- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- SAP Central Finance – Business Processes Design vi...

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

nitin_gupta10

Active Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

06-23-2020

12:39 PM

With SAP Central Payment, we already know there will be lot of process changes will come in an organization and it is important to understand what that change means in terms of process, people, technology and most important the impact on customer (it may be indirect too). In this blog I intend to explain an summarise the changes which Central Payments bring in business processes which will then needs to be boiled out to further impact analysis and I will share the framework for the analysis.

This is more of a business & strategic steps rather just a technical step. But once activated Central Payment brings in lot of changes which we will discuss now and will also assess next steps within the framework.

Before we go to the assessment, let us understand in a simple pictorial way as how a process that was managed in a single ERP system will be split into more than ONE. Mainly the two core processes are impacted and on top of these processes, the reporting is impacted:

- Order to Cash (OtC or O2C)

- Procure to Pay (PtP or P2P)

Order to Cash

Key watch areas:

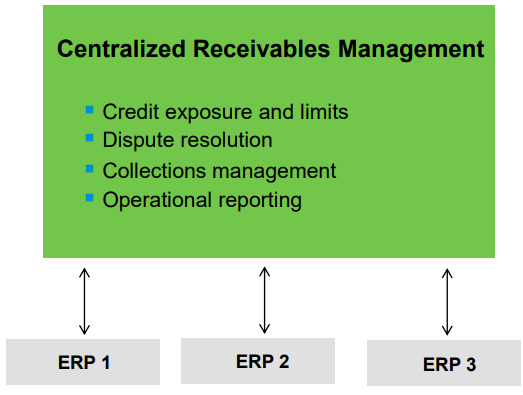

- Credit Check will be Centralised which adds benefits but at the Same time it adds risk as if there is a technical failure in connecting the two systems the credit check is not happening then Sales Order Processing will be impacted and which may result in commercial business impact as well as customer impact.

- Both systems needs to run hand in hand for end to end business process until SAP ECC is sunset as a part of long term transformation strategy

Centralised FSCM will also help in reducing the overheads as it simplifies the structure and processes from multiple ERPs to One ERP

image credit - SAP

Now let us have a view of

Procure to Pay or Source to Pay

Key Watch Areas:

If any satellite is connected like Ariba or Zycus for Vendor/Contract management, that still needs to be continued with SAP ECC. In addition, until Accounting View of Logistics Information is implemented the information related to PO etc. will not be even visible in SAP Central Finance. To rerad more on AVL – CLICK HERE

That gives a clear picture how the process is split and it is really complex to manage process in different system rather running in same system. However, that complexity can be reduced if we implement Cross System Process Control (CSPC) in SAP Central Finance scenario. Read here what it is all about.

Now do not just assume or consider it as a complexity rather it comes with lot of benefits like:

- Central open item management and reporting

- Cross-system view of customer and vendor accounts

- Real-time operational reporting with Fiori user experience

- Centralized process know-how in shared service centre & Standardize payment processes

- Centralized A/R processes like cash application, credit exposure calculations & dunning

- Reduction in bank connectivity and hence cost reduction

- HANA optimization of payment proposal generation

- Integration of Digital Payments

With implementation of Central Payment, some other dependent processes also change or get impacted. Read here in detail - PART - 1 & PART - 2

- Document changes

- Reversals

- Tax Management

- Value Added Tax (VAT)

- Deferred Tax

- Withholding Tax

- Down Payment processes

- Condition based

- Request based

- ALE IDOC Scenarios

- Asset Accounting

- Cash & Liquidity Management

- Bank Account Management

- Credit Management

- Dispute Management

- Collections Management

- Balance Carry forward

This analysis opens up the discussion for the overall transformation strategy and bring the below questions:

- Is this the interim state of the end state of transformation?

- If it is interim, how long this can be managed/continued?

- How will business benefit be quantified with this approach?

- How the end state looks like and what will be the cost benefit analysis?

- What will be the end state – Full blown SAP S/4HANA or a mix of Non-SAP systems as well?

- What will be impact on people and processes?

- What amount of change management is needed?

- What are the next steps to move?

- What will be the cost of change as well as ongoing cost?

The moment Central Payment is implemented it opens up a big bubble and demand for more futuristic vision is needed. This should not be just considered a technology change rather a business process and finance transformation which will then result in enterprise wide transformation.

Key SAP notes -

- 2827364 – Central Payment Consulting Note

- 2727394 - Handling of Historical Open Items

- 2346233 - Central Payment for SAP Central Finance: Pilot Note for Activation of Central Payment

- 2292043 - Central Finance: Enable Clearing Transfer in Source System

- 2623514 - Central Finance and Withholding Tax - SAP Notes

- 2509047 - Central Finance: Required SAP Notes to support Tax Reporting

- 2474760 - Central Payment: SD Down Payments

- 2683870 – Central Payment: MM Down Payments

Happy reading and plan well before you activate Central Payment.

also recomended to read:

SAP Central Payment - Central Tax Reporting

SAP Central Payment & SEPA Mandates

SAP Central Payment & WHT

Also view

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- ISAE 3000 for SAP S/4HANA Cloud Public Edition - Evaluation of the Authorization Role Concept in Enterprise Resource Planning Blogs by SAP

- Update of the SAP Activate Roadmap for SAP S/4HANA (on prem) upgrades with the Clean Core Strategy in Enterprise Resource Planning Blogs by SAP

- Please share the list of Business Processes in SAP PP. in Enterprise Resource Planning Q&A

- Integration of SAP Service and Asset Manager(SSAM) with SAP FSM to support S/4HANA Service Processes in Enterprise Resource Planning Blogs by SAP

- SAP Signavio Process Navigator turning 1-year old today! in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |