- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Results Analysis using Method 14 Derive Cost of S...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

vinodasharma

Discoverer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-27-2020

12:58 PM

Introduction

In my 20 + years of working with SAP customers in the service industry , I have seen multiple instances of the customers settling for a solution to match costs and revenues at month-end that is based on a forecast or estimates despite SAP offering more sophisticated functionality to address the requirement accurately. This is primarily due to in-adequate understanding or the additional integration effort or both needed to pull together a solution based on advanced Results Analysis methods. This is what led me to put this blog together, basically to create more awareness in the SAP consulting community about the what/how/when of the more advanced Results Analysis techniques.

For starters, more generally the Results Analysis functionality in SAP controlling is used to valuate ongoing unfinished activities, such as production order, sales order, internal orders or projects at month end. This functionality addresses the ‘matching principle’ functionality which runs across accounting standards IAS / IFRS. And the matching principle instructs that an expense should be reported in the same period in which the corresponding revenue is earned, and is associated with accrual accounting.

There are multiple valuation methods primarily driven by the percentage of completion (PoC) metric, which is applied to either the planned cost or planned revenue or both to calculate the cost of sale (COS) or calculate revenue or both. Depending on the accounting principle to be applied at the point of closing, either reserves for unrealized costs or work in progress or the difference between the billing and revenue are posted to adjust the profit to account for matching between the costs and revenues.

The valuation Method 14 derives costs linked to the billing items in the sales order. To establish the link between the costs incurred and billing items SAP uses the dynamic insertion profile (DIP) functionality. In the DIP profile the costs are linked to the service materials via cost elements.

The RA key for Valuation Method 14 is linked to the DIP profile that is used to define the cost roll-up into the service materials that is billed to the customer.

How to configure the functionality

In this case we link the DIP profile to a Sales Order type

The characteristics section is the most important part of the DIP profile. Here, you set up which characteristics are used and how they are used.

Generally, the system distinguishes between two types of characteristics:

I have setup one characteristic relevant for the DIP profile,

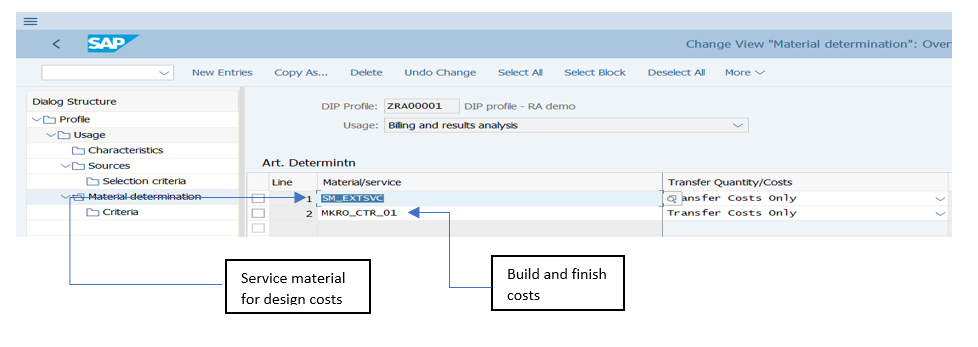

There are two cost elements one for design costs mapped to a service material and another cost element for build costs mapped to the other service material, these components will be elaborated in the example below.

the different business processes. I have selected actual costs

finding the materials are specified in this part of the profile.

profile

There are other steps in the setup of the DIP profile that relate now to quotation and pricing that I have skipped to focus on the elements that impact the RA calculation.

The typical steps to setup the RA KEY for valuation method 14 are same as other RA Keys,

A Typical requirement that can be addressed by the RA Valuation Method 14

In our example, we have a project for two months, in month 1 the design is planned for completion and billing. Part of the build cost is incurred in month 1 but not billed. In month 2 the build is completed and billed.

At the end of month 1 cost incurred for design is considered as COS and build costs incurred is WIP. At the of month two all costs are considered as COS since the entire project has been billed to the customer.

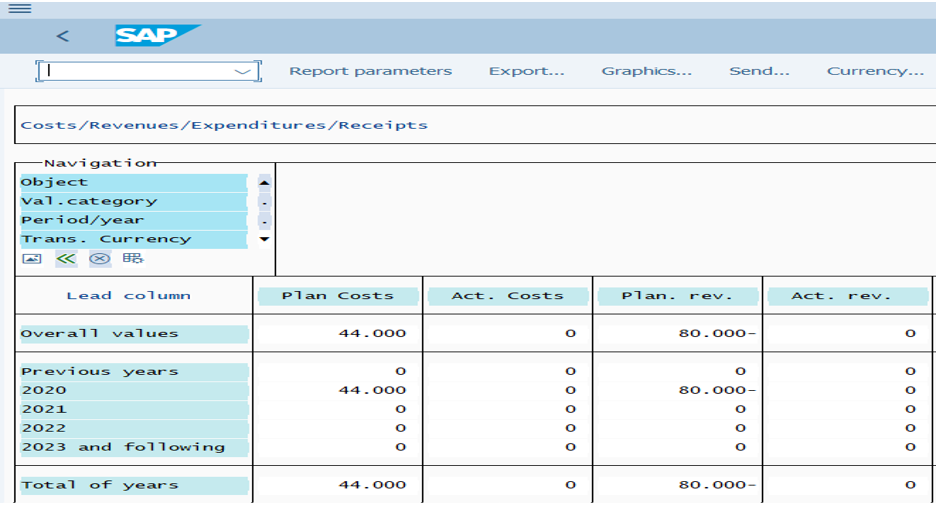

Revenue and cost planning at the start of the project in SAP

We created Sales Orders which are assigned to the DIP profile and account assigned

to the billing WBS element.

Costs for month 9 charged to the design and build & finish GLs

Design services billed via resource related billing

The status of the project after incurring design costs of EUR 5400 and build costs of EUR 2000. Further as design work is billed out to the customer

RA is run individually for each of the billing elements

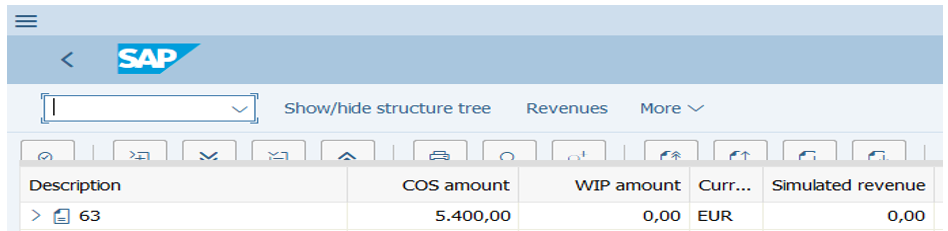

RA120_REV_POC1 – design work

Cost Eur 5400 incurred on account of design work, which is billed is the calculated COS in this method

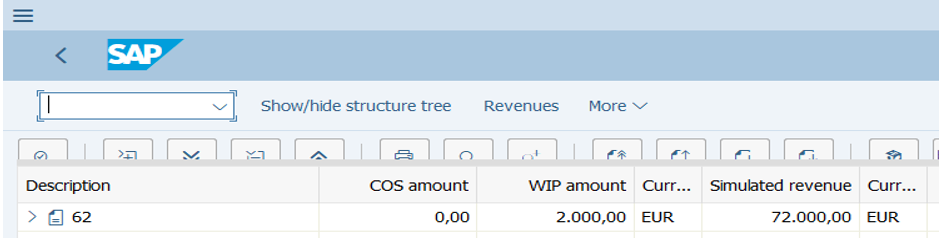

RA120_REV_POC2 – build work

The amount spent in month 9 on the build work after the close of the design has not been billed to the customer in that month hence is WIP for month 9.

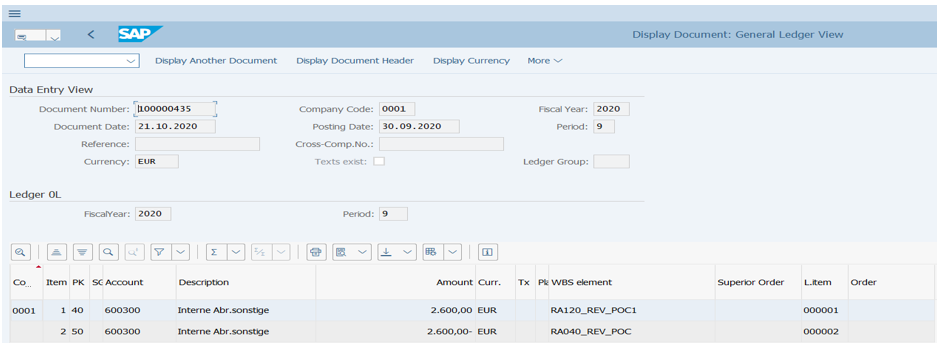

Accounting entry posted after the settlement transaction is run.

Settlement entry on WBS RA120_REV_POC1, on which design costs are incurred and billed to the customer, there is no WIP or COS entry as the cost and revenue are booked to the WBS. Profit is recorded on a dummy WBS as CO-PA is not setup in this system .

Settlement entry on WBS RA120_REV_POC2, on which execution costs are incurred but not billed to the customer. The cost incurred on this billing element is considered as WIP .

Conclusion

The RA method 14 based on Cost of Sales from Resource-Related Billing of Dynamic Items is one of the more advanced RA methods used to address the principle of matching between costs and revenue. The calculated Cost of Sales is not an estimate as in other methods but the sum of actual costs that link back to billed activities. However, this method has integration points with other modules that need to be addressed such as DIP profile setup which drives the linkage between costs incurred and the amounts billed, that needs careful consideration and testing for the Results Analysis calculation and posting to work as expected.

In my upcoming series on advances technique in Results Analysis I will discuss Valuation Methods 15; Derive Revenue from Resource-Related Billing and Simulation of Dynamic Items; and 7; POC Method on Basis of Project Progress Value Determination. Stay tuned !

Btw - In case you have questions please post them here in Q&A.

In my 20 + years of working with SAP customers in the service industry , I have seen multiple instances of the customers settling for a solution to match costs and revenues at month-end that is based on a forecast or estimates despite SAP offering more sophisticated functionality to address the requirement accurately. This is primarily due to in-adequate understanding or the additional integration effort or both needed to pull together a solution based on advanced Results Analysis methods. This is what led me to put this blog together, basically to create more awareness in the SAP consulting community about the what/how/when of the more advanced Results Analysis techniques.

For starters, more generally the Results Analysis functionality in SAP controlling is used to valuate ongoing unfinished activities, such as production order, sales order, internal orders or projects at month end. This functionality addresses the ‘matching principle’ functionality which runs across accounting standards IAS / IFRS. And the matching principle instructs that an expense should be reported in the same period in which the corresponding revenue is earned, and is associated with accrual accounting.

There are multiple valuation methods primarily driven by the percentage of completion (PoC) metric, which is applied to either the planned cost or planned revenue or both to calculate the cost of sale (COS) or calculate revenue or both. Depending on the accounting principle to be applied at the point of closing, either reserves for unrealized costs or work in progress or the difference between the billing and revenue are posted to adjust the profit to account for matching between the costs and revenues.

The valuation Method 14 derives costs linked to the billing items in the sales order. To establish the link between the costs incurred and billing items SAP uses the dynamic insertion profile (DIP) functionality. In the DIP profile the costs are linked to the service materials via cost elements.

The RA key for Valuation Method 14 is linked to the DIP profile that is used to define the cost roll-up into the service materials that is billed to the customer.

How to configure the functionality

- Transaction ODP1 to define the DIP Profile

DIP Profile Setup

- Specify the usage , it could be either for ‘Billing and Results Analysis’ or ‘Quotation Creation’ or both of them.

In this case we link the DIP profile to a Sales Order type

DIP Profile Usage

- Define characteristics that drive the basis of cost capture

The characteristics section is the most important part of the DIP profile. Here, you set up which characteristics are used and how they are used.

Generally, the system distinguishes between two types of characteristics:

- Independent characteristics are filled directly from the source data (if the source data can provide the characteristic). Example: cost element, cost center.

- Dependent characteristics are derived from independent characteristics. For example, the object type is derived from the object number.

I have setup one characteristic relevant for the DIP profile,

Profile Characteristics

Define Cost Element

There are two cost elements one for design costs mapped to a service material and another cost element for build costs mapped to the other service material, these components will be elaborated in the example below.

- In the sources view, the source data to be processed is specified. SAP delivers nine sources for

the different business processes. I have selected actual costs

Define Source for DIP Profile

- For all dynamic items, a material has to be found to process them further. The rules for

finding the materials are specified in this part of the profile.

Material Mapping

- The cost elements identified in step # 3 are linked to the service materials setup on the DIP

profile

DIP Profile Material To Cost Element mapping

There are other steps in the setup of the DIP profile that relate now to quotation and pricing that I have skipped to focus on the elements that impact the RA calculation.

The typical steps to setup the RA KEY for valuation method 14 are same as other RA Keys,

Configuration Required

A Typical requirement that can be addressed by the RA Valuation Method 14

In our example, we have a project for two months, in month 1 the design is planned for completion and billing. Part of the build cost is incurred in month 1 but not billed. In month 2 the build is completed and billed.

At the end of month 1 cost incurred for design is considered as COS and build costs incurred is WIP. At the of month two all costs are considered as COS since the entire project has been billed to the customer.

| Posting Period | Billing Line | Cost description | Plan | Actual | Billed | ||

| Cost (Euro) | Revenue(Euro) | Cost (Euro) | Revenue (Euro) | ||||

| 9 | 1 | Design - CE 400000 | 4000 | 8000 | 5400 | 8000 | Yes - Service material # SM_EXTSVC |

| 2 | Build and Finish - CE 400001 | 40000 | 72000 | 2000 | Nil | No - Service material # MKRO_CTR_01 | |

| Total | 44000 | 80000 | 7400 | 8000 | |||

| 10 | 1 | Design - CE 400000 | 4000 | 8000 | 5400 | 8000 | Yes - billed in the previous month |

| 2 | Build and Finish - CE 400001 | 40000 | 72000 | 38500 | 75000 | Yes - Service material # MKRO_CTR_01 | |

| Total | 44000 | 80000 | 43900 | 82200 | |||

Revenue and cost planning at the start of the project in SAP

We created Sales Orders which are assigned to the DIP profile and account assigned

to the billing WBS element.

Costs for month 9 charged to the design and build & finish GLs

Design services billed via resource related billing

The status of the project after incurring design costs of EUR 5400 and build costs of EUR 2000. Further as design work is billed out to the customer

RA is run individually for each of the billing elements

RA120_REV_POC1 – design work

Cost Eur 5400 incurred on account of design work, which is billed is the calculated COS in this method

RA120_REV_POC2 – build work

The amount spent in month 9 on the build work after the close of the design has not been billed to the customer in that month hence is WIP for month 9.

Accounting entry posted after the settlement transaction is run.

Settlement entry on WBS RA120_REV_POC1, on which design costs are incurred and billed to the customer, there is no WIP or COS entry as the cost and revenue are booked to the WBS. Profit is recorded on a dummy WBS as CO-PA is not setup in this system .

Settlement entry on WBS RA120_REV_POC2, on which execution costs are incurred but not billed to the customer. The cost incurred on this billing element is considered as WIP .

Conclusion

The RA method 14 based on Cost of Sales from Resource-Related Billing of Dynamic Items is one of the more advanced RA methods used to address the principle of matching between costs and revenue. The calculated Cost of Sales is not an estimate as in other methods but the sum of actual costs that link back to billed activities. However, this method has integration points with other modules that need to be addressed such as DIP profile setup which drives the linkage between costs incurred and the amounts billed, that needs careful consideration and testing for the Results Analysis calculation and posting to work as expected.

In my upcoming series on advances technique in Results Analysis I will discuss Valuation Methods 15; Derive Revenue from Resource-Related Billing and Simulation of Dynamic Items; and 7; POC Method on Basis of Project Progress Value Determination. Stay tuned !

Btw - In case you have questions please post them here in Q&A.

- SAP Managed Tags:

- FIN Cost Object Controlling

Labels:

3 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

23 -

Expert Insights

114 -

Expert Insights

151 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,686 -

Product Updates

205 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

85

Related Content

- Futuristic Aerospace or Defense BTP Data Mesh Layer using Collibra, Next Labs ABAC/DAM, IAG and GRC in Enterprise Resource Planning Blogs by Members

- Service with Advanced Execution and Resource-related Billing in Enterprise Resource Planning Blogs by SAP

- An introduction into Service Management in S/4HANA Cloud Private Edition in Enterprise Resource Planning Blogs by SAP

- Higher Education & Research in S/4HANA Cloud Public Edition 2402 in Enterprise Resource Planning Blogs by SAP

- Artificial Intelligence and Technologies in SAP S/4HANA Cloud Public Edition 2402 in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 |