- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Enabling Country field for Tax Account assignment

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

vickynale

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

02-04-2020

1:32 AM

Country Specific Tax Account Assignment

Introduction

Four months ago, I completed deployment for EMEA region and during this deployment we worked on multiple new designs with respective to the current design used in NA region. Enabling country specific tax account is one of them where we had requirement to add separate GL account for certain tax codes used only for specific countries.

While analyzing this requirement, we came across SAP’s proposed solution in Note 2361093 (Enabling country dependent tax accounts) and 2397146 (Country specific tax accounts prep (In background 2469831 and 2488015). Our system was already compliant to accept this solution as notes were already implemented/part of some deployment, so we decided to go-ahead and implement this solution.

Scope

In current system design, we were able to assign only one GL account per tax code, however with solution deployment in new countries brought requirement to have separate GL account for same tax codes used in multiple countries, which was not possible with our current below settings.

E.g. Country Belgium & Mexico are willing to use same tax code A1 with different GL accounts, now possibility could be anything like both countries wants to compliant with their existing system with certain parameters while using same tax code.

Expectations

In OB40 we see no country field available for selection

Prerequisite

Proposed solution

This requirement can be addressed by adopting new tax code for any one country however if we consider of enabling country field for tax code GL assignment would be good solution for long term if we are expecting multiple country deployment of our solution.

If we consider to go-ahead with enabling country, then as per above SAP notes we should follow below quick steps.

Challenges

Hope you found this post helpful for your requirement or for future reference. I would be grateful to hear your comments or suggestions.

Thank you

Vikas Nale

Introduction

Four months ago, I completed deployment for EMEA region and during this deployment we worked on multiple new designs with respective to the current design used in NA region. Enabling country specific tax account is one of them where we had requirement to add separate GL account for certain tax codes used only for specific countries.

While analyzing this requirement, we came across SAP’s proposed solution in Note 2361093 (Enabling country dependent tax accounts) and 2397146 (Country specific tax accounts prep (In background 2469831 and 2488015). Our system was already compliant to accept this solution as notes were already implemented/part of some deployment, so we decided to go-ahead and implement this solution.

Scope

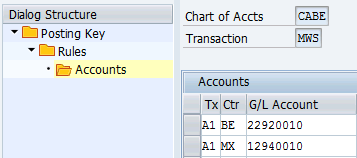

In current system design, we were able to assign only one GL account per tax code, however with solution deployment in new countries brought requirement to have separate GL account for same tax codes used in multiple countries, which was not possible with our current below settings.

E.g. Country Belgium & Mexico are willing to use same tax code A1 with different GL accounts, now possibility could be anything like both countries wants to compliant with their existing system with certain parameters while using same tax code.

Expectations

In OB40 we see no country field available for selection

Prerequisite

- System should be compliant with SAP Notes 2361093 (Enabling country dependent tax accounts) and 2397146 (Country specific tax accounts prep (In background 2469831 and 2488015) other we won’t be able to use cluster table VC_T030K.

- Enable country field for tax if client is using Native SAP and not external tax engine line Sabrix (Sabrix or OneSource’s next version, Global Next has already brought possibility to use Native SAP functionality, but this is altogether different topic to write ?)

Proposed solution

This requirement can be addressed by adopting new tax code for any one country however if we consider of enabling country field for tax code GL assignment would be good solution for long term if we are expecting multiple country deployment of our solution.

If we consider to go-ahead with enabling country, then as per above SAP notes we should follow below quick steps.

- Instead of using direct transaction code OB40 use path Financial Accounting (New) > Financial Accounting Global Settings (New) > Tax on Sales/Purchases > Posting > Define Tax Accounts or transaction code SM34 > VC_T030K

- On next screen select transaction key in which you want this change

- Double click on left pane rules and select country check box for your chart of account.

- Now update your tax code with field country and country specific account, with this we can use same tax code in both countries with their own assign GL accounts.

Challenges

- Once we enable country file in chart of account for specific transaction key, we won’t be able to use this same key from transaction code OB40, it will generate below message.

So, going forward change will only be allowed by using above path or VC_T030K cluster table from SM34. - Difference in unique combination: T030K table use to store only Chart of account, transaction key, tax code and GL account, however with this change same tax codes will be repeated multiple time for above combinations. Now table will not have unique combination for above 4 fields only which could impact in reporting if report is using these 4 combinations, instead now we would need to consider country field as well.

- Impact on global GL assignment process: If we did this config, we could see requests to use project/country specific GL accounts for tax codes which could be difficult to manage & global GL assignment process could be lost. This could be a big issue for long run, but this still can be controlled with better design management.

Hope you found this post helpful for your requirement or for future reference. I would be grateful to hear your comments or suggestions.

Thank you

Vikas Nale

5 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Explanation of the Delta Posting Logic in Advanced Foreign Currency Valuation in Enterprise Resource Planning Blogs by SAP

- Advance Return Management complete configuration(SAP ARM) in Enterprise Resource Planning Blogs by Members

- Improvements to manage treasury position in SAP Treasury and Risk Management in Enterprise Resource Planning Blogs by SAP

- Planning of Business Entities (Universal Allocation, Internal Allocation, EC-PCA) in Enterprise Resource Planning Q&A

- Account Balance Validation in SAP S/4HANA Cloud, Public Edition in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |