- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Input service distributor process and configuratio...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Input service distributor process and configuration in SAP S/4HANA Cloud

This blog provides how to configure ISD and process in SAP S/4HANA Cloud.

Target Audience

Business Users, Key Users, Consultants

Target Industry

All

Input service distributor

An Input Service Distributor is a unit who receives GST (CGST/IGST/SGST) invoices for goods and services related to its branches. It is common for HO (Corporate Office) of large manufacturing organizations to receive services related to Audit and taxation, maintenance services (ERP) on behalf of its branches. In such cases, the Invoice along with tax is raised with HO. Since HO does not have any selling activity, the tax benefit remains utilized if not passed to the respective branches. GST law gives the benefit to use the same by branches with certain conditions and rules laid down by GST law. I have tried to put the solution given by SAP for ISD and rules given by GST law.

The concept of ISD under GST is a legacy carried over from the Service Tax Regime. The government of India has laid down certain conditions and rules in order to help the entities claim ISD tax on the services rendered to the HO or corporate office as mentioned in below picture.

ISD Applicability and Rules

ISD is applicable for common services rendered at HO

Pre GST law called as service tax

HO to take a separate registration as such ISD registration number

HO (ISD) and branches should have same PAN number

Tax directly attributable to any branch, then 100% can be distributed to that particular branch

Incase distributable tax can’t be ascertained, then turnover of last year should be taken as the base of distribution.

v ISD to furnish the return in FORM GSTR-6

v Details on the tax invoice on which credit has been received

v Relating to input (Goods) and capital goods

v Relating to services where reverse charge mechanism is applicable.

SAP has given complete solution in S/4 HANA.

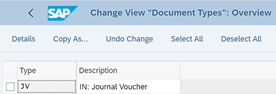

Create New document type for ISD:

Go to the below SSCUI (SSCUI ID - 101522)

Click on configure and follow the below activities

Copy the document Type JV and create new document type for ISD – ZD – “IN: ISD Invoice”

Assign new document type created to ISD invoice Doc Type

Sending and receiving business place configuration (SSCUI ID - 101911)

Multiple Receiving Business Places can be configured as pe the business requirement.

Distribution will be created as per the number of receiving business places maintained

Maintain the turnover for the receiving business place (SSCUI ID - 101912)

Click on Configure

ISD invoice posting configurations: maintain the Tax GL accounts for posting in the receiving business place (SSCUI ID - 101927)

Below configuration is used to map the Tax GL accounts to the new receiving Business Places created

ISD Process

Create a purchase order for plant 1810 – mapped to ISD business place – 1810 (Sending Business Place) & service entry sheet or Post Supplier invoice

Go to the app: “Re-distribute and Create ISD Invoices”

Distribution details: IGST credit distributed from ISD Business place to the Receiving Business place

Post distribution details

Enter tax reporting date and post the ISD invoice

ISD accounting document posted:

Note:

The fiscal year check for the distribution for the ISD formula (April to March) for India will be considered by the below configuration

Configuration App

Configuration:

- SAP Managed Tags:

- SAP S/4HANA Public Cloud

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

23 -

Expert Insights

114 -

Expert Insights

151 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

205 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

85

- Data migration approach for Open PO and Contract in Public Cloud in Enterprise Resource Planning Q&A

- How to Migrate of Product variant configuration data ? in Enterprise Resource Planning Q&A

- Quick Start guide for PLM system integration 3.0 Implementation/Installation in Enterprise Resource Planning Blogs by SAP

- Business Rule Framework Plus(BRF+) in Enterprise Resource Planning Blogs by Members

- Intercompany Execution of Services (aka "Dual Order") in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 |