- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Highlights on SAP Cash & TRM innovations (from TAC...

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

ignacio_kristof

Active Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-14-2020

4:53 AM

Hi everyone!

This blog is to bring some information and insights based on the SAP Treasury event that happened las week from 6-Octo to 8-Oct , organized by TA Cook , SAP and several sponsors . The event of course was virtual, but was really easy to follow. Very well organized.

There were several sessions, presenting cases hosted by sponsors and customers, most of them interesting to see how solutions are applied and good description of the solutions.

As disclaimer, I am commenting or summarizing mostly what was presented by SAP, specially by Haresh Chhaya and Dr. Arif Esa. All screenshots are from presentations hosted at the meeting and also I am highlighting what in my opinion are the most relevant features, but there were other things showed in the event.

First, as reminder, let´s start with the broad picture of SAP Treasury Workstation and the integration scenarios map:

As summary of the innovations, the following slide was presented:

Below, I divided the updates that I considered relevant under the different areas:

1.FIORI LAUNCHPAD

Some features were highlighted for FIORI launchpad, being SAP Copilot, as “intelligent assistant” the most interesting feature.

This functionallity, in theory, allows to ask “questions” like "What is my Cash Position", or "What is the bank account balance for account XXXXXXX?" Sounds really cool, I would like to see it working before getting excited about it.

2.HIGHLIGHTS FROM CASH MANAGEMENT SESSIONS

I took most of this information from a session leaded by Haresh Chhanya.

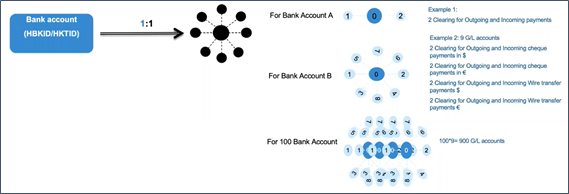

2.1 Bank Account Ledger

This is the most relevant update from my point of view. This seems to be a huge change from what we are doing now, despite it is not mandatory (or I understood that is not mandatory).

Today we are used to manage 1 House Bank – Account ID à 1 Cash GL Account + Multiple Clearing Accounts. Different clearing accounts are used for different incoming and outgoing type of transactions:

This can result in literally thousands of GL Accounts (imagine a multinational company with 600 bank accounts around the world)

SAP is introducing a change to this approach, which is to assign multiple bank accounts to 1 set of GL Accounts.

Impacts:

After using many years the classic solution it is a bit hard for me to disconnect the direct relationship between this two objects, because I guess that at some point you will want to check if your GL Account matches the balance shown by Cash Management. I guess that since in S/4HANA we now have the House Bank and Account ID as part of BSEG, you could use those fields to filter the transactions for one GL Account with many bank accounts.

2.2 Generate Trade Requests from Cash Flow Analyzer.

This feature, allows to generate a trading requests from Cash Flow Analyzer. Check point 3.3 below

2.3 Bank Relationship Overview

This was new to me, I had not seen it before. This shows a consolidated view of bank accounts information, as you can see below. It looks good, always this type of applications with summarized information are nice to have And from this key figures, you can navigate to detail.

Something similar, but with more complete information was added to SAC Treasury Executive Dashboard in what it was called “360 degree review on bank relationships”. Check the SAP Analytics Cloud view.

2.4 Payment Centralization Approach

Haresh described an approach to centralize payment operations, and you could use Central Finance or not to follow this approach. If you use CFIN , all the different applications work on top of Central Finance. The complete approach with all components is built by:

The picture below , graphics the full approach but you can use some of them or combine them. For example you are not interested in Advanced Payment Management, but you want to stablish a payment factory so you implement In House Cash. The base requirement for all of it is to have S/4 Cash Management solution.

1.4 Crisis response panel

Something I really liked that Haresh showed during his presentation, was a custom applications group he built in his FIORI Launchpad and called "Crisis Response Panel" with the most relevant FIORI apps to monitor Cash and Working Capital.

I think that this is good to show in a practical example what you can do with FIORI, that allows to create your custom group of applications and this combined with the KPI apps or "alert" apps can be a powerfull tool.

3.HIGHLIGHTS FROM TREASURY AND RISK MANAGEMENT SESSION

3.1 Legislation Coverage support --> Regulations for IBOR transition to RFR

As brief background, specially for consultants not aware, LIBOR will be discontinued as benchmark by the end of 2021 due to several concerns that questions LIBOR as a valid reference.

LIBOR Rates must be replaced by Risk-Free-Rates. Picture below shows the replacement rates for main currencies

This, of course, has impacts for Treasury activity:

Few links below

https://blogs.deloitte.ch/banking/2018/10/ibor-the-journey-ahead.html

https://www.lexology.com/library/detail.aspx?g=35c51bd0-6280-46a7-a5b9-5e70e904297c

https://www.ingwb.com/media/3109461/ibor-faq-v2-0420.pdf

How SAP will help?

SAP TRM and SAP CML will support the new free rates initially:

New calculation types:

How the changes will be delivered?

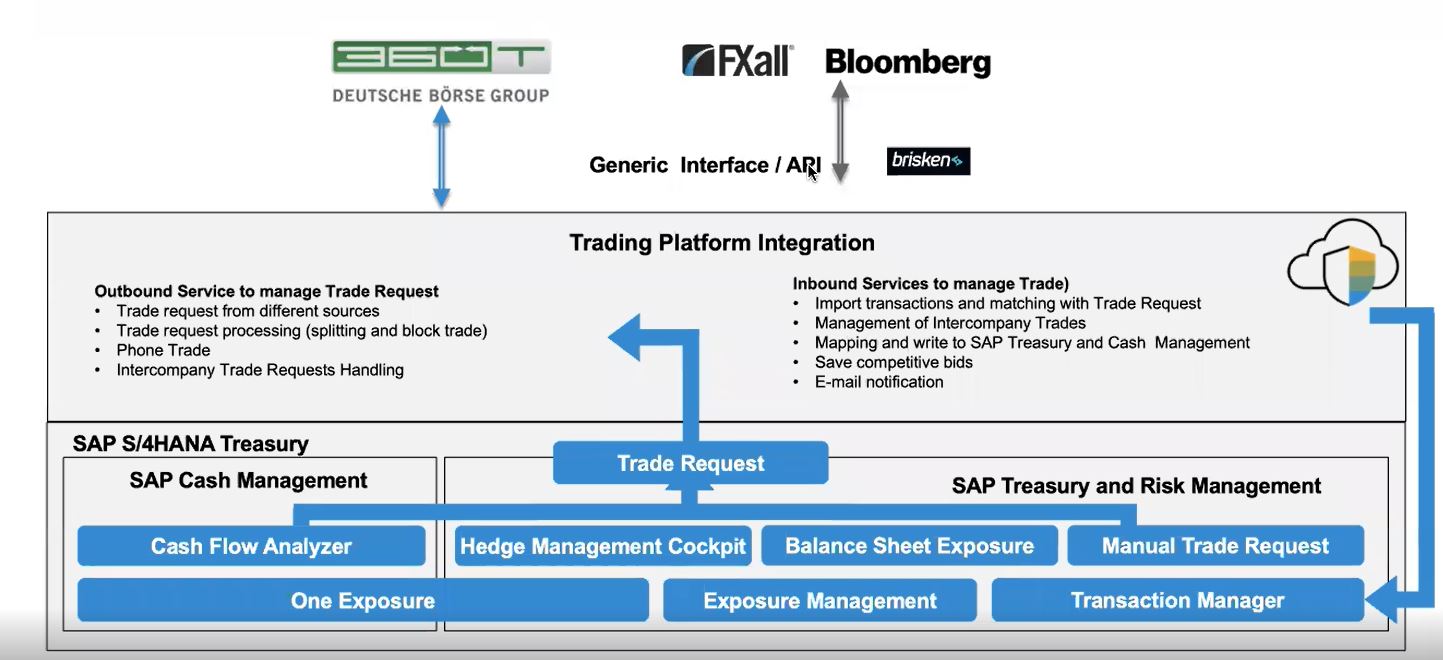

3.2 Smart Trading

3.3 Trade requests:

In the graphic below, see the different ways to initiate a trade:

4.SAP ANALYTICS CLOUD

SAC offers the Treasury Executive Dashboard that is available for users with Cash Management license

As reminder ,SAC is free if you have S/4HANA Cloud. The stories described a few lines below are delivered by standard. If you have a separate license, you can create your own views, using the different models.

I am not sure if for users with S/4HANA On Premise, buying the subscription to SAC they access the same Treasury Dashboard. I would assume that yes.

The Treasury Executive Dashboard has 8 stories relevant for our area of interest. Recently, last April 2020, key figures for market and credit risk where added. Let´s do an overview of the different tabs

To be fully honest, I was not super impressed with the visuals. I think that there is a lot room for improvement. Of course, as this comes fully ready to use if you have S/4HANA Cloud, they are good features to have really. Today in SAP Business Suite or even S/4HANA you need a lot of work to have something like this, so over all it is good to have it ready for using.

Below there is a chart with different models available to create your own dashboards if you have a SAP Analytis Cloud License

Another very interesting session was hosted by Nicole Baranov, to give an overview on how SAC can bring innovation to Working Capital Management, specially focused in receivables management. We know how critical is receivables for working capital.

Of course that most of these functionality require Collection Management, Dispute Management , credit Management implemented (S/4HANA brings some KPI or specific apps for Receivables Managers but for using most of features on SAC , Collection Mgmt is required).

5.Roadmap

To close this, I would like to refresh the link to the roadmap

Road Map Explorer

This blog is to bring some information and insights based on the SAP Treasury event that happened las week from 6-Octo to 8-Oct , organized by TA Cook , SAP and several sponsors . The event of course was virtual, but was really easy to follow. Very well organized.

There were several sessions, presenting cases hosted by sponsors and customers, most of them interesting to see how solutions are applied and good description of the solutions.

As disclaimer, I am commenting or summarizing mostly what was presented by SAP, specially by Haresh Chhaya and Dr. Arif Esa. All screenshots are from presentations hosted at the meeting and also I am highlighting what in my opinion are the most relevant features, but there were other things showed in the event.

First, as reminder, let´s start with the broad picture of SAP Treasury Workstation and the integration scenarios map:

- SAP Analytics Cloud to empower analytics

- SAP Cloud Platform for extensions and as integration layer.

- Integration with multiple systems

- Integration with SAP Multi Bank Connectivity

- Integration with External Market Data Providers

- Integration with trading platforms

As summary of the innovations, the following slide was presented:

Below, I divided the updates that I considered relevant under the different areas:

1.FIORI LAUNCHPAD

Some features were highlighted for FIORI launchpad, being SAP Copilot, as “intelligent assistant” the most interesting feature.

This functionallity, in theory, allows to ask “questions” like "What is my Cash Position", or "What is the bank account balance for account XXXXXXX?" Sounds really cool, I would like to see it working before getting excited about it.

2.HIGHLIGHTS FROM CASH MANAGEMENT SESSIONS

I took most of this information from a session leaded by Haresh Chhanya.

2.1 Bank Account Ledger

This is the most relevant update from my point of view. This seems to be a huge change from what we are doing now, despite it is not mandatory (or I understood that is not mandatory).

Today we are used to manage 1 House Bank – Account ID à 1 Cash GL Account + Multiple Clearing Accounts. Different clearing accounts are used for different incoming and outgoing type of transactions:

- Outgoing and Incoming checks

- Outgoing and Incoming Wires

- Etc

This can result in literally thousands of GL Accounts (imagine a multinational company with 600 bank accounts around the world)

SAP is introducing a change to this approach, which is to assign multiple bank accounts to 1 set of GL Accounts.

Impacts:

- This will reduce drastically the number of GL Accounts required.

- GL Account cannot longer be used as an alternate ID for GL Accounts.

- That close relationship between bank account and GL account does no longer exist.

After using many years the classic solution it is a bit hard for me to disconnect the direct relationship between this two objects, because I guess that at some point you will want to check if your GL Account matches the balance shown by Cash Management. I guess that since in S/4HANA we now have the House Bank and Account ID as part of BSEG, you could use those fields to filter the transactions for one GL Account with many bank accounts.

2.2 Generate Trade Requests from Cash Flow Analyzer.

This feature, allows to generate a trading requests from Cash Flow Analyzer. Check point 3.3 below

2.3 Bank Relationship Overview

This was new to me, I had not seen it before. This shows a consolidated view of bank accounts information, as you can see below. It looks good, always this type of applications with summarized information are nice to have And from this key figures, you can navigate to detail.

Something similar, but with more complete information was added to SAC Treasury Executive Dashboard in what it was called “360 degree review on bank relationships”. Check the SAP Analytics Cloud view.

2.4 Payment Centralization Approach

Haresh described an approach to centralize payment operations, and you could use Central Finance or not to follow this approach. If you use CFIN , all the different applications work on top of Central Finance. The complete approach with all components is built by:

- Payments through S/4Cash Management (with BCM as part of Cash Mgmt)

- Payments on Behalf, using In House Cash.

- Advanced Payment Management. 3 versions: essentials and extended in Cloud, and On-Premise. Not part of this blog to describe the differences between them.

- SAP Multibank Connectivity.

The picture below , graphics the full approach but you can use some of them or combine them. For example you are not interested in Advanced Payment Management, but you want to stablish a payment factory so you implement In House Cash. The base requirement for all of it is to have S/4 Cash Management solution.

1.4 Crisis response panel

Something I really liked that Haresh showed during his presentation, was a custom applications group he built in his FIORI Launchpad and called "Crisis Response Panel" with the most relevant FIORI apps to monitor Cash and Working Capital.

I think that this is good to show in a practical example what you can do with FIORI, that allows to create your custom group of applications and this combined with the KPI apps or "alert" apps can be a powerfull tool.

3.HIGHLIGHTS FROM TREASURY AND RISK MANAGEMENT SESSION

3.1 Legislation Coverage support --> Regulations for IBOR transition to RFR

As brief background, specially for consultants not aware, LIBOR will be discontinued as benchmark by the end of 2021 due to several concerns that questions LIBOR as a valid reference.

LIBOR Rates must be replaced by Risk-Free-Rates. Picture below shows the replacement rates for main currencies

This, of course, has impacts for Treasury activity:

- Adjustments of existing contracts.

- Adjustment for financial instruments valuations curve and hedge accounting.

Few links below

https://blogs.deloitte.ch/banking/2018/10/ibor-the-journey-ahead.html

https://www.lexology.com/library/detail.aspx?g=35c51bd0-6280-46a7-a5b9-5e70e904297c

https://www.ingwb.com/media/3109461/ibor-faq-v2-0420.pdf

How SAP will help?

SAP TRM and SAP CML will support the new free rates initially:

- Money Market Instruments

- Interest Rate Instruments

- Current-Account Style Instruments

- Bond instruments

- Interest Rates Swaps

- And more to come

New calculation types:

- Compound Interest Calculation

- Average Compound Interest Calculation

How the changes will be delivered?

- S/4HANA Cloud in release 2008

- On Premise Release in Q3 2020

- OSS Notes 2939657 (Common Basis), 2932789 (RFR in TRM), 2880124 (RFP in CML)

3.2 Smart Trading

- New Integration in SAP Trading Platform, with ICD to reflect information on short term investments coming from this platform. It is expected to be available by beginning of 2021à https://icdportal.info/

- Highlight of the integrations with trading platforms :

- Already known out of the box integration with 360T

- Integration created by Brisken (SAP Partner) for FXall.

3.3 Trade requests:

There are now several sources to initiate Trade Requests that will go through the integration with Trading Plaftform. This means that:

- You generate the trade request.

- The trade request is received by the trader and sent to the trading vendor through the trading platform integration.

- After the trading is done, the trade comes back and creates the contract in Transaction Manager.

In the graphic below, see the different ways to initiate a trade:

4.SAP ANALYTICS CLOUD

SAC offers the Treasury Executive Dashboard that is available for users with Cash Management license

As reminder ,SAC is free if you have S/4HANA Cloud. The stories described a few lines below are delivered by standard. If you have a separate license, you can create your own views, using the different models.

I am not sure if for users with S/4HANA On Premise, buying the subscription to SAC they access the same Treasury Dashboard. I would assume that yes.

The Treasury Executive Dashboard has 8 stories relevant for our area of interest. Recently, last April 2020, key figures for market and credit risk where added. Let´s do an overview of the different tabs

- Liquidity

- For Liquidity story, now you can see Liquidity by Treasury Center

- Cash Management

- You can see cash available and cash Forecast

- Bank Relationship

- You can see key information for your banks

- Bank accounts per banks

- Payment amounts

- Company codes by bank

- Funds

- Credit lines

- You can see key information for your banks

- Indebtedness

- Insights on Debt

- Counterparty Risk

- Market Risk

- Bank guarantee

- Market Overview

To be fully honest, I was not super impressed with the visuals. I think that there is a lot room for improvement. Of course, as this comes fully ready to use if you have S/4HANA Cloud, they are good features to have really. Today in SAP Business Suite or even S/4HANA you need a lot of work to have something like this, so over all it is good to have it ready for using.

Below there is a chart with different models available to create your own dashboards if you have a SAP Analytis Cloud License

Another very interesting session was hosted by Nicole Baranov, to give an overview on how SAC can bring innovation to Working Capital Management, specially focused in receivables management. We know how critical is receivables for working capital.

- Stories

- SAP Credit Management

- SAP Collections Management

- SAP Dispute Management

- SAP Analytics Cloud – BI, Planning and Predictive à Embedded in S/4HANA Cloud

- KPI

- Collaborative Enterprise Planning

- Cross busines area reporting.

Of course that most of these functionality require Collection Management, Dispute Management , credit Management implemented (S/4HANA brings some KPI or specific apps for Receivables Managers but for using most of features on SAC , Collection Mgmt is required).

5.Roadmap

To close this, I would like to refresh the link to the roadmap

Road Map Explorer

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- FAQ on Upgrading SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- SAP Enterprise Support Highlights Resources to Achieve a Clean Core in Enterprise Resource Planning Blogs by SAP

- Asset Management in SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release in Enterprise Resource Planning Blogs by SAP

- Review and Adapt Business Roles after a Major Upgrade in the SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Environment, Health and Safety in SAP S/4HANA Cloud Public Edition 2402 in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |