- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- W-4 State Withholding Tax Calculation 2020 - Based...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member87

Active Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

04-03-2020

9:49 PM

++New Updates++

October 28th - FAQ section has been updated (questions 2 and 3 about the indicator 7 and the KBA numbers)

July 15th - The following SAP Note has been released:

June 12th - The following SAP Note has been released and FAQ section has been updated (question 😎

May 22nd - The following question has been added to the FAQ section

May 20th - The following SAP Note has been released:

May 19th - The following SAP Note has been released:

May 18th - The following question has been added to the FAQ section

April 30th - The following SAP Note has been released:

April 7th - BSI Interface section has been updated (TaxFactory 11.0 example)

April 6th - The following SAP Notes have been released:

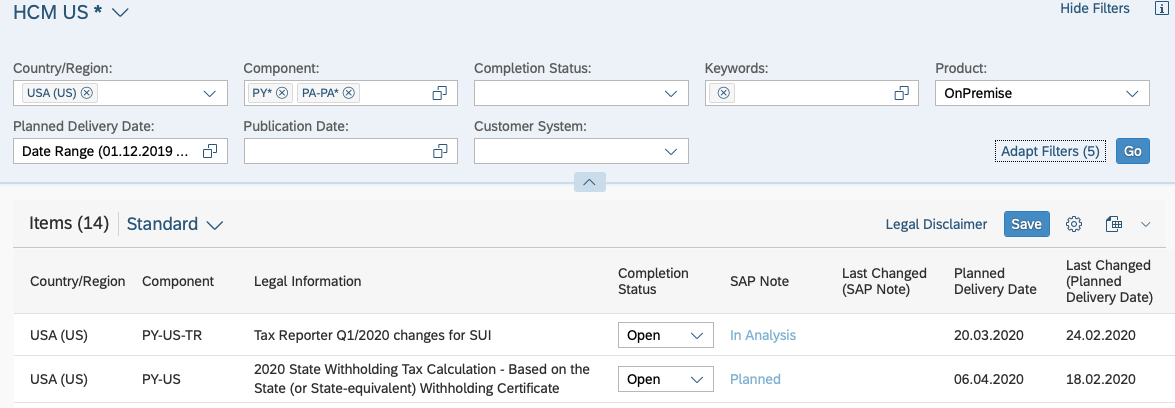

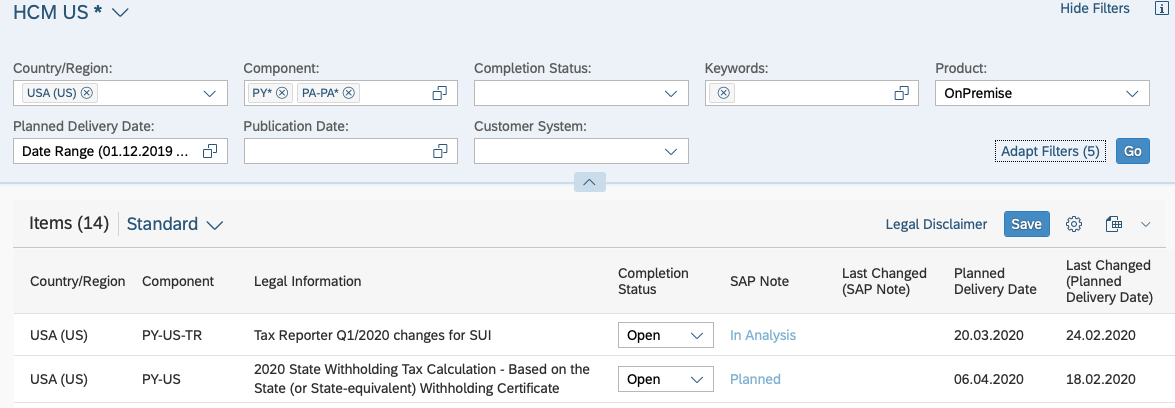

This blog refers to the following Legal Changes with title “2020 State Withholding Tax Calculation - Based on the State (or State-equivalent) Withholding Certificate” announced on the ONE Support Launchpad for USA.

For On-premise payroll customers see link.

For SuccessFactors Employee Central Payroll see link.

Your employees may want to adjust their withholding on their state W-4. We've got this important legal change you'll need to know about! Don't worry, this blog will give you all the details you need to be in compliance.

SAP has delivered updates to address to relevant technical changes to prepare for the new Withholding Tax Calculation based on the state-equivalent withholding certificate for year 2020. The aim of this blog is to provide implementation information that needs to be performed in SAP side for activating the new/changed functionality supported by SAP.

W-4 business background/impact

Affects payroll processing from the first pay period of year 2020. Changes will impact Master Data, Tax Computation, BSI Interface and W-4 Tax Withholding Employee Self-Service (Web Dynpro ABAP) application.

What you need to know about the state W-4 form?

Prior to January 1, 2020, seven states (Colorado, Delaware, Nebraska, New Mexico, North Dakota, South Carolina and Utah) used information reported on Federal Forms W-4 to calculate state withholding tax on wages because these states did not have their own Withholding Certificate.

Effective January 1, 2020, the IRS made significant changes to the Federal Form W-4, including revising the filing status values and removing the withholding allowance.

The 2020 version of the federal W-4 form may have done away with withholding allowances for federal income tax withholding, but many states continue to use withholding allowances for state income tax withholding. As a result, the seven states that had previously relied on the Federal Form W-4 have reacted as follows:

• Colorado, Delaware, Nebraska, New Mexico, North Dakota, South Carolina and

Utah decided to retain existing, pre-2020 Federal Forms W-4 for employees employed prior to January 1, 2020 who do not wish to change their withholding deductions.

• Colorado, New Mexico, North Dakota and Utah decided to use the 2020 Federal Form

W-4 in lieu of a state-specific Withholding Certificate for employees who commence

employment on or after January 1, 2020 or any existing employees who wish to change

their withholding deductions on or after January 1, 2020.

• Delaware, Nebraska and South Carolina created a state-specific Withholding Certificate

for employees who commence employment on or after January 1, 2020 or any existing

employees who wish to change their withholding deductions on or after January 1, 2020.

• Colorado, New Mexico, North Dakota and Utah revised their withholding tax calculation

to accommodate the use of older versions of Federal Form W-4 as well as either the new

2020 Form W-4 or the new state-specific Withholding Certificate for Delaware, Nebraska

and South Carolina.

The impact will be determined based on whether an employee has filled out a new 2020 Federal or 2020 State Form W-4 or if they are retaining a previously completed pre-2020 Federal Form W-4.

For employees completing a new State (or State-equivalent) Form W-4, additional variables will be used to determine how the state Withholding tax will be calculated.

Employers may continue to use payroll values on employee State (or State equivalent) Withholding Certificates provided before 2020. However, any employee payroll changes

that occur on or after January 1, 2020 must be provided on the 2020 State (or State-equivalent) Withholding Certificate

Marital Statuses for Delaware and South Carolina are based on their new State Withholding

Certificate.

Example:

What you need to know about the state W-4 form in SAP system?

1 – New customizing

Table View V_T5UTZC_W4_OVR

The new fields previously delivered for Federal W-4 are now also available for State Level W-4. Please note that the fields shown are not necessarily correct for New York, it is just a demonstration of where the new fields are displayed. SAP does not deliver state-specific screens by standard, but you can adapt the screen for each authority according to your business requirements.

PA30 – Withholding Info W4/W5 US (0210) infotype

2 - Withholding Info W4/W5 US (0210) infotype screen

When editing Withholding Info W4/W5 US (0210) infotype for a state, you may encounter the following scenario: both Deductions and Additional exemption amount fields are displayed on the screen. At the current, these fields have the same purpose. Hence need to fill in only one of both fields and hide the other field. There is no need to enter the amount in both fields, as they report the same data to BSI. Otherwise, the following error message may appear: Unable to use Deduction and Additional Exemption Amount at the same time.

BSI Interface

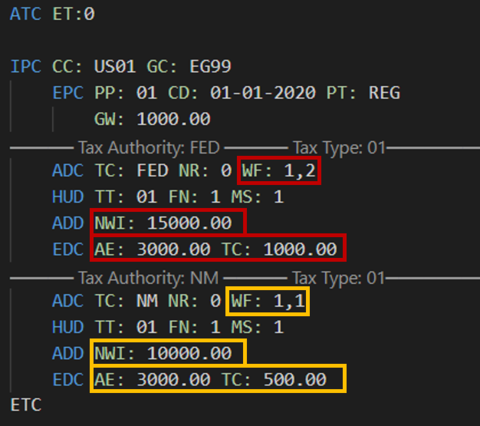

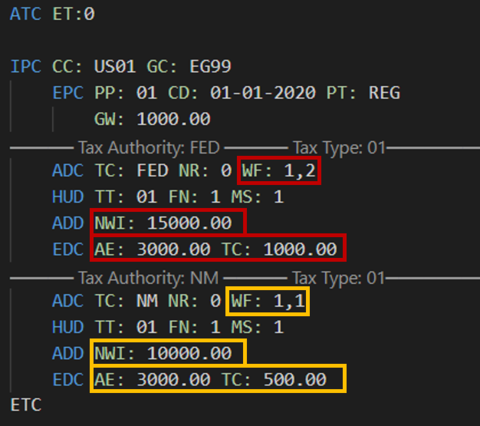

BSI Interface is the log of what SAP sent to BSI for tax calculation. For Federal W-4, some fields were added to the BSI Interface: WF (Withholding Form), NWI (Non-Wage Income) and TC (Tax Credit Amount). These fields are now also available for states. However, BSI accepts then differently for Federal and State, as you can check below:

In this example, Federal has a Non-Wage Income (NWI) of USD 15000, Additional Exemption Amount/Deduction (AE) of USD 3000, Tax Credit Amount (TC) of USD 1000 and it is using the 2020 format with higher withholding rates (hence WF as 1,2). State of New Mexico has a Non-Wage Income (NWI) of USD 10000, Additional Exemption Amount/Deduction (AE) of USD 3000, Tax Credit Amount (TC) of USD 500 and it is using the 2020 format without higher withholding rates (hence WF as 1,1).

As you can see in red, for Federal, parameters WF and NWI are accepted by BSI in employee level, while for state, in yellow, these parameters are in tax level. Parameters AE and TC are passed equally for Federal and state.

Please notice that the State of New Mexico does not necessarily use all the parameters displayed for Withholding calculation, this serves only as an example of how BSI deals differently with the new fields for Federal and state.

BSI Interface - TaxFactory 10

BSI Interface - TaxFactory 11.0

In this example, Federal has a Non-Wage Income (NWI) of USD 15000, Additional Exemption Amount/Deduction (AE) of USD 3000, Tax Credit Amount (TC) of USD 1000 and it is using the 2020 format with higher withholding rates (hence WF as 1,2). State of New Mexico has a Non-Wage Income (NWI) of USD 10000, Additional Exemption Amount/Deduction (AE) of USD 3000, Tax Credit Amount (TC) of USD 500 and it is using the 2020 format without higher withholding rates (hence WF as 1,1).

As you can see in red, for Federal, parameter WF (1,2) is in line ADC and NWI is in line ADD.

Please notice that the State of New Mexico does not necessarily use all the parameters displayed for Withholding calculation, this serves only as an example of how BSI deals differently with the new fields for Federal and state.

Important SAP Notes:

All SAP Notes with changes related to Federal W-4 format must be applied. You can refer to blog https://blogs.sap.com/2019/12/07/w-4-form-for-year-2020/ to see the complete list of SAP Notes.

- 2878657 - 2020 State Withholding Tax Calculation - Based on the State (or State-equivalent) Withholding Certificate (SAP_HR) - Phase I

- 2891794 - 2020 State Withholding Tax Calculation - Based on the State (or State-equivalent) Withholding Certificate (EA-HR) - Phase I

- 2895426 - Prerequisite objects for SAP Note 2878657

- 2926692 - V_T5UTZC_W4_OVR Saving Invalid Values in CODID field

- 2923981 - TAX: Missing Search Help on View V_T5UTZC_W4_OVR

The following SAP Notes refer to installation instructions:

- 2911130 - 2020 State Withholding Tax Calculation - Based on the State (or State-equivalent) Withholding Certificate - On Premise

- 2911187 - 2020 State Withholding Tax Calculation - Based on the State (or State-equivalent) Withholding Certificate - Employee Central Payroll

Prerequisites

- 2939463- TAX: Changes on W-4 Indicator 7 Behavior

Frequently Asked Questions – FAQ

1- What if the message 'Unable to use Deduction and Additional Exemption Amount at the same time' appears?

You attempted to enter a deduction amount in both Deductions and Additional exemption amount fields, which is incorrect. You must fill in one of these fields, instead of adding amount to both of them. There is no need to enter the amount in both fields, as they report the same data to BSI. While field Deductions was added to enable the Federal format to be replicated for state, field Additional exemption amount was kept to maintain previous specific screen layouts where this field was used. You better allow to edit only one of both fields on the screen and hide the other. Both have the same business meaning and will be used equally.

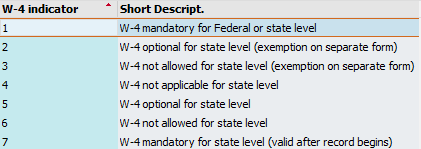

2 - Which are the possible W-4 Indicators?

The possible values for W-4 Indicator (in both T5UTZ and V_T5UTZC_W4_OVR) are:

Note: The indicator 7 is only maintained by V_T5UTZC_W4_OVR view. The other values can be maintained by both V_T5UTZ and V_T5UTZC_W4_OVR views.

For more details on how to use indicator 7, you can refer to the KBA 2984635 - W-4 Indicator 7 Behavior.

For all the other indicators, you can refer to KBA IT0210 W4 Indicator.

3- What is the behavior of each W-4 Indicator?

1 – Mandatory: in Infotype 0210, you will be able to create a record and edit any field. In Payroll execution, the system searches for state W-4 entries in Infotype 0210 at pay date to pass to the BSI interface. If no state W-4 record was found for the pay date, the system will use the default information for the authority (which is maintained in V_T5UTZC_W4_OVR or V_T5UTZ).

2 – Optional (exemption on separate form): in Infotype 0210, you will be able to create a record and edit any field. In Payroll execution, the system searches for authority-specific W-4 entries at pay date in Infotype 0210 record to pass to the BSI interface. If no record for the authority was found, it will inherit from the next upper tax level where a W-4 is available state (local->county->state->federal) (if the current authority is a city or county) or from Federal (if the current authority is a state) and use all field except for Additional Withholding. For this W-4 Indicator, if information is inherited, the system also clears the inherited Exempt Indicator, so if the employee was exempt for Federal withholding and Federal data is used for a state (no Infotype 0210 found for the state), the employee will not be exempt for the state withholding.

3 – Not allowed (exemption on separate form): in Infotype 0210, you will able to create a record, but only edit some fields. In Payroll execution, almost all fields will be inherited from the state (if the current authority is a city or county) or from Federal (if the current authority is a state). The only fields used from the current authority are the Additional Withholding and the Exempt Indicator.

4 – Not applicable: you won’t be able to create or save a record of Infotype 210. Payroll does not retrieve data from Infotype 0210 for this authority.

5 – Optional: follows the same behavior of W-4 Indicator 2, however the field Exempt Indicator is not cleared when inheriting data. So if the employee was exempt for Federal withholding and Federal data is used for a state (no Infotype 210 found for the state), the employee will also be exempt for the state withholding.

6 – Not allowed: follows the same behavior of W-4 Indicator 3, however instead of using fields Additional Withholding and Exempt Indicator from the current authority, it uses Additional Withholding and Formula Number.

Indicator 7 was also introduced. For more details on how to use indicator 7, you can refer to the KBA 2984635 - W-4 Indicator 7 Behavior.

For all the other indicators, you can refer to KBA IT0210 W4 Indicator.

4- My infotype 0210 screen (mash-up or PA30) has different filing statuses when compared to the W-4 in BSI TaxProfileFactory. How does it affect me?

BSI TaxProfileFactory uses the same options as published by the respective authority in the W-4 form:

And, in the mash-up for infotype 0210, the options available are the ones configured in table view T5UTK. For the Federal 2020 W-4, the default values are:

From a taxation perspective, values 01 – Single and 03 – Married filing separately are the same for federal income tax. Just like 06 – Head of household or family and 08 – Widower

So, if your employee selects Single or Married filing separately in TaxProfileFactory, when the data is replicated to the back-end, the Infotype 0210 is created with filing status as 01 – Single.

5- Is there any way to have the options in the infotype 0210 screen (mash-up or PA30) to be the same as the options in BSI TaxProfileFactory?

Yes, in case you wish to have the same filing status valueses in Infotype 0210 and BSI TaxProfileFactory, you can maintain the entries in T5UTK as follows:

This same approach is valid for either Federal or State Tax Authority.

6- How can I configure state W-4 in the Employee Self-Service Web Dynpro ABAP application?

For more information on how to configure state W-4 in ESS, you can watch the following videos:

Watch this video (2020 W-4 State Withholding Tax Calculation - Based on the State (or State-equivalent) Withholding Certificate)

Watch this video (2020 W-4 State Withholding Tax Calculation - Create and Change W-4 State Form Based on the State)

7- How to hide W-4 fields for state specific forms in infotype 0210?

The following steps must be performed:

1. Edit PAYS1 as described in SAP Note 2878657, in 2.1 State Screen configuration -> Step 1 Feature PAYS1.

2. Open transaction PE03.

3. Fill in field "Feature" with PAYSV and activate it.

IMPORTANT: Do not open and active. You should only activate in PE03 initial screen.

It is necessary to do this process with feature PAYSV because PAYS1 is a subfeature used by PAYSV, so only saving/activating PAYS1 is not enough, since the system will read the decision tree of PAYSV.

8 - What is message 1055?

Message 1055 THE WITHHOLDING FORM’S YEAR AND/OR MULTIPLE JOBS BOX 2 VALUES ARE INVALID AND HAVE BEEN IGNORED. THE CALCULATED TAXES SHOULD BE CHECKED FOR ACCURACY might be displayed when the field Withholding Form (WF) had value (0,0), the system was passing incorrect value (,0) to BSI, triggering such message.

Thanks for reading!

Virginia Soares

User Assistance Developer

October 28th - FAQ section has been updated (questions 2 and 3 about the indicator 7 and the KBA numbers)

July 15th - The following SAP Note has been released:

June 12th - The following SAP Note has been released and FAQ section has been updated (question 😎

May 22nd - The following question has been added to the FAQ section

- What is message 1055?

May 20th - The following SAP Note has been released:

May 19th - The following SAP Note has been released:

May 18th - The following question has been added to the FAQ section

- How to hide W-4 fields for state specific forms in infotype 0210?

April 30th - The following SAP Note has been released:

April 7th - BSI Interface section has been updated (TaxFactory 11.0 example)

April 6th - The following SAP Notes have been released:

- 2911130 - 2020 State Withholding Tax Calculation - Based on the State (or State-equivalent) Withhold...

- 2911187 - 2020 State Withholding Tax Calculation - Based on the State (or State-equivalent) Withhold...

This blog refers to the following Legal Changes with title “2020 State Withholding Tax Calculation - Based on the State (or State-equivalent) Withholding Certificate” announced on the ONE Support Launchpad for USA.

For On-premise payroll customers see link.

For SuccessFactors Employee Central Payroll see link.

Your employees may want to adjust their withholding on their state W-4. We've got this important legal change you'll need to know about! Don't worry, this blog will give you all the details you need to be in compliance.

SAP has delivered updates to address to relevant technical changes to prepare for the new Withholding Tax Calculation based on the state-equivalent withholding certificate for year 2020. The aim of this blog is to provide implementation information that needs to be performed in SAP side for activating the new/changed functionality supported by SAP.

W-4 business background/impact

Affects payroll processing from the first pay period of year 2020. Changes will impact Master Data, Tax Computation, BSI Interface and W-4 Tax Withholding Employee Self-Service (Web Dynpro ABAP) application.

What you need to know about the state W-4 form?

Prior to January 1, 2020, seven states (Colorado, Delaware, Nebraska, New Mexico, North Dakota, South Carolina and Utah) used information reported on Federal Forms W-4 to calculate state withholding tax on wages because these states did not have their own Withholding Certificate.

Effective January 1, 2020, the IRS made significant changes to the Federal Form W-4, including revising the filing status values and removing the withholding allowance.

The 2020 version of the federal W-4 form may have done away with withholding allowances for federal income tax withholding, but many states continue to use withholding allowances for state income tax withholding. As a result, the seven states that had previously relied on the Federal Form W-4 have reacted as follows:

• Colorado, Delaware, Nebraska, New Mexico, North Dakota, South Carolina and

Utah decided to retain existing, pre-2020 Federal Forms W-4 for employees employed prior to January 1, 2020 who do not wish to change their withholding deductions.

• Colorado, New Mexico, North Dakota and Utah decided to use the 2020 Federal Form

W-4 in lieu of a state-specific Withholding Certificate for employees who commence

employment on or after January 1, 2020 or any existing employees who wish to change

their withholding deductions on or after January 1, 2020.

• Delaware, Nebraska and South Carolina created a state-specific Withholding Certificate

for employees who commence employment on or after January 1, 2020 or any existing

employees who wish to change their withholding deductions on or after January 1, 2020.

• Colorado, New Mexico, North Dakota and Utah revised their withholding tax calculation

to accommodate the use of older versions of Federal Form W-4 as well as either the new

2020 Form W-4 or the new state-specific Withholding Certificate for Delaware, Nebraska

and South Carolina.

The impact will be determined based on whether an employee has filled out a new 2020 Federal or 2020 State Form W-4 or if they are retaining a previously completed pre-2020 Federal Form W-4.

For employees completing a new State (or State-equivalent) Form W-4, additional variables will be used to determine how the state Withholding tax will be calculated.

Employers may continue to use payroll values on employee State (or State equivalent) Withholding Certificates provided before 2020. However, any employee payroll changes

that occur on or after January 1, 2020 must be provided on the 2020 State (or State-equivalent) Withholding Certificate

Marital Statuses for Delaware and South Carolina are based on their new State Withholding

Certificate.

- If a new 2020 State (or State-equivalent) Withholding Certificate has been filed for

Colorado (CO), New Mexico (NM), North Dakota (ND) or Utah (UT), you may need to update in view T5UTK for the respective state the Filing Status

values as of start date 01/01/2020.

Example:

- 01: Single

- 03: Married Filing Separately

- 04: Married Filing Jointly

- 06: Head of Household

- 08: Widow(er) Discontinued and replaced by value "04" is for new W-4 as of 01/01/2020

- 02: Married

- If a new 2020 State Withholding Certificate has been filed for Nebraska (NE), you may need to

update the Marital Status value as follows:

- 01: Single

- 02: Married

- 03: Married Filing Separately

- 06: Head of Household

- 08: Widow(er)

- 18: Married, Spouse Nonresident Alien

What you need to know about the state W-4 form in SAP system?

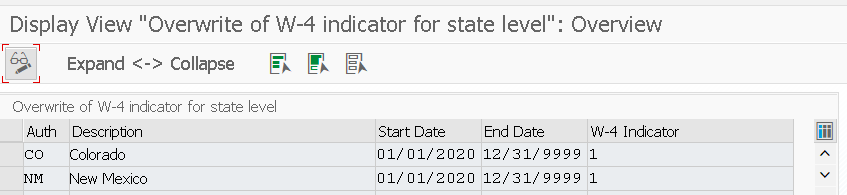

1 – New customizing

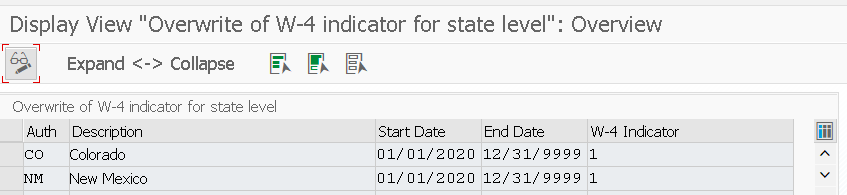

- In the standard system, table view V_T5UTZ enables the configuration of how a specific tax authority (in this case, a state) to use W-4. This is done using field W-4 Indicator (W4IND).

- As an additional configuration, the system enables to define a different W-4 indicator value as of 01.01.2020 for specific states. This configuration can be performed in new table view V_T5UTZC_W4_OVR.

- Table view V_T5UTZC_W4_OVR has Start and End Dates. Therefore, you can modify the W-4 Indicator for an authority for a specific period, according to your business needs. Values and dates below are demonstrative and may not match the legal requirement as defined by the states:

Table View V_T5UTZC_W4_OVR

The new fields previously delivered for Federal W-4 are now also available for State Level W-4. Please note that the fields shown are not necessarily correct for New York, it is just a demonstration of where the new fields are displayed. SAP does not deliver state-specific screens by standard, but you can adapt the screen for each authority according to your business requirements.

PA30 – Withholding Info W4/W5 US (0210) infotype

2 - Withholding Info W4/W5 US (0210) infotype screen

When editing Withholding Info W4/W5 US (0210) infotype for a state, you may encounter the following scenario: both Deductions and Additional exemption amount fields are displayed on the screen. At the current, these fields have the same purpose. Hence need to fill in only one of both fields and hide the other field. There is no need to enter the amount in both fields, as they report the same data to BSI. Otherwise, the following error message may appear: Unable to use Deduction and Additional Exemption Amount at the same time.

BSI Interface

BSI Interface is the log of what SAP sent to BSI for tax calculation. For Federal W-4, some fields were added to the BSI Interface: WF (Withholding Form), NWI (Non-Wage Income) and TC (Tax Credit Amount). These fields are now also available for states. However, BSI accepts then differently for Federal and State, as you can check below:

In this example, Federal has a Non-Wage Income (NWI) of USD 15000, Additional Exemption Amount/Deduction (AE) of USD 3000, Tax Credit Amount (TC) of USD 1000 and it is using the 2020 format with higher withholding rates (hence WF as 1,2). State of New Mexico has a Non-Wage Income (NWI) of USD 10000, Additional Exemption Amount/Deduction (AE) of USD 3000, Tax Credit Amount (TC) of USD 500 and it is using the 2020 format without higher withholding rates (hence WF as 1,1).

As you can see in red, for Federal, parameters WF and NWI are accepted by BSI in employee level, while for state, in yellow, these parameters are in tax level. Parameters AE and TC are passed equally for Federal and state.

Please notice that the State of New Mexico does not necessarily use all the parameters displayed for Withholding calculation, this serves only as an example of how BSI deals differently with the new fields for Federal and state.

BSI Interface - TaxFactory 10

BSI Interface - TaxFactory 11.0

In this example, Federal has a Non-Wage Income (NWI) of USD 15000, Additional Exemption Amount/Deduction (AE) of USD 3000, Tax Credit Amount (TC) of USD 1000 and it is using the 2020 format with higher withholding rates (hence WF as 1,2). State of New Mexico has a Non-Wage Income (NWI) of USD 10000, Additional Exemption Amount/Deduction (AE) of USD 3000, Tax Credit Amount (TC) of USD 500 and it is using the 2020 format without higher withholding rates (hence WF as 1,1).

As you can see in red, for Federal, parameter WF (1,2) is in line ADC and NWI is in line ADD.

Please notice that the State of New Mexico does not necessarily use all the parameters displayed for Withholding calculation, this serves only as an example of how BSI deals differently with the new fields for Federal and state.

Important SAP Notes:

All SAP Notes with changes related to Federal W-4 format must be applied. You can refer to blog https://blogs.sap.com/2019/12/07/w-4-form-for-year-2020/ to see the complete list of SAP Notes.

- 2878657 - 2020 State Withholding Tax Calculation - Based on the State (or State-equivalent) Withholding Certificate (SAP_HR) - Phase I

- 2891794 - 2020 State Withholding Tax Calculation - Based on the State (or State-equivalent) Withholding Certificate (EA-HR) - Phase I

- 2895426 - Prerequisite objects for SAP Note 2878657

- 2926692 - V_T5UTZC_W4_OVR Saving Invalid Values in CODID field

- 2923981 - TAX: Missing Search Help on View V_T5UTZC_W4_OVR

The following SAP Notes refer to installation instructions:

- 2911130 - 2020 State Withholding Tax Calculation - Based on the State (or State-equivalent) Withholding Certificate - On Premise

- 2911187 - 2020 State Withholding Tax Calculation - Based on the State (or State-equivalent) Withholding Certificate - Employee Central Payroll

Prerequisites

- You must be using BSI TaxFactory 10.0 version with Cyclic X.

- 2939463- TAX: Changes on W-4 Indicator 7 Behavior

Frequently Asked Questions – FAQ

1- What if the message 'Unable to use Deduction and Additional Exemption Amount at the same time' appears?

You attempted to enter a deduction amount in both Deductions and Additional exemption amount fields, which is incorrect. You must fill in one of these fields, instead of adding amount to both of them. There is no need to enter the amount in both fields, as they report the same data to BSI. While field Deductions was added to enable the Federal format to be replicated for state, field Additional exemption amount was kept to maintain previous specific screen layouts where this field was used. You better allow to edit only one of both fields on the screen and hide the other. Both have the same business meaning and will be used equally.

2 - Which are the possible W-4 Indicators?

The possible values for W-4 Indicator (in both T5UTZ and V_T5UTZC_W4_OVR) are:

Note: The indicator 7 is only maintained by V_T5UTZC_W4_OVR view. The other values can be maintained by both V_T5UTZ and V_T5UTZC_W4_OVR views.

For more details on how to use indicator 7, you can refer to the KBA 2984635 - W-4 Indicator 7 Behavior.

For all the other indicators, you can refer to KBA IT0210 W4 Indicator.

3- What is the behavior of each W-4 Indicator?

1 – Mandatory: in Infotype 0210, you will be able to create a record and edit any field. In Payroll execution, the system searches for state W-4 entries in Infotype 0210 at pay date to pass to the BSI interface. If no state W-4 record was found for the pay date, the system will use the default information for the authority (which is maintained in V_T5UTZC_W4_OVR or V_T5UTZ).

2 – Optional (exemption on separate form): in Infotype 0210, you will be able to create a record and edit any field. In Payroll execution, the system searches for authority-specific W-4 entries at pay date in Infotype 0210 record to pass to the BSI interface. If no record for the authority was found, it will inherit from the next upper tax level where a W-4 is available state (local->county->state->federal) (if the current authority is a city or county) or from Federal (if the current authority is a state) and use all field except for Additional Withholding. For this W-4 Indicator, if information is inherited, the system also clears the inherited Exempt Indicator, so if the employee was exempt for Federal withholding and Federal data is used for a state (no Infotype 0210 found for the state), the employee will not be exempt for the state withholding.

3 – Not allowed (exemption on separate form): in Infotype 0210, you will able to create a record, but only edit some fields. In Payroll execution, almost all fields will be inherited from the state (if the current authority is a city or county) or from Federal (if the current authority is a state). The only fields used from the current authority are the Additional Withholding and the Exempt Indicator.

4 – Not applicable: you won’t be able to create or save a record of Infotype 210. Payroll does not retrieve data from Infotype 0210 for this authority.

5 – Optional: follows the same behavior of W-4 Indicator 2, however the field Exempt Indicator is not cleared when inheriting data. So if the employee was exempt for Federal withholding and Federal data is used for a state (no Infotype 210 found for the state), the employee will also be exempt for the state withholding.

6 – Not allowed: follows the same behavior of W-4 Indicator 3, however instead of using fields Additional Withholding and Exempt Indicator from the current authority, it uses Additional Withholding and Formula Number.

Indicator 7 was also introduced. For more details on how to use indicator 7, you can refer to the KBA 2984635 - W-4 Indicator 7 Behavior.

For all the other indicators, you can refer to KBA IT0210 W4 Indicator.

4- My infotype 0210 screen (mash-up or PA30) has different filing statuses when compared to the W-4 in BSI TaxProfileFactory. How does it affect me?

BSI TaxProfileFactory uses the same options as published by the respective authority in the W-4 form:

- Single or Married filing separately

- Married filing jointly (or Qualifying widow(er))

- Head of household

And, in the mash-up for infotype 0210, the options available are the ones configured in table view T5UTK. For the Federal 2020 W-4, the default values are:

- 01: Single

- 03: Married filing separately

- 04: Married filing jointly

- 06: Head of household or family

- 08: Widower

From a taxation perspective, values 01 – Single and 03 – Married filing separately are the same for federal income tax. Just like 06 – Head of household or family and 08 – Widower

So, if your employee selects Single or Married filing separately in TaxProfileFactory, when the data is replicated to the back-end, the Infotype 0210 is created with filing status as 01 – Single.

5- Is there any way to have the options in the infotype 0210 screen (mash-up or PA30) to be the same as the options in BSI TaxProfileFactory?

Yes, in case you wish to have the same filing status valueses in Infotype 0210 and BSI TaxProfileFactory, you can maintain the entries in T5UTK as follows:

| Tax Authority | Filing Status | Filing Status Text | Begin Date | End Date |

| FED | 01 | Single or Married Filing Separately | 01-Jan-2020 | 31-Dec-9999 |

| FED | 04 | Married Filing Separately | 01-Jan-2020 | 31-Dec-9999 |

| FED | 06 | Head of Household or family or Widow(er) | 01-Jan-2020 | 31-Dec-9999 |

This same approach is valid for either Federal or State Tax Authority.

6- How can I configure state W-4 in the Employee Self-Service Web Dynpro ABAP application?

For more information on how to configure state W-4 in ESS, you can watch the following videos:

Watch this video (2020 W-4 State Withholding Tax Calculation - Based on the State (or State-equivalent) Withholding Certificate)

Watch this video (2020 W-4 State Withholding Tax Calculation - Create and Change W-4 State Form Based on the State)

7- How to hide W-4 fields for state specific forms in infotype 0210?

The following steps must be performed:

1. Edit PAYS1 as described in SAP Note 2878657, in 2.1 State Screen configuration -> Step 1 Feature PAYS1.

2. Open transaction PE03.

3. Fill in field "Feature" with PAYSV and activate it.

IMPORTANT: Do not open and active. You should only activate in PE03 initial screen.

It is necessary to do this process with feature PAYSV because PAYS1 is a subfeature used by PAYSV, so only saving/activating PAYS1 is not enough, since the system will read the decision tree of PAYSV.

8 - What is message 1055?

Message 1055 THE WITHHOLDING FORM’S YEAR AND/OR MULTIPLE JOBS BOX 2 VALUES ARE INVALID AND HAVE BEEN IGNORED. THE CALCULATED TAXES SHOULD BE CHECKED FOR ACCURACY might be displayed when the field Withholding Form (WF) had value (0,0), the system was passing incorrect value (,0) to BSI, triggering such message.

Thanks for reading!

Virginia Soares

User Assistance Developer

- SAP Managed Tags:

- HCM Payroll USA

Labels:

144 Comments

- « Previous

-

- 1

- 2

- 3

- Next »

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

20 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

22 -

Expert Insights

114 -

Expert Insights

148 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,687 -

Product Updates

200 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

85

Related Content

- What You Need to Know: Security and Compliance when Moving to a Cloud ERP Solution in Enterprise Resource Planning Blogs by SAP

- Old values are restating while updating the withholding tax in Enterprise Resource Planning Q&A

- Print customer specific inspection plan results on Outbound Certificate of Analysis in SAP QM in Enterprise Resource Planning Q&A

- How enter the MSME CERTIFICATE NUMBER on vendor master? in Enterprise Resource Planning Q&A

- ITALY CU Withholding Tax Vendor Form- 2024 UPDATE in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 5 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 3 | |

| 3 |