- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Understanding Currency Translation process in SAP ...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Purpose of this blog post is to understand the currency translation process from the Business and from SAP S/4HANA Finance for group reporting perspective.

What will you learn from this blog post?

From this blog post, you will be able to understand:

- Overview of currency Translation from Business process side.

- How SAP S/4HANA Finance for group reporting does currency translation?

- System set up for currency translation in SAP S/4HANA Finance for group reporting

- Explanation of currency translation calculation with example.

Overview of Currency translation

In today’s world, most of the companies operate across the globe. Many companies such a coca cola, cisco, SAP etc. operate globally. They might operate directly or through branches or invest in subsidiaries.

When a company has 1 or more subsidiary, it is under legal obligation to prepare the consolidated financial statements (CFS).

There can be 2 cases while preparing the CFS

- Holding and subsidiary has same reporting currency

- Holding and subsidiary has different reporting currency

For case 1 it is simple - we can combine the values and prepare CFS. But how to prepare CFS for case 2?

In order to prepare CFS for case 2, we will have to translate the Financial statement of subsidiary company in to Holding company currency and then start the consolidation activities, such as elimination of intercompany transactions, share capital, investments, goodwill calculation etc.

International Accounting Standard has laid down the guidelines on how a foreign subsidiary financial statement needs to be translated in to holding company reporting currency.

During the part of this translations, there might be a chances of rounding differences. These rounding differences are adjusted to Currency Translation Adjustment (CTA) account.

General guidelines on how to do the translation is as below:

| Item | Trans Type | How to Translate |

Non historic Balance sheet items | Opening | The opening balance is translated using the closing rate of the previous year. |

| Movements | The movements of the period are translated using the average rate. | |

| Currency differences | The currency difference is recorded on a CTA transc type on the original fs item. | |

Historic balance sheet items | The opening balance remains unchanged from the previous year. | |

| The movements of the period are translated using the average rate. | ||

| The currency difference is recorded on a CTA transc type and a CTA FS item. | ||

Profit & Loss A/Cs | Movements | Translation using the average rate. |

Currency differences | The currency difference is recorded on a CTA ttype and a CTA fs item |

SAP S/4HANA Finance for group reporting - Currency Translation

SAP S/4HANA Finance for group reporting is the newest tool embedded in SAP S/4HANA providing statutory as well as managerial financial consolidation capabilities for both On-Premise and Cloud customers. It provides the feature to translate the foreign subsidiary operations to holding company reporting currency values.

SAP S/4HANA Finance for group reporting has given the flexibility of translating the financial statements of consolidation units.

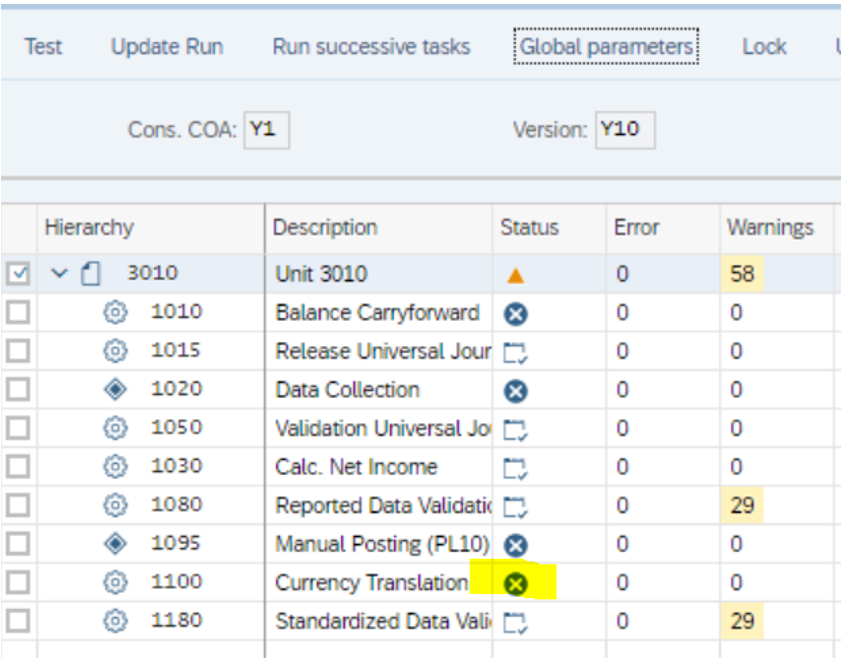

In SAP S/4HANA Finance for group reporting, we have majorly two activities, Data Monitor and Consolidation Monitor. Activities performed under data Monitor and consolidation monitor are called tasks.

Currency translation task is part of Data Monitor.

System set up for currency translation in SAP S/4HANA Finance for group reporting

a) Configuration points for currency translation:

Below screen shot shows the important configuration steps involved with currency translation in group reporting

- Define exchange rate indicators – here you define an exchange rate indicator and map the exchange rate type that will be used for this indicator.

- Define currency translation methods – We have some pre-delivered translation methods. These methods are assigned to the consolation units.

Within this method, it is defined which currency translation attribute will use which exchange rate indicator.

Within this method, it is defined which currency translation attribute will use which exchange rate indicator.

These currency translation attributes are mapped to the FS items.

- Specify translation ratio – This setting is same as that we use for SAP S/4HANA Finance. Here we maintain the translation ratio between different currencies.

- Maintain exchange rate – This is same setting as transaction code OB08. Here we maintain the exchange rate for different combination of currencies

Important Master data settings for currency translation

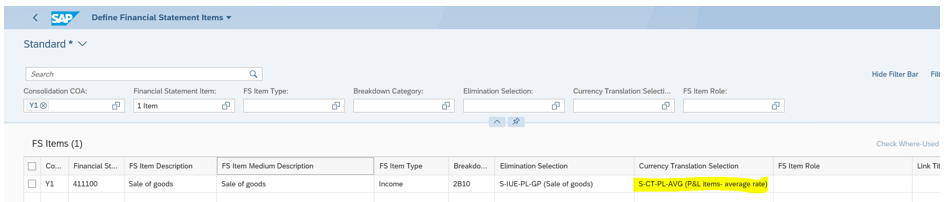

- Map FS item to currency translation attribute.

In SAP S/4HANA Finance for group reporting each GL account is mapped to a FS item. This FS item has its own master data settings in the form of different attributes mapped to it i.e. elimination attribute etc.

One such attribute is “Currency Translation”. Based on the currency translation attribute mapped to the FS item, the exchange rate type and exchange rate is identified for translation.

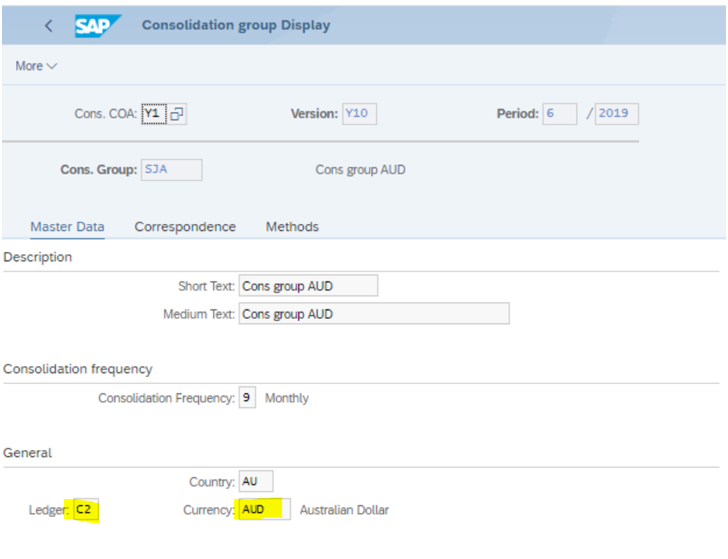

2. Mapping of currency to Consolidation ledger.

3. Mapping of currency to the consolidation group

4. Mapping of currency & integration currency to consolidation Unit.

5. Mapping of translation method to consolidation Unit

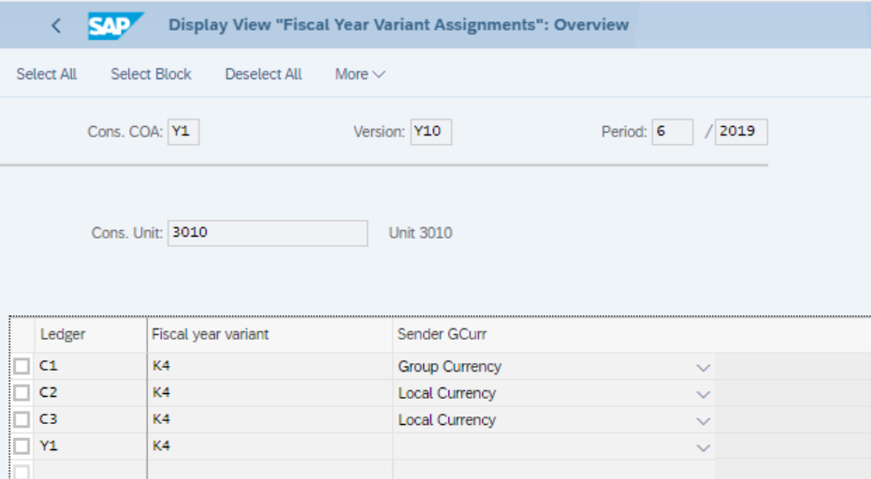

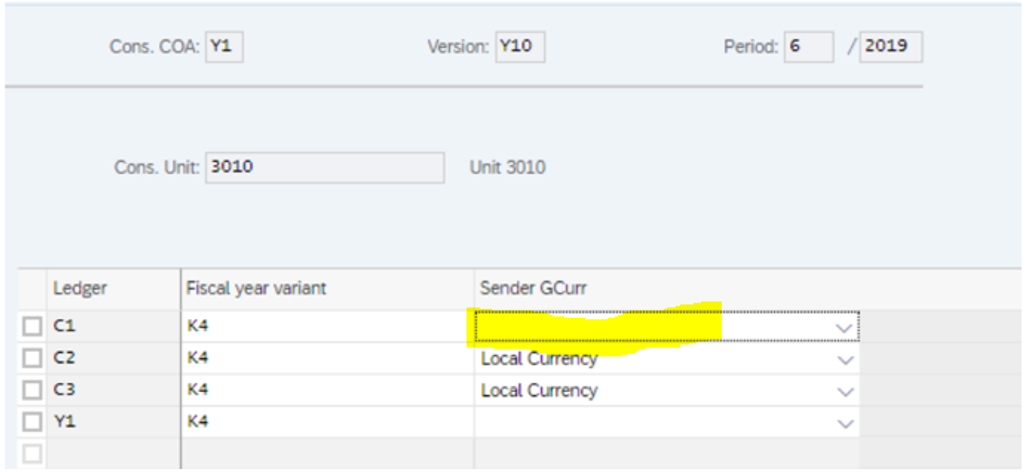

6. Mapping of sender currency for consolidation ledger in consolidation Unit

Currency translation result is determined based on different combination of above master data settings.

Here I have taken 2 different combinations and showed how the settings impact the value for amount in group currency and the currency translation task.

Example 1:

Company code 3010 in SAP S/4HANA Finance is having local currency as AUD & Group currency as SGD. For consolidation purpose it needs the group currency to be AUD.

| Consolidation ledger | C2 |

| Consolidation Ledger currency | AUD |

| Consolidation group currency | AUD |

| Consolidation unit currency | AUD |

| Sender group currency for consolidation ledger in consolidation unit | Local currency |

In this case, currency translation task will not execute any translation. Since we have indicated system to use the local currency (i.e. AUD) coming from ACDOCA as consolidation group currency

Hence while executing the release universal journal task in SAP S/4HANA Finance for group reporting system will update the column for amount in group currency

When we execute check the data monitor for currency translation task, we notice that this task is marked as X. This is because values are already available in group currency and no new calculation needs to be done.

Example 2:

Company code 3010 in SAP S/4HANA Finance is having local currency as AUD & Group currency as SGD

For consolidation purpose it needs the group currency to be SGD. Since the group currency in ACDOCA is also SGD we have an option to bring the values of ACDOCA group currency in S/4HANA Group Reporting.

| Consolidation ledger | C1 |

| Consolidation Ledger currency | SGD |

| Consolidation group currency | SGD |

| Consolidation unit currency | AUD |

| Sender group currency for consolidation ledger in consolidation unit | Group currency |

While executing the release universal journal task in SAP S/4HANA Finance for group reporting system will update the column for amount in group currency.

However, in this example the currency translation will still take place even though we have for amount in group currency coming from ACDOCA. This is because the consolidation ledger currency is SGD and in group reporting we can have different methods and rates for translation.

Explanation on the calculation of currency translation

A) When sender group currency is blank in consolidation unit.

To explain the calculation, I have taken below set of data:

| Consolidation Ledger currency | SGD |

| Consolidation unit currency | AUD |

| Sender currency for the consolidation ledger | Blank |

| PL FS item | 652000 |

| BS FS item | 111100 |

Since the "Sender group currency" is blank, while executing the release universal journal task amount in group currency is not updated.

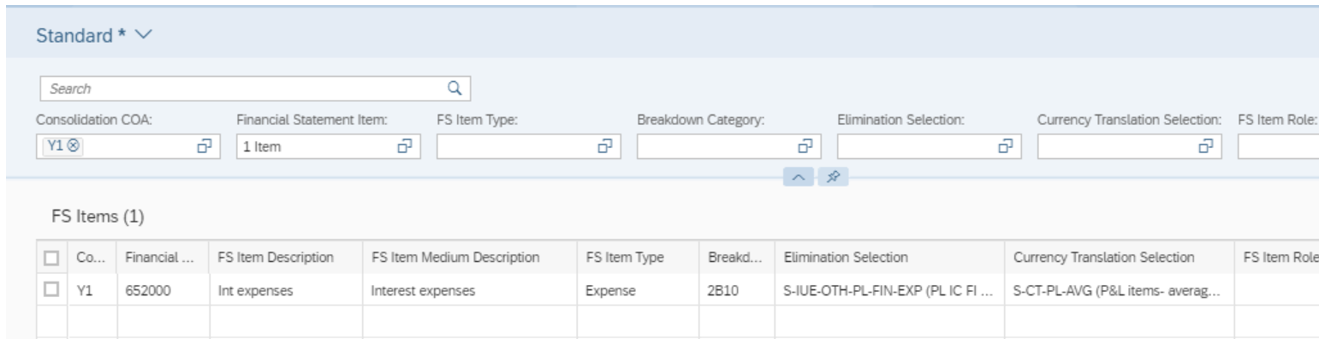

Based on the currency translation attribute mapped to the FS item the exchange rate for the currency translation is determined.

Example 1: FS item 652000 - PL FS item

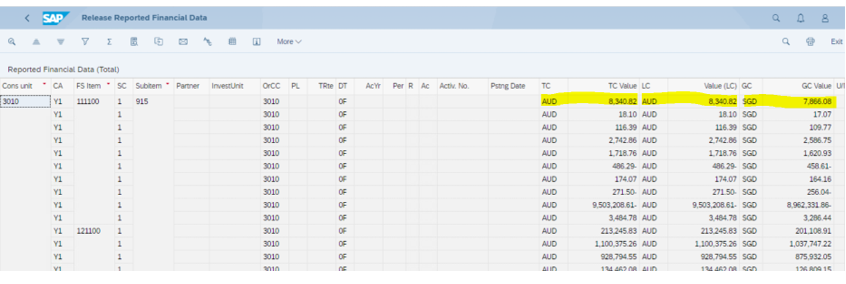

Data posted in ACDOCU table during release universal journal task for this FS item is as below. Here if you notice the last column there is no value updated, since the sender group currency was set as blank in consolidation unit.

The currency translation for this FS item has given below results.

Currency translation attribute mapped to this FS item is “S-CT-PL-AVG”

Exchange rate indicator for this currency translation attribute is A (AVG rate)

Amount in local and group currency for this FS item after currency translation is as below.

Below table shows how different amounts are calculated during the currency translation task:

Example 2: FS item 111100 – B/S FS item.

Data posted in ACDOCU table during release universal journal task for this FS item is as below. Here if you notice the last column there is no value updated, since the sender group currency was set as blank in consolidation unit.

The currency translation for this FS item has given below results.

Currency translation attribute mapped to this FS item is “S-CT-BS-CLO”

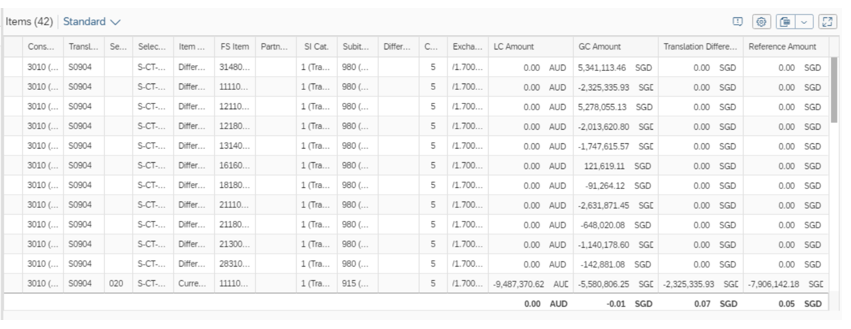

Here the FS item has currency translation elimination as S-CT-BS-CLO . Based on the account assignment configuration setting for the currency translation method selection, the debit and credit posting for the currency translation is updated on the same FS item or different FS item . In the above example for FS item 111100 the account assignment field is blank hence there is a dr 2325335.93 and cr 2325335.93 to the same FS item where it originated i.e 111100. Hence the balance for this FS item with this account assignment setting is seen to be at closing rate i.e 7906142.18

If you change the account assignment mapping in the currency translation attribute to post to a different FS item system will post the second leg of the adjustment entry to different account. e.g In below screen shot you can see that we have changed the account assignment FS item as 314800. This is for the currency attribute selection for the balance sheet item 111100

Now when we execute the currency translation and check the posting on the FS item 111100 only we don't see the cr entry since it is now posted to FS item 314800. hence the balance for this FS item is seen as 5580806.25

B. When sender group currency is “group currency” in consolidation unit.

To explain the calculation, I have taken below set of data

| Consolidation Ledger currency | SGD |

| Consolidation unit currency | AUD |

| Sender currency for the consolidation ledger | Group currency |

| PL FS item | 652000 |

| BS FS item | 111100 |

In this example the "Sender group currency" is set as Group currency. While executing the release universal journal task amount in group currency will be updated with the values from the ACDOCA table.

In this example even though we had the amount in group currency coming from ACDOCA table, currency translation will still be executed since there is difference in the exchange rate in SAP S/4HANA Finance and in SAP S/4HANA Finance for group reporting.

Based on the currency translation attribute mapped to the FS item the exchange rate for the currency translation is determined.

Example 1: FS item 652000 - PL FS item

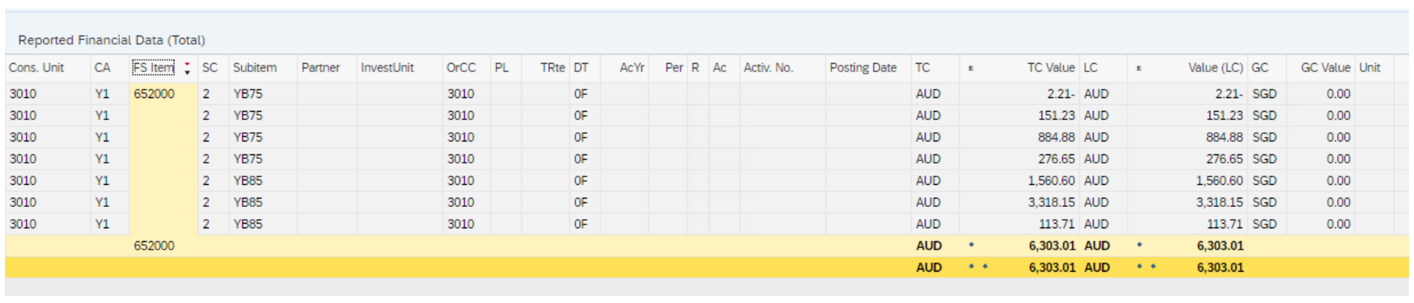

Data posted in ACDOCU table during release universal journal task for this FS item is as below. Here if you notice the last column amount in group currency is already updated.

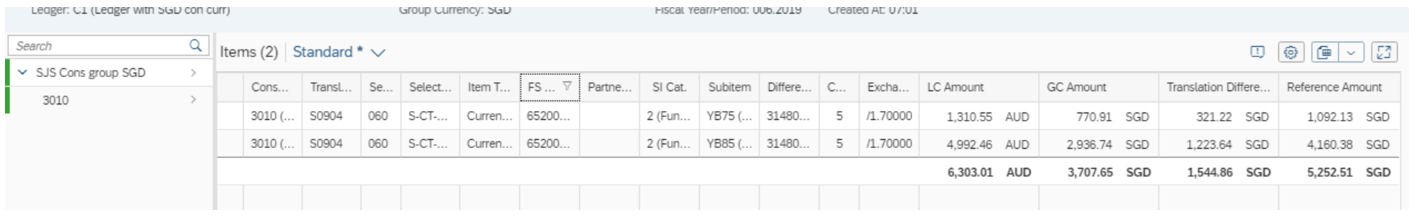

The currency translation for this FS item has given below results.

Currency translation attribute mapped to this FS item is “S-CT-PL-AVG”

Exchange rate indicator for this currency translation attribute is A (AVG rate)

Amount in local and group currency for this FS item after currency translation is as below.

Now we shall analyze data only for FS item 652000 with functional area YB75

Here we analyze data only for FS item 652000 with functional area YB85

Example 2: FS item 111100 – B/S FS item.

Data posted in ACDOCU table during release universal journal task for this FS item is as below. Here if you notice the last column amount in group currency is already updated.

The currency translation for this FS item has given below results.

Currency translation attribute mapped to this FS item is “S-CT-BS-CLO”

Here the FS item has currency translation elimination as S-CT-BS-CLO . As seen above since the account assignment mapped to the currency translation attribute for this FS item 111100 is blank, both dr and cr entry is posted to the originating FS item i.e 111100. Hence , the net total of amount in group currency for this FS item is seen at closing rate i.e 7906142.18

Final note:

From above examples you can notice that amount in group currency varies based on different settings and options that user updates in the master data as well as in the configuration.

This is not an exhaustive list of scenarios however a small attempt to give some insight how currency translation works in SAP S/4HANA Finance for group reporting. Hope this blog post helps you understand the same.

Special mention and thanks

To my colleagues Gayathri & Prasad who helped me with this first blog post.

- SAP Managed Tags:

- SAP S/4HANA Finance for group reporting,

- SAP S/4HANA,

- SAP S/4HANA Finance

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

23 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

158 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

219 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

- FAQ on Upgrading SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Environment, Health and Safety in SAP S/4HANA Cloud Public Edition 2402 in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 2 in Enterprise Resource Planning Blogs by SAP

- Step-by-Step Guide: Creating a Custom Migration Object: SAP QM Certificate Profile in Enterprise Resource Planning Blogs by Members

- Streamline Your Journey to the Cloud with the RISE with SAP Methodology in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 13 | |

| 11 | |

| 10 | |

| 7 | |

| 7 | |

| 6 | |

| 5 | |

| 5 | |

| 4 | |

| 4 |