRTE NDB payroll function log.

Example:

An employee in a given week:

- Works 40 regular hours (Wage Type "/WRK")

- Works 3 overtime hours (Wage Type "/OVR")

- Earns a salary of USD 1000.00 (Wage Type "/SLR")

- Earns a non-discretionary bonus of USD 100.00 (Wage Type "/NDB")

*Note that these are fictional wage types used to exemplify the calculation.You may have your own wage types configured, according to your business requirements.

Previous behavior

In the scenario below, the non-discretionary bonus overtime premium is the difference between the original regular overtime calculated in the bonus reference period and the overtime plus the bonus amount.

Consider the following Adj. ID configuration in view V_T596J_US_FAOH:

| Wage Type | Wage Type Participation on Adjustment Rate |

| /R00 | Output Only (Does Not Contribute) |

| /SLR | Contributes with Amount |

| /WRK | Determined by Processing Class 85 |

| /OVR | Reevaluation Only (Does Not Contribute) |

Consider the following wage type "/WRK" configuration in view V_512W_D:

| Wage Type | Processing Class 85 Option |

| /WRK | 1 - Contributes to RR with number and amount, not valuated with RR |

Consider the following wage type "/OVR" configuration in view V_512W_B:

| Wage Type | Valuation basis | % Rate |

| /OVR | 01 | 150.00 |

Considering the configuration above, in payroll, the RGRTE FAOH function was calculated as follows:

- Regular rate of pay = USD 1000.00 / 40h

- Regular rate of pay = 25

- Total overtime pay = 3h * 1.5 * 25

- Total overtime pay = USD 112.50

- /OVR = USD 112.50

The original overtime calculated was USD 112.50.

Now, consider the following Adj. ID configuration in view V_T596J_US_NDB:

| Wage Type | Wage Type Participation on Adjustment Rate |

| /NDB | Contributes with Amount |

| /SLR | Contributes with Amount |

| /WRK | Determined by Processing Class 85 |

| /OVR | Reevaluation Only (Does Not Contribute) |

| /OUT | Output Only (Does Not Contribute) |

Considering the configuration above, in payroll, the RGRTE NDB function will be calculated as follows:The configuration for /WRK in view V_512W_D and /OVR in view V_512W_B remains the same.

The RGRTE NDB overtime will be the original overtime (FAOH), plus the bonus amount.

- Regular rate of pay = (USD 1000.00+USD 100.00) / 40h

- Regular rate of pay = 27.5

- Total overtime pay = 3h * 1.5 * 27.5

- Total overtime pay = USD 123.75

- /OVR = USD 123.75

The function output is the difference between the original overtime (FAOH) and the original overtime, plus bonus amount, as calculated above.

- /OUT = (FAOH original overtime + bonus amount) - FAOH original overtime

- /OUT = USD 123.75 - USD 112.50

- /OUT = USD 11.25

New behavior

After SAP Note 3061765, the non-discretionary bonus overtime is calculated over the bonus amount only.

Now, consider the following Adj. ID configuration in view V_T596J_US_NDB:

| Wage Type | Wage Type Participation on Adjustment Rate |

| /NDB | Contributes with Amount |

| /WRK | Determined by Processing Class 85 |

| /OVR | Reevaluation Only (Does Not Contribute) |

| /OUT | Output Only (Does Not Contribute) |

Considering the configuration above, in payroll, the RGRTE NDB function will be calculated as follows:The configuration for /WRK in view V_512W_D and /OVR in view V_512W_B remains the same.

- Regular rate of pay = USD 100.00 / 40h

- Regular rate of pay = 2.5

- NDB overtime premium = 3h * 1.5 * 2.5

- NDB overtime premium = USD 11.25

- /OUT = USD 11.25

The new behavior allows the NDB overtime premium to be calculated for two different formulas for the same original overtime.

12- How can I configure NDB overtime premium calculation for employees with different requirements?

- Step 1: In PE01 transaction, change your payroll schema where function RGRTE is called with Par1 = NDB.

For users who rely on a screen reader, the screenshot shows the payroll schema where function RGRTE is called with Par1 = NDB.

- Step 2: Configure schema to set the Adjustment Rate ID in Par2

For users who rely on a screen reader, the screenshot shows the payroll schema where function RGRTE is set with the Adjustment Rate ID in Par2 (example RRAB)

Note: If no Adjustment Rate ID is set in Par2, all the Adjusment Rate IDs configured in view V_T596J_US_NDB will be used in the calculation.

Example:

Employee A: from Work Area 1

- RGRTE NDB RRAB

Employee B: from Work Area 2

- RGRTE NDB STDB

For example, Adjustment Rate ID for Work Area 1, configured as follows in view V_T596J_US_NDB, uses 43 worked hours in the regular rate of pay calculation:

| Wage Type | Wage Type Participation on Adjustment Rate |

| /NDB | Contributes with Amount |

| /WRK | Determined by Processing Class 85 |

| /OVR | Determined by Processing Class 85 |

| /OUT | Output Only (Does Not Contribute) |

In payroll, the RGRTE NDB function for adjustment ID for Work Area 1 is calculated as follows:

- Regular rate of pay = USD 100.00 / (40h+3h)

- Regular rate of pay = 2.33

- NDB overtime premium = 3h * 1.5 * 2.33

- NDB overtime premium = USD 10.45

- /OUT = USD 10.45

And Adjustment Rate ID for Work Area 2, configured as follows in view V_T596J_US_NDB, uses the 40 regular worked hours in the regular rate of pay calculation:

| Wage Type | Wage Type Participation on Adjustment Rate |

| /NDB | Contributes with Amount |

| /WRK | Determined by Processing Class 85 |

| /OVR | Reevaluation Only (Does Not Contribute) |

| /OUT | Output Only (Does Not Contribute) |

In payroll, the RGRTE NDB function for adjustment ID for Work area 2 is calculated as follows:

- Regular rate of pay = USD 100.00 / 40h

- Regular rate of pay = 2.5

- NDB overtime premium = 3h * 1.5 * 2.5

- NDB overtime premium = USD 11.25

- /OUT = USD 11.25

The payroll schema must be configured to indicate whether the RGRTE NDB must use all worked hours or the regular worked hours in the regular rate of pay by choosing one Adjustment Rate ID or another.

13- 'The NDB overtime will be calculated over the bonus amount only.' and 'For Adjustment ID ****, the following wage types will not contribute with amount:' messages:

These messages may appear in the payroll log. The RGRTE NDB payroll function log can display all wage types which were configured to contribute with the amount but are not considered in the regular rate of pay calculation.

14- How does RGRTE funcion handle the NDB overtime premium when the bonus reference dates are inside my current pay period?

Before SAP Note 3104785, that bonus overtime premium would be calculated only in the next payroll period.

After SAP Note 3104785, that bonus overtime premium is calculated in the current payroll period.For this scenario, since there is no payroll results saved in the cluster yet for the current payroll period, the wage types and amounts that will be used in the calculation are the ones present in payroll tables RT and IT at the time the function is called in the payroll schema.

We want this content to be available and helpful to all users. So, please share it with your peers that don’t know this yet!

Did you enjoy this blog post? Choose “Like” and share the content with your colleagues.

Feel free to leave your feedback, comments or questions in the space provided below. And don’t forget to follow the tag HCM Payroll USA in SAP Community to stay tuned on the Payroll USA blogs.

You can also leave questions in our Q&A platform https://answers.sap.com/index.html

All the best, and happy reading!

Virginia Soares

User Assistance Developer

- SAP Managed Tags:

- SAP SuccessFactors HXM Suite,

- HCM (Human Capital Management),

- HCM Payroll USA

Labels:

10 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

23 -

Expert Insights

114 -

Expert Insights

151 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

205 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

85

Related Content

- New material type (non-valuated, no accounting view) for asset materials. in Enterprise Resource Planning Q&A

- Unplanned Delivery Cost of Purchasing in S4HANA Cloud, Public Edition in Enterprise Resource Planning Blogs by SAP

- Change material type KMAT to HALB in Enterprise Resource Planning Q&A

- Change category of unit of measure material master in Enterprise Resource Planning Q&A

- Actual Cost Component Split always active? in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 |