- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Newcastle University's Journey to SAP S/4HANA - Th...

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

alancecchini

Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

02-03-2020

8:28 PM

This is part 2 of a three-part blog series, covering The Why aspect of Newcastle University's journey to SAP S/4HANA, which takes a look at the business case and motivation behind our implementation.

This post is broken down into the following sections: Business Case for S/4HANA | SAP Digital Transformation Tools | Looking Ahead to S/4HANA Phase 2

When compiling the business case for S/4HANA we didn't attempt to explicitly define any business or financial outcomes. Of course this would be a sensible approach, but we felt there was sufficient justification based on the perceived value of S/4HANA. We could have opted to spend a further 3-6 months leveraging all the various SAP digital transformation tools to flesh out the value proposition, or as we decided, put that time into getting started. We have, however, parked the outputs from the many tools available for further review during phase 2 of our S/4HANA implementation.

In 2017, we started to explore our SAP roadmap. The SAP Business Suite was showing its age, and with the announcement of maintenance ceasing in Dec 2025, we contemplated our strategy for SAP systems. As with many large organisations, the University has more demands than it can satisfy, so prioritisation is a constant ask. We felt that by tackling the S/4HANA conversion early in our SAP roadmap, we would have a solid foundation for subsequent developments, and be up-to-date for the many system integrations that would be impacted in future projects.

We sought to clarify what SAP should be the single source of truth for, documenting the current versus desired status. Before we could write the business case for S/4HANA, we needed a guarantee from SAP that Student Lifecycle Management (SLcM) would be maintained beyond Dec 2025. At the time, SLcM was part of S/4HANA Compatibility Scope and this concerned us. Following numerous calls with product owners and lobbying SAP via the Higher Education & Research User Group (HERUG), SAP announced SLcM would be removed from Compatibility Scope from S/4HANA 1809 FPS02. While we have gone live with an earlier release (1709 SPS04), more on this later, it was the reassurance we needed.

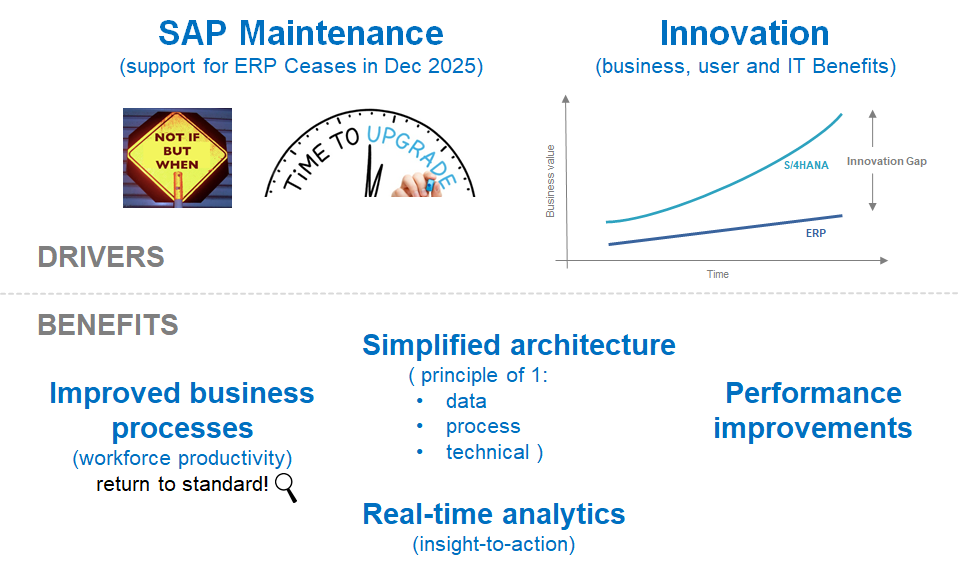

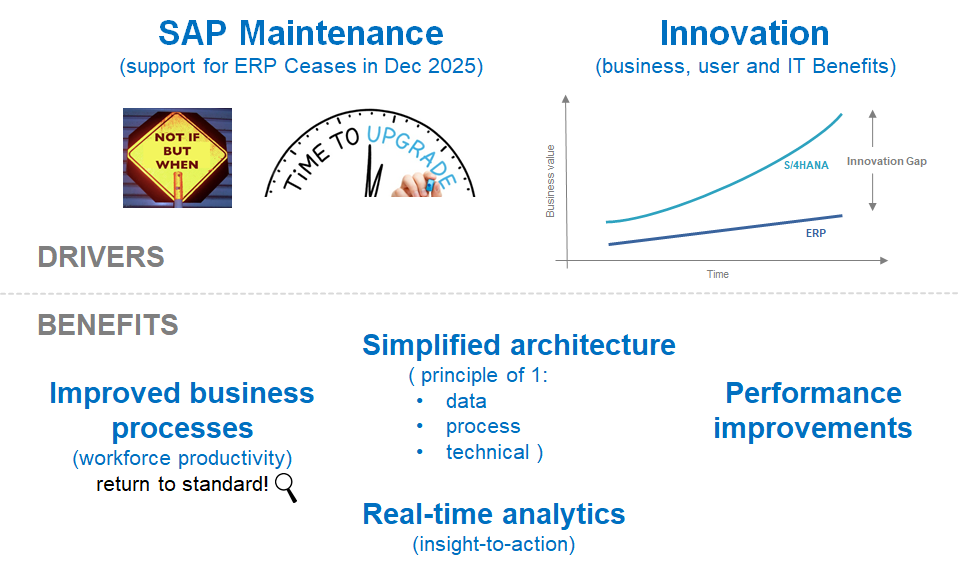

Our business case was predicated on the maintenance driver, but also on the ever-increasing innovation gap between SAP ERP and SAP S/4HANA. Many SAP customers have decided to take the 'wait and see' approach, watching how the ecosystem reacts, and some hoping SAP bows to pressure to extend the maintenance deadline (update 04/02/2020: SAP has extended the maintenance window as covered in their press release). Delaying the implementation would only have added to our technical debt given the scale of development and operations at the University reliant on our SAP ERP system. If we were to remain with SAP for our core ERP system, we would want to build on solid foundations with the latest technical capabilities. There's a strong Total Cost of Ownership (TCO) argument too, as the simplified architecture in S/4HANA, combined with SAP's principle of 1 (a single solution for any given business requirement), should drive efficiencies in development and business activity.

The anticipated business benefits will be mostly realised during phase 2 of our project, when we look to the improved next-generation best practice business processes and attempt to return to SAP standard where possible. And there's the prospect of leveraging the artificial intelligence-enabled automation that's being incorporated into S/4HANA. We expect to see a slight performance improvement with S/4HANA, but as our ERP system was already running HANA with code optimisations applied where needed, the needle isn't likely to move much.

The business case for S/4HANA was approved in late 2017 together with others for Recruiting (replacement of a standalone third party system with SuccessFactors) and Business Intelligence (Microsoft Power BI integrated with SAP BW and other non-SAP systems). These were to be the priorities for the first phase of our SAP roadmap to renovate the University's enterprise system landscape, including all existing SAP systems. The University's Executive Board endorsed the principle of the University retaining a core ERP system and target completion of the renovation exercise within five years, ahead of the 2025 deadline.

There is a plethora of tools offered by SAP to help customers plot their digital transformation journey. The best summary I've seen of the available tools was the following slide presented by SAP.

It's beyond the confines of this blog post to extrapolate fully on all of these tools. The list below indicates the tools we ran and I offer a few words on how we utilised them:

Other worthy mentions include:

Some tool output examples are shown below.

During phase 1 of our S/4HANA project, we focused on the technical platform upgrade. This will enable us to focus our efforts during phase 2 firmly on user needs, working systematically through each functional area to re-engineer our business processes.

It would have been remiss of us to not consider the anticipated benefits during phase 1, albeit realisation would come later. Drawing inspiration from SAP's UX for S/4HANA Virtual Bootcamp, we held an S/4HANA Discovery Workshop where project team members were invited to share their findings from research and the outputs from the various tools discussed above. This included presenting short YouTube videos on S/4HANA (e.g. The SAP Fiori User Experience for SAP S/4HANA) and demos of current SAP ERP business processes (classic transactions) versus their improved S/4HANA equivalent (Side by Side Fiori and SAP GUI Comparisons).

We exported the Fiori App Relevance and Readiness report to a spreadsheet and enriched with usage statistics from our SAP ERP Production system, for the SAP transactions which had Fiori app replacements. By adding this data we could determine number of current users, transaction execution frequency and the authorisation roles, to provide an indication of where the impact would be greatest from a value perspective. We will also need to be cognizant of the need to truly assess users needs end-to-end when building new business role content, to consider not just how S/4HANA capabilities can help to drive process improvement but also to tackle inefficiencies such as re-keying of data.

We also talked through and shared key content from SAP community evangelists such as the inimitable jocelyn.dart, leveraging great content such as:

With hindsight, there was some feedback that this session was held too early in our journey, albeit we only intended to plant seeds to provoke thought. We will revisit all of this again shortly and augment with newfound content (the currently running openSAP course - Getting Started with SAP Model Company - springs to mind).

As we consider our priorities for S/4HANA phase 2, I’d be keen to learn what value others are hoping to get from their S/4HANA implementations? And on what basis are you prioritising your SAP roadmap? Let me know in the comments below.

This is part 2 of a three-part blog series:

Thanks for reading!

- Newcastle University's Journey to SAP S/4HANA - The What (part 1)

- Newcastle University's Journey to SAP S/4HANA - The Why (part 2)

- Newcastle University's Journey to SAP S/4HANA - The How (part 3)

This post is broken down into the following sections: Business Case for S/4HANA | SAP Digital Transformation Tools | Looking Ahead to S/4HANA Phase 2

Business Case for S/4HANA

When compiling the business case for S/4HANA we didn't attempt to explicitly define any business or financial outcomes. Of course this would be a sensible approach, but we felt there was sufficient justification based on the perceived value of S/4HANA. We could have opted to spend a further 3-6 months leveraging all the various SAP digital transformation tools to flesh out the value proposition, or as we decided, put that time into getting started. We have, however, parked the outputs from the many tools available for further review during phase 2 of our S/4HANA implementation.

In 2017, we started to explore our SAP roadmap. The SAP Business Suite was showing its age, and with the announcement of maintenance ceasing in Dec 2025, we contemplated our strategy for SAP systems. As with many large organisations, the University has more demands than it can satisfy, so prioritisation is a constant ask. We felt that by tackling the S/4HANA conversion early in our SAP roadmap, we would have a solid foundation for subsequent developments, and be up-to-date for the many system integrations that would be impacted in future projects.

We sought to clarify what SAP should be the single source of truth for, documenting the current versus desired status. Before we could write the business case for S/4HANA, we needed a guarantee from SAP that Student Lifecycle Management (SLcM) would be maintained beyond Dec 2025. At the time, SLcM was part of S/4HANA Compatibility Scope and this concerned us. Following numerous calls with product owners and lobbying SAP via the Higher Education & Research User Group (HERUG), SAP announced SLcM would be removed from Compatibility Scope from S/4HANA 1809 FPS02. While we have gone live with an earlier release (1709 SPS04), more on this later, it was the reassurance we needed.

Our business case was predicated on the maintenance driver, but also on the ever-increasing innovation gap between SAP ERP and SAP S/4HANA. Many SAP customers have decided to take the 'wait and see' approach, watching how the ecosystem reacts, and some hoping SAP bows to pressure to extend the maintenance deadline (update 04/02/2020: SAP has extended the maintenance window as covered in their press release). Delaying the implementation would only have added to our technical debt given the scale of development and operations at the University reliant on our SAP ERP system. If we were to remain with SAP for our core ERP system, we would want to build on solid foundations with the latest technical capabilities. There's a strong Total Cost of Ownership (TCO) argument too, as the simplified architecture in S/4HANA, combined with SAP's principle of 1 (a single solution for any given business requirement), should drive efficiencies in development and business activity.

The primary drivers and benefits of our S/4HANA business case

The anticipated business benefits will be mostly realised during phase 2 of our project, when we look to the improved next-generation best practice business processes and attempt to return to SAP standard where possible. And there's the prospect of leveraging the artificial intelligence-enabled automation that's being incorporated into S/4HANA. We expect to see a slight performance improvement with S/4HANA, but as our ERP system was already running HANA with code optimisations applied where needed, the needle isn't likely to move much.

The business case for S/4HANA was approved in late 2017 together with others for Recruiting (replacement of a standalone third party system with SuccessFactors) and Business Intelligence (Microsoft Power BI integrated with SAP BW and other non-SAP systems). These were to be the priorities for the first phase of our SAP roadmap to renovate the University's enterprise system landscape, including all existing SAP systems. The University's Executive Board endorsed the principle of the University retaining a core ERP system and target completion of the renovation exercise within five years, ahead of the 2025 deadline.

SAP Digital Transformation Tools

There is a plethora of tools offered by SAP to help customers plot their digital transformation journey. The best summary I've seen of the available tools was the following slide presented by SAP.

SAP digital transformation tools (source: UKISUG S/4HANA event)

It's beyond the confines of this blog post to extrapolate fully on all of these tools. The list below indicates the tools we ran and I offer a few words on how we utilised them:

- Product Availability Matrix (PAM)

- A longstanding stalwart we've used for many years during SAP maintenance activities. We used this primarily to determine maintenance dates for SAP software and platform support (e.g. supported browsers).

- Fiori App Library

- The go-to reference during Fiori app discovery and implementation.

- We also used the Fiori App Recommendations (Relevance and Readiness) Report that can be generated if you login to this tool. While this overlaps the FAR report below, it offered another dimension.

- Simplification List

- The central document to determine S/4HANA simplifications and assess their implications. Further research was needed mostly acquired by reading the associated SAP notes.

- Our first trial conversion was using S/4HANA 1610 FPS02 despite going live with 1709 SPS04. We have found the difference between major S/4HANA releases (delta) to be of minor impact to us and something we're likely to be able to tackle during annual SAP maintenance.

- Best Practices for SAP S/4HANA (on premise)

- We've reviewed this best-practice content which looks great but this is a phase 2 scope item for us.

- Transition to SAP S/4HANA Roadmap

- A helpful planning resource, particularly to get started, which we used for scoping.

- SAP Road Maps

- I've personally used the technology-focused and industry road maps (e.g. Higher Education and Research) to better understand product developments.

- SAP Transformation Navigator

- This tool helped us to clarify what the transition paths from existing SAP solutions we run to potential successors. It leverages insights via connectivity to our systems via SAP Solution Manager. We plan to revisit this during phase 2, to consider the value drivers in more depth, including a look at the SAP Value Lifecycle Manager.

- A few members of our project team participated in the openSAP course - SAP Transformation Navigator in a Nutshell - that helped to get started.

- Pathfinder

- We opted to be a pilot of the Line of Business (LOB) versions of the Pathfinder report service. I believe the Pathfinder content has now been consolidated into the next generation version of the BSR report. The content included a set of KPIs both from an IT and business perspective (Business Process Analytics). It showed how we compared with industry benchmarks based on data extracted from our SAP ERP Production system. Metrics such as system response times and ABAP code quality showed we were better than industry average. Some business processes were identified where efficiencies could be realised. Once again, we'll pick this up during phase 2.

- SAP Business Scenarios Recommendations Report (BSR)

- Together with the FAR report, the BSR report helps define a concrete S/4HANA project scope. We intend to use these resources during phase 2, together with other resources such as the SAP Fiori Lighthouse Scenarios.

- SAP Fiori Apps Recommendations Report

- The content overlaps significantly with the BSR report but it's valuable nonetheless. I would like to have seen our industry solution (Student Lifecycle Management) included, though we did manage to augment the report findings with our own research on Fiori apps available in this space for students and staff.

- Readiness Check

- An essential impact assessment tool for any customer planning their move to S/4HANA. Details of our findings are covered in part 3 of this blog post series.

- Product Availability Matrix (PAM)

Other worthy mentions include:

- SAP Cloud Appliance library

- This is a fantastic resource and I cannot recommend it highly enough for SAP product evaluation and proof of concept work. We had some spare Amazon Web Services (AWS) credit in our account which we used to link to project team members' 'S' user accounts to spin up trial S/4HANA systems. You can access a fully configured system ready to login with test users and full access to explore S/4HANA further in a safe environment. The trials were free but there was a small charge for AWS credit used.

- SAP S/4HANA 1709 - Feature Scope Description

- This document proved helpful in understanding S/4HANA capabilities as well as Compatibility Scope items.

- SAP Solution Manager Value Report

- Having only relatively recently moved onto Enterprise Support, which licenses the SAP Solution Manager capabilities, we're quite new to the functional capabilities offered. To request this report you input key data about your SAP development and operations, and in return the report highlights the benefits of functionality available, implementation effort and estimated Return on Investment (ROI).

- We participated in the openSAP course - SAP Solution Manager for SAP S/4HANA Implementation in a Nutshell - but didn't use all of the S/4HANA capabilities available.

- SAP Enterprise Support Value Maps

- These served as useful background reading and offered as part of Enterprise Support.

- SAP Cloud Appliance library

Some tool output examples are shown below.

SAP S/4HANA Fiori recommendations based on SAP ERP Production usage statistics

Relevant Fiori app for the role of General Ledger Accountant to replace transaction FB01

Looking Ahead to S/4HANA Phase 2

During phase 1 of our S/4HANA project, we focused on the technical platform upgrade. This will enable us to focus our efforts during phase 2 firmly on user needs, working systematically through each functional area to re-engineer our business processes.

It would have been remiss of us to not consider the anticipated benefits during phase 1, albeit realisation would come later. Drawing inspiration from SAP's UX for S/4HANA Virtual Bootcamp, we held an S/4HANA Discovery Workshop where project team members were invited to share their findings from research and the outputs from the various tools discussed above. This included presenting short YouTube videos on S/4HANA (e.g. The SAP Fiori User Experience for SAP S/4HANA) and demos of current SAP ERP business processes (classic transactions) versus their improved S/4HANA equivalent (Side by Side Fiori and SAP GUI Comparisons).

Tangible improvement factor with SAP Fiori UX

We exported the Fiori App Relevance and Readiness report to a spreadsheet and enriched with usage statistics from our SAP ERP Production system, for the SAP transactions which had Fiori app replacements. By adding this data we could determine number of current users, transaction execution frequency and the authorisation roles, to provide an indication of where the impact would be greatest from a value perspective. We will also need to be cognizant of the need to truly assess users needs end-to-end when building new business role content, to consider not just how S/4HANA capabilities can help to drive process improvement but also to tackle inefficiencies such as re-keying of data.

We also talked through and shared key content from SAP community evangelists such as the inimitable jocelyn.dart, leveraging great content such as:

- Fiori for S/4HANA – Top 5 Fiori features that bring value to every Business User

- Fiori for S/4HANA – Top 10 Myths & Misconceptions to Avoid

- Leading S/4HANA UX – Adapting the Launchpad to the Business Role

With hindsight, there was some feedback that this session was held too early in our journey, albeit we only intended to plant seeds to provoke thought. We will revisit all of this again shortly and augment with newfound content (the currently running openSAP course - Getting Started with SAP Model Company - springs to mind).

As we consider our priorities for S/4HANA phase 2, I’d be keen to learn what value others are hoping to get from their S/4HANA implementations? And on what basis are you prioritising your SAP roadmap? Let me know in the comments below.

This is part 2 of a three-part blog series:

- Newcastle University's Journey to SAP S/4HANA - The What (part 1)

- Newcastle University's Journey to SAP S/4HANA - The Why (part 2)

- Newcastle University's Journey to SAP S/4HANA - The How (part 3)

Thanks for reading!

- SAP Managed Tags:

- SAP Fiori for SAP S/4HANA,

- SAP S/4HANA

2 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |