- SAP Community

- Products and Technology

- Supply Chain Management

- SCM Blogs by SAP

- Agriculture Commodity Scheduling - Challenges in t...

Supply Chain Management Blogs by SAP

Expand your SAP SCM knowledge and stay informed about supply chain management technology and solutions with blog posts by SAP. Follow and stay connected.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member33

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

07-28-2020

8:41 AM

Agriculture commodities follow a complex supply chain and are influenced by global demand and inventory levels along with local weather, harvest conditions, and freight availability. The commodities are traded, hedged, stored, and speculated in most of the world. The commodity therefore transacts through multiple entities before it is ultimately consumed by processing units for end-customer use.

Let's consider soybeans. It is an important global crop and provides a good source of oil and protein. The United States, Brazil, and Argentina are the world's largest soybean producers and consequently also the largest exporters of soybeans to the rest of the world. The top importers are China, followed by the European Union and Japan. This global import-export pattern, along with domestic origination to consumption pattern, results in a complex, multi-modal, transportation-based supply chain.

Looking closer at the origination process, the soybean farmer is afforded various options. He can decide to sell the harvest to a choice of markets. Alternatively, he can sign a contract in advance of the growing season depending on his view of expected future price. The farmer can also choose to wait until the crop is mature and then decide to store the harvest in a nearby elevator again in speculation of a better price. However, the most common process for a farmer is to truck the soybean to a nearby storage elevator for sale.

A storage elevator (storage unit/silo for grain) plays a strategic role in the agricultural industry. It provides leverage in future markets in trading grain and oilseeds. Storage capacity grants the farmer the ability to sell when the price is favorable or sit out if the market price is running low. The accumulated grain also provides flexibility in meeting the contractual demand and schedules. The location of an elevator can provide additional benefit. An elevator close to the farm is normally the first choice for farmers to sell or store their harvest. River shore elevators provide elasticity in terms of receiving the stock and loading as soon as a set of barges are made available.

The transportation process, as shown in Figure 1, normally begins with the truck that transports materials from the farm to the farm elevator. The elevator has a couple of options in deciding where and how to move the soybean it has purchased from many nearby farmers:

Figure 1: Transportation Process

Most of the soybean in the United States are exported through the ports on the Gulf of Mexico. The low transportation cost makes a barge the first choice for moving soybean to the gulf ports. Most of the fertile corn and grain farmland has reasonable access to the Mississippi River. In situations where barges are not available or the availability conflicts with the export schedule (vessel load date), the next best option is rail cars. For maximum efficiency a 100-120 hopper car unit train is moved between origin and destination elevators. Since unit trains and barges are not always available or accessible to all elevators, the stock is also moved via road on fully loaded trucks.

Real life situations add more complexity to this process flow. Let us take an example to understand a little more.

An elevator has a purchase contract from a farmer or a third-party vendor to purchase soybean. When the soybean is loaded for shipment, the quality detail along with the quantity is shared with the buyer. The sourcing elevator realizes that the quality is not up to the mark to store it along with the other grain and it cannot reject the shipment because the quality, even though not satisfying, is still within the stipulated contractual range. The buyer therefore decides to sell this stock to another customer while in transit (back-to-back purchase and sale).

When the new customer is made aware of the quality details, he decides to divert this load to another facility or counterparty, which can ultimately store the grain. Such unplanned stock movement, back-to-back purchase and sale (also known as scalp), is not uncommon in grain origination supply chain. In fact, such unplanned movements can happen for a variety of reasons:

Due to the nature of the product movement schedule planning and re-planning are a day-to-day job. As a result, it is completely a manual process with lots of data and multiple spreadsheets to work on.

The scheduling process and associated challenges are not unique to soybean. Other commodities – oil & gas, mining and metals, grain and oilseeds, ethanol, edible oil, etc. – have similar scheduling needs. Another way to look at it would be from a mode of transport standpoint. Shipments in rail, barge, vessel and pipeline mode normally qualify as bulk and have similar dynamics during scheduling.

SAP Traders’ and Schedulers’ Workbench, which was originally part of IS Oil and IS Mining, is also available as a module integrated with the SAP Agriculture Contract Management solution. SAP Traders’ and Schedulers’ Workbench was built to meet the scheduling requirements for bulk commodities in such a dynamic environment. The “nomination” transaction is used to capture and represent the product movement schedule. It can accommodate a single move or multiple back-to-back transactions as the product gets diverted or sold to a different counterparty while in transit. The usability offered by nomination to plan in a simplistic spreadsheet-like manner has a limitation too – it does not integrate with shipment planning. As a result, the efficiency gained by nomination-based planning, particularly for truck movements, is quickly lost because of duplication of work in excel sheets to support career planning and optimization. Out of the box, only SAP Traders’ and Schedulers’ Workbench ticketing integrates with shipment costing to support career payment.

SAP Transportation Management is an overall transportation solution from SAP. It caters to all the transportation and logistics requirements for almost all the industries in a standalone system. It provides capability for better career collaboration, improved visibility, and reduced freight spend. Its integration with the ERP system is typically at order or delivery document level. With nomination being the leading document for scheduling, there was no opportunity available to integrate SAP Transportation Management into the planning process for a transaction occurring SAP Agriculture Contract Management. To bridge this gap, SAP very recently released an add-on product, SAP S/4HANA, bulk transportation extension for SAP Agricultural Contract Management. The integration model in Figure 2 represents how SAP Agricultural Contract Management transactions starting from nomination are integrated with SAP Transportation Management as per this new product.

Figure 2: Integration Model

Image source: https://blogs.sap.com/2019/12/09/integration-between-sap-agricultural-contract-management-and-sap-tr...

The integration model supports different modes of transport – truck, rail, barge, and vessel – and represents how a scheduler and freight coordinator work together. For rail and barge movements, a scheduler typically creates a separate line item in nomination to represent each shipment. If the rail car or barge ends up being diverted or scalped, an additional line is created on the nomination representing the new destination. As per the integration model, once a nomination line is confirmed and marked as transportation management relevant (i.e., freight planning needs to be carried out), a freight unit is created in the transportation management module. Immediately freight units are available on the SAP Transportation Management planning tab. The freight coordinator reviews this information and takes it forward with freight order (FOR) creation. FOR is tendered to approved truck providers and carrier assignment is made via the collaboration portal. When the traffic is high, the freight coordinator can assign load appointment time for truck liftings to prioritize shipments and avoid demurrage costs.

Truck movements are generally aggregated based on the scheduling date on a nomination line item. One nomination line can represent multiple trucks. The freight unit building rule in SAP Transportation Management is called to create the appropriate number of freight units representing each truck. And each freight unit is attached to a freight order. In the case of unit trains, a single freight order contains several freight units representing the entire train and the rail career is assigned to the freight order.

Actual load and unload weight and grade information is captured via load data capture (LDC). A freight order can be referenced to create the load/unload event on LDC. The LDC event on release creates the underlying transactions – order, delivery, goods movement, and application document. On FOR reference, LDC information is integrated with FOR to update bill of lading number, execution date, and shipment weight information.

This solution also supports splitting of the total freight cost as per individual nomination line items. For instance, when scheduling marine voyage, a nomination consists of multiple purchase and sales contracts. The total voyage cost needs to be distributed to the individual trade contract for better financial reporting. This product provides a distribution profile in the SAP Transportation Management cost distribution tab for the cost to be split to each of the contract that the nomination line item gets applied to. The details of the cost distribution are passed on to the freight settlement document (FSD). Subsequently, as per standard transportation management process, FSD leads to the creation of freight purchase order and service entry sheet for accounting integration into the ERP system.

As part of this integration model, a few new monitors have been introduced:

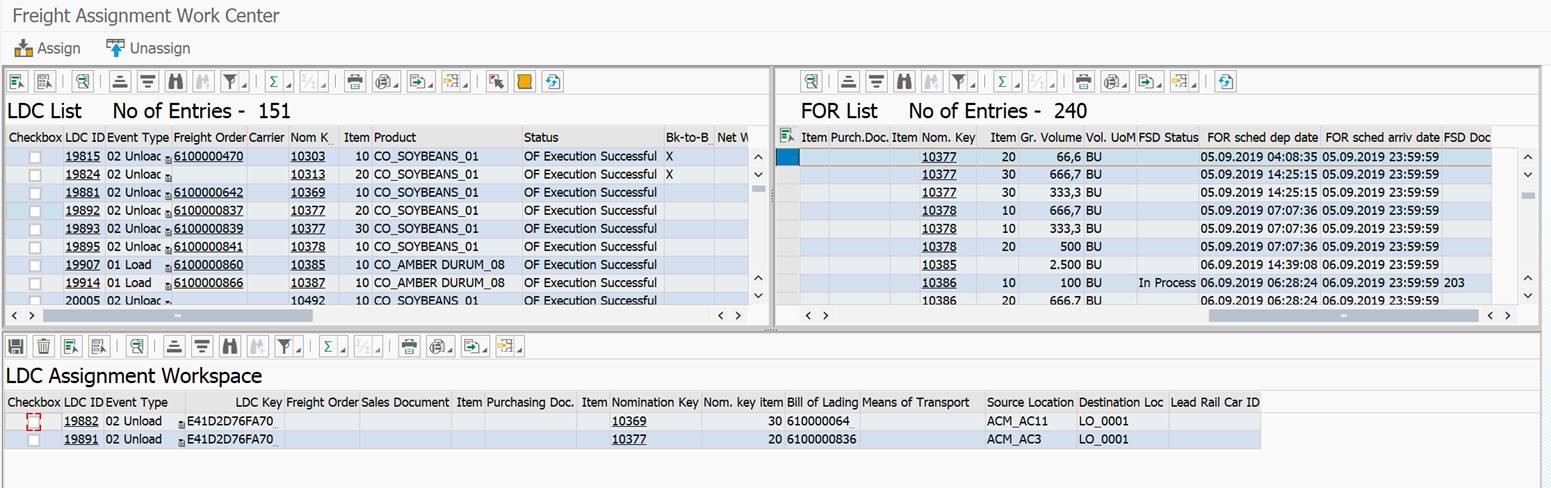

Figure 3: Freight Assignment Work Center

Figure 5: LDC - TM Integration Monitor

A key success factor in the scheduling process is the ability to make quick decisions and execute on opportunities as they arise. Integrated scheduling and transportation planning provide the much-needed agility to deal with market dynamics and changing contractual positions. The integration provided by this new product removes the day-to-day struggle between scheduler and freight coordinator to keep up with transaction processing and helps in freeing up availability to identify and execute on additional opportunities.

Early planning with freight careers based on nomination schedule provides better control on freight spend. Cost distribution profile and its integration with freight settlement process gives better insight into trade economics and promotes better decision making from the traders.

help.sap.com/acmtm

https://blogs.sap.com/2019/12/09/integration-between-sap-agricultural-contract-management-and-sap-tr...

https://help.sap.com/viewer/f1887ef576ef4b599f71ae32f72347be/1.0/en-US

This content was originally published on SAPinsider Online.

Let's consider soybeans. It is an important global crop and provides a good source of oil and protein. The United States, Brazil, and Argentina are the world's largest soybean producers and consequently also the largest exporters of soybeans to the rest of the world. The top importers are China, followed by the European Union and Japan. This global import-export pattern, along with domestic origination to consumption pattern, results in a complex, multi-modal, transportation-based supply chain.

Looking closer at the origination process, the soybean farmer is afforded various options. He can decide to sell the harvest to a choice of markets. Alternatively, he can sign a contract in advance of the growing season depending on his view of expected future price. The farmer can also choose to wait until the crop is mature and then decide to store the harvest in a nearby elevator again in speculation of a better price. However, the most common process for a farmer is to truck the soybean to a nearby storage elevator for sale.

A storage elevator (storage unit/silo for grain) plays a strategic role in the agricultural industry. It provides leverage in future markets in trading grain and oilseeds. Storage capacity grants the farmer the ability to sell when the price is favorable or sit out if the market price is running low. The accumulated grain also provides flexibility in meeting the contractual demand and schedules. The location of an elevator can provide additional benefit. An elevator close to the farm is normally the first choice for farmers to sell or store their harvest. River shore elevators provide elasticity in terms of receiving the stock and loading as soon as a set of barges are made available.

The transportation process, as shown in Figure 1, normally begins with the truck that transports materials from the farm to the farm elevator. The elevator has a couple of options in deciding where and how to move the soybean it has purchased from many nearby farmers:

- Move it to a processing unit to produce soya-meal, oil, and animal feed

- Move it to a river terminal elevator to then be transported via barges to ports for export

- Send via rail directly to the elevators for loading to export vessels

- Sell it to a competitor at any point in the transportation process

Figure 1: Transportation Process

Most of the soybean in the United States are exported through the ports on the Gulf of Mexico. The low transportation cost makes a barge the first choice for moving soybean to the gulf ports. Most of the fertile corn and grain farmland has reasonable access to the Mississippi River. In situations where barges are not available or the availability conflicts with the export schedule (vessel load date), the next best option is rail cars. For maximum efficiency a 100-120 hopper car unit train is moved between origin and destination elevators. Since unit trains and barges are not always available or accessible to all elevators, the stock is also moved via road on fully loaded trucks.

Real life situations add more complexity to this process flow. Let us take an example to understand a little more.

Real-life Example of Transportation Process

An elevator has a purchase contract from a farmer or a third-party vendor to purchase soybean. When the soybean is loaded for shipment, the quality detail along with the quantity is shared with the buyer. The sourcing elevator realizes that the quality is not up to the mark to store it along with the other grain and it cannot reject the shipment because the quality, even though not satisfying, is still within the stipulated contractual range. The buyer therefore decides to sell this stock to another customer while in transit (back-to-back purchase and sale).

When the new customer is made aware of the quality details, he decides to divert this load to another facility or counterparty, which can ultimately store the grain. Such unplanned stock movement, back-to-back purchase and sale (also known as scalp), is not uncommon in grain origination supply chain. In fact, such unplanned movements can happen for a variety of reasons:

- Ambiguity in grain quality (color, grain size, splits, odor, foreign material, dockage, etc.)

- Change in vessel load date at the export facility (delay in vessel arrival, demurrage)

- Fluctuations in barge and vessel freight rates and availability, particularly during harvest

- Port congestion when the traffic volume is high

- Decision between different modes because of cost and availability (i.e., truck, rail, barge) impacting transit time

- Elevator is running full – stock cannot be unloaded and is therefore sold to a customer directly; or sold to a customer directly to minimize elevation cost (load and unload) and impact on quality of grain in terms of breakage and splits with elevation

- Shift in market condition between the time a grain purchase or sale contract is created and the time window when it is up for execution

- Freight commitments, such as a shuttle unit train has been contracted for a specific duration with railroad and the freight capacity needs to be fully utilized

- Market opportunities created by competition because of their internal supply chain compulsions

- To accommodate changes in supply chain based on combination of above reasons

Due to the nature of the product movement schedule planning and re-planning are a day-to-day job. As a result, it is completely a manual process with lots of data and multiple spreadsheets to work on.

The scheduling process and associated challenges are not unique to soybean. Other commodities – oil & gas, mining and metals, grain and oilseeds, ethanol, edible oil, etc. – have similar scheduling needs. Another way to look at it would be from a mode of transport standpoint. Shipments in rail, barge, vessel and pipeline mode normally qualify as bulk and have similar dynamics during scheduling.

SAP Traders’ and Schedulers’ Workbench

SAP Traders’ and Schedulers’ Workbench, which was originally part of IS Oil and IS Mining, is also available as a module integrated with the SAP Agriculture Contract Management solution. SAP Traders’ and Schedulers’ Workbench was built to meet the scheduling requirements for bulk commodities in such a dynamic environment. The “nomination” transaction is used to capture and represent the product movement schedule. It can accommodate a single move or multiple back-to-back transactions as the product gets diverted or sold to a different counterparty while in transit. The usability offered by nomination to plan in a simplistic spreadsheet-like manner has a limitation too – it does not integrate with shipment planning. As a result, the efficiency gained by nomination-based planning, particularly for truck movements, is quickly lost because of duplication of work in excel sheets to support career planning and optimization. Out of the box, only SAP Traders’ and Schedulers’ Workbench ticketing integrates with shipment costing to support career payment.

SAP Transportation Management

SAP Transportation Management is an overall transportation solution from SAP. It caters to all the transportation and logistics requirements for almost all the industries in a standalone system. It provides capability for better career collaboration, improved visibility, and reduced freight spend. Its integration with the ERP system is typically at order or delivery document level. With nomination being the leading document for scheduling, there was no opportunity available to integrate SAP Transportation Management into the planning process for a transaction occurring SAP Agriculture Contract Management. To bridge this gap, SAP very recently released an add-on product, SAP S/4HANA, bulk transportation extension for SAP Agricultural Contract Management. The integration model in Figure 2 represents how SAP Agricultural Contract Management transactions starting from nomination are integrated with SAP Transportation Management as per this new product.

Figure 2: Integration Model

Image source: https://blogs.sap.com/2019/12/09/integration-between-sap-agricultural-contract-management-and-sap-tr...

The integration model supports different modes of transport – truck, rail, barge, and vessel – and represents how a scheduler and freight coordinator work together. For rail and barge movements, a scheduler typically creates a separate line item in nomination to represent each shipment. If the rail car or barge ends up being diverted or scalped, an additional line is created on the nomination representing the new destination. As per the integration model, once a nomination line is confirmed and marked as transportation management relevant (i.e., freight planning needs to be carried out), a freight unit is created in the transportation management module. Immediately freight units are available on the SAP Transportation Management planning tab. The freight coordinator reviews this information and takes it forward with freight order (FOR) creation. FOR is tendered to approved truck providers and carrier assignment is made via the collaboration portal. When the traffic is high, the freight coordinator can assign load appointment time for truck liftings to prioritize shipments and avoid demurrage costs.

Truck movements are generally aggregated based on the scheduling date on a nomination line item. One nomination line can represent multiple trucks. The freight unit building rule in SAP Transportation Management is called to create the appropriate number of freight units representing each truck. And each freight unit is attached to a freight order. In the case of unit trains, a single freight order contains several freight units representing the entire train and the rail career is assigned to the freight order.

Actual load and unload weight and grade information is captured via load data capture (LDC). A freight order can be referenced to create the load/unload event on LDC. The LDC event on release creates the underlying transactions – order, delivery, goods movement, and application document. On FOR reference, LDC information is integrated with FOR to update bill of lading number, execution date, and shipment weight information.

This solution also supports splitting of the total freight cost as per individual nomination line items. For instance, when scheduling marine voyage, a nomination consists of multiple purchase and sales contracts. The total voyage cost needs to be distributed to the individual trade contract for better financial reporting. This product provides a distribution profile in the SAP Transportation Management cost distribution tab for the cost to be split to each of the contract that the nomination line item gets applied to. The details of the cost distribution are passed on to the freight settlement document (FSD). Subsequently, as per standard transportation management process, FSD leads to the creation of freight purchase order and service entry sheet for accounting integration into the ERP system.

As part of this integration model, a few new monitors have been introduced:

- Freight assignment work center (Figure 3) supports manual matching and unmatching process of FORs with LDC along with underlying validations. This allows a flexible mechanism to recover from mistakes when a wrong FOR is referenced on LDC events. The users do not need to reverse and rebook the logistics execution.

Figure 3: Freight Assignment Work Center

- Nomination integration monitor (Figure 4) is a report to monitor integration between nomination and freight order. Here you can see error logs and reprocess nomination line items that failed on integration.

Figure 4: TSW-TM Integration Monitor

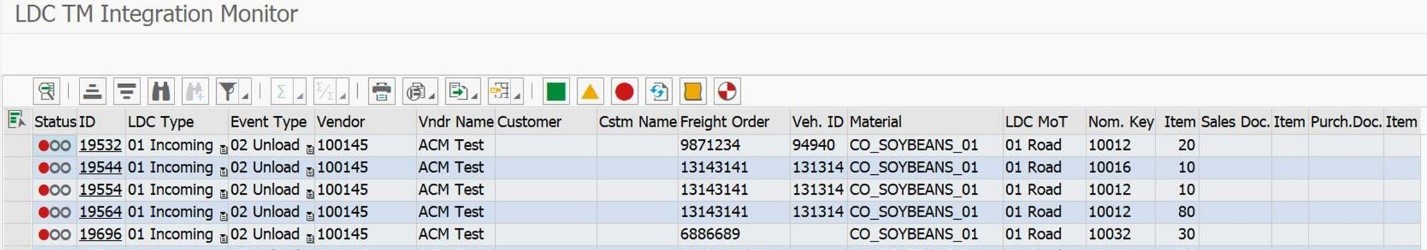

- Similarly, LDC integration monitor (Figure 5) is used to monitor integration status between LDC events and freight orders and allows for reprocessing of failed items.

Figure 5: LDC - TM Integration Monitor

Business Benefit

A key success factor in the scheduling process is the ability to make quick decisions and execute on opportunities as they arise. Integrated scheduling and transportation planning provide the much-needed agility to deal with market dynamics and changing contractual positions. The integration provided by this new product removes the day-to-day struggle between scheduler and freight coordinator to keep up with transaction processing and helps in freeing up availability to identify and execute on additional opportunities.

Early planning with freight careers based on nomination schedule provides better control on freight spend. Cost distribution profile and its integration with freight settlement process gives better insight into trade economics and promotes better decision making from the traders.

Further Reference

help.sap.com/acmtm

https://blogs.sap.com/2019/12/09/integration-between-sap-agricultural-contract-management-and-sap-tr...

https://help.sap.com/viewer/f1887ef576ef4b599f71ae32f72347be/1.0/en-US

This content was originally published on SAPinsider Online.

- SAP Managed Tags:

- Mining,

- Oil, Gas, and Energy,

- SAP Transportation Management,

- LE (Logistics Execution)

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Business Trends

169 -

Business Trends

24 -

Catalog Enablement

1 -

Event Information

47 -

Event Information

4 -

Expert Insights

12 -

Expert Insights

38 -

intelligent asset management

1 -

Life at SAP

63 -

Product Updates

500 -

Product Updates

66 -

Release Announcement

1 -

SAP Digital Manufacturing for execution

1 -

Super Bowl

1 -

Supply Chain

1 -

Sustainability

1 -

Swifties

1 -

Technology Updates

187 -

Technology Updates

17

Related Content

- Advanced Shipping and Receiving Simplifying the Connectivity in Supply Chain Management Blogs by Members

- Announcement: New integration platform in SAP Business Network for Logistics in Supply Chain Management Blogs by SAP

- Premium Hub CoE – DSC Knowledge Bits Series in Supply Chain Management Blogs by SAP

- AI-powered supply chain solutions: Better decisions, better outcomes in Supply Chain Management Blogs by SAP

- RISE with SAP Advanced Logistics Package in Supply Chain Management Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 9 | |

| 8 | |

| 5 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |