- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- SAP Central Finance 2020 (Preview)

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

nitin_gupta10

Active Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-02-2020

11:35 AM

As you are aware that from now onwards SAP has changed the release pattern of SAP S/4HANA O Premise systems. Previously it was like 1709, 1809, 1909 (YYMM) but from now onwards it will be YYYY so the upcoming release is SAP S/4HANA 2020 and next may be S/4HANA 2021.

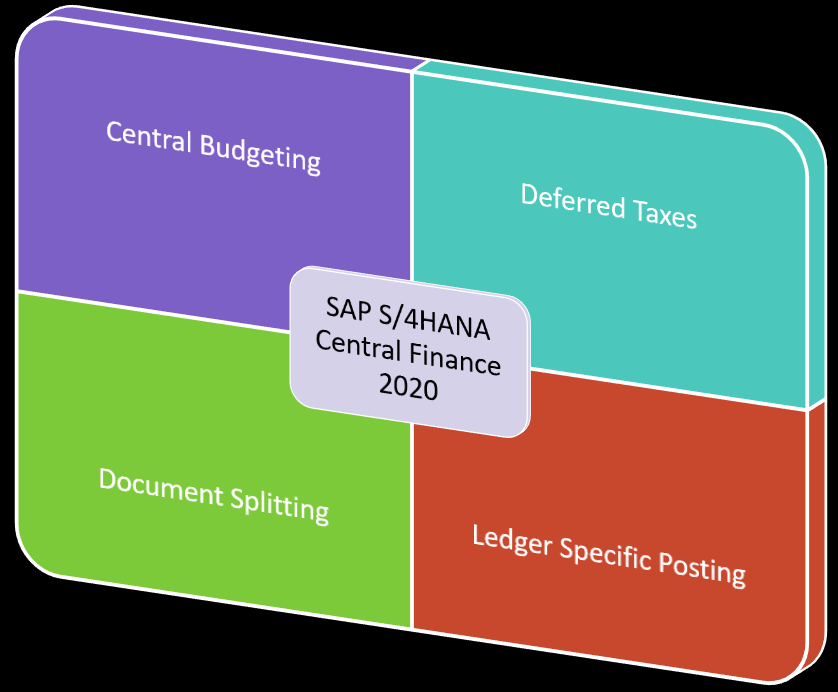

In this blog we will discuss the core features introduced in SAP Central Finance area with the upcoming release.

- Ledger Posting - Documents from the Non-SAP source system can now be posted into a predefined ledger group in S4. If any ERP is used for local accounting/reporting then the data can be replicated to S/4HANA and can post only to the allocated ledger for local reporting and no impact on leading ledger data set.

- Deferred Taxes - With Release 2020 the initial load of open items is changed for documents which involves deferred tax codes. As all open items are generally transferred without relevant tax information, the entries in the DEFTAX_ITEM table are not created correctly in the Central system. Due to this the invoices relevant for deferred taxes from the open items or balance phase are now transferred as financial postings as previously it was transferred as open items. Also a rectification/correction document is posted in the receiver system (CFIN) which ensures that the balances of all affected accounts are correct. It can be identified with the document header text DEFTAX correction document. Important to note that these correction document are not relevant for business operations. Users should not change, delete or reset such documentsAfter completion of Initial Load user need to execute the report - RFINS_CFIN_CORR_DEFTAX_ITEM. Replication of documents should not be started until the report execution is complete.

What this report do?

This report update and adjust the deferred tax data in table DEFTAX_ITEM as during initial load all the entries are not created. Additional Reports to be executed during ongoing replication

- Deferred tax toolbox RFUMSV53

- Deferred tax transfer report RFUMSV50 in test mode

Limitations

- Switching to the Central Payment Scenario will not be supported if the Initial Load has been done before implementing the new deferred tax functionality.

- Reset clearing of documents from open items or from the balance phase are not supported in central system.

- The Central Reversal with Repost functionality of Central Finance cannot handle documents relevant for deferred taxes.

- Document Splitting - No need to have document splitting in ECC source system. It can directly be done in S/4HANA system when document is replicated . So age old systems without document splitting can be easily connected to SAP S/4HANA getting the advantage of Central Finance. It will also help to implement segment or profit centre reporting without a huge data conversion exercise as it was done in any CFIN projects

- Central Budgeting (Internal Orders) – In SAP Central Finance 2020, the budget on Internal Orders can be managed centrally rather managing it in different source systems. With Central Budgeting a remote budget check from a source system to the Central Finance system will be active during the posting process. The remote budget check which runs during posting in a source system considers the Customizing settings that you made in the Central Finance system for the budget profile and the tolerance limits for the availability control

Key Features

- Central mechanism to manage internal order budgeting

- Central Reporting available for budgets in one system

- Lock concept to enforce the tolerance limits and availability control Customizing settings of a Central Finance system in a source system

- Remote budget check – Real and online via RFC

- Supports 1:1 and N:1 mapping cardinality

- Central budget can be created for mapping scenarios such as 1:1 mapping of internal orders as well as N:1 mapping from one source system to a Central Finance system.

Limitations

- Internal Orders replicated via Cost Object Mapping framework are supported

- KO22 in ECC goes into display mode

- No standard consistency check available

- Internal Order to Internal Order mapping is supported

- Remote check is via RFC. Any interruption will stop posting in ECC

Key Areas to Note

- Company Codes & Internal Order types should be listed out

- Cutover date is important to consider

- Source systems budget will not be used anymore

- A transfer report for budget created in a source system which should be transferred to the Central Finance system is not available .

- A clean-up report for budget already created in the source system is not available and after you activated the Customizing for Central Budgeting for Internal Orders,

- Transaction KO22 will only allow display as it used to allow change of budget in ECC previously.

This is just a preview and more to come as release is available.

This post will be updated

4 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Manage Supply Shortage and Excess Supply with MRP Material Coverage Apps in Enterprise Resource Planning Blogs by SAP

- Introducing the GROW with SAP, core HR add-on in Enterprise Resource Planning Blogs by SAP

- SAP Enterprise Support Academy Newsletter April 2024 in Enterprise Resource Planning Blogs by SAP

- Purchase Order Accrual in S/4HANA - Part 2 in Enterprise Resource Planning Blogs by Members

- Purchase Ordre Accrual in S/4HANA - Part 1 in Enterprise Resource Planning Blogs by Members

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |