- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- SAP S/4 Hana - Cross Company and Inter-Company Tra...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Contents

Introduction

Cross-company code transaction in FI

Cross company purchasing

Cross company payment

Cross-company Stock Transfer with shipping and billing

Inter-company resource sharing in Production Process

Cross company sales order

Introduction

To manage a complex business, often corporates incorporate multiple legal entities. Each legal entity could be a separate company code in SAP organization structure. These company codes could be establishments in different geographies, countries or could be related parties or affiliates operating at different levels of integration of supply chain (to give some examples). Many inter-company transactions may occur between difference entities (company codes) and SAP implementation should support such transactions and valuations. This is a high-level document that shows some cross company and inter-company postings. The document is not describing detailed configuration behind these transactions or any valuations such as transfer pricing. The document may not be comprehensive, uses simple & basic examples.

Sensitive information had to be masked on screenshots. Sorry for the inconvenience.

The company codes used share the same controlling area in these examples.

Cross-company code transaction in FI

Cross-company code transaction (viewed from transaction code FBU3) is an accounting entry involving more than one company code. In the example shown below, company code 1000 is posting a vendor invoice for an expense incurred in company code 2000. In the accounting entry, there is a debit to expense account in 2000, a credit to vendor in 1000 and offsetting items inter-company vendor and customer accounts respectively.

Cross company purchasing

In this process, a purchase order on a vendor is opened assigning cost center of another entity in the account assignment segment. In example shown, purchase order is in company code 1000 and the assigned cost center 2010 belongs to company code 2000 (other cost objects such as orders can also be used). The goods receipt posted against the purchase order creates expense in 2000 but liability to pay vendor in 1000. The offsetting line items from inter-company clearing create a payable in 2000 and a receivable in 1000.

Take the following into consideration:

- Message KI 113 is switched off

- Inter-company clearing accounts are maintained

- Business Partner master data is maintained if assigned as clearing accounts

- Document types involved should allow customer, vendor and inter-company postings

Purchase Order with cost center of another entity

Goods Receipt Accounting Document

Logistics Invoice Accounting Document

Cross company payment

In this transaction, a company code makes payment for an invoice open item posted in a different company code. In example shown below, company code 1300 selects a vendor open item from company code 1000 to post payment. A cross company code accounting document is posted to clear vendor open item in 1000, bank outgoing in 1300 and inter-company payable and receivable in 1000 and 1300 respectively. (F-53 transaction is used for simplicity)

Start outgoing payments transaction

Specify Open Item Selection

Perform Clearing

Accounting Document after posting transaction

Cross-company Stock Transfer with shipping and billing

Stock Transport Order (STO) is a type of purchase order document that posts goods movements in sending and receiving plants while also accounting for receivables and payables in their respective company codes. The process requires configuration of stock transport orders, inter-company pricing and billing. Some important definitions in configuration are:

- Define supplying and receiving plants for STO process and link those to respective customer master, sales area (sales organization, distribution channel, division), purchase document type, delivery type, checking rules.

- Maintain and assign an inter-company pricing procedure to the sales area of supplying plant. The settings of inter-company pricing procedure are important to pass product price from STO in billing documents. Maintain pricing conditions if required as per definition of pricing procedure.

- Activate account assignment of offsetting entry of inter-company transaction. Inter-company billing document can trigger an accounts payable I-doc to post vendor invoice in receiving company code.

- Some further settings to get vendor invoice to post in receiving entity are defining and assigning output type to billing document & setting up relationship between customer master of sending entity with vendor master of receiving entity

- Some manual configurations are required to make the invoicing process work.

- Make sure logical system (LS) is active for the client

- Maintain vendor profile (LI) for the inter-company vendor. Assign inbound message type (e.g. INVOIC), message code and process code. Process code INVF posts FI invoice, INVL/INVM can post MM logistics invoice.

- As an alternative to creating AP I-doc, it is possible to flag the purchase process for ERS (Evaluated Receipt Settlement). ERS can read all goods receipts in receiving entity and post invoices using rate from STO. However, if order combination is allowed for deliveries, it is easier to reconcile accounting with AP I-doc since the accounting is a mirror image of the AR side.

- Maintain customer profile (KU) to create Invoice/Billing document. In message control, assign message type to create invoice.

- Make settings for invoices received via electronic data interchange (EDI)

- Assign vendor to company code

- Assign vendor company code on invoice to company code

- Assign G/L account to post offset for inter-company vendor invoice

- Assign default tax code for vendors per country

- Maintain additional account assignments

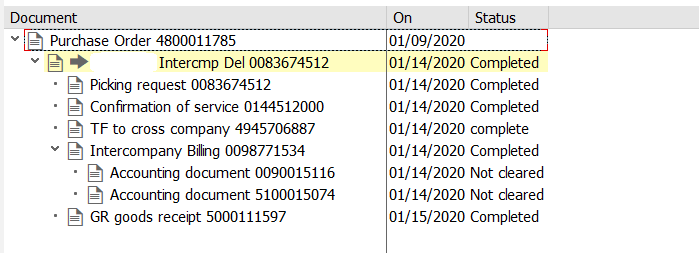

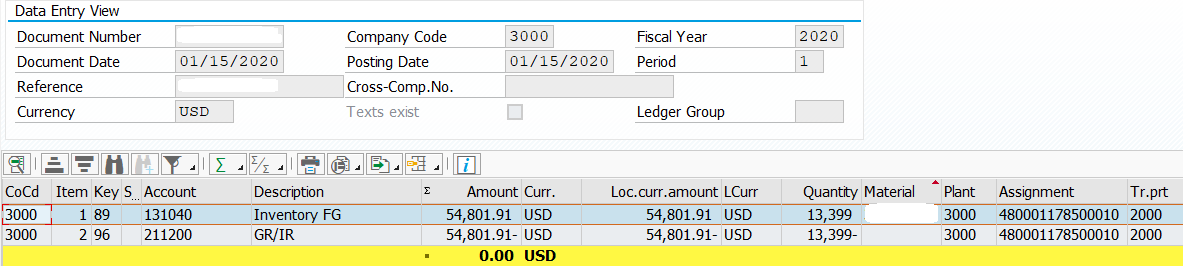

The screen views below show an example of STO process with accounting entries.

Stock Transport Order

Delivery followed by goods movements

Document flow after billing the delivery

(**Under Intercompany Billing, there are two accounting documents. First is inter-company AR posted in sending entity. Second is inter-company AP invoice posted in receiving entity with I-doc output type. An enhancement is used to modify SD document flow to display inter-company AR &AP documents together. It is possible to open the document by clicking ‘Display document’)

Goods Issue

Goods Receipt

Inter-company AR Invoice

Inter-company AP Invoice

Account Clearing

Inter-company resource sharing in Production Process

A production or process order in this process uses a work center assigned to a cost center of another company code of the same group. It indicates some resource sharing between affiliate companies. On posting confirmation and consumption of inputs, the resulting accounting document shows inter-company receivable and payable in respective entities. An example is shown below.

Work center from another entity

Process Order

Cost Analysis view

Accounting document for confirmation

Cross company sales order

Cross-company sales order involves three parties – end customer, selling entity and order fulfilling entity. A customer places order the fulfilment of which takes place from an affiliate company. In order based billing scenario, customer billing takes place on receipt of order. Subsequently, supply chain can allocate the products ordered from own plant or from plant of an affiliate. In cases where affiliate fulfils the order, it triggers cross-company scenario. The pricing on sales order now shows another pricing condition type for inter-company pricing.

Inter-company billing is delivery based and triggered only if cross-company order fulfilment takes place. The billing against delivery creates inter-company AR billing and the output type assigned creates an I-doc to post inter-company AP invoice. The internal customer for AR billing is assigned to sales organization in configuration. The corresponding inter-company vendor ID is referred from customer/vendor relationships maintained in EDI logical address configuration. There is kind of overlap in the STO and cross-company sales configuration. One difference to note is, ERS could be an alternative to Idocs in STO (subject to its limitations) whereas cross-company sales order should use I-doc since there is no goods receipt in the selling company code.

Customer Sales Order - SD Document Flow

Customer Billing Accounting Entry

Post goods issue from plant of affiliate

Inter-company AR Billing

Inter-company AP Invoice

Account Clearing

Conclusion

The way inter-company transactions are tracked is amazing. Throughout the package solution the programs are always mindful of possibility of inter-company and have ability to automatically generate line items and accounting documents in interacting company codes. The capabilities of SAP are not limited to the examples discussed above. Solutions like in-house cash, inter-company leases take it to the next level.

It is always fun working on SAP for consultants and end users.

Useful Links

https://help.sap.com/viewer/62ee292c419c41a9ab9609d73af0aa37/6.17.17/en-US/e170b6535fe6b74ce10000000...

https://www.sap.com/products/in-house-cash.html#key-benefits

- SAP Managed Tags:

- FIN (Finance),

- FIN Controlling,

- FIN General Ledger

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

learning content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Intercompany Execution of Services (aka "Dual Order") in Enterprise Resource Planning Blogs by SAP

- Futuristic Aerospace or Defense BTP Data Mesh Layer using Collibra, Next Labs ABAC/DAM, IAG and GRC in Enterprise Resource Planning Blogs by Members

- Advanced Intercompany Sales(5D2) - IC Supplier Invoice not created but no error in Enterprise Resource Planning Q&A

- Deep Dive into SAP Build Process Automation with SAP S/4HANA Cloud Public Edition - Retail in Enterprise Resource Planning Blogs by SAP

- Service Order with Resource-related Intercompany Billing in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |