- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Accrual Calculation for 2VB: Purchase Order Accrua...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

What kind of PO need to be accrued? – The business context and scenario

Business Context

Business Scenario

o Purchasing products that are directly used; for example, office materials.

o Purchasing of services that are received during a period of time; for example, IT consulting.

o Products that are put on stock, as no costs are associated to such purchase order items. For example, raw material that will later be used for producing other products.

o Products that represent a fixed asset, for example a laptop. Their value is posted to a balance sheet account. The costs will occur later during depreciation postings.

o Purchase orders that represent an inter-company stock transfer:

They are not related to an external supplier, so no accruals are needed.

How does PO selected for PO Accruals calculation and posting in S/4HANA Public Cloud with the pre-delivered configurations?

PO selection

By default, accruals are only posted for purchase orders that represent a purchasing into costs, not into stock or fixed assets.

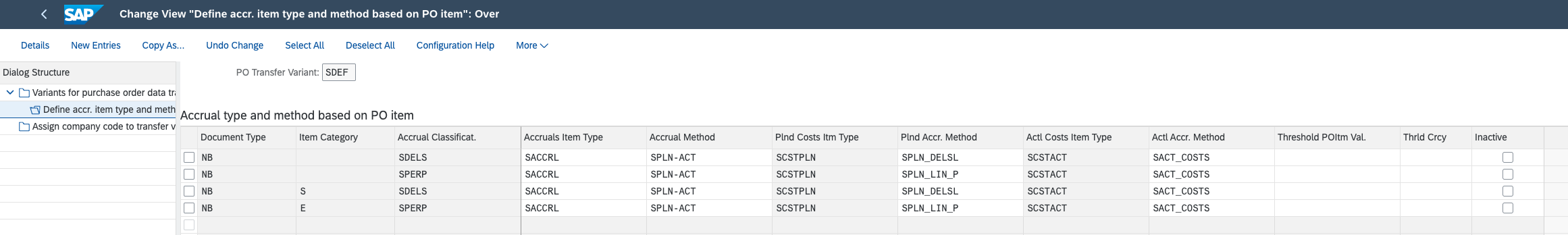

By default, accrual objects are created for standard purchase orders with standard purchase order items only, that is,

o Order Type = Standard PO.

The technical value for this field is NB

o Item Category = <space>

For purchase order items that represent a purchasing of services or an enhanced limit item, the accrual method SPLN_LIN_P is used which means that the planned costs are calculated according to a straight-line approach, that is, a linearization is done between start and end date that are entered in the purchase order item.

For all other types of purchase order items, the accrual method SPLN_DELSL is used, that is, the planned costs are calculated using the dates and quantities that are given in the delivery schedule.

You can activate the accrual calculation for specific types of PO by creating additional entries in this table.

What are the calculation logic and steps?

Basic calculation logic - accrual item types and three step approach

SAP delivers the following three predefined accrual item types:

o PLNCST Planned Costs.

o ACTCST Actual Costs (the posted invoices / goods receipts).

o ACCRL Accruals which are the result of planned costs minus actual costs.

o The system calculates two amounts:

Planned costs

Actual costs

o The system calculates accruals:

Accruals = Cumulated planned costs - Cumulated actual costs.

The accruals are calculated by subtracting the actual from planned amounts. If the result is negative, it is set to zero since accruals cannot be negative from a business point of view.

o PP Periodic Posting

This type of posting is performed by the periodic accrual posting run:

The amount that is calculated by the accrual method for this period is posted.

o Full posting logic - Post full amounts

§ The accrual engine first creates a posting that inverts (reverses) the accrual amount that was posted in former periods.

§ Afterwards it posts the full accrual amount using the last day of the current period as translation date.

§ In both postings the posting date is by default in the current period.

- Example: 12.000 EUR are to be accrued over 12 periods, linearly:

(In the last period, the amounts in local currency (and other additional FI currencies) were converted with the latest exchange rate 1.6.)

- SAP Managed Tags:

- SAP S/4HANA Cloud for Finance

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

22 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

157 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

217 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

- SAP S4HANA Cloud Public Edition Logistics FAQ in Enterprise Resource Planning Blogs by SAP

- Purchase Order Accrual in S/4HANA - Part 2 in Enterprise Resource Planning Blogs by Members

- Service with Advanced Execution and Fixed Price Billing in Enterprise Resource Planning Blogs by SAP

- Purchase Ordre Accrual in S/4HANA - Part 1 in Enterprise Resource Planning Blogs by Members

- Asset Management in SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 13 | |

| 11 | |

| 10 | |

| 8 | |

| 7 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 3 |