- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- IFRS 16 Leasing & Lease Liability Reclassification...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

This blog post is intended for aspirant FICO/RE-FX consultants who want to gain an insight into IFRS 16 solution offered by SAP RE-FX for Leases and IAS 1 reclassification process of Lease Liability at the end of month. This blog post will explain the basic concept of IFRS 16 and related accounting postings using SAP RE-FX , it will also dig into one of the unexplored area of Lease Liability reclassification which many of us are not familiar with.

The main idea of IFRS 16 is to eliminate off-balance sheet accounting for leases thereby eliminating the difference between operating and finance leases. Previously operating leases payments were charged to P&L but with the introduction of IFRS 16 in January 2016, operating leases are required to be reported as RoU assets which in turn has favorable impact on operating profit,solvency, EBIT & EBITDA.

SAP RE-FX (Flexible Real Estate Management) module has played a pivotal role in assisting organization in transitioning to new standards set by IFRS 16 for lessees. It can assist entities in leasing scenarios for Leased In Properties, Buildings etc..

SAP RE-FX Function for IFRS 16 Compliance:

To meet the new rules as governed by IFRS 16, SAP RE-FX module came up with functionality of Valuation contracts. Lease valuation contracts enable an organization to record the following in integration with Asset Accounting and FI-GL.

- Right Of Use assets capitalization with Net present value

- Overall Lease liability computation

- Lease Rental payments

- Interest on lease rental using various methods

- Deprecation posting with a special deprecation key which works in integration with RE-FX

Above postings are integrated postings and originate from Lease valuation contracts in SAP RE-FX. Apart from above accounting entries , many organizations as part of the month end closing process require the disclosure of lease liability postings by splitting it into short term (current) and long term portion (non-current). This is in line with the requirement set out by IAS 1 to regroup Lease liability into short term and long term at the end of every month for financial statement presentation. Before diving into the details of reclassification , i would like to explain the complete flow of accounting entries in IFRS 16 leasing solution offered by RE-FX by building a practical scenario and its related accounting postings.

Note: If a company does not use Asset Accounting component then Company can choose Direct Balance Sheet Posting Integration Type in customizing RECECUST...Control Settings for Each Contract Type in Company Code

Illustration:

We have a leased property for which company has entered into three years of Lease Agreement with a lessor with payment frequency monthly to be paid in advance of every month . Monthly lease rental is 10,000 AED. The interest rate is 2% which will be used to discount future cash flows to their present value. In this regard a contract with value (10,000*36)=360,000 AED has been created with some critical information maintained in the valuation parameters tab of the contract.

The general data tab includes details of contract start and end date, contract name etc, partner tab contains information about lessor whose business partner has been created., object tab contains object assignments of the contract including start of relationship, cost object assignment and object type. Posting parameters tab contains frequency settings of contract, posting parameters (tax information, partner information etc) and organization assignments. Condition tab of the contract contains various conditions of contract like Lease Rental, Initial cost, incentives etc. For the sake of simplicity we have kept one condition 'Lease Rental" in the contract with full consideration to the IFRS 16 valuation.

From IFRS 16 perspective,valuation parameter and valuation tabs of the contract are the most important ones. Valuation parameter tab of the contract that we created with value of 360,000 AED is shown below.

After running contract valuation, valuation tab of the contract will look like below. Here net present value has been computed by using effective interest rate because 2% is annual interest rate , we have to compute effective interest rate to arrive at the present value of the contract. Effective interest rate is used when interest given is annual but lease rentals are paid monthly/quarterly.

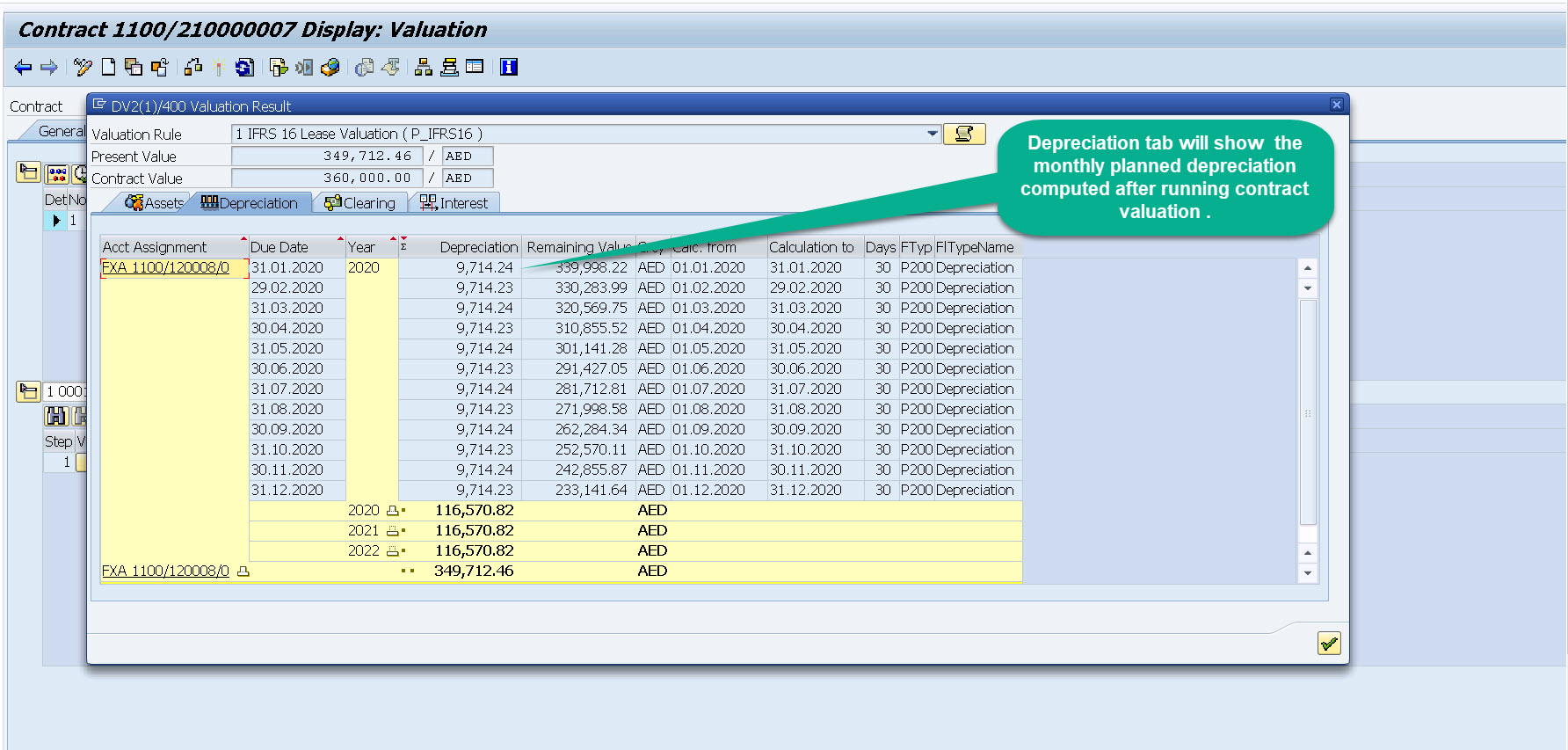

Depreciation tab will look like below , for IFRS 16 leasing purpose a special depreciation key LEAX has been provided by SAP with base method depreciation settings as "Depreciation from Real Estate Leasing"

Monthly lease rental to be paid to the landlord/supplier are shown in Clearing tab of valuation run. These are the rentals for which either a PO has been created in procurement to pay rentals or we can also generate vendor liability for these cash flows using partner cash flow postings (periodic postings RERAPP) in RE-FX for the same contract.

Interest expense tab will look like below

Valuation Postings to Accounting:

So far we saw the valuation run results, valuation run execution is a prerequisite for the contract valuation postings to accounting. Valuation postings of the contract is done via t code RECEEP-Post Valuation for Contracts. In the first month a total of four entries will be posted which are shown as under.

a. RoU Asset Capitalization

Asset explorer AW01N will populate following value after above entry.

b. Transfer Posting

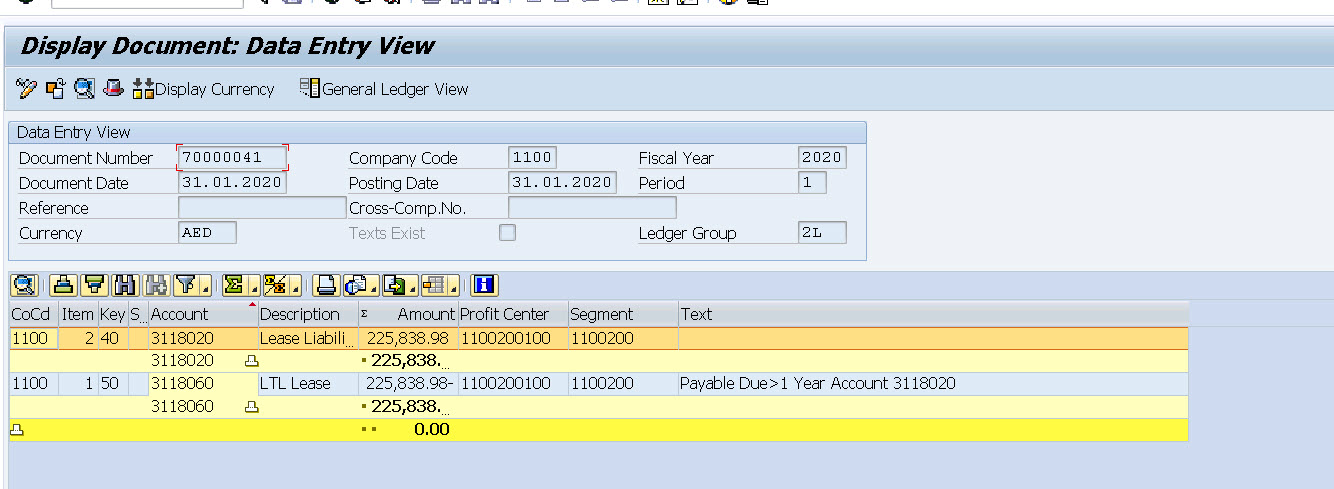

Second accounting entry which is posted by valuation run postings is Transfer posting which nullifies RoU clearing account which was credited in first accounting entry. Transfer posting generates the total lease liability amount , this lease liability amount is used by Regrouping Run (OBJREG) for a proportionate posting into Short term lease liability ( lease liability value falling within one year) and long term liability portion (lease liability value beyond one year). Accounting entry is shown below

c. Lease Payment (Lease liability reduction)

Lease liability is reduced based on the frequency of lease rental agreed with lessor. In our case it is monthly hence lease rental is posted which results in the reduction of lease liability.

d. Interest Posting

Interest expense will be posted using the cost object assignment of the contract. SAP RE-FX Valuation Rule customizing offers various interest calculation methods , we can have simple to complex interest calculations in valuation contracts .

In all the subsequent months, posting of monthly lease rentals and interest expense will happen while its equivalent invoice to supplier can be generated either from SAP MM or the same contract using periodic posting of partner related cash flows.

IAS 1 and Closing Process in RE-FX Leasing:

Above postings were for the first month of first lease year, for all the subsequent months interest posting and lease payment posting will occur in valuation posting run. At the end of every month there is a disclosure requirement by IAS 1 to reclassify Lease Liability into Short term lease liability and Long term liability. SAP has provided a special note 2624449 - Configuration of Special Ledger as preliminary work for closing processes from RE-FX leasing (IFRS 16) to setup configuration needed for the reclassification of lease liability.

To prepare for the closing process in RE-FX leasing, FI-SL (Special ledger) is used ,as we know in any of closing process in FI, GL accounts forms the basis for closing monthly financials, if we choose GL accounts for the closing process in SAP RE-FX, it will be very slow and difficult to aggregate lease liabilities balances on account level at the end of month. This problem has been solved by creating a Special purpose ledger in FI-SL . Here contract number and valuation rule are used to collect lease liability balances at the end of every month for reclassification.

The implementation of note 2624449 adds three fields Financial Valuation Object Type (VAL_OBJ_TYPE=RECL-Lease Liability), Financial Valuation Sub object (VALOBJ_ID_SL) and Financial Valuation Object (VAL_OBJ_ID). Newly designed object based FI regrouping transaction OBJREG selects RECL (Lease liability) values based on these valuation object fields from special ledger (FI-SL) to get the reclassification percentage and then posts reclassification.

A special report RECEISRECLASSIFY - Info System: Reclassification has also been provided by SAP RE-FX to show reclassification percentage at a key date for a Company code, contract type and sort method. We will now come to the process of reclassification of lease liability considering our Lease valuation contract 210000007.

OBJREG - Regrouping of Valuation Objects:

In order to regroup/reclassify the lease liability/lease receivables for the valuation objects, SAP has provided OBJREG t code. We will first look at the valuation cash flow position of contract 210000007 to see balance of lease liability at the end period1 of first lease year and balance of lease liability >1 year.

Screenshot below has been taken from the valuation cash flow of overview tab of Lease contract. It shows the complete lease schedule including interest, lease payments, depreciation with opening and closing balance of lease cash flows. Looking at it we can easily arrive at the value which OBJREG should allocate at the key date 31.01.2020 to short term lease liability (liability portion <1 year) and long term lease liability (liability portion >1 year) . Amounts in bold shows the posted valued via valuation posting RECEEP.

An overview of FI-SL document posted for the lease liability can be seen in below screenshot, we can view this by displaying transfer posting FI document in FB03 and then going to environment...Document environment... Relationship browser.

RE-FX special report RECEISRECLASSIFY which has been designed to show the lease liability reclassification at a given date shows the results which will be verified by our postings in OBJREG. This report uses Sort method settings (OBBU) which most of FI consultants must be familiar with.

OBJREG selection screen looks very similar to FAGLF101 T code which is essentially used for regrouping of AP/AR in SAP Financials.

The tab Valuation object lets you specify the Identif. Val. Obj ID which we saw in our screenshot of FAGLL03 for the lease liability GL . In the below screenshot , it is imperative to note that we have entered lease liability GL 3118020 so that system reclassifies only its balances.

We can restrict GL based valuation in customizing for FI-SL ledger (in our case LG) T code GCL1. GL based valuation can be setup in rule defined in GCL1..Select your ledger...Choose Assign Activity...Ledger Selection...Rules by adding SAKNR in below rule.

After execution following will show , the explanation of the amount split has already been provided in valuation cash flow overview screenshot. The values shown are in concurrence with RECEISRECLASSIFY report.

If we select postings button , following sequence of postings will be shown for reclassification of Lease Liability. Posting scheme works as valuation reclassification is done at the end of every month for disclosure purpose and reversal posting is done at the first day of next period.

In above example only the non-current portion (> 1 year) has been posted according to our customizing which is also a recommended setting as per SAP. The current portion (lease liability amount< 1 year) remains on the lease liability account. Following reclassification entry was posted when we selected Post Documents Immediately in first tab of OBJREG and its reversal entry was posted at the same time on 01.02.2020.

Recommended OSS Notes:

Following Notes are strongly recommended in order to gain an insight into the IFRS 16 lease valuation process and closing process in RE-FX leasing.

https://launchpad.support.sap.com/#/notes/2255555

https://launchpad.support.sap.com/#/notes/ 2297363

https://launchpad.support.sap.com/#/notes/ 2516889

https://launchpad.support.sap.com/#/notes/ 2555105

https://launchpad.support.sap.com/#/notes/ 2580277

https://launchpad.support.sap.com/#/notes/ 2660070

https://launchpad.support.sap.com/#/notes/2699475

https://launchpad.support.sap.com/#/notes/ 2624449

Closing Note:

At the end of this blog post, i would like to add that i have reviewed this document many times but still if there is something left over which requires clarification, rectification , please feel free to suggest. Keep learning new things, it keeps you motivated and competitive in market 🙂 .

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

learning content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Use of Post B/S Reclassification to Reclass Lease Liability from CLREM/CLM/REFX Module in Enterprise Resource Planning Q&A

- Simplifying Financial Statement Adjustments in SAP FI – Through Sorting/Reclassification in Enterprise Resource Planning Blogs by Members

- Discounting of Long-Term Assets and Liabilities in SAP S/4HANA Public Cloud in Enterprise Resource Planning Blogs by Members

- Balance Sheet Reclassification and Regrouping in S/4HANA Cloud in Enterprise Resource Planning Blogs by Members

- Advanced Foreign Currency Valuation in S/4HANA Cloud (Cloud ERP) in Enterprise Resource Planning Blogs by Members

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |