- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Customer Down Payment Configuration

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

goody-1

Active Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-09-2020

7:25 PM

In the R3 environment you have scenarios that require configuration in order to work properly. As you investigate S4 HANA you will find some of these activities are part of the standard set up. Customer Down Payments are an example of one of those processes.

We still have several years before R3 completely goes away so I wanted to share with you the process to update your R3 system if you are required to post a Customer Down Payment.

The SAP customer down payment process is required when advances are received from customers to fulfill sales orders before the actual sale has occurred. These customer advances are a liability for the organization which will be cleared by future sales. This blog details the steps required for the set up and processing of the SAP customer down payment process.

I have broken this into three distinct steps:

The process involves a lot of steps but you will find it all flows smoothly as you work your way through it. In the end you will have a very easy and efficient way of handling Advanced Payments from your customers.

We still have several years before R3 completely goes away so I wanted to share with you the process to update your R3 system if you are required to post a Customer Down Payment.

The SAP customer down payment process is required when advances are received from customers to fulfill sales orders before the actual sale has occurred. These customer advances are a liability for the organization which will be cleared by future sales. This blog details the steps required for the set up and processing of the SAP customer down payment process.

I have broken this into three distinct steps:

- Create an Alternative Reconciliation General Ledger(GL) Account

- Link the Alternative and Standard Reconciliation Accounts

- Then execute the SAP Customer Down Payment

- Post Advance Receipt

- Post Sales Invoice Against Advance Receipt

- Transfer Posting

- Clear Normal Items

- Advance receipts from customers need to be shown as liabilities on the balance sheet. In order to support this requirement down payments received are posted as special general ledger (G/L) transactions. An alternative reconciliation account is required to post such transactions. When a down payment is received from the customer the system updates the alternative reconciliation account instead of the standard AR reconciliation account.

- Here's how to create the new GL Account

- Account texts should be similar to "Advance from Customers"

- Account type needs to be set up as a D-Customers

- For this example acocunt 430000 will be created

- Here's how to create the new GL Account

- To facilitate the recording of the down payment as a special G/L transaction, a link must be created between the standard reconciliation account and the alternative reconciliation account. To create this link, use transaction code OBXR or use the customizing path below in transaction code SPRO:Financial Accounting – Accounts Receivables and Accounts Payable – Business Transactions – Down Payment Received – Define Reconciliation Accounts for Customer Down Payments

- On the special G/L maintenance initial screen, double click on the line with special G/L transaction indicator A – Down payment. Enter the relevant chart of accounts in the resulting pop-up screen and hit Enter.

- Now link the standard AR reconciliation account with the alternative reconciliation account number you created in the last step. In our example, 240002 is the standard reconciliation account and 430000 is the alternative reconciliation account.

- If a normal payment is received against an invoice, the standard account240002 will be leveraged. However if an advance payment is received ,then use special G/L indicator A and the system will automaticallyuse the alternative account 430000 due to this linkage.

- On the special G/L maintenance initial screen, double click on the line with special G/L transaction indicator A – Down payment. Enter the relevant chart of accounts in the resulting pop-up screen and hit Enter.

- Now that the set-up for the SAP customer down payment process has been completed, let’s walk through a demonstration. Here are the steps to be followed to execute the process:

- Post Advance Receipt

- The process begins when the advance payment is received from the customer. Post the advance receipt as an accounts receivable down payment.

- Accounting -- Financial Accounting -- Accounts Receivable -- Document Entry -- Down Payment(F-29)

- In the initial screen of transaction code F-29 enter the relevant required information and be sure to enter special G/L indicator A as highlighted below:

- After posting this Down Payment here's what you'll see in the Accounting Document

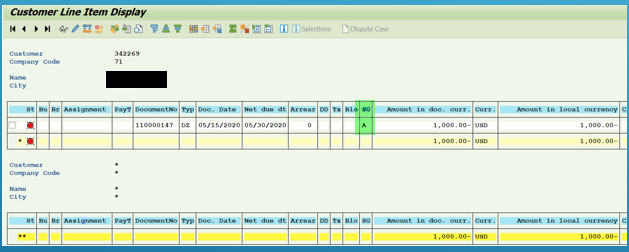

- Now let’s see the customer line item report using transaction code FBL5N. In the report selection screen, select the Open items radial button and the Special G/L transactions tickbox. Execute the report and you can see the advance receipt you just created, appearing as a credit to the customer account as shown below:

- In the initial screen of transaction code F-29 enter the relevant required information and be sure to enter special G/L indicator A as highlighted below:

- Post Sales Invoice Against Advance Receipt

- Now post the sales invoice, signifying that the goods have been delivered or the service has been rendered. This will be offset against the down payment and, if no further payment is required, cleared in the next step.

- Accounting -- Financial Accounting -- Accounts Receivable -- Document Entry -- Invoice -- General(F-22)

- Post the sales invoice for the same customer from which the advance was received in the previous step. The accounting document will look similar to the below, with a debit to the customer account and credit to the sales account:

- Again, let’s see the customer line item report using transaction code FBL5N. In the report selection screen, select the Open items radial button and both the Normal items and Special G/L transactions tickboxes. Execute the report and you can see both the invoice you just created and the advance receipt from the previous step remain as open items on the customer account:

- Post the sales invoice for the same customer from which the advance was received in the previous step. The accounting document will look similar to the below, with a debit to the customer account and credit to the sales account:

- Transfer Posting

- Next, we must transfer the advance receipt amount from the alternative reconciliation account to the standard reconciliation account. That is to say, we will move the down payment from the special G/L to the normal G/L.

- Accounting -- Financial Accounting -- Accounts Receivable -- Document Entry -- Down Payment -- Clearing(F-39)

- In the initial screen of transaction code F-39 enter the following information:

- Document and posting dates

- Company code

- Customer account

- Sales invoice number created in previous step

Click the Process down pmnts button

to see the advance payments. - Transfer Posting Initial Screen

All advance receipts for the customer account are displayed. Select those that you would like to include

- Take a look at the customer line item report using transaction code FBL5N. In the report selection screen, select the Cleared items radial button and the Special G/L transactions tickbox. Execute the report and you can see that the advance receipt document you posted in the first step is cleared by the transfer posting you just made:

- In the initial screen of transaction code F-39 enter the following information:

- Accounting -- Financial Accounting -- Accounts Receivable -- Document Entry -- Down Payment -- Clearing(F-39)

- Next, we must transfer the advance receipt amount from the alternative reconciliation account to the standard reconciliation account. That is to say, we will move the down payment from the special G/L to the normal G/L.

- Clear Normal Items

- Finally, we only need to clear the customer invoice against the normalized advance payment we transferred in the previous step.

- Accounting -- Financial Accounting -- Accounts Receivable -- Account -- Clear(F-32)

- In the initial screen of transaction code F-32 enter the customer account and company code, then click the Process open items button.

In the open items clearing screen, all open amounts remaining on the customer account will be displayed. Double click the amounts of the documents you want to clear. The amounts will be highlighted and they will net to 0.00, as demonstrated below:

- Let’s look at the customer line item report one last time via transaction code FBL5N. In the report selection screen, select the Cleared items radial button and the Normal items tickbox. Execute the report and you can see that the customer invoice you created in step two and the normalized transfer posting you made in the last step are now cleared. At this point the SAP customer down payment process is complete!

- In the initial screen of transaction code F-32 enter the customer account and company code, then click the Process open items button.

- Post Advance Receipt

The process involves a lot of steps but you will find it all flows smoothly as you work your way through it. In the end you will have a very easy and efficient way of handling Advanced Payments from your customers.

5 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Advance Return Management complete configuration(SAP ARM) in Enterprise Resource Planning Blogs by Members

- Posting Journal Entries with Tax Using SOAP Posting APIs in Enterprise Resource Planning Blogs by SAP

- Integration of SAP Service and Asset Manager(SSAM) with SAP FSM to support S/4HANA Service Processes in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Public Edition: Security Configuration APIs in Enterprise Resource Planning Blogs by SAP

- Account Balance Validation in SAP S/4HANA Cloud, Public Edition in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 6 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |