- SAP Community

- Products and Technology

- Human Capital Management

- HCM Blogs by SAP

- Handling different accrual recalculation scenarios...

Human Capital Management Blogs by SAP

Get insider info on HCM solutions for core HR and payroll, time and attendance, talent management, employee experience management, and more in this SAP blog.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

08-02-2020

4:56 PM

As a Time Off consultant, it is imperative to understand different nuances of handling recalculation in Employee Central Time Off. You could come across different recalculation requirements simple or complex, but Should be aware of how to best make use of the Time off Framework. I am going to discuss one such case here which differs from the traditional or standard recalculation

From a customer standpoint, you will definitely come across a requirement where there is a need to recalculate accruals when an employee goes on a leave of absence (or LOA) like Maternity, Paternity, Sabbatical, etc.

Again there are two flavors to it

Let’s take an example to compare 1) and 2)

Say a Regular Accrual = 25 days (full-time employee) Then let’s say employee takes parental leave or LOA from the 15th of October until the 31st of December.

That means at least as a standard If I take the days from Jan 1st until including the 14th of October, I have 287 days So calculation will be

(287 / 365) *25 = 19,65 rounded = 20 (Case 1)

But October needs to be fully considered (only full months with LOA count)

That means I should have 304 days from Jan 1st until the 31st of October.

(304 / 365) * 25 = 20,82 rounded = 21 (Case 2)

I hope you got the difference between the two recalculation requirements. And I will explain to you how to tackle both the scenarios. Most of you already might know how to handle case 1)

But to make the blog complete I think it is better to explain both the scenarios or requirements to help you understand and compare different variants. The second case is valid, especially in European countries.

A common configuration for both cases is below

Pretty standard case. You could use a custom job info field to store the accrual amount. Ex: Say an accrual depends on Seniority or FTE, the accrual value should change as and when an employee changes FTE mid of the accrual year.

An onSave rule can be written to store the accrual amount * FTE in the custom field.

The average job info rule function then averages out the accrual for the year. The advantage of using this function that we have a parameter called “Consider eligibility” which automatically takes eligible days into consideration

Considering the above example of an employee taking parental leave from 15th of October until the 31st of December, the accruals are automatically recalculated as

Number of days between Jan1 to Oct 14 : (287 / 365) *25 = 19,65 rounded = 20

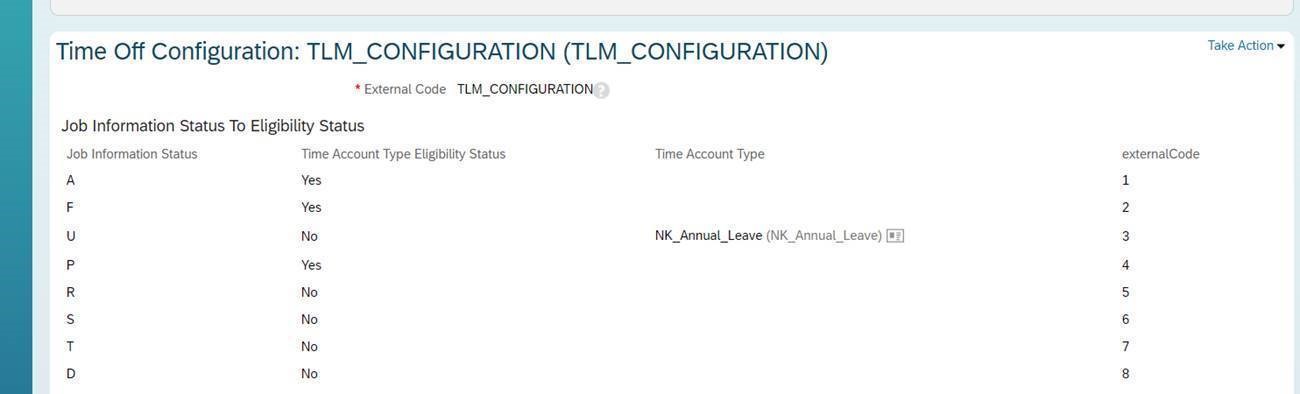

The config to achieve this would be to use the Corresponding time account for vacation/leave with Eligibility as ‘No’ in Time Configuration as shown

If the employee status in job info changes to Unpaid when LOA is requested, the time account eligibility of the Time account is set to “No” and accruals are recalculated using the “Calculate Average Value of Numeric Job Info field”.

Make sure to mark Eligibility change as recalculation relevant field in time account type config

You can also achieve the above scenario by simply multiplying the accrual amount of a year by the number of eligible days as shown below

But the Rule function to calculate average value already takes eligibility into consideration. Its a choice you can make depending on the complexity of the accrual recalculation requirement

This gets trickier as now we need to consider full months and not exact eligible days into our calculation. Taking the same example of an employee taking parental leave or LOA from 15th of October until the 31st of December,

Even though in theory the employee is not eligible from 15th October to Dec 31st, Some customers want only full months to be taken into the calculation of eligibility. This means he is still eligible for the period from 15th October till 31st Oct even though he is on LOA. We need to take non eligible days only from period Nov 1st till Dec 31st. Interesting and complex isn’t it? Well read through for a simple solution below

In this case, do not set any eligibility flag in Time Off Configuration (TLM_Configuration). Because this directly counts the non-eligible days as Oct 15th to Dec 31st which we want to avoid, Else it can lead to incorrect Accrual recalculation

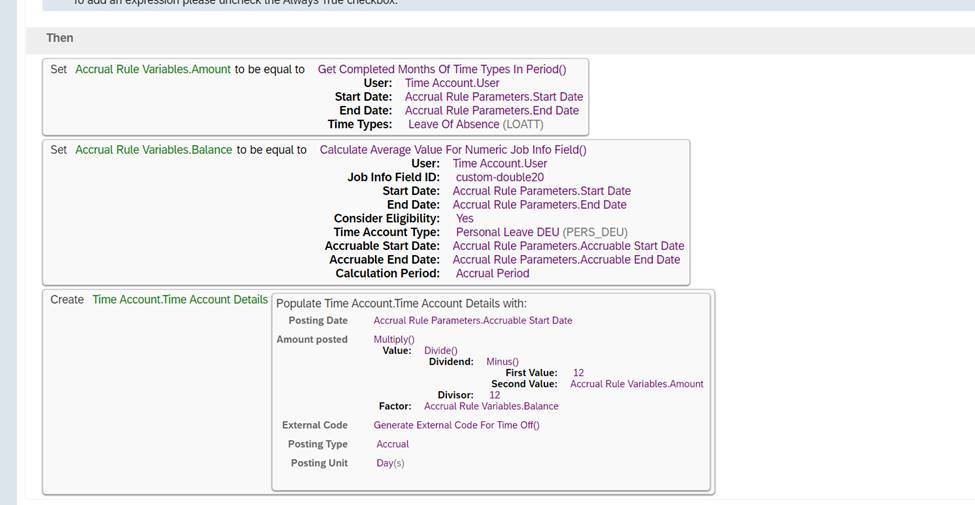

Use the function “Get Completed Months of Time Types in Period” to get Full months where the employee is on LOA as shown below

There are two variables:

The first variable gets the Number of completed LOA months in the accrual period. In theory, this is 2 months now (Nov and Dec) and not 78 days from Oct 15th to Dec 31st (standard case)

The second which averages the Accrual from a custom field in Job Info for the entire accrual year. This is similar to case 1) where accrual amount can vary on FTE change in a calendar year

Third Calculation takes the average accrual and Multiplies it with Number of eligible months Divided by 12 months (for a calendar year)

The below are Test results:

The employee is 1 FTE and has accrual eligibility of 25 days

Leave of Absence applied from Oct 15 to Dec 31

Accruals are recalculated correctly as 20.83 (approx 21) when LOA is entered (based on full completed months only)

This matches our calculation in the sample example provided in the overview

In the consulting world, you will surely come across various recalculation requirements and some may be crazy like Case 2). Hope this blog helps to cater to any such requirement

Any feedback is welcome.

Thanks

Neelesh

Senior Product Specialist

Best Practices for SuccessFactors

From a customer standpoint, you will definitely come across a requirement where there is a need to recalculate accruals when an employee goes on a leave of absence (or LOA) like Maternity, Paternity, Sabbatical, etc.

Again there are two flavors to it

- The accruals should be recalculated or reduced by the number of days he/she is on leave of absence i.e the employee is not eligible for accruals during LOA and we need to factor in only eligible days. This is pretty standard and can be achieved in two ways using the time eligibility framework. We will see an example

- The accruals should be recalculated or reduced by the number of months he is eligible. Only full LOA months should be taken into consideration when recalculating accruals. This becomes a bit tricky. Since it is not the days which we need to count where an employee is on LOA, but full months and the matter can get complex when an employee is on LOA more than once in an accrual year

Let’s take an example to compare 1) and 2)

Say a Regular Accrual = 25 days (full-time employee) Then let’s say employee takes parental leave or LOA from the 15th of October until the 31st of December.

That means at least as a standard If I take the days from Jan 1st until including the 14th of October, I have 287 days So calculation will be

(287 / 365) *25 = 19,65 rounded = 20 (Case 1)

But October needs to be fully considered (only full months with LOA count)

That means I should have 304 days from Jan 1st until the 31st of October.

(304 / 365) * 25 = 20,82 rounded = 21 (Case 2)

I hope you got the difference between the two recalculation requirements. And I will explain to you how to tackle both the scenarios. Most of you already might know how to handle case 1)

But to make the blog complete I think it is better to explain both the scenarios or requirements to help you understand and compare different variants. The second case is valid, especially in European countries.

A common configuration for both cases is below

- Make the LOA time type as relevant for recalculation

- Mark the time account for Vacation/Personal Leave which needs to be recalculated with Following Config i.e Absence change is present as recalculation relevant field

Case 1) The accruals should be recalculated or reduced by the number of days

Pretty standard case. You could use a custom job info field to store the accrual amount. Ex: Say an accrual depends on Seniority or FTE, the accrual value should change as and when an employee changes FTE mid of the accrual year.

An onSave rule can be written to store the accrual amount * FTE in the custom field.

The average job info rule function then averages out the accrual for the year. The advantage of using this function that we have a parameter called “Consider eligibility” which automatically takes eligible days into consideration

Considering the above example of an employee taking parental leave from 15th of October until the 31st of December, the accruals are automatically recalculated as

Number of days between Jan1 to Oct 14 : (287 / 365) *25 = 19,65 rounded = 20

The config to achieve this would be to use the Corresponding time account for vacation/leave with Eligibility as ‘No’ in Time Configuration as shown

If the employee status in job info changes to Unpaid when LOA is requested, the time account eligibility of the Time account is set to “No” and accruals are recalculated using the “Calculate Average Value of Numeric Job Info field”.

Make sure to mark Eligibility change as recalculation relevant field in time account type config

You can also achieve the above scenario by simply multiplying the accrual amount of a year by the number of eligible days as shown below

But the Rule function to calculate average value already takes eligibility into consideration. Its a choice you can make depending on the complexity of the accrual recalculation requirement

Case 2) The accruals should be recalculated or reduced by the number of months the employee is eligible. Only full LOA months should be taken into consideration

This gets trickier as now we need to consider full months and not exact eligible days into our calculation. Taking the same example of an employee taking parental leave or LOA from 15th of October until the 31st of December,

Even though in theory the employee is not eligible from 15th October to Dec 31st, Some customers want only full months to be taken into the calculation of eligibility. This means he is still eligible for the period from 15th October till 31st Oct even though he is on LOA. We need to take non eligible days only from period Nov 1st till Dec 31st. Interesting and complex isn’t it? Well read through for a simple solution below

In this case, do not set any eligibility flag in Time Off Configuration (TLM_Configuration). Because this directly counts the non-eligible days as Oct 15th to Dec 31st which we want to avoid, Else it can lead to incorrect Accrual recalculation

Use the function “Get Completed Months of Time Types in Period” to get Full months where the employee is on LOA as shown below

There are two variables:

The first variable gets the Number of completed LOA months in the accrual period. In theory, this is 2 months now (Nov and Dec) and not 78 days from Oct 15th to Dec 31st (standard case)

The second which averages the Accrual from a custom field in Job Info for the entire accrual year. This is similar to case 1) where accrual amount can vary on FTE change in a calendar year

Third Calculation takes the average accrual and Multiplies it with Number of eligible months Divided by 12 months (for a calendar year)

The below are Test results:

The employee is 1 FTE and has accrual eligibility of 25 days

Leave of Absence applied from Oct 15 to Dec 31

Accruals are recalculated correctly as 20.83 (approx 21) when LOA is entered (based on full completed months only)

This matches our calculation in the sample example provided in the overview

In the consulting world, you will surely come across various recalculation requirements and some may be crazy like Case 2). Hope this blog helps to cater to any such requirement

Any feedback is welcome.

Thanks

Neelesh

Senior Product Specialist

Best Practices for SuccessFactors

- SAP Managed Tags:

- SAP SuccessFactors Employee Central,

- HCM Time Management

Labels:

20 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

1H 2023 Product Release

3 -

2H 2023 Product Release

3 -

Business Trends

104 -

Business Trends

4 -

Cross-Products

13 -

Event Information

75 -

Event Information

9 -

Events

5 -

Expert Insights

26 -

Expert Insights

18 -

Feature Highlights

16 -

Hot Topics

20 -

Innovation Alert

8 -

Leadership Insights

4 -

Life at SAP

67 -

Life at SAP

1 -

Product Advisory

5 -

Product Updates

499 -

Product Updates

33 -

Release

6 -

Technology Updates

408 -

Technology Updates

7

Related Content

- 1H 2024 - Release highlights of SuccessFactors Calibration in Human Capital Management Blogs by Members

- Standard integration templates in Talent Intelligence Hub in Human Capital Management Blogs by SAP

- Global filter definition for Country Compliance WTPA forms in Human Capital Management Blogs by SAP

- Late Coming and Early Departure Detection for Double Shifts on the same day - SF Time Tracking in Human Capital Management Blogs by Members

- What is the recommended Application-Specific rule scenario to raise an error message in EC? in Human Capital Management Q&A

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 4 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 |