- SAP Community

- Products and Technology

- Spend Management

- Spend Management Blogs by SAP

- How to add taxes to the Purchase Order sent to Ari...

Spend Management Blogs by SAP

Stay current on SAP Ariba for direct and indirect spend, SAP Fieldglass for workforce management, and SAP Concur for travel and expense with blog posts by SAP.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member52

Discoverer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

05-25-2020

9:34 PM

One of the more common requirements when it comes to what to include on the Purchase Order sent to Supplier Network is taxes.

Customer in some countries have a legal obligation to add a tax on the PO line item.

Having that, the next step is to force the vendor to include the same on the PO flipped invoice.

To Populate PO taxes in IDOC ARBCIG_ORDERS segment E1EDP04 to Ariba system

We can populate taxes To Ariba using User Exit - EXIT_SAPLEINM_002 INCLUDE ZXM06U02.

In SAP:

After implementation, this what you would see in an IDOC for material PO:

Which shows up in the user interface in the following fashion:

So a buyer, requester or a planner would see taxes in SAP:

IDOC of Service PO would look like that:

Which is represented in the UI:

Once Tax appears on the Purchase Order, to make it copied automatically to invoice business rule needs to enabled:

Customer in some countries have a legal obligation to add a tax on the PO line item.

Having that, the next step is to force the vendor to include the same on the PO flipped invoice.

To Populate PO taxes in IDOC ARBCIG_ORDERS segment E1EDP04 to Ariba system

We can populate taxes To Ariba using User Exit - EXIT_SAPLEINM_002 INCLUDE ZXM06U02.

IF int_edidd-segnam = 'E1EDP01'.

DATA:idoc_data TYPE edidd,

ls_e1edp04 TYPE e1edp04,

it_komvtab TYPE STANDARD TABLE OF komv,

is_taxcom TYPE taxcom,

es_lfa1 TYPE lfa1.

IF xekko-bsart NE 'ZSER'. “ For Po type Not Equal to Services

LOOP AT xekpo INTO DATA(is_ekpodata) WHERE ebelp = int_edidd-sdata+0(5).

is_taxcom-bukrs = xekko-bukrs.

is_taxcom-budat = xekko-aedat.

is_taxcom-bldat = xekko-aedat.

is_taxcom-waers = xekko-waers.

is_taxcom-hwaer = xekko-waers.

is_taxcom-kposn = is_ekpodata-ebelp.

is_taxcom-mwskz = is_ekpodata-mwskz.

*IS_TAXCOM-KOART = 'H'.

is_taxcom-shkzg = 'H'.

IF xekko-bstyp EQ 'F'.

is_taxcom-wrbtr = is_ekpodata-netwr.

ELSE.

is_taxcom-wrbtr = is_ekpodata-zwert.

ENDIF.

is_taxcom-xmwst = 'X'."is_ekpodata-xmwst."

is_taxcom-lifnr = xekko-lifnr.

is_taxcom-ekorg = xekko-ekorg.

is_taxcom-llief = xekko-llief.

is_taxcom-bwtar = xekpo-bwtar.

is_taxcom-txjcd = is_ekpodata-txjcd.

is_taxcom-matnr = is_ekpodata-matnr.

is_taxcom-werks = is_ekpodata-werks.

is_taxcom-matkl = is_ekpodata-matkl.

is_taxcom-meins = is_ekpodata-meins.

is_taxcom-mglme = is_ekpodata-menge.

is_taxcom-mtart = is_ekpodata-mtart.

is_taxcom-land1 = xekko-lands.

is_taxcom-ebeln = is_ekpodata-ebeln.

is_taxcom-ebelp = is_ekpodata-ebelp.

IF xekko-bstyp EQ 'F'.

is_taxcom-mglme = is_ekpodata-menge.

ELSE.

IF xekko-bstyp EQ 'K' AND is_ekpodata-abmng GT 0.

is_taxcom-mglme = is_ekpodata-abmng.

ELSE.

is_taxcom-mglme = is_ekpodata-ktmng.

ENDIF.

ENDIF.

IF is_taxcom-mglme EQ 0.

is_taxcom-mglme = 1000.

ENDIF.

*To Get Tax Calculation for PO

DATA: lv_gst_rele TYPE char1,

lo_gst_service_purchasing TYPE REF TO j_1icl_gst_service_purchasing,

lo_copypo TYPE REF TO if_ex_me_cin_mm06efko,

ls_ekpo TYPE ekpo,

ls_ekko TYPE ekko.

CLEAR:lv_gst_rele,lo_gst_service_purchasing,lo_copypo,ls_ekpo,ls_ekko.

CALL FUNCTION 'J_1BSA_COMPONENT_ACTIVE'

EXPORTING

bukrs = xekko-bukrs

component = xekko-lands "'IN'.

EXCEPTIONS

component_not_active = 1

OTHERS = 2.

IF sy-subrc = 0.

DATA is_t005 TYPE t005.

CALL FUNCTION 'SAP_TO_ISO_COUNTRY_CODE'

EXPORTING

sap_code = xekko-lands

IMPORTING

iso_code = is_t005-intca

EXCEPTIONS

not_found = 1

no_iso_code = 2

OTHERS = 3.

IF sy-subrc <> 0.

MESSAGE ID sy-msgid TYPE sy-msgty NUMBER sy-msgno

WITH sy-msgv1 sy-msgv2 sy-msgv3 sy-msgv4.

ENDIF.

* CALL METHOD cl_exithandler=>get_instance

* CHANGING

* instance = me_copypo.

*

* CALL METHOD me_copypo->me_cin_copy_po_data

* EXPORTING

* flt_val = t005-intca

* y_ekpo = ekpo.

ls_ekpo = is_ekpodata.

ls_ekko = xekko.

CALL METHOD cl_exithandler=>get_instance

EXPORTING

exit_name = 'ME_CIN_MM06EFKO'

null_instance_accepted = 'X'

CHANGING

instance = lo_copypo.

IF NOT lo_copypo IS INITIAL.

CALL METHOD lo_copypo->me_cin_copy_po_data

EXPORTING

flt_val = is_t005-intca

y_ekpo = ls_ekpo.

ENDIF.

*** GST India ---------------------------------------------------------------*

***Check if Company Code Country is India

CALL FUNCTION 'J_1BSA_COMPONENT_ACTIVE'

EXPORTING

bukrs = ls_ekko-bukrs

component = 'IN'

EXCEPTIONS

component_not_active = 1

OTHERS = 2.

IF sy-subrc EQ 0.

DATA:im_gst_rele TYPE char1.

CLEAR im_gst_rele.

CALL FUNCTION 'J_1IG_DATE_CHECK'

IMPORTING

ex_gst_rele = im_gst_rele.

IF im_gst_rele EQ 'X'.

*PASS EKKO and EKPO to pricing

CALL FUNCTION 'J_1IG_PASS_EKKO_EKPO'

EXPORTING

im_ekko = ls_ekko

im_ekpo = ls_ekpo.

*** Begin of note 2444868

*DATA lo_gst_service_purchasing TYPE REF TO j_1icl_gst_service_purchasing.

lo_gst_service_purchasing = j_1icl_gst_service_purchasing=>get_instance( ).

lo_gst_service_purchasing->extend_mm06efko_kond_taxes( ls_ekpo ).

*** End of note 2444868

ENDIF.

ENDIF.

ENDIF.

CALL FUNCTION 'CALCULATE_TAX_ITEM'

EXPORTING

anzahlung = 'X'

i_taxcom = is_taxcom

* IMPORTING

* E_NAVFW =

* E_TAXCOM =

* E_XSTVR =

* NAV_ANTEIL =

TABLES

t_xkomv = it_komvtab

EXCEPTIONS

mwskz_not_defined = 1

mwskz_not_found = 2

mwskz_not_valid = 3

steuerbetrag_falsch = 4

country_not_found = 5

txjcd_not_valid = 6

amounts_too_large_for_tax = 7

OTHERS = 8.

IF sy-subrc <> 0.

* Implement suitable error handling here

ENDIF.

*To Populate tax data to Idoc Segment

LOOP AT it_komvtab ASSIGNING FIELD-SYMBOL(<fs_komvtab>) WHERE kschl NE 'BASB'.

"KNTYP = D or KNTYP ne space

ls_e1edp04-mwskz = is_taxcom-mwskz. "<fs_komvtab>-mwsk1.

IF <fs_komvtab>-kbetr IS NOT INITIAL.

ls_e1edp04-msatz = <fs_komvtab>-kbetr / 10.

ENDIF.

ls_e1edp04-mwsbt = <fs_komvtab>-kwert.

ls_e1edp04-txjcd = <fs_komvtab>-kschl.

SELECT SINGLE vtext FROM t685t INTO ls_e1edp04-ktext WHERE spras = 'E' AND kschl = <fs_komvtab>-kschl.

CONDENSE:ls_e1edp04-mwskz, ls_e1edp04-msatz, ls_e1edp04-mwsbt, ls_e1edp04-txjcd, ls_e1edp04-ktext NO-GAPS.

idoc_data-segnam = 'E1EDP04'.

idoc_data-sdata = ls_e1edp04.

APPEND idoc_data TO int_edidd[].

CLEAR : ls_e1edp04,idoc_data.

ENDLOOP.

REFRESH:it_komvtab.CLEAR:is_taxcom.

ENDLOOP.

ELSE. "Logic To Calculate tax for Service POS

DATA(it_ekpoitem) = xekpo[].

DELETE it_ekpoitem WHERE ebelp NE int_edidd-sdata+0(5).

SELECT * FROM esll INTO TABLE @DATA(it_esll1) FOR ALL ENTRIES IN @xekpo[]

WHERE packno = @xekpo-packno.

IF sy-subrc = 0.

SELECT * FROM esll INTO TABLE @DATA(it_esll2) FOR ALL ENTRIES IN @it_esll1

WHERE packno = @it_esll1-sub_packno.

IF sy-subrc = 0.

*To GET TAXTARIFFCODE

SELECT * FROM asmd INTO TABLE @DATA(it_asmd) FOR ALL ENTRIES IN @it_esll2

WHERE asnum = @it_esll2-srvpos.

IF sy-subrc = 0.

READ TABLE it_ekpoitem[] INTO DATA(is_werks) INDEX 1.

SELECT SINGLE * FROM t001w INTO @DATA(is_t001w) WHERE werks = @is_werks-werks.

CALL FUNCTION 'LFA1_READ_SINGLE'

EXPORTING

id_lifnr = xekko-lifnr

*ID_CVP_BEHAVIOR =

IMPORTING

es_lfa1 = es_lfa1

EXCEPTIONS

not_found = 1

input_not_specified = 2

lifnr_blocked = 3

OTHERS = 4.

IF sy-subrc <> 0.

* Implement suitable error handling here

ENDIF.

*Condition Table this will differ from Customer to Customer

SELECT * FROM A900 INTO TABLE @DATA(it_a900) FOR ALL ENTRIES IN @it_asmd

WHERE kappl = 'TX' AND lland = @is_t001w-land1 AND regio = @es_lfa1-regio AND wkreg = @is_t001w-regio AND taxim = @it_asmd-taxim AND mwskz = @is_werks-mwskz AND steuc = @it_asmd-taxtariffcode.

IF sy-subrc = 0.

SELECT * FROM konp INTO TABLE @DATA(it_konp) FOR ALL ENTRIES IN @it_a900

WHERE knumh = @it_a900-knumh.

LOOP AT it_esll2 INTO DATA(is_esll2).

*TO GET TAXIM

READ TABLE it_asmd INTO DATA(is_amd) WITH KEY asnum = is_esll2-srvpos.

IF sy-subrc = 0.

LOOP AT it_a900 INTO DATA(is_a900) WHERE steuc = is_esll2-taxtariffcode AND

mwskz = is_werks-mwskz.

READ TABLE it_konp INTO DATA(is_konp) WITH KEY knumh = is_a900-knumh.

IF sy-subrc = 0.

*w_netpr = ( ( is_esll2-netwr * ( is_konp-kbetr / 10 ) ) / 100 ).

ls_e1edp04-mwskz = is_werks-mwskz.

IF is_konp-kbetr IS NOT INITIAL.

ls_e1edp04-msatz = is_konp-kbetr / 10.

ENDIF.

ls_e1edp04-mwsbt = ( is_esll2-netwr * ls_e1edp04-msatz ) / 100.

ls_e1edp04-txjcd = is_konp-kschl.

SELECT SINGLE vtext FROM t685t INTO ls_e1edp04-ktext WHERE spras = 'E' AND

kschl = is_konp-kschl.

CONDENSE:ls_e1edp04-mwskz, ls_e1edp04-msatz, ls_e1edp04-mwsbt, ls_e1edp04-txjcd, ls_e1edp04-ktext NO-GAPS.

idoc_data-segnam = 'E1EDP04'.

idoc_data-sdata = ls_e1edp04.

APPEND idoc_data TO int_edidd[].

CLEAR : ls_e1edp04,idoc_data.

ENDIF.

ENDLOOP.

ENDIF.

ENDLOOP.

ENDIF.

ENDIF.

ENDIF.

ENDIF.

ENDIF.

ENDIF.

MATERIAL PO

In SAP:

After implementation, this what you would see in an IDOC for material PO:

Which shows up in the user interface in the following fashion:

SERVICE PO

So a buyer, requester or a planner would see taxes in SAP:

IDOC of Service PO would look like that:

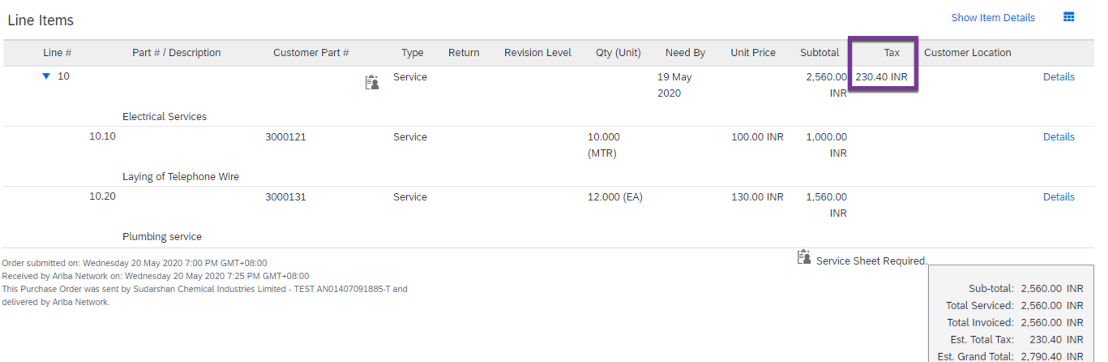

Which is represented in the UI:

Once Tax appears on the Purchase Order, to make it copied automatically to invoice business rule needs to enabled:

Conclusion

In General Most of the customers needs to populate PO tax details from S/4 to Ariba Network, So by following the above process you can be able to send PO tax details in IDOC segment which we can map it in Ariba Network.

Labels:

4 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Business Trends

113 -

Business Trends

10 -

Event Information

44 -

Event Information

2 -

Expert Insights

18 -

Expert Insights

24 -

Life at SAP

32 -

Product Updates

253 -

Product Updates

25 -

Technology Updates

82 -

Technology Updates

13

Related Content

- SAP Ariba Procure to Order 2405 Release Key Innovations in Spend Management Blogs by SAP

- SAP Ariba Supplier Management 2405 Release Key Innovations Preview in Spend Management Blogs by SAP

- SAP Ariba Source to Contract 2405 Release Key Innovations in Spend Management Blogs by SAP

- Workflow Email notification in CP in Spend Management Q&A

- Restrict Remit To field in BN Invoice in Spend Management Q&A