- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Utilities and Tax Payments in Brazil

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

08-31-2020

11:38 AM

In Brazil, collections and payment information are exchanged among banks and companies using electronic bank files in the format FEBRABAN CNAB240.

With SAP S/4HANA OnPremise 2019 and SAP S/4HANA Cloud 2005 there are two new possibilities for tax and utilities payments:

- With a bar code

- Without a bar code where all the information must be informed manually (each tax has a specific payment form)

There are two specific segments N and O used as follows:

- N, O for remittance

- N, O, and Z for return

Segment N is exclusive for payments without bar code and segment O is exclusive for payments with bar code, including payments of services for the public concessionaire. In the return file, segment Z is optional and currently not supported by the program logic.

Bar Code for Tax and Utilities Payments

The most common payment format is “boleto”, which contains data from both companies, financial information, and a bar code printed in 2 different forms: bar code and bar code numeric representation.

Bar code in the taxes and utilities bills has a specific structure with 48 digits. It contains 4 blocks and each block has a check digit at the last position.

Once the bar code is informed in a proper field (size of 48 characters) in the accounting document and the specific payment form is assigned, this document can be processed for payment. The bank-specific format for taxes and utilities with bar code file is then generated and sent to the bank.

Note: The bar code for the tax invoices always starts with number 8.

Tax Forms

The tax form is a 2-digit ID that identifies the payment form for each tax type. You can use the ID of a tax/payment form when no bar code exists for the given tax payment. During the payment media creation, tax form ID is identified, and the payment data is added into the payment file (in BR_FEBRABAN_A payment medium format), in a new segment, called segment N.

Supported Tax Forms:

| Tax Form ID | Description of Tax Form ID |

| 16 | DARF |

| 18 | DARF Simples |

| 21 | DARJ |

| 22 | GARE - SP ICMS |

| 23 | GARE - SP DR |

| 24 | GARE - SP ITCMD |

Processing Tax and Utilities Invoices with Bar Code

- Create the tax invoice in the Create Incoming Invoices.

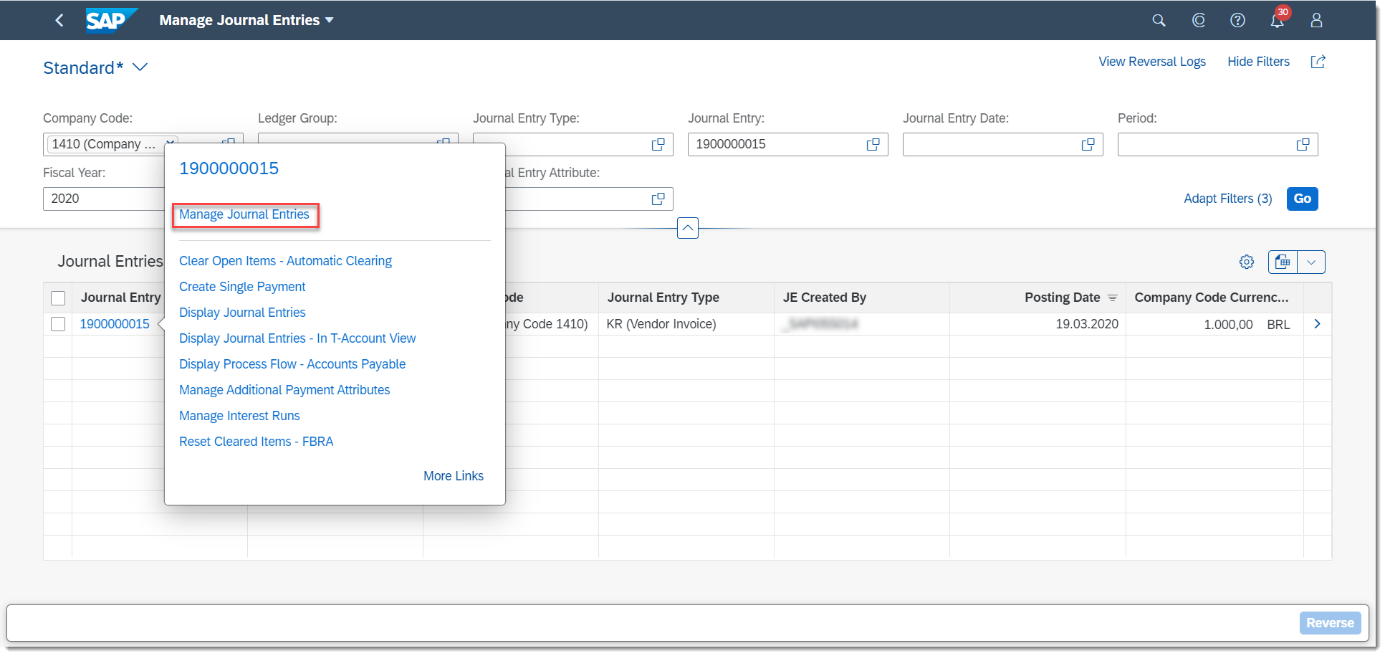

- In the Manage Journal Entries app, open the tax invoice you created using the Create Incoming Invoices app, click the journal entry, and choose Manage Journal Entries.

- To enter the bar code manually, open the line item in Edit mode.

- After entering a correct bar code, select Back to Journal Entry and Save your changes.

- Execute the payment run using the Manage Automatic Payments.

The app groups the payment data according to the grouping rules and eventually generates the payment file using the BR_FEBRABAN_A payment medium format. The payment file contains a new segment, called segment O.

Processing Tax Invoices Without Bar Code

- Create the tax invoice in the Create Incoming Invoices.

Enter data as required and ensure also that you specify the tax form as well in the Tax Form field.

Note: You can enter only one tax form in the field at a time. Please note that if you use a tax form, you cannot enter a bar code for the tax invoice.

- Open the tax invoice you created using the Create Incoming Invoices app, click the journal entry, and choose Manage Additional Payment Attributes.

- Choose Edit so that you can enter the necessary complementary information. The data you can enter differs for each tax form. Save the changes.

- Execute the payment run using the Manage Automatic Payments.

The app generates the payment file using the BR_FEBRABAN_A payment medium format. The payment file contains a new segment, called segment N.

Do you have any further comments regarding this topic? Do not hesitate to share them in the comment section below. You are also welcome to ask any questions about SAP S4/HANA Finance in the Community Q&A section.

- SAP Managed Tags:

- SAP S/4HANA Cloud for Finance,

- SAP S/4HANA Finance

Labels:

15 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

153 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

211 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 2 in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 1 in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud, Private Edition 2023 Product Tour in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud, Private Edition 2023 Product Launch in Enterprise Resource Planning Blogs by SAP

- Exploring the Latest Innovations in S/4HANA 2022 (FPS00, FPS01 and FPS02) for IS-Oil and Gas in Enterprise Resource Planning Blogs by Members

Top kudoed authors

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 7 | |

| 7 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 3 | |

| 3 |