- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- IAS 20 - Grants Accounting (SAP FI/GM)

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member46

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

04-15-2020

2:13 PM

Introduction:

For the past few years I have been involved in Implementing SAP FICO, PSM-FM (Funds Management) and GM (Grant Management) in different organizations. Today I wanted to share my experience with respect to the Accounting for Grants including Expenditure on Grants and Grant Amortizations.

Overview of IAS 20:

IAS 20 Accounting for Grants and Disclosure outlines how to account for government grants and other assistance. Grants are recognized in profit or loss on a systematic basis over the periods in which the entity recognizes expenses for the related costs for which the grants are intended to compensate, which in the case of grants related to assets requires setting up the grant as deferred income or deducting it from the carrying amount of the asset.

Accounting Entries:

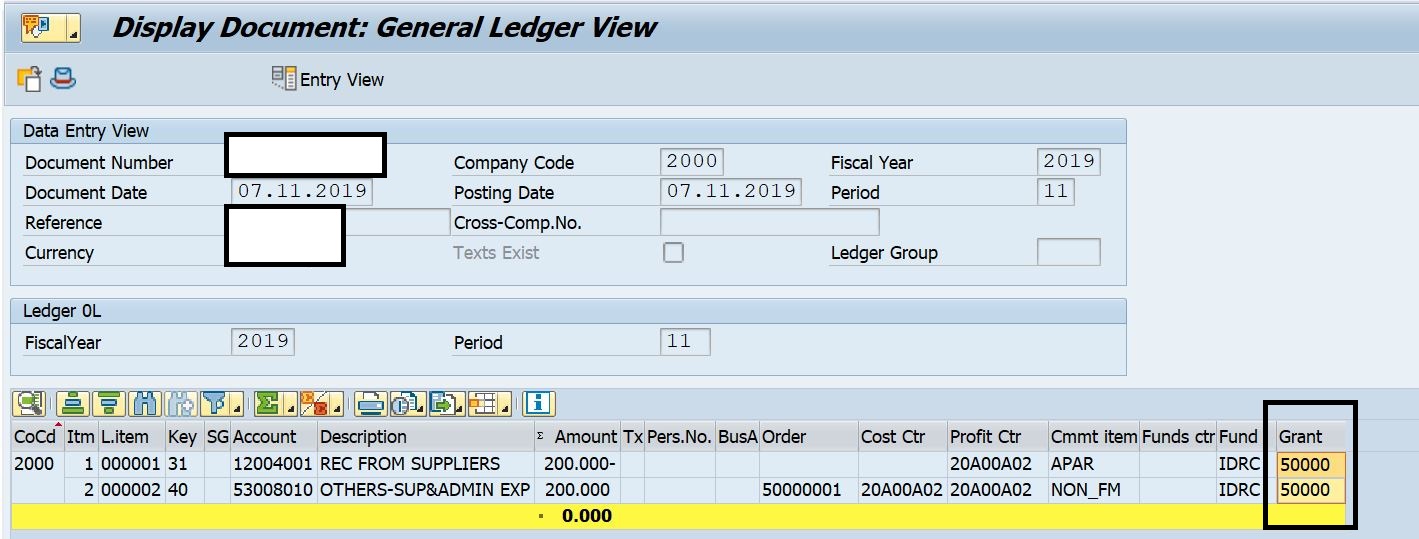

Document Splitting on Grants:

In order to achieve the Grants in the Financial Ledgers, we should implement Grant as a Document Splitting Characteristic with Zero Balancing.

In S4 HANA, when we activate Grants Management, the fields GEBER (Fund) and GRANT_NBR (Grant) are automatically available in the list of fields in document splitting characteristic.

After activating the characteristic the Grant No. will be appearing in FI documents.

Do review the following SAP Notes related to Document Splitting:

1085921 - Document split

891144 - General Ledger Accounting (new)/document splitting: Risks of subsequent changes

Thank you very much for reviewing my blog and I hope that I am able to explain the concept. I will take the time to write more on multiple scenarios on Grants Management very soon.

Best Regards,

Anss Shahid

For the past few years I have been involved in Implementing SAP FICO, PSM-FM (Funds Management) and GM (Grant Management) in different organizations. Today I wanted to share my experience with respect to the Accounting for Grants including Expenditure on Grants and Grant Amortizations.

Overview of IAS 20:

IAS 20 Accounting for Grants and Disclosure outlines how to account for government grants and other assistance. Grants are recognized in profit or loss on a systematic basis over the periods in which the entity recognizes expenses for the related costs for which the grants are intended to compensate, which in the case of grants related to assets requires setting up the grant as deferred income or deducting it from the carrying amount of the asset.

Accounting Entries:

| In Case of Expenses on Grants | ||||||

| Intial Entry at the time when you received Cheque / Cash from the Grant | ||||||

| DR | CR | |||||

| BS | Bank / Cash | 100,000.00 | ||||

| BS | Deferred Grant | 100,000.00 | ||||

| Booking Grants Related Expenses | ||||||

| PnL | Grant Expenses | 20,000.00 | ||||

| BS | Vendor / Bank / Cash | 20,000.00 | ||||

| At Month End - Amortization of Grant | ||||||

| BS | Deferred Grant | 20,000.00 | ||||

| PnL | Grant Income | 20,000.00 | ||||

| In Case of Fixed Assets on Grants | ||||||

| Intial Entry at the time when you received Cheque / Cash from the Grant | ||||||

| DR | CR | |||||

| BS | Bank / Cash | 100,000.00 | ||||

| BS | Deferred Grant | 100,000.00 | ||||

| Booking Grants Related Fixed Assets | ||||||

| BS | Fixed Assets - Cost GL | 20,000.00 | ||||

| BS | Vendor / Bank / Cash | 20,000.00 | ||||

| At Month End - Amortization of Grant (Fixed Assets) | ||||||

| BS | Deferred Grant | 20,000.00 | ||||

| BS | Capital Asset Grant | 20,000.00 | ||||

| At Month End - Depreciation Run | ||||||

| PnL | Depreciation Expense | 416.67 | ||||

| BS | Accumulated Depreciation Expense | 416.67 | ||||

| At Month End - Amortization of Grant (Fixed Assets - Depreciation) | ||||||

| BS | Capital Asset Grant | 416.67 | ||||

| PnL | Grant Income | 416.67 | ||||

Document Splitting on Grants:

In order to achieve the Grants in the Financial Ledgers, we should implement Grant as a Document Splitting Characteristic with Zero Balancing.

In S4 HANA, when we activate Grants Management, the fields GEBER (Fund) and GRANT_NBR (Grant) are automatically available in the list of fields in document splitting characteristic.

After activating the characteristic the Grant No. will be appearing in FI documents.

Do review the following SAP Notes related to Document Splitting:

1085921 - Document split

891144 - General Ledger Accounting (new)/document splitting: Risks of subsequent changes

Thank you very much for reviewing my blog and I hope that I am able to explain the concept. I will take the time to write more on multiple scenarios on Grants Management very soon.

Best Regards,

Anss Shahid

- SAP Managed Tags:

- SAP S/4HANA Finance

7 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Is there an API for cost accounting results in S/4 Hana cloud in Enterprise Resource Planning Q&A

- Define Bank Accounts to be Included in PEPPOL in Enterprise Resource Planning Q&A

- BUSINESS TRANSACTION IN SAP S/4HANA CLOUD, PUBLIC EDITION in Enterprise Resource Planning Q&A

- Accounting entries getting wrong at the time of sales return credit note in Enterprise Resource Planning Q&A

- Improvements to manage treasury position in SAP Treasury and Risk Management in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |