- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by SAP

- IFRS Update – 2020 H1 Publications

Financial Management Blogs by SAP

Get financial management insights from blog posts by SAP experts. Find and share tips on how to increase efficiency, reduce risk, and optimize working capital.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member18

Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

07-16-2020

9:39 AM

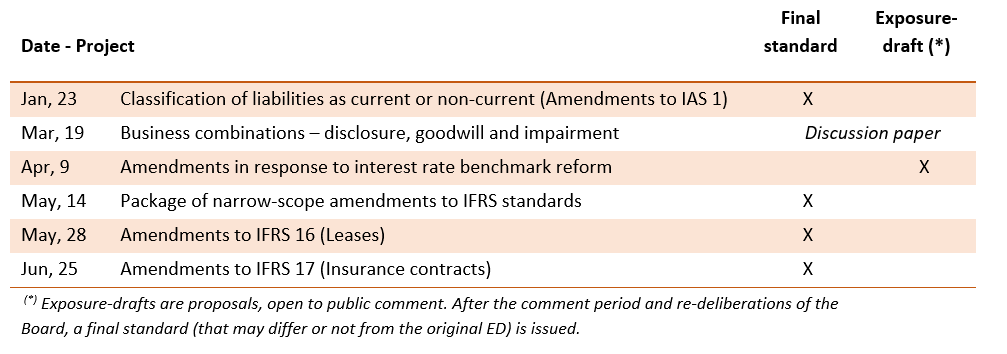

As IFRS (International Financial Reporting Standards) are evolving fast, we continue our focus on the latest IASB’s (International Accounting Standards Board) updates. Since our last blog published in January 2020, the following publications have been issued by the IASB:

Classification of liabilities (amendments to IAS 1)

The amendments clarify, not change, existing requirements regarding classification in the statement of financial position, either as current or non-current, of debt and other liabilities with an uncertain settlement date. They specify that, to classify a liability as non-current, an entity must have the right to defer settlement of the liability for at least twelve months after the reporting period and, in case where specific conditions must be met to get this right, these conditions should be met at the end of the reporting period.

Package of narrow-scope amendments to IFRS standards

The IASB published a package of minor amendments (including the annual improvement cycle) to clarify wording or correct minor consequences, oversights or conflicts between requirements in the standards. They do not call for further development.

Amendments to IFRS 16 (Leases)

In May, the IASB issued an amendment to IFRS 16 to help lessees accounting for covid-19-related rent concessions. It exempts them from requirements that normally apply in case of a change in lease payments. This amendment is immediately effective and regards covid-19-related rent concessions that reduce lease payments due on or before 30 June 2021.

Amendments to IFRS 17 (Insurance contracts)

The IASB issued amendments to IFRS 17 in response to feedback from stakeholders who complained about difficulties to implement this new standard (released in 2017). The amendments do not change the fundamental principles but simplify some requirements and defer the effective date to 2023 (instead of 2021).

Discussion paper for business combinations accounting

Discussion paper is a preliminary step for research projects before developing an exposure-draft. This research project on goodwill and impairment has been launched to consider issues identified during the PIR (post-implementation review) of IFRS 3 (Business Combinations). Three topics are particularly interesting.

Disclosures about acquisitions: Regarding disclosures, the Board proposes to add new requirements about disclosing the subsequent performance of an acquisition. These are intended to help investors understand whether the objectives that management set for an acquisition are being met. These disclosures would be more detailed and quantitative, based on metrics used in internal reporting.

Impairment vs. amortization of goodwill: A small majority of Board members (8 out of 14) prefers retaining the impairment-only model instead of reintroducing amortization of goodwill. However, they are willing to have stakeholders’ feedback on that preliminary view. They also suggest simplifying impairment tests (see below) and presenting on the balance sheet the amount of total equity excluding goodwill. Although it is simple for investors to calculate this amount, the Board considers that presenting this amount separately would give it more prominence

Simplification of the impairment test for goodwill: First, the Board proposes to remove the requirement to perform an impairment test for cash-generating units containing goodwill each year; the test will be conducted only if there is an indication that there may be an impairment. The Board also proposes to simplify the calculation of value in use.

Update of the Board’s Work Plan

The latest workplan is available here on the official IFRS website.

- SAP Managed Tags:

- SAP BusinessObjects Financial Consolidation

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

Related Content

- SAP ECC Conversion to S/4HANA - Focus in CO-PA Costing-Based to Margin Analysis in Financial Management Blogs by SAP

- Get peace of mind for evolving compliance requirements with SAP advanced compliance automation in Financial Management Blogs by SAP

- What you need to know when chosing between Co-deployment or Standalone SAP GTS, edition for SAP HANA in Financial Management Blogs by SAP

- Basis view on Upgrade / Conversion to SAP GTS E4H 2023 (GTS, ED. FOR SAP HANA 2023 in Financial Management Blogs by Members

- how to update planned quantity in public cloud? in Financial Management Q&A

Top kudoed authors

| User | Count |

|---|---|

| 3 | |

| 3 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |