- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- SAP Interest Calculation Configuration

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member64

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-30-2020

10:28 AM

Interest refers to two related but very distinct concepts: either the amount a borrower pays the bank for the cost of lending or the amount an account holder receives for the favor of leaving money with the bank. In SAP, we can post interest either payable or receivable automatically using transaction code "F.52". although, some configration steps are mandatory in order to activate this transaction.

In this blog, I plan on following the process to activate the balance interest calculation. In fact, this process takes nine steps:

First of all, we've created two G/L accounts, one for the bank loan (in my example G/L account number 162100) and the other for the interest paid (in my example G/L account number 455501) using transaction FS00.

Next, we've created an calculation type using transaction OB46

After that, we've prepared a general conditions for interest scale using TCOD OBAA.

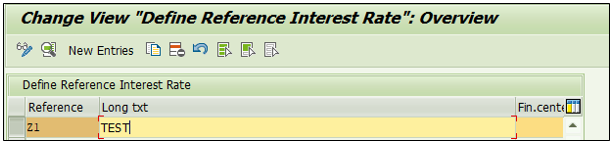

Here we've defined reference for interest rate using TCOD OBAC

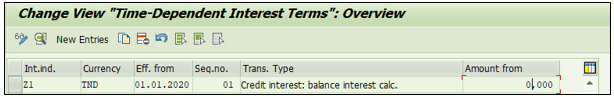

In this step, we've defined time-dependent interest terms using TCOD OB81

Next, We've used transaction OB83 to define validation date and interest rate.

We've prepared account determination using transaction OBV2.

In transaction FS00 we've assigned interest indicator to our G/L account.

Finally, We post our bank loan using transaction F-02

Now, once all the steps have been set, we can use transaction F.52 in order to calculate and post the balance interest.

So, In the selection screen of transaction F.52 we've introduced the calculation period and the posting control.

And this is the result of the interest calculation:

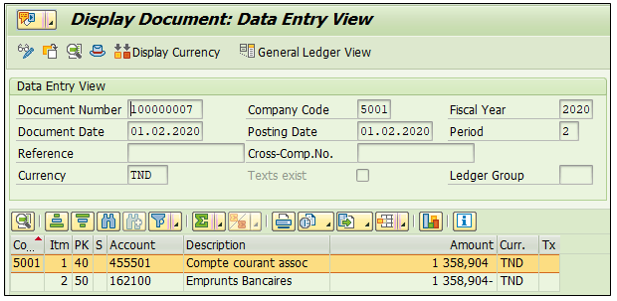

And here is the document posting automatically by SAP displayed with transaction FB03:

To sum up, in this blog, we've detailed the required setting to activate the balance interest calculation in SAP. I hope this could help you understand the balance interest calculation method in SAP.

In this blog, I plan on following the process to activate the balance interest calculation. In fact, this process takes nine steps:

- Create G/L accounts : FS00;

- Create a calculation type :OB46;

- Prepare Account Balance Interest Calculation:OBAA;

- Define reference interest rates : OBAC;

- Define time based terms : OB81;

- Enter interest values: OB83;

- Prepare G/L account balances interest calculation procedure: OBV2;

- Assign interest indicator to G/L account : FS00;

- Post a G/L document : F-02

1- Create G/L accounts

First of all, we've created two G/L accounts, one for the bank loan (in my example G/L account number 162100) and the other for the interest paid (in my example G/L account number 455501) using transaction FS00.

2- Create calculation type

Next, we've created an calculation type using transaction OB46

3- Prepare Account Balance Interest Calculation

After that, we've prepared a general conditions for interest scale using TCOD OBAA.

4- Define reference interest rates

Here we've defined reference for interest rate using TCOD OBAC

5- Define time based terms

In this step, we've defined time-dependent interest terms using TCOD OB81

6- Enter interest values

Next, We've used transaction OB83 to define validation date and interest rate.

7- Prepare G/L account balances interest calculation procedure

We've prepared account determination using transaction OBV2.

8- Assign interest indicator to G/L account

In transaction FS00 we've assigned interest indicator to our G/L account.

9- Post a G/L document

Finally, We post our bank loan using transaction F-02

10- Result of the above settings

Now, once all the steps have been set, we can use transaction F.52 in order to calculate and post the balance interest.

So, In the selection screen of transaction F.52 we've introduced the calculation period and the posting control.

And this is the result of the interest calculation:

And here is the document posting automatically by SAP displayed with transaction FB03:

To sum up, in this blog, we've detailed the required setting to activate the balance interest calculation in SAP. I hope this could help you understand the balance interest calculation method in SAP.

- SAP Managed Tags:

- FIN (Finance)

2 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- FAQ on Upgrading SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Purchase Ordre Accrual in S/4HANA - Part 1 in Enterprise Resource Planning Blogs by Members

- Asset Management in SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release in Enterprise Resource Planning Blogs by SAP

- Advanced WIP reporting in S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Review and Adapt Business Roles after a Major Upgrade in the SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |