- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- PREDICTIVE ACCOUNTING IN SAP S/4HANA 18.09 Part 1

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

ihsen_abroug2

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

04-22-2020

3:59 PM

SAP has introduced Predictive Accounting in S/4 HANA 18.09,

In this Blog i'll cover the main configuration steps and dive into hands on process flow with detailed explanation of predictives postings to the extension leder

As the prediction needs to be always up to date, I'll demonstrate how predictives are automatically adjusted and updated when changes occurs on the original document used as basis for the prediction

The impact of actual document at the moment of good issue and customer invoice on predictive accounting will be detailed on an upcoming part2 of this blog

Create Ledger ‘ZS’ as Extended ledger for prediction and commitments

Assign Company code ‘FR01’ to the ledger ‘ZS’

Assign Accounting principles to the corresponding Ledger

In dedicated table FINSV_PRED_RLDNR we have to add entry for the ledger used for prediction

Use SM30 transaction to add the entry

In this Customizing activity, you enable the creation of Predictive Accounting journal entries. This allows for management analyses based on accounting-specific characteristics, such as G/L accounts or posting periods.

The Predictive Accounting journal entries are based on simulated customer invoices for predefined sales scenarios.

For the corresponding controlling area, we activate the predictive Accounting for Incoming sales orders

Transaction code: FINS_PRED_INC_SO_ACT

In this step, we maintain the relevant billing types for predictive accounting

Use SM30 transaction to add relevant billing types to dedicated table FINSV_PRED_FKART

In this step, we maintain the relevant items categories for predictive accounting

Use SM30 transaction to add relevant Items categories in dedicated table FINSV_PRED_FKREL

In the following, we'll create process flow for predictive accounting for incoming sales order, we'll check predictives postings for the planned values on the extension ledger and actual values on leading Ledger

We'll see how the postings in both ledgers are synchrinized to reflect the predictive and the actual economic effects

Create sales order with sales item category in the scope of the defined customizing for predictive accounting

Sales Order pricing details

As explained before, as soon as the sales order in created, the predictive accounting simulates predictive Goods Issue, predictive COGS and predictive Customer Invoice and posted corresponding to extension ledger

We recognize 3 documents with 3 different Business transaction types, corresponding to simulated Good Issue, Simulated COGS and simulated Customer Invoice

In SAP S/4HANA 18.09, 2 apps are available for Predictive Accounting

Let's check Gross Margin app (Presumed/Actual)

For demonstration purpose we restricted the section to our sales order

In real live, the app displays all Actual/Planned for the period range with graphical chart and items as the following

We can select from many types of available chart view

Predictions needs to be up to date, means any change in the sales order must be reflected in the predictive accounting,

The system resimulate the process steps and replace the predictive values, dates and characteristics

Lets see the impact of changing existing sales order

As described above our predicted customer invoice posting is the folowing:

Let’s change conditions for our order 8649975

PR00 price condition changed from 100 Euros to 120 Euros, now order amount is 2160 Euros

Lets see the impact on Sales Predictive Accounting

Now we have 2 additional new documents prosted to the extension ledger

Lets check again KPI in Gross Margin app

--> Prediction are resimulated and the app shows updated prediction based on current sales order values and characterestics

In upcoming part 2 of this Blog i'll show the impact of posting Good Issue and Customer Invoice on the predictive accounting and we'll see how to use FIORI Apps to monitor Planned and Actual data

Please feel free to comment

References:

https://www.sap.com/assetdetail/2018/08/383436e6-177d-0010-87a3-c30de2ffd8ff.html

https://blogs.sap.com/2018/10/16/predictive-accounting-in-sap-s4hana-1809-a-foundation-for-intellige...

https://blogs.sap.com/2019/05/13/predictive-accounting-for-incoming-sales-orders-in-s4hana/

Best regards

Ihsen ABROUG

In this Blog i'll cover the main configuration steps and dive into hands on process flow with detailed explanation of predictives postings to the extension leder

As the prediction needs to be always up to date, I'll demonstrate how predictives are automatically adjusted and updated when changes occurs on the original document used as basis for the prediction

The impact of actual document at the moment of good issue and customer invoice on predictive accounting will be detailed on an upcoming part2 of this blog

1 Customizing

1.1 Define Settings for Ledgers and Currency Types

Create Ledger ‘ZS’ as Extended ledger for prediction and commitments

Assign Company code ‘FR01’ to the ledger ‘ZS’

Assign Accounting principles to the corresponding Ledger

1.2 Define Predictive Ledger

In dedicated table FINSV_PRED_RLDNR we have to add entry for the ledger used for prediction

Use SM30 transaction to add the entry

1.3 Activate Predictive Accounting for Incoming Sales Orders

In this Customizing activity, you enable the creation of Predictive Accounting journal entries. This allows for management analyses based on accounting-specific characteristics, such as G/L accounts or posting periods.

The Predictive Accounting journal entries are based on simulated customer invoices for predefined sales scenarios.

For the corresponding controlling area, we activate the predictive Accounting for Incoming sales orders

Transaction code: FINS_PRED_INC_SO_ACT

1.4 Assign Billing Types for Predictive Accounting

In this step, we maintain the relevant billing types for predictive accounting

Use SM30 transaction to add relevant billing types to dedicated table FINSV_PRED_FKART

1.5 Maintain SD item categories for Predictive Accounting

In this step, we maintain the relevant items categories for predictive accounting

Use SM30 transaction to add relevant Items categories in dedicated table FINSV_PRED_FKREL

2 Business Process Flow

In the following, we'll create process flow for predictive accounting for incoming sales order, we'll check predictives postings for the planned values on the extension ledger and actual values on leading Ledger

We'll see how the postings in both ledgers are synchrinized to reflect the predictive and the actual economic effects

2.1 Create Sales Order

Create sales order with sales item category in the scope of the defined customizing for predictive accounting

Sales Order pricing details

2.1.1 Predictive Postings

As explained before, as soon as the sales order in created, the predictive accounting simulates predictive Goods Issue, predictive COGS and predictive Customer Invoice and posted corresponding to extension ledger

We recognize 3 documents with 3 different Business transaction types, corresponding to simulated Good Issue, Simulated COGS and simulated Customer Invoice

2.1.1.1 Predictive Good Issue

2.1.1.2 Predictive COGS Splitting

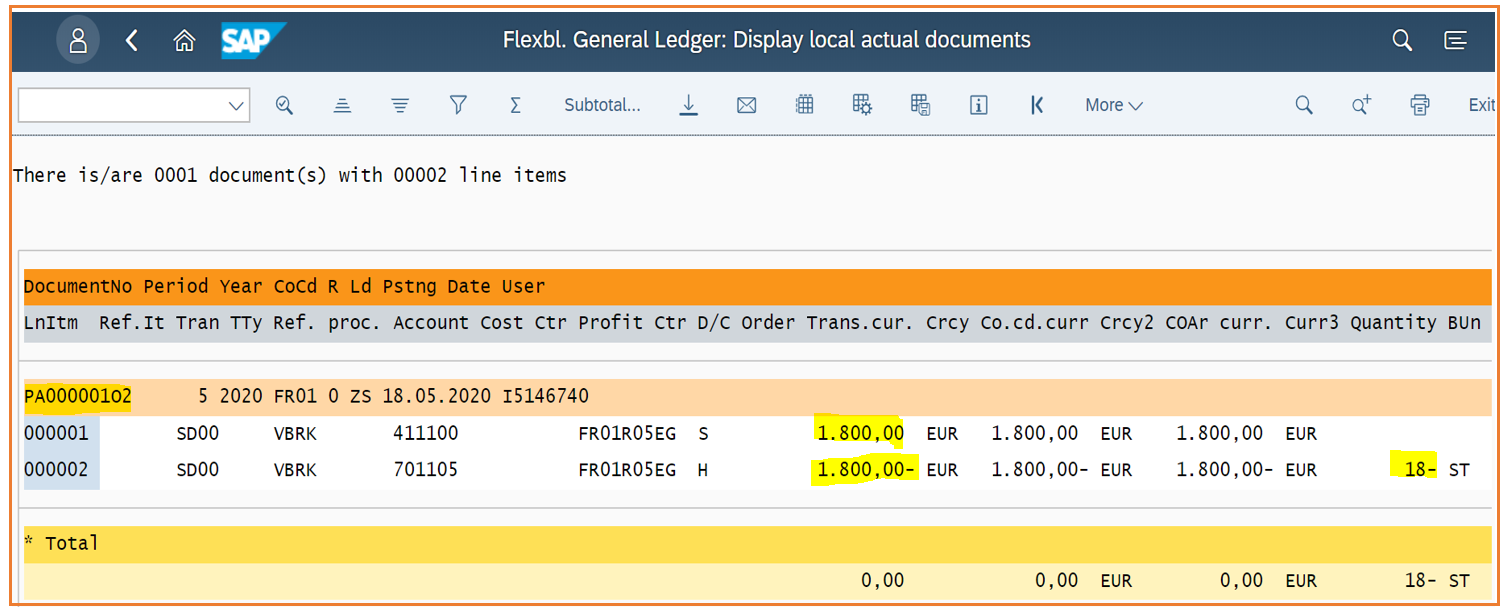

2.1.1.3 Predictive Customer Invoice

2.1.2 Predictive KPI

In SAP S/4HANA 18.09, 2 apps are available for Predictive Accounting

Let's check Gross Margin app (Presumed/Actual)

For demonstration purpose we restricted the section to our sales order

In real live, the app displays all Actual/Planned for the period range with graphical chart and items as the following

We can select from many types of available chart view

2.2 Change Sales Order

Predictions needs to be up to date, means any change in the sales order must be reflected in the predictive accounting,

The system resimulate the process steps and replace the predictive values, dates and characteristics

Lets see the impact of changing existing sales order

As described above our predicted customer invoice posting is the folowing:

Let’s change conditions for our order 8649975

PR00 price condition changed from 100 Euros to 120 Euros, now order amount is 2160 Euros

Lets see the impact on Sales Predictive Accounting

Now we have 2 additional new documents prosted to the extension ledger

- The First additional one is reversion document of the outdated original one, --> Both documents are balancing zero

- The Second additional document is the new created prediction document carrying all sales order data at last save, in our example the new price

Lets check again KPI in Gross Margin app

--> Prediction are resimulated and the app shows updated prediction based on current sales order values and characterestics

In upcoming part 2 of this Blog i'll show the impact of posting Good Issue and Customer Invoice on the predictive accounting and we'll see how to use FIORI Apps to monitor Planned and Actual data

Please feel free to comment

References:

https://www.sap.com/assetdetail/2018/08/383436e6-177d-0010-87a3-c30de2ffd8ff.html

https://blogs.sap.com/2018/10/16/predictive-accounting-in-sap-s4hana-1809-a-foundation-for-intellige...

https://blogs.sap.com/2019/05/13/predictive-accounting-for-incoming-sales-orders-in-s4hana/

Best regards

Ihsen ABROUG

- SAP Managed Tags:

- SAP S/4HANA Finance

3 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- SAP ERP Functionality for EDI Processing: UoMs Determination for Inbound Orders in Enterprise Resource Planning Blogs by Members

- Advanced WIP reporting in S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- S4 HANA Cost Center Activity Rate Calculation Hybrid Approach in Enterprise Resource Planning Blogs by Members

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 2 in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Public Edition: the Right Cloud ERP Solution for Your Business in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |