- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- PARALLEL LEDGERS VALUATION IN S/4 HANA NEW ASSETS ...

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

ihsen_abroug2

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

04-08-2020

1:46 PM

Using the parallel ledger, companies can set parallel valuation in different accounting principles

Typically, a local company that belongs to a group needs to follow both local and group accounting principles

In Assets accounting, we can set Parallel ledger accounting using depreciations areas

We need to define depreciation area per involved accounting principles,

In our scenario company FR01 a local branch of an international group, company FR01 needs to report financial statements in group accounting principles IFRS and in local GAAP accounting principles.

We defined the Leading ledger '0L' for IFRS and non leading ledger '2L' for LG accounting principles.

Let's see the major customizing steps and a process flow to demonstrate the power of the ledger approach in parallel valuation in assets accounting.

We assigned accounting principles to corresponding ledgers for the company 'FR01'.

In our example we created the following 2 depreciation areas:

Both areas 1 and 12 posts in real time

Important note:

In New Assts accounting, the delta depreciation area is no longer needed, the system posts in real time to both ledgers.

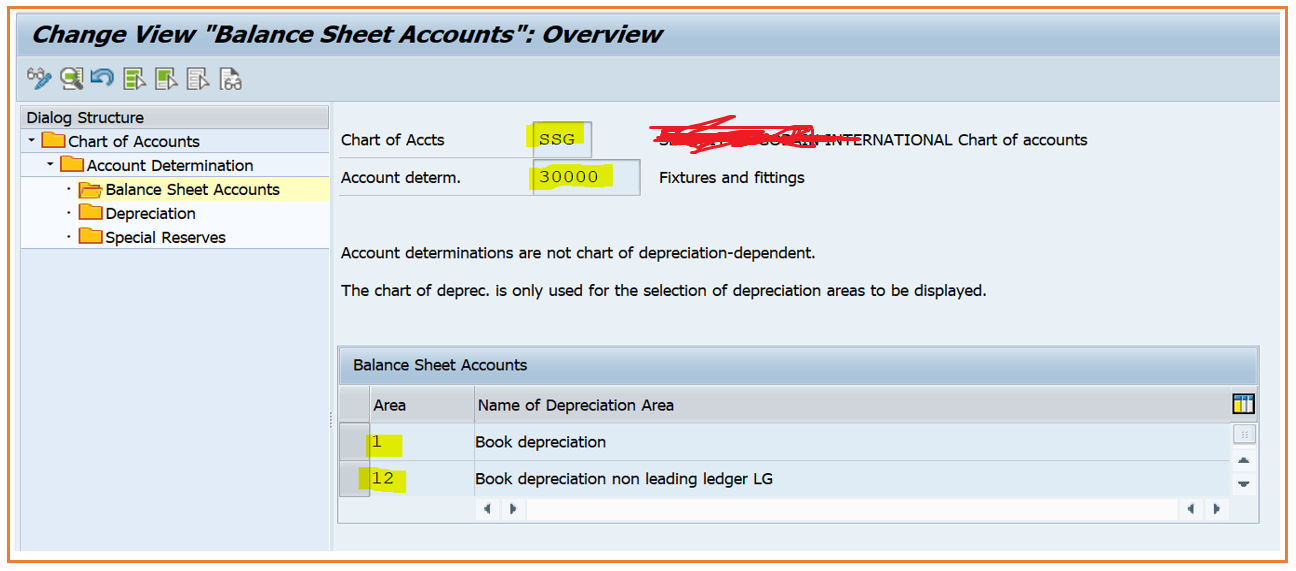

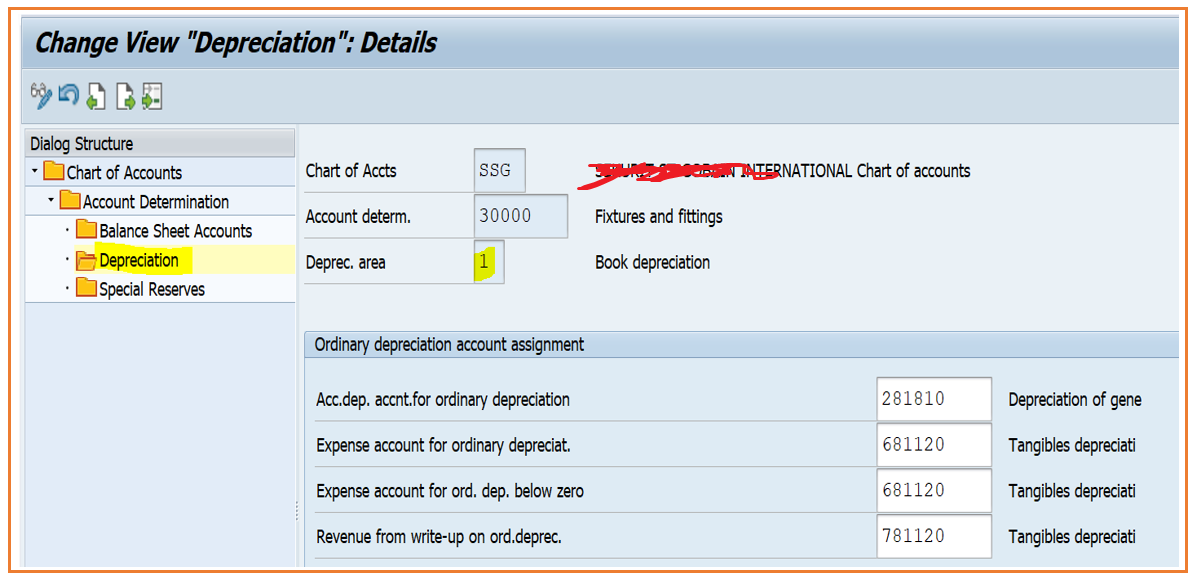

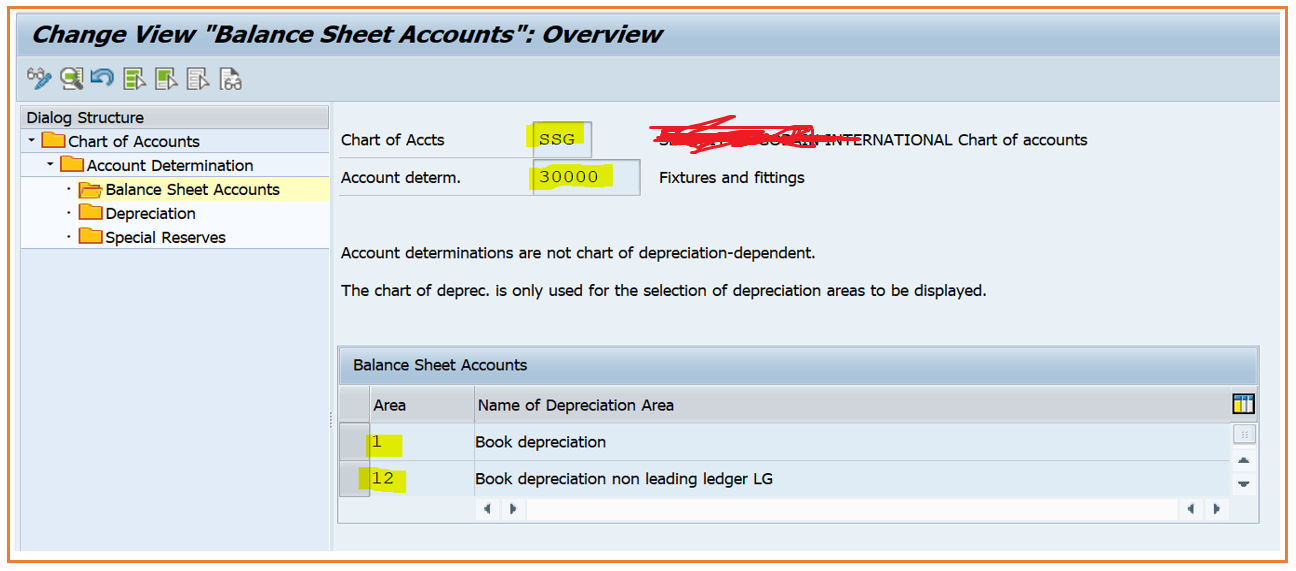

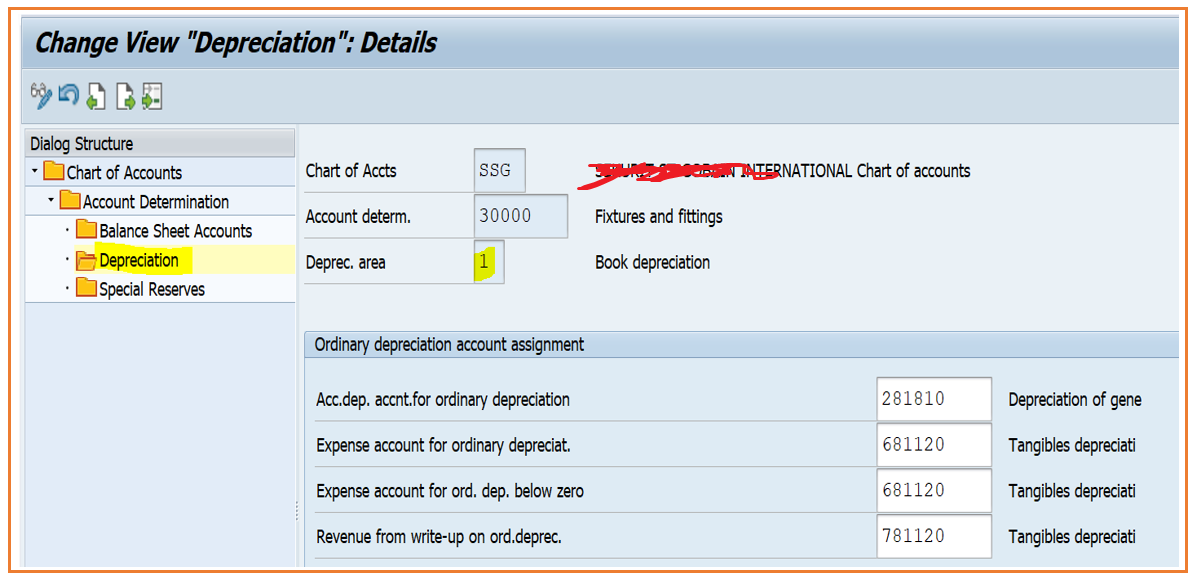

In this step we need to assign GL accounts for both depreciations areas, 1 and 12

We used the same accounts for both areas as we are using separate ledgers for both areas

The following screen shots applies for area 1, area 12 have the same accounts assignments

Below the SAP definition of the integrated aquisition postings available in SAP HELP

You can find this definition also when clicking on the glasses in front of the main customizing neud

"For an integrated asset acquisition posting, the system divides the business transaction into an operational part and a valuating part:

The derived document type is for the valuation posting created at the same moment of vendor invoice when posting Asset aquisition

Select Asset class 3000

--> Deactivate all depreaciations areas except 01 and 12 areas

--> Set the usefull life 2 years for depreciation area 01 and 4 years for depreciation area 12

The company FR01 needs to maintain accounting and reporting for Assets in both group and local accounting principles,

In this scénario will process the following flow and track accounting posting and reporting in both acct principles

Create an asset, Post acquisition, Run depreciation, post retirement

Create asset for Fixture and fitting (class 3000) with straight line depreciation method for depreciation area 1 and depreciations area 12

Transaction: AS01

Asset acquisition for 2400 Euros

Transaction: F-90

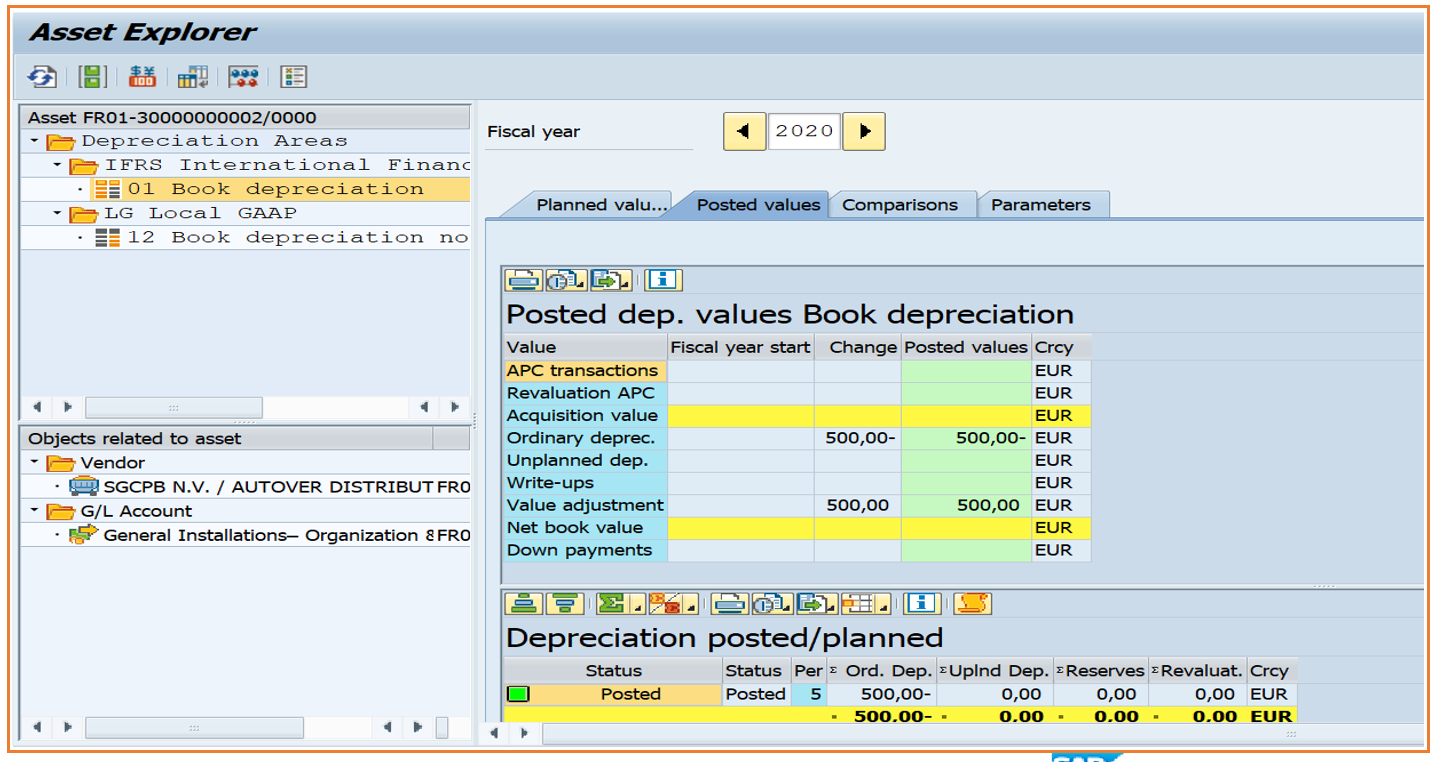

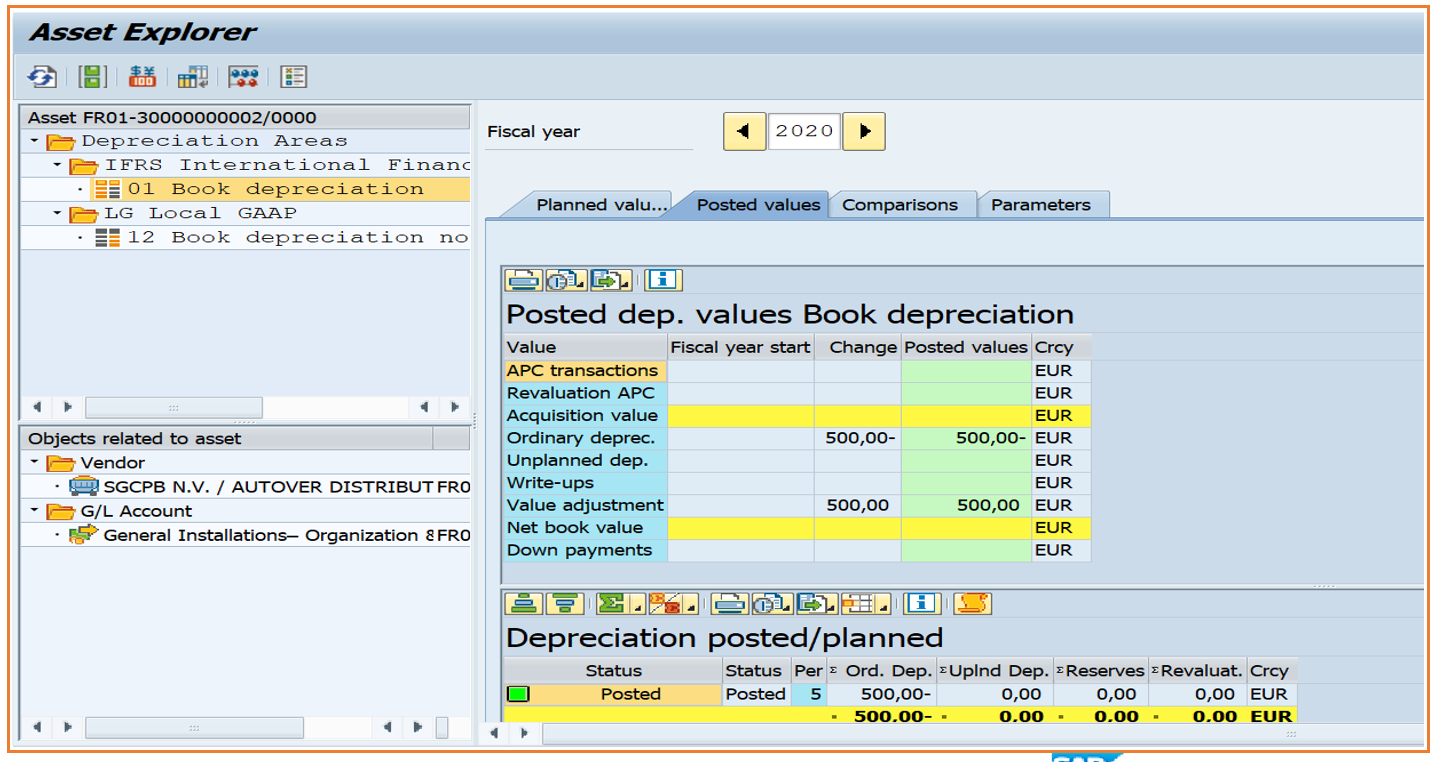

Transaction: AFAB

Posting for the first 5 periods of 2020.

Asset explorer for IFRS (0L)

--> Posted depreciation value 500,00 Euos for ledger “0L” for 5 periods (100,00 Euros per period).

Depreciation FI document posted to Ledger 0L:

Asset explorer for Local GAAP (2L)

--> Posted depreciation value 250,00 Euros for ledger “2L” for 5 periods (50,00 Euros per period).

Depreciation FI document posted to Ledger 2L:

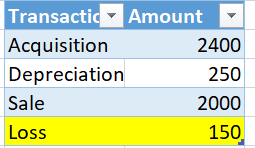

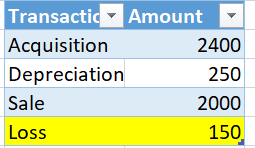

Asset retirement for a sale value of 2000 Euros

Transaction: ABAON

Posting to IFRS acct principles (Ledger 0L)

--> 100 Euros gain for 0L ledger

Posting to LG acct principles (Ledger 2L)

--> 150 Euros Loss for ledger 2L

--> In IFRS Depreciation area we have a gain of 100 Euros and in the LG depreciation area we have 150 Euros loss

Using the parallel ledgers 0L and 2L, we are able to run parallel valuation according to different accounting principles

Please feel free to comment

Best Regards

Ihsen ABROUG

Typically, a local company that belongs to a group needs to follow both local and group accounting principles

In Assets accounting, we can set Parallel ledger accounting using depreciations areas

We need to define depreciation area per involved accounting principles,

In our scenario company FR01 a local branch of an international group, company FR01 needs to report financial statements in group accounting principles IFRS and in local GAAP accounting principles.

We defined the Leading ledger '0L' for IFRS and non leading ledger '2L' for LG accounting principles.

Let's see the major customizing steps and a process flow to demonstrate the power of the ledger approach in parallel valuation in assets accounting.

1. Define settings for ledgers

We assigned accounting principles to corresponding ledgers for the company 'FR01'.

- 0L Ledger:

- 2L Ledger:

2. Define Depreciations areas

In our example we created the following 2 depreciation areas:

- Depreciation area 1 for IFRS accounting principles (0L Ledger group)

- Depreciation area 12 for LG accounting principles (2L Ledger group)

Both areas 1 and 12 posts in real time

Important note:

In New Assts accounting, the delta depreciation area is no longer needed, the system posts in real time to both ledgers.

3. Assign GL Accounts

In this step we need to assign GL accounts for both depreciations areas, 1 and 12

We used the same accounts for both areas as we are using separate ledgers for both areas

The following screen shots applies for area 1, area 12 have the same accounts assignments

4. Define technical clearing account for integrated assets aquisition:

Below the SAP definition of the integrated aquisition postings available in SAP HELP

You can find this definition also when clicking on the glasses in front of the main customizing neud

"For an integrated asset acquisition posting, the system divides the business transaction into an operational part and a valuating part:

- For the operational part (vendor invoice), the system posts a document valid for all accounting principles against the technical clearing account for integrated asset acquisitions. From a technical perspective, the system generates a ledger-group-independent document.

- For each valuating part (asset posting with capitalization of the asset), the system generates a separate document that is valid only for the given accounting principle. This document is also posted against the technical clearing account for integrated asset acquisitions. From a technical perspective, the system generates ledger-group-specific documents for each accounting principle."

5. Specify alternative document type for the valuation part of the posting

The derived document type is for the valuation posting created at the same moment of vendor invoice when posting Asset aquisition

6. Determine Depreciations Areas in Asset Class

Select Asset class 3000

--> Deactivate all depreaciations areas except 01 and 12 areas

--> Set the usefull life 2 years for depreciation area 01 and 4 years for depreciation area 12

7. Business Scenario for Parallel Ledger Valuation

The company FR01 needs to maintain accounting and reporting for Assets in both group and local accounting principles,

In this scénario will process the following flow and track accounting posting and reporting in both acct principles

Create an asset, Post acquisition, Run depreciation, post retirement

7.1 Create asset

Create asset for Fixture and fitting (class 3000) with straight line depreciation method for depreciation area 1 and depreciations area 12

- In Class 3000 for Area 1, the useful life is 2 years

- In Class 3000 for Area 12, the useful life is 4 year

Transaction: AS01

7.2 Asset Aquisition

Asset acquisition for 2400 Euros

Transaction: F-90

- Operational part (vendor invoice)

- Valuating part (asset posting with capitalization of the asset)

7.3 Asset Depreciation Run

Transaction: AFAB

Posting for the first 5 periods of 2020.

Asset explorer for IFRS (0L)

--> Posted depreciation value 500,00 Euos for ledger “0L” for 5 periods (100,00 Euros per period).

Depreciation FI document posted to Ledger 0L:

Asset explorer for Local GAAP (2L)

--> Posted depreciation value 250,00 Euros for ledger “2L” for 5 periods (50,00 Euros per period).

Depreciation FI document posted to Ledger 2L:

7.4 Asset Retirement

Asset retirement for a sale value of 2000 Euros

Transaction: ABAON

Posting to IFRS acct principles (Ledger 0L)

--> 100 Euros gain for 0L ledger

Posting to LG acct principles (Ledger 2L)

--> 150 Euros Loss for ledger 2L

--> In IFRS Depreciation area we have a gain of 100 Euros and in the LG depreciation area we have 150 Euros loss

Using the parallel ledgers 0L and 2L, we are able to run parallel valuation according to different accounting principles

Please feel free to comment

Best Regards

Ihsen ABROUG

17 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Explanation of the Delta Posting Logic in Advanced Foreign Currency Valuation in Enterprise Resource Planning Blogs by SAP

- Change category of unit of measure material master in Enterprise Resource Planning Q&A

- Migrate to new asset accounting within ECC in Enterprise Resource Planning Q&A

- Readiness for Universal Parallel Accounting in Enterprise Resource Planning Blogs by SAP

- Parallel crcy area (crcy type 30) missing for area 01 ch. of deprec. HCL3 ...Message no. ACC_AA116 in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |