- SAP Community

- Products and Technology

- Technology

- Technology Blogs by SAP

- Reconciliation from HGB or Local GAAP to IFRS with...

Technology Blogs by SAP

Learn how to extend and personalize SAP applications. Follow the SAP technology blog for insights into SAP BTP, ABAP, SAP Analytics Cloud, SAP HANA, and more.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

08-14-2020

12:57 PM

In this article, I would like to describe a typical business planning challenge in the context of integrated financial- and cost planning and how they are handled within SAP Analytics Cloud.

Problem definition: In various areas of financial corporate planning, or in general planning processes, it is necessary to carry out operating results such as the income statement and the balance sheet in accordance with various accounting regulations. For example, the balance sheet and income statement in Germany are normally composed according to HGB (Handelsgesetzbuch). If the company is also listed on a stock exchange in other countries, the additional regulation exists, to execute the financial reporting additionally in the local GAAP (Generally Accepted Accounting Principles) or according to IFRS (International Financial Reporting Standards).

In general, the main difference between the IFRS and the accounting regulations of the HGB is that the HGB always sees the protection of creditors as their highest priority. On the other hand, IFRS and US GAAP, which is a prerequisite for entry to the New York Stock Exchange - focus on investor protection.

For planning or reporting, this means in detail that individual P&L and balance sheet items are valued differently, depending on the accounting variant. This has an impact on the way in which certain income statement and balance sheet items like Deferred taxes, Realization of profit on long-term contracts, Intangible self-produced goods or Accruals are calculated.

For example, the HGB prohibits the capitalization of self-produced intangible goods, although US-GAAP and IAS / IFRS allow this in certain cases.

The consequence now is, that you either must carry out the calculations of the income statement and balance sheet separately for each required accounting rule and possibly create some independent planning models which then calculate depending on the requirements and are loaded differently via loading processes. Or you can create a joint planning and reporting model and create transition rules that map the transition from HGB to IFRS.

In this case I would like to concentrate on the 2nd procedure of the transition and describe in more detail how this can be implemented with the SAP Analytics Cloud.

Technical Solution: Within the SAP Analytics Cloud, this task can be solved using a so-called “Bridge” dimension. For this purpose, an additional dimension (Bridge) is required in the respective data model in addition to the dimensions which are used anyway (like measures, organizations, Time, Version etc.).

Example : Corporate Finance Model

In this example the SAP Analytics Cloud data model which includes the income statement and balance sheet according to the different accounting regulations, has the following dimensions included: Version (Scenario), Date (Time), I_Company (Organization), I_Finance_Measure (Measures) and the additional Bridge dimension.

The bridge dimension is structured in such a way that the individual accounting rules are structured in a hierarchy of posting levels with additional adjustment elements. The adjustment elements can then be used to store adjustment data entries. This means that all correction postings can also be precisely traced. If a value now is entered as an HGB value, it will be aggregated up to IFRS, if no reconciliation entries have been entered. If a reconciliation entry is made, the aggregation will be corrected and adjusted.

If an adjustment booking has been entered, this will be calculated and added to the next accounting regulations rule. Of course, these adjustment bookings can be used in combination with all versions (Budget, Forecast etc.).

These adjustment bookings or transfer bookings can be entered manually for each P&L or balance sheet item. But it is also possible to do this using small calculation logics named DataActions. In this case, it is possible to add so-called DataActionTrigger to the input and analysis reports and use these buttons to execute the calculation logic in the background.

In this example, reconciliation and adjustment entries are made for 3 accounts. These can be created separately in several DataActions or they can all be used together in one. In the specific case, a correction entry with -50% is posted as an adjustment for the balance sheet item "Income from other investments". The correction percentages could be different, or it is also possible to read out the percentages from a matching table or model.

Variance analysis report:

Outlook: The reconciliation with adjustment and correction entries can of course be used for all possible reconciliations. From Local GAAP according to IAS or IFRS, even without HGB. Only the bridge dimension needs to be structured accordingly. Additional In many other use cases, dimensions with a posting level are very useful in order to save and track correction bookings.

Problem definition: In various areas of financial corporate planning, or in general planning processes, it is necessary to carry out operating results such as the income statement and the balance sheet in accordance with various accounting regulations. For example, the balance sheet and income statement in Germany are normally composed according to HGB (Handelsgesetzbuch). If the company is also listed on a stock exchange in other countries, the additional regulation exists, to execute the financial reporting additionally in the local GAAP (Generally Accepted Accounting Principles) or according to IFRS (International Financial Reporting Standards).

In general, the main difference between the IFRS and the accounting regulations of the HGB is that the HGB always sees the protection of creditors as their highest priority. On the other hand, IFRS and US GAAP, which is a prerequisite for entry to the New York Stock Exchange - focus on investor protection.

For planning or reporting, this means in detail that individual P&L and balance sheet items are valued differently, depending on the accounting variant. This has an impact on the way in which certain income statement and balance sheet items like Deferred taxes, Realization of profit on long-term contracts, Intangible self-produced goods or Accruals are calculated.

For example, the HGB prohibits the capitalization of self-produced intangible goods, although US-GAAP and IAS / IFRS allow this in certain cases.

The consequence now is, that you either must carry out the calculations of the income statement and balance sheet separately for each required accounting rule and possibly create some independent planning models which then calculate depending on the requirements and are loaded differently via loading processes. Or you can create a joint planning and reporting model and create transition rules that map the transition from HGB to IFRS.

In this case I would like to concentrate on the 2nd procedure of the transition and describe in more detail how this can be implemented with the SAP Analytics Cloud.

Technical Solution: Within the SAP Analytics Cloud, this task can be solved using a so-called “Bridge” dimension. For this purpose, an additional dimension (Bridge) is required in the respective data model in addition to the dimensions which are used anyway (like measures, organizations, Time, Version etc.).

Example : Corporate Finance Model

In this example the SAP Analytics Cloud data model which includes the income statement and balance sheet according to the different accounting regulations, has the following dimensions included: Version (Scenario), Date (Time), I_Company (Organization), I_Finance_Measure (Measures) and the additional Bridge dimension.

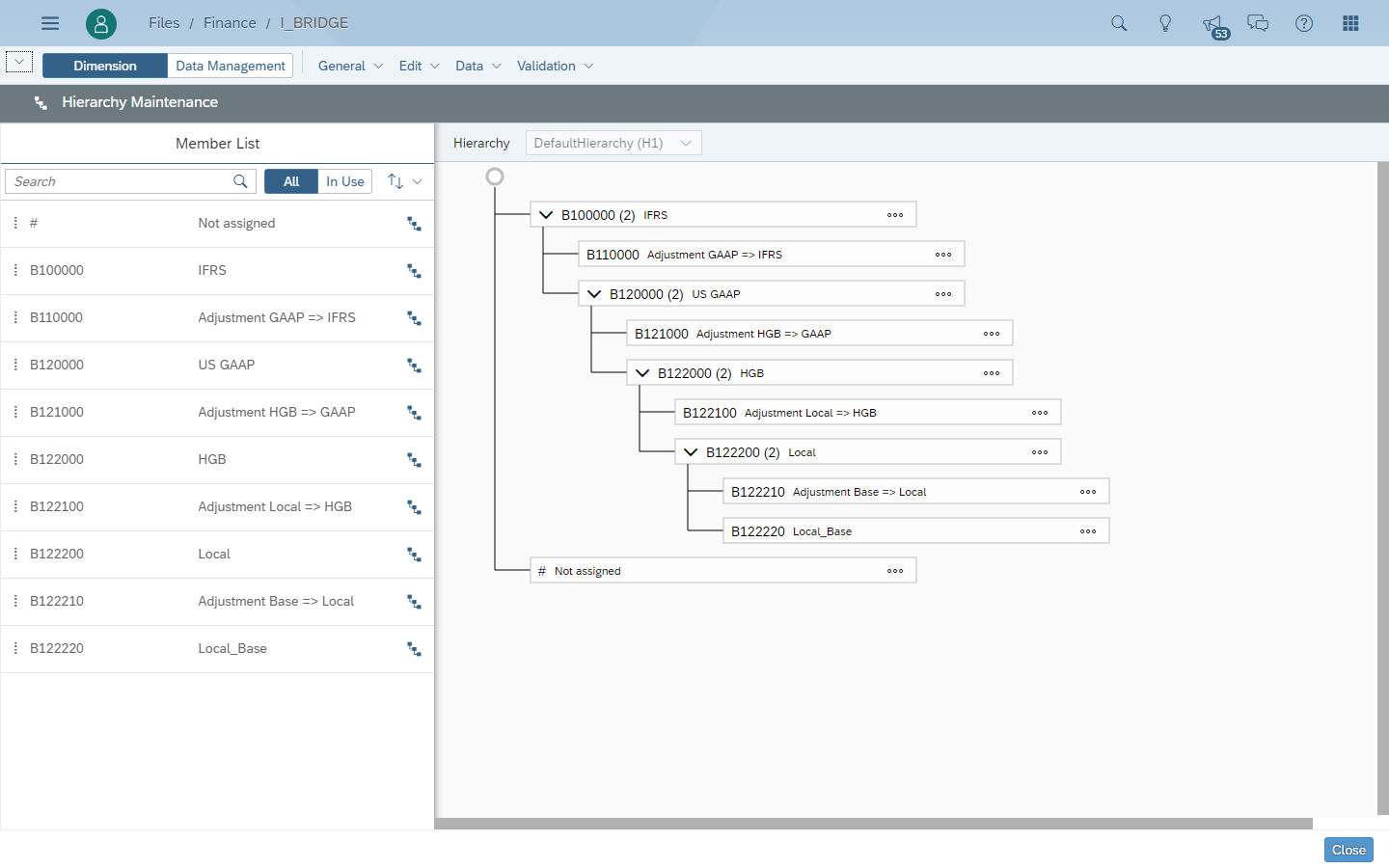

Bridge Dimension:

The bridge dimension is structured in such a way that the individual accounting rules are structured in a hierarchy of posting levels with additional adjustment elements. The adjustment elements can then be used to store adjustment data entries. This means that all correction postings can also be precisely traced. If a value now is entered as an HGB value, it will be aggregated up to IFRS, if no reconciliation entries have been entered. If a reconciliation entry is made, the aggregation will be corrected and adjusted.

Input and analysis sheet:

If an adjustment booking has been entered, this will be calculated and added to the next accounting regulations rule. Of course, these adjustment bookings can be used in combination with all versions (Budget, Forecast etc.).

Input and analysis sheet with adjustment booking:

These adjustment bookings or transfer bookings can be entered manually for each P&L or balance sheet item. But it is also possible to do this using small calculation logics named DataActions. In this case, it is possible to add so-called DataActionTrigger to the input and analysis reports and use these buttons to execute the calculation logic in the background.

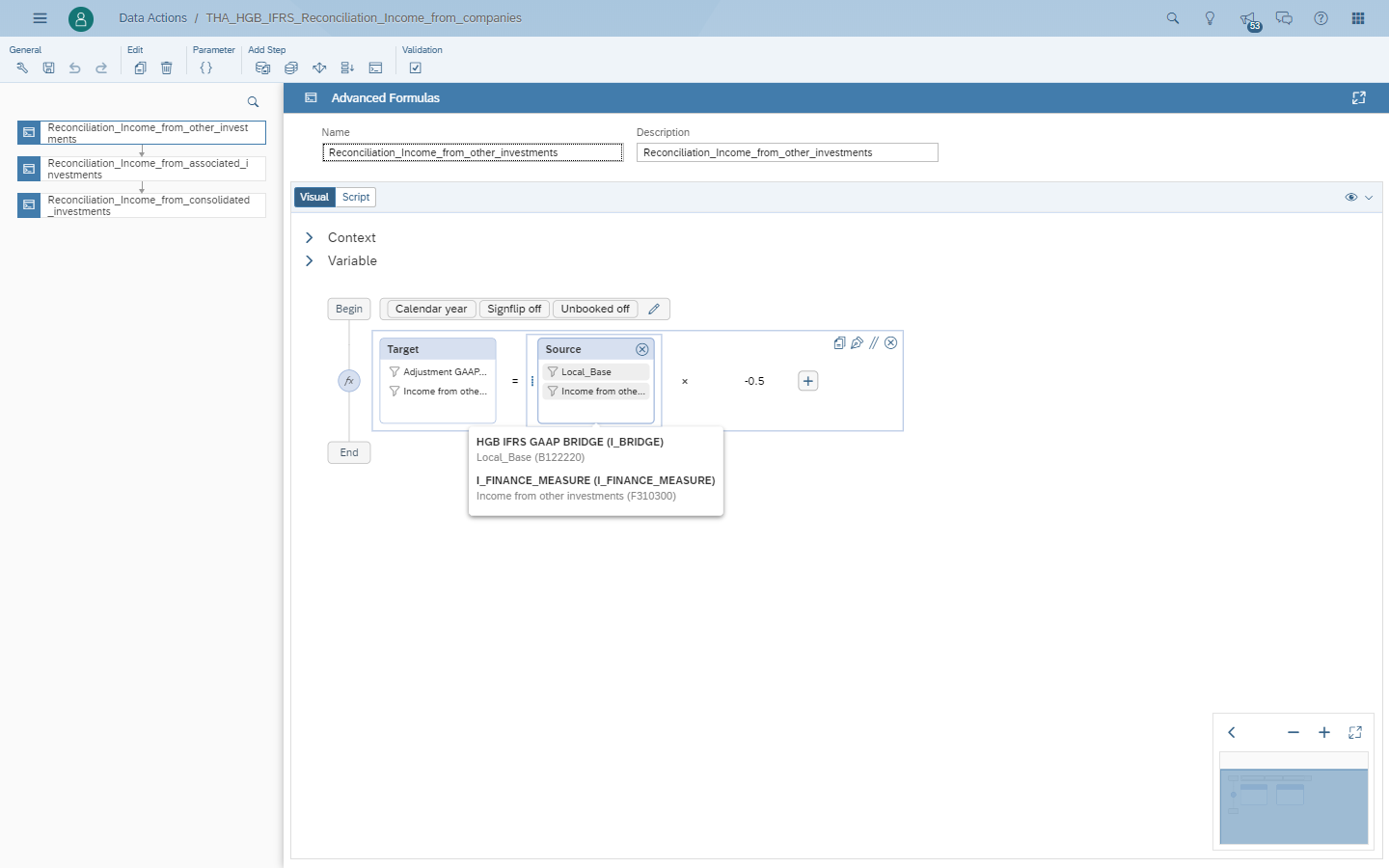

DataAction:

In this example, reconciliation and adjustment entries are made for 3 accounts. These can be created separately in several DataActions or they can all be used together in one. In the specific case, a correction entry with -50% is posted as an adjustment for the balance sheet item "Income from other investments". The correction percentages could be different, or it is also possible to read out the percentages from a matching table or model.

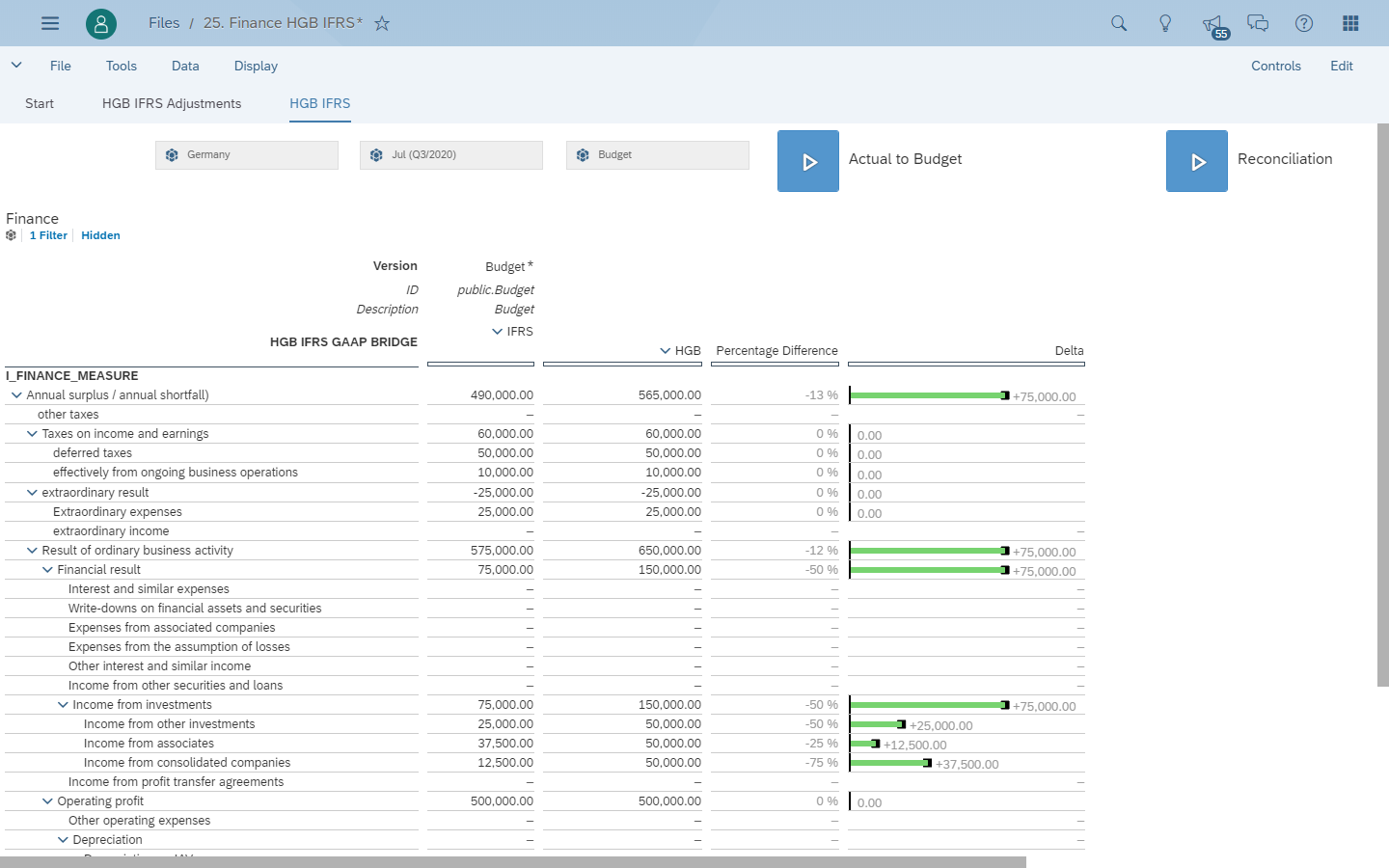

Result after DataAction execution:

Variance analysis report:

Outlook: The reconciliation with adjustment and correction entries can of course be used for all possible reconciliations. From Local GAAP according to IAS or IFRS, even without HGB. Only the bridge dimension needs to be structured accordingly. Additional In many other use cases, dimensions with a posting level are very useful in order to save and track correction bookings.

- SAP Managed Tags:

- SAP Analytics Cloud,

- SAP Analytics Cloud for planning

Labels:

3 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

ABAP CDS Views - CDC (Change Data Capture)

2 -

AI

1 -

Analyze Workload Data

1 -

BTP

1 -

Business and IT Integration

2 -

Business application stu

1 -

Business Technology Platform

1 -

Business Trends

1,661 -

Business Trends

86 -

CAP

1 -

cf

1 -

Cloud Foundry

1 -

Confluent

1 -

Customer COE Basics and Fundamentals

1 -

Customer COE Latest and Greatest

3 -

Customer Data Browser app

1 -

Data Analysis Tool

1 -

data migration

1 -

data transfer

1 -

Datasphere

2 -

Event Information

1,400 -

Event Information

64 -

Expert

1 -

Expert Insights

178 -

Expert Insights

270 -

General

1 -

Google cloud

1 -

Google Next'24

1 -

Kafka

1 -

Life at SAP

784 -

Life at SAP

11 -

Migrate your Data App

1 -

MTA

1 -

Network Performance Analysis

1 -

NodeJS

1 -

PDF

1 -

POC

1 -

Product Updates

4,578 -

Product Updates

323 -

Replication Flow

1 -

RisewithSAP

1 -

SAP BTP

1 -

SAP BTP Cloud Foundry

1 -

SAP Cloud ALM

1 -

SAP Cloud Application Programming Model

1 -

SAP Datasphere

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Migration Cockpit

1 -

Technology Updates

6,886 -

Technology Updates

395 -

Workload Fluctuations

1

Related Content

- Top Picks: Innovations Highlights from SAP Business Technology Platform (Q1/2024) in Technology Blogs by SAP

- What’s New in SAP Analytics Cloud Release 2024.08 in Technology Blogs by SAP

- SAP Analytics Cloud Planning Data Action Advance Formula in Technology Q&A

- ad-hoc analysis on BW Querys in SAP Analytics Cloud on iOS mobile devices in Technology Q&A

- SAP Analytics Cloud Optimize Story - How to reset input control range date filter in Technology Q&A

Top kudoed authors

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 10 | |

| 10 | |

| 8 | |

| 7 | |

| 7 | |

| 7 | |

| 7 | |

| 6 |