- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Import Process for Free of Cost items (India Loca...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

This Blog aims to highlight the business process of procurement of Free of Cost items from international market. Such items can be supplied by foreign vendor as replacement or samples etc. however business needs to pay the custom duty, Social welfare cess and IGST on imports

To handle this type of scenario in system, purchase order is raised with minimal price of material say 0.50 & its advisable to go for separate material code to avoid any impact on valuation of original material code

Target Audience

Business Users, Key Users, Consultants

Target Industry

All

In Our Example of Import Scenario, below tax conditions are used with below combination

JCDB - IN Basic Customs (Maintained in Material pricing procedure A18001-Service/Material)

JSWC - IN: Social Welfare C (Maintained in Material pricing procedure A18001-Service/Material)

JIMD - IN: Import GST deduct (Maintained in Tax pricing procedure 0TXIN – Sales Tax India)

Test Scenario - FOC Import with IGST (Deductible)

Below Roles are used to simulate the example

Step – 1 Create Purchase Order (Import)

Role – PURCHASER; Fiori App – Create Purchase Order – Advance

Let’s assume product SP001- Bearing is supplied as free of cost by supplier 1006714. In order to entertain custom conditions, minimal gross value of material in Purchase order is maintained. Lets say its 0,20EUR

In Condition Tab, Ensure Custom Vendor is maintained for the Condition type

JCDB – IN: Basic Custom

JSWC – IN: Social Welfare C

At item level, Click on Invoice then maintain Tax code K1 – GST 18% Deductible

After Entering all the details Save the PO. In our case, PO reference is 4500020641

Step 2 - PO Approval

We are assuming automatic approval of Purchase Order

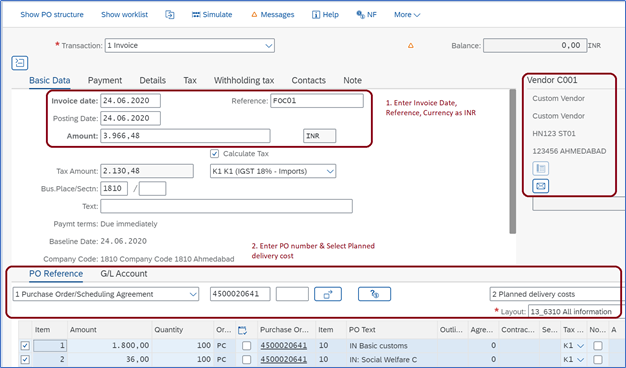

Step 3- Book Custom Supplier Invoice

Role - AP_ACCOUNTANT

Fiori App – Create Supplier Invoice – Advance

In this step, custom vendor is paid

Next step is to Enter Assessable value, Basic Custom & Social Welfare Surcharges manually as per Bill of Entry. Lets assume, here assessable value is 10000 & corrosponding BCD, SWS values are maintained manually as shown in screen shot

Ensure, selection of Tax code which is maintained in Purchase Order

In above example, Total amount payable to custom vendor is 3.966,48 as per below tax calculation

After validating all the entries, post the custom invoice. Below FI accounting entries are generated after posting it

Step 4 - Delivery of Goods

After custom clearance, next step is receive the goods in plant

Role: WAREHOUSE_CLERK

Fiori App – Post Goods Movement

Conclusion - FOC material through Import process is received in the plant

Additional Learning

Standard Import Process in SAP S/4 HANA Cloud

- SAP Managed Tags:

- localization as a self-service for SAP S/4HANA Cloud

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

29 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

27 -

Expert Insights

114 -

Expert Insights

174 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,683 -

Product Updates

251 -

Roadmap and Strategy

1 -

Technology Updates

1,500 -

Technology Updates

92

- SAP S/4HANA Cloud Public Edition Integration Extensibility FAQ-1 in Enterprise Resource Planning Blogs by SAP

- Recap of SAP S/4HANA 2023 Highlights Webinar: Sourcing and Procurement in Enterprise Resource Planning Blogs by SAP

- SAP PO- Remove Double Quotes From Sent Request in Enterprise Resource Planning Blogs by Members

- SAP Signavio Process Navigator turning 1-year old today! in Enterprise Resource Planning Blogs by SAP

- Revolutionizing Taxation: Navigating VAT in the Digital Age (ViDA) in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 29 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |