- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- SAP S/4HANA Sales: Invoicing, Taxes and Inventory ...

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

fmroque10

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-28-2020

6:34 AM

This blog post explains the Sales process, the inverse operation of the Purchase Order. The purchase steps in SAP S/4 is explained in this blog post.

SAP S/4HANA Procurement process with Financial Accounting Journal Entries

https://blogs.sap.com/2020/10/23/sap-s-4hana-procurement-process-with-financial-accounting-journal-e...

https://blogs.sap.com/2020/10/23/sap-s-4hana-procurement-process-with-financial-accounting-journal-e...

You will review that the Journal entries are opposite in the Purchase and the Sales. The Purchase increases the Inventory value by entering new goods and creating new obligations to pay. Sales increment our active creating payments in our positive balance. Also downs the inventory with the exit of products for sales.

The difference between the taxes of Purchases and Sales is the amount of money that we have to pay for the Taxes Government Office.

The accounts payable to Vendors creates two journal transactions to reflect the exit of money from the bank account to the vendor account we owe money. Backward is when we receive a payment from a Client. The Bank account increases with the client's payment.

When we exit the products from the warehouse to deliver the order to the client, SAP S/4 creates two accounting journal entries with the cost of the products. This cost depends on the revalorization method chosen for our products (FIFO/LIFO or Average). You can read about the Materials and Actual costing in this article:

Material Ledgers/ Actual Costing

SAP S/4HANA is an Enterprise Resource Planning (ERP) that covers the processes involved in company operation. For a general introduction to Finance needed for SAP S/4 ERP, you can review the free content in this course on Udemy:

SAP S4-HANA ERP: Purchases, Inventories, Sales, Accounting

https://www.udemy.com/course/sap-s4-hana-erp-purchases-inventories-salesaccounting/?referralCode=109...

Before we can create a sales order to deliver the products to the client, we have to allocate the number of units for sale in the warehouse by using the Manage Stock option. Here we will allocate 10 units of product TG11 Led Light set. See figure 1.

Figure 1. Allocate 10 units of product TG11 Led Light set.

Then we create a Sales Order using the Create Sales Order Fast Entry option. Enter the Sold to Party (Client number) ID 17100001, Silverstar Corp. On the detail enter Led Light product id TG11. The quantity order is ten units.

Figure 2. Create a Sales Order using the Create Sales Order Fast Entry option

To deliver the products to the client, create an Outbound Delivery Order in Create Outbound delivery from the Sales Order option.

Figure 3. Create an Outbound Delivery Order

The outbound delivery creates a GI document to transport the products to the client's location. Click on the Pick outbound delivery option to take out the products from the warehouse.

Figure 4. Pick an outbound delivery option

The Pick outbound delivery creates two journal entries to record the warehouse exit movement of the products.

Figure 5. Debit and Credit Journals after Pick Outbound Deliveries.

In the credit column of the Inventory Trading good account, SAP S/4 records the cost of the products. This cost is the revaluated value after each Purchase Order. The revaluation depends on the chosen method:

-First In-First Out (FIFO)

-Last In-First Out

-Average

To balance the transaction, S4 records the cost of the product on the debit column of the Inventory Constptn Trade Goods account. Ten units of LED lights at 1.3 for an amount of 130.00.

Note the difference between the cost of the Led lights in this account which is 1.30 per unit, with the sale price of 1.70. This difference is the gross revenue of this product.

The next step is to create the Billing Documents in the Sales menu.

At this point we have the Sales process of the ten Led Light set to 17100001, Silverstar Corp in the process steps described in Figure x.

-Allocate the products in the Warehouse.

-Order Processing.

-Delivery. Creates two journal entries to reflect the exit of products at the cost of the goods calculated by Inventory revaluation.

-Create the Billing Documents. Up the Invoice to the client. This step creates three main journal entries: Account Receivable(including tax) in the Debit column, Products accounts without taxes in Credit columns, and taxes in the Credit column to balance the transaction.

Figure 6. Create the Billing Documents or Invoicing.

The creation of Billing documents or Invoicing generates six entries in the accounting journal. The invoice is for 10 Led Light Set for a Total without tax of 175.50.

Figure 7. Invoicing generates six entries in the accounting journal.

The first entry is in the Debit column of the Account Receivables of the total invoiced including taxes of 191.12.

The second entry is the Total without taxes in the Credit column. The amount is 175.50.

The third entry is a collection of taxes in the Credit column that sums a total of

15.62.

With these entries the transaction is balanced.

To receive the payment from clients, go to Post Incoming Payments in Accounts Receivable menu options.

Figure 8. Post Incoming Payments in Accounts Receivable menu

After filling the input data including the Client ID that will do the payment and our Bank account that will receive the funds, SAP S/4 presents us with a list of Accounts receivable.

Click CLEAR on the account that will receive the payment.

The payment amount is 100.

Input this amount in the G/L account option. Enter the same 100 amount in the Allocated option.

The balance of the transaction must be ZERO to operate the payment.

Figure 9. Payment from the client.

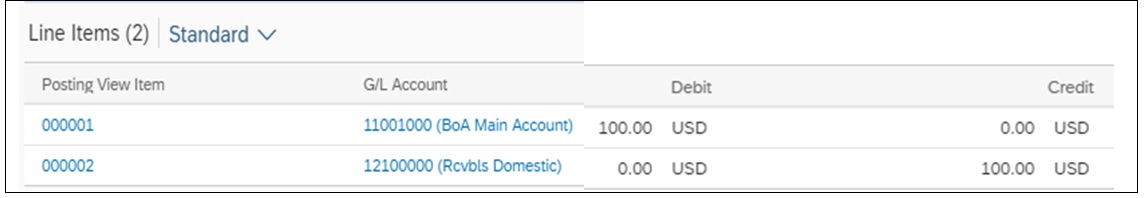

After reviewing and posting the payment, see the two accounting journal entries. The Bank account has 100 in the debit and the Receivables account has the same amount of 100 in the credit column.

Figure 10 Payment from client journals.

Account Receivable updates the balance.

Figure 10. Account receivable lows the balance after the payment of 100.00.

The Sales Process in SAP S/4 imposes a strict order to control products and cash flow. From the beginning is necessary to allocate the number of units to create the Sales Order. The delivery to the client of the products saves in the Accounting journals the exit of the products from the warehouse. The invoicing account journals save the account receivables. The payments from clients keep tracking of the debt and the bank account that received the payment.

- SAP Managed Tags:

- SAP S/4HANA,

- SAP Ariba Central Procurement

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- New material type (non-valuated, no accounting view) for asset materials. in Enterprise Resource Planning Q&A

- Unplanned Delivery Cost of Purchasing in S4HANA Cloud, Public Edition in Enterprise Resource Planning Blogs by SAP

- How to Create Outbound Delivery With order reference in SAP VL01N in Enterprise Resource Planning Blogs by Members

- Creation of Outbound Delivery using VL01N in SAP in Enterprise Resource Planning Q&A

- Inventory Split Valuation in Enterprise Resource Planning Blogs by Members

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |