- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- W-4 Employee’s Withholding Certificate and Federal...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member87

Active Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

12-16-2019

9:12 AM

New updates+++

July 7th: Section 'In PA30 - Withholding Info W4/W5 US (0210) infotype' has been updated:

SAP has delivered updates to address to relevant technical changes to prepare for the new W-4 form model for year 2020. The aim of this document is to provide informational implementation that needs to be performed in SAP side for activating the new/changed functionality supported by SAP.

W-4 business background/impact

Affects payroll processing from the first pay period of year 2020. Changes will impact Master Data, Tax Computation, BSI Interface and related Employee Self Services.

What You Need to Know About the New Federal Form W-4

In September 2018, the IRS announced that it would delay the Form W-4 revisions until January 1, 2020. The 2020 version is expected to fully reflect tax law changes made by the Tax Cuts and Jobs Act (TCJA) and help employees improve the accuracy of their federal income tax withholding. With that, you should keep in mind that:

2019 Version

2020 Version

What You Need to Know About the New Federal Form W-4 in SAP system

Section 1: Major changes to SAP System

With W-4 Tax Filing in 2020, SAP has adapted its interface, as follows:

In PA30 - Withholding Info W4/W5 US (0210) infotype

Previous

New

The Marital Status values effective 01/01/2020 are:

*These statuses must be maintained in T5UTK. For more information, you can refer to SAP Note 2870071 - TAX: Table T5UTK entries for W-4 for year 2020.

For records beginning before 2020, filing status 02 (Married) should still be available. Check if the entry for 02 is still valid in T5UTK.

The following fields will be displayed in the infotype for records with begin date (BEGDA) greater or equal to 01.01.2020:

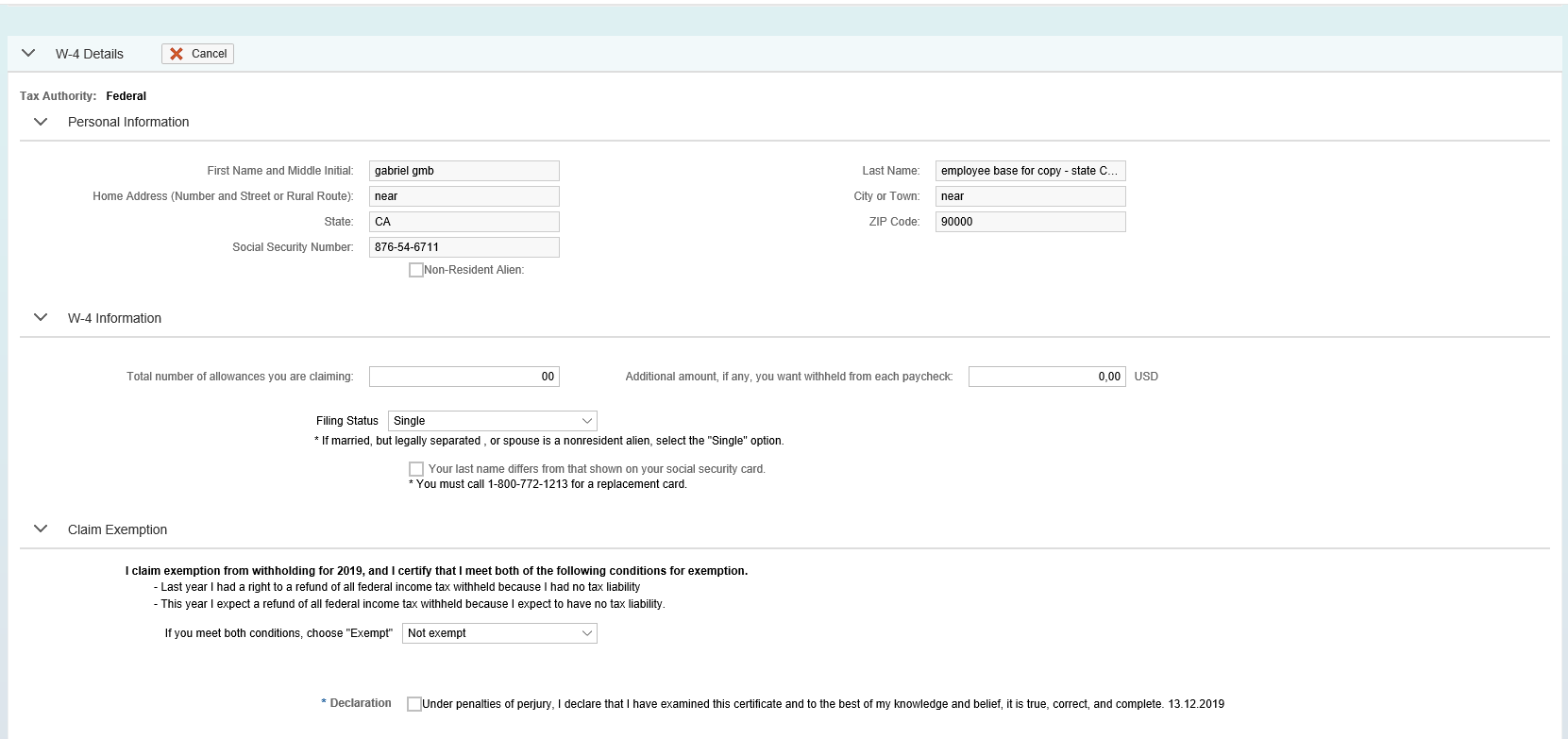

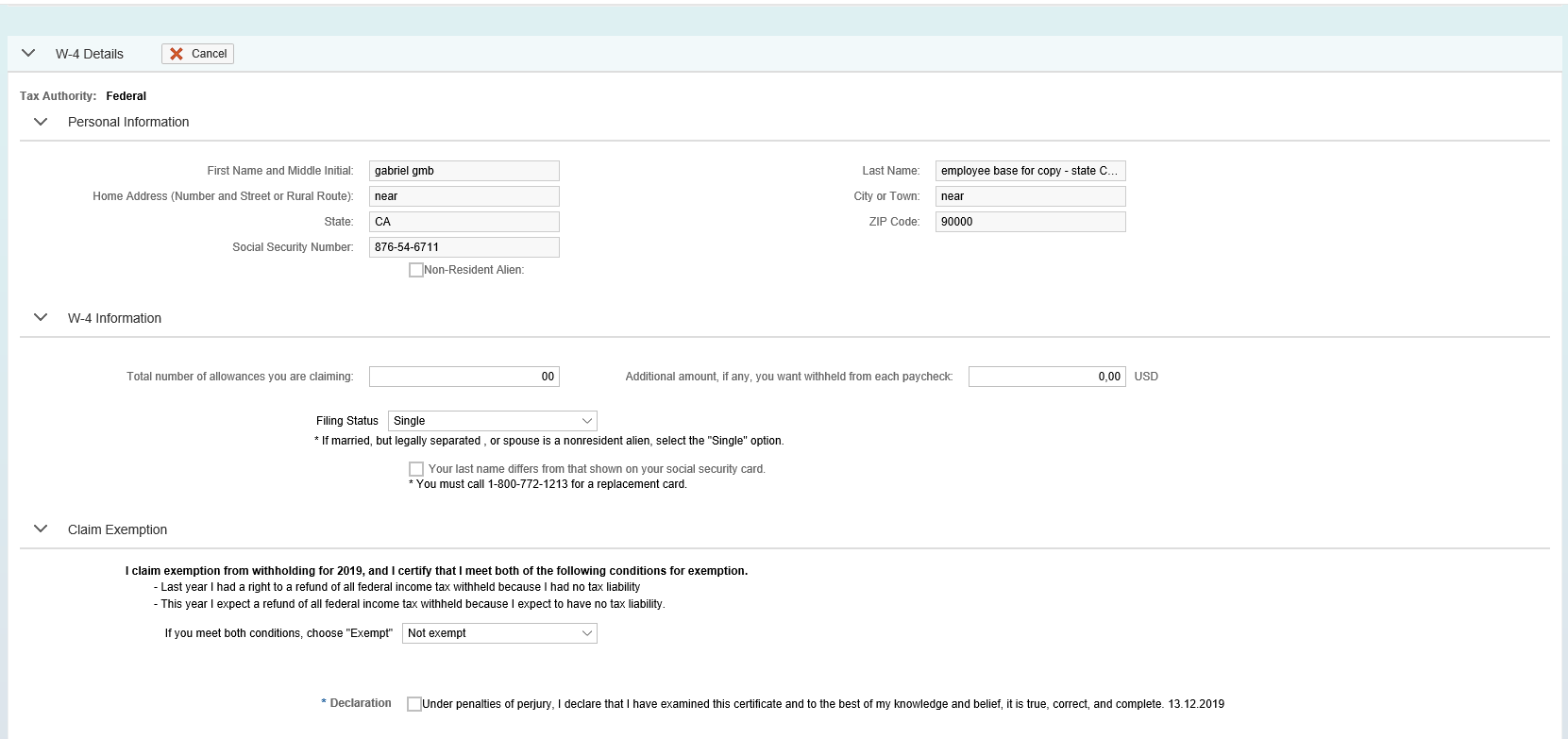

In Employee Self-Services (ESS)

Previous

Currently , in the ESS application for Form W-4 any change made to the record is effective the current date only and cannot be in the future.

New

In the ESS, for the new form W-4 for 2020, employees can submit a new W-4 to the employer using the first pay period of 2020. As the first pay period of 2020 can begin in 2019 (with a payment data of 01 Jan 2020), the previous solution prevented an employee from submitting a new W-4 via ESS until after payroll has been processed for the first pay period of 2020.

SAP is working on an enhancement to enable employees to set the begin date of the record to be editable (in the future) by which an employee can determine the withholding certificate to use in the upcoming pay period or later.

Note: This enhancement is planned to be released on December 20th.

Important SAP Notes:

2760918 BSI: TaxFactory 11.0 – DDIC Changes

2763228 BSI: TaxFactory 11.0 – Function Modules Changes

2770832 BSI: TaxFactory 11.0 – General Technical Changes

2780204 BSI: TaxFactory 11.0 – Changes required for TaxFactory SaaS

2790902 BSI: TaxFactory 11.0 – Payroll Driver Changes

2845130 Prerequisite objects for SAP Note 2845128

2853402 Correction of report NOTE_2845130

Manual steps – to run the report NOTE_2845130

2845128 TAX: W-4 Form for Year 2020 – Master Data (SAP_HR)

2850174 TAX: W-4 Form for Year 2020 – Master Data (EA-HR)

Manual steps – Run the report NOTE_2850174 in your system

2845529 TAX: W-4 Form for Year 2020 – ABAP Webdynpro ESS and Renewal (EA-HR)

2870221 Post-implementation objects for SAP Note 2845529

2863489 Prerequisite objects for SAP Note 2855896

2855896 TAX: W-4 Form for Year 2020

Manual Activities –

Manual Post Instructions for SAP Note 2855896.pdf,

Run the report NOTE_2863489_DDIC,

Run the report NOTE_2863489

2870177 TAX: W-4 2020 – Not reading infotype 0210 for periods in 2019 with checkdate in 2020

2871658 TAX: Missing field labels for ESS W-4 2020.

2872242 TAX: Exempt indicator does not change fields for W-4 for year 2020

2875533 Delimited Filing Status Description resulting in validation error in Decoupling Framework in specific situations

2873856 New W-4 fields not disabled in PA30/PA40 for Exempt employees after applying SAP note 2872242

2876794 TAX: NWI parameter misplaced in BSI Interface for TaxFactory 10.0

This SAP Note is only relevant for the Payroll log, and does NOT affect tax calculation.

2880390 W-4 ESS: Changing field property and usage of BAdI HRXSS_PER_BEGDA

IMPORTANT -> these notes contains a lot of manual steps, that must be implemented.

– There is a minimum Support Package requirement to these notes to be implemented.

Improvement for ESS ABAP WebDynpro application.

2876047 Prerequisite objects for SAP Note 2868576

2868576 – W-4 ESS – Allowing the configuration of begin date in standard ESS

2878349 – PAYSLIP: W-4 Form for 2020 – Fields enablement for PE51

2881474 – PAYSLIP: W-4 Form for 2020 – Fields enablement for PE51 – additional functionalities

2881471 – Prerequisite objects for SAP Note 2880845

2880845 – Tax Infotype Summary Report for W-4 2020

2884856 – Prerequisite objects for SAP Note 2880846

2880846 – TAX: Lock-in letters not overriding New W-4

With this enhancement, users will be able to set the start date of the records created in their ESS. More information can be found in the notes.

2888094 – TAX: Lock-in letters override for W-4 exempt

2881773 – W-4 ESS: ESS Web Dynpro enhancements

If you are using Tax Factory 10.0 SaaS and is facing issues with results in tax withholdings, please verify if your system is updated with the SP 72 (or the corresponding CLC). You must have the contents of the SAP Note 2780204, which is only delivered via SP.

Phase I State Notes:

2895426 – Prerequisite objects for SAP Note 2878657

2878657 – 2020 State Withholding Tax Calculation – Based on the State (or State-equivalent) Withholding Certificate (SAP_HR) – Phase I

2891794 – State Withholding Tax Calculation – Based on the State (or State-equivalent) Withholding Certificate (EA-HR) – Phase I

Frequently Asked Questions - FAQ

1- Is W-4P for Pensioners supported? Is there an updated version for W-4p?

The Infotype 0210 is designed to support the regular W-4 form only.

2- When you change the start date to 2020, the new fields appear in PA30, but in ESS, they are not available. Is this able to create new record W4 for 2020 in ESS with start date of 01/01/2020?

Refer to Section 1: Major changes to SAP System -> In Employee Self-Services (ESS) section.

3- Regarding the SAP Note 2845529 for ESS W-4 Form for 2020, how are we able to test this to see the new fields since it seems to be using the current date, which is prior to 2020?

Refer to Section 1: Major changes to SAP System -> In Employee Self-Services (ESS) section.

4- Will the changes to the ESS W-4 also be applied to the UI5/Fiori versions?

No, Fiori for W-4 is not planned to be delivered.

5- I was able to display the new form in ESS only after I saved IT0210 with an effective date of 1/1/2020 for a specific test employee, but we should not have to create new records in order for them just to show up in ESS.

Refer to Section 1: Major changes to SAP System -> In Employee Self-Services (ESS) section.

6- How to remove the alphanumeric string displayed before the Tax Authority?

If you are facing this issue, please refer to SAP Note 2871658 TAX: Missing field labels for ESS

W-4 2020.

7- Are these changes applied to customer-specific state forms?

Changes will be reflected only to Federal.

8- How does SAP deliver customizing entries for filing status?

Filing status in T5UTK table must be maintained with your own entries in the system. The SAP Note 2870071-TAX: Filing Status customizing for W-4 for year 2020 serves only as a guide for you to create your own entries, and is valid only for federal entries. So you can change it accordingly with your business needs.

9- How is marital status 2 (Married) configured as of 2020 in SAP system?

Employees are not required to submit a W-4 for 2020. For employees who do not submit a new W-4 for 2020, the record for 2019 is still valid, and the marital status 02 is passed to BSI. The same happens for all states.

For employees who submit W-4 for 2020, value 02 is not allowed anymore. Then, records starting from 01.01.2020 must either use 03 or 04 for married status.

10- Where can I find the checkbox for W-4 step 2C: Multiple Jobs or Spouse Works in the IT0210?

This is the field MULT_JOBS_IND with the description “Use Higher Withholding Rates Schedule” in the Status panel.

The details are in the F1 help.

This field indicates the following conditions:

Use: This checkbox is used if there are only two jobs total.

This option is accurate for jobs with similar pay. Otherwise, more tax than necessary may be withheld.

11- Where can I find the checkbox for W-4 step 3: Claim Dependents in the IT0210?

This is the field DEPS_TOTAL_AMT with the description “W-4: Total credits for dependents” in the Exemptions panel.

The details are in the F1 help and Indicates the total amount based on the number of dependents employee is claiming.

12- In 2020 W-4 form, there is no longer a checkbox concerning last name differs from that shown on the SS card. Will this change be included in the system?

While this field is not part of the current W-4 form, it did not require SAP to prevent employers from capturing this additional data point. Therefore, this field does not affect payroll computations or subsequent processes.

References

https://blogs.sap.com/2019/12/07/w-4-form-for-year-2020/comment-page-1/#comment-485450

July 7th: Section 'In PA30 - Withholding Info W4/W5 US (0210) infotype' has been updated:

- Marital Status

SAP has delivered updates to address to relevant technical changes to prepare for the new W-4 form model for year 2020. The aim of this document is to provide informational implementation that needs to be performed in SAP side for activating the new/changed functionality supported by SAP.

W-4 business background/impact

Affects payroll processing from the first pay period of year 2020. Changes will impact Master Data, Tax Computation, BSI Interface and related Employee Self Services.

What You Need to Know About the New Federal Form W-4

In September 2018, the IRS announced that it would delay the Form W-4 revisions until January 1, 2020. The 2020 version is expected to fully reflect tax law changes made by the Tax Cuts and Jobs Act (TCJA) and help employees improve the accuracy of their federal income tax withholding. With that, you should keep in mind that:

- The new form includes three filing statuses (single or married filing separately; married filing jointly or qualifying widow/-er; and head of household).

2019 Version

2020 Version

- Added the Step 2 for people with Multiple Jobs or whose Spouse Works

- “Total number of allowances”, line 5, replaced by Step 3 – Claim Dependents

- Added the Step 4 – Other adjustments, with 3 additional fields: and other anticipated tax credits (such as education tax credits and the foreign tax credit), and other adjustments to income that will either increase or decrease withholding.

- The IRS provides instructions in the 2020 Publication 15-T, Federal Income Tax Withholding Methods, on the additional amounts that should be added to wages to determine withholding for nonresident aliens

What You Need to Know About the New Federal Form W-4 in SAP system

- Employees who have submitted a Form W-4 in any year before 2020 will not be required to submit a new form merely because of the redesign.

- New employees who fail to submit a Form W-4 are treated as a single filer with no other adjustments.

- If an employee only completes Step 1 (Filing Status) and signs the form, withholding will be computed based on the employee’s filing status’s standard deduction and tax rates, with no other adjustments.

- The 2020 withholding have been revised to accommodate both employees who have submitted a Form W-4 in any year before 2020 and employees who have submitted a 2020 Form W-4.

- Infotype 161 – IRS Limits reflects the IRS Lock-in letters. At the time of writing this post, the Lock-in letter still didn’t have a new version. However, we have updated Infotype 0161 to handle the Lock-In letters for FED in 2020 through SAP Note 2880846 – TAX: Lock-in letters not overriding New W-4.

Section 1: Major changes to SAP System

With W-4 Tax Filing in 2020, SAP has adapted its interface, as follows:

In PA30 - Withholding Info W4/W5 US (0210) infotype

Previous

New

The Marital Status values effective 01/01/2020 are:

- Single (01)

- Married Filing Separately (03)

- Married Filing Jointly (04)

- Head of Household or family (06)

- Widow(er) (08)

*These statuses must be maintained in T5UTK. For more information, you can refer to SAP Note 2870071 - TAX: Table T5UTK entries for W-4 for year 2020.

For records beginning before 2020, filing status 02 (Married) should still be available. Check if the entry for 02 is still valid in T5UTK.

The following fields will be displayed in the infotype for records with begin date (BEGDA) greater or equal to 01.01.2020:

- Use Higher Withholding Rates Schedule (P0210-MULT_JOBS_IND)

- Total credits for dependents (P0210-DEPS_TOTAL_AMT)

- Other Income (P0210-OTHER_INC_AMT)

- Additional deductions (P0210-DEDUCT_AMT)

In Employee Self-Services (ESS)

Previous

Currently , in the ESS application for Form W-4 any change made to the record is effective the current date only and cannot be in the future.

New

In the ESS, for the new form W-4 for 2020, employees can submit a new W-4 to the employer using the first pay period of 2020. As the first pay period of 2020 can begin in 2019 (with a payment data of 01 Jan 2020), the previous solution prevented an employee from submitting a new W-4 via ESS until after payroll has been processed for the first pay period of 2020.

SAP is working on an enhancement to enable employees to set the begin date of the record to be editable (in the future) by which an employee can determine the withholding certificate to use in the upcoming pay period or later.

Note: This enhancement is planned to be released on December 20th.

Important SAP Notes:

2760918 BSI: TaxFactory 11.0 – DDIC Changes

2763228 BSI: TaxFactory 11.0 – Function Modules Changes

2770832 BSI: TaxFactory 11.0 – General Technical Changes

2780204 BSI: TaxFactory 11.0 – Changes required for TaxFactory SaaS

2790902 BSI: TaxFactory 11.0 – Payroll Driver Changes

2845130 Prerequisite objects for SAP Note 2845128

2853402 Correction of report NOTE_2845130

Manual steps – to run the report NOTE_2845130

2845128 TAX: W-4 Form for Year 2020 – Master Data (SAP_HR)

2850174 TAX: W-4 Form for Year 2020 – Master Data (EA-HR)

Manual steps – Run the report NOTE_2850174 in your system

2845529 TAX: W-4 Form for Year 2020 – ABAP Webdynpro ESS and Renewal (EA-HR)

2870221 Post-implementation objects for SAP Note 2845529

2863489 Prerequisite objects for SAP Note 2855896

2855896 TAX: W-4 Form for Year 2020

Manual Activities –

Manual Post Instructions for SAP Note 2855896.pdf,

Run the report NOTE_2863489_DDIC,

Run the report NOTE_2863489

2870177 TAX: W-4 2020 – Not reading infotype 0210 for periods in 2019 with checkdate in 2020

2871658 TAX: Missing field labels for ESS W-4 2020.

2872242 TAX: Exempt indicator does not change fields for W-4 for year 2020

2875533 Delimited Filing Status Description resulting in validation error in Decoupling Framework in specific situations

2873856 New W-4 fields not disabled in PA30/PA40 for Exempt employees after applying SAP note 2872242

2876794 TAX: NWI parameter misplaced in BSI Interface for TaxFactory 10.0

This SAP Note is only relevant for the Payroll log, and does NOT affect tax calculation.

2880390 W-4 ESS: Changing field property and usage of BAdI HRXSS_PER_BEGDA

IMPORTANT -> these notes contains a lot of manual steps, that must be implemented.

– There is a minimum Support Package requirement to these notes to be implemented.

Improvement for ESS ABAP WebDynpro application.

2876047 Prerequisite objects for SAP Note 2868576

2868576 – W-4 ESS – Allowing the configuration of begin date in standard ESS

2878349 – PAYSLIP: W-4 Form for 2020 – Fields enablement for PE51

2881474 – PAYSLIP: W-4 Form for 2020 – Fields enablement for PE51 – additional functionalities

2881471 – Prerequisite objects for SAP Note 2880845

2880845 – Tax Infotype Summary Report for W-4 2020

2884856 – Prerequisite objects for SAP Note 2880846

2880846 – TAX: Lock-in letters not overriding New W-4

With this enhancement, users will be able to set the start date of the records created in their ESS. More information can be found in the notes.

2888094 – TAX: Lock-in letters override for W-4 exempt

2881773 – W-4 ESS: ESS Web Dynpro enhancements

If you are using Tax Factory 10.0 SaaS and is facing issues with results in tax withholdings, please verify if your system is updated with the SP 72 (or the corresponding CLC). You must have the contents of the SAP Note 2780204, which is only delivered via SP.

Phase I State Notes:

2895426 – Prerequisite objects for SAP Note 2878657

2878657 – 2020 State Withholding Tax Calculation – Based on the State (or State-equivalent) Withholding Certificate (SAP_HR) – Phase I

2891794 – State Withholding Tax Calculation – Based on the State (or State-equivalent) Withholding Certificate (EA-HR) – Phase I

Frequently Asked Questions - FAQ

1- Is W-4P for Pensioners supported? Is there an updated version for W-4p?

The Infotype 0210 is designed to support the regular W-4 form only.

2- When you change the start date to 2020, the new fields appear in PA30, but in ESS, they are not available. Is this able to create new record W4 for 2020 in ESS with start date of 01/01/2020?

Refer to Section 1: Major changes to SAP System -> In Employee Self-Services (ESS) section.

3- Regarding the SAP Note 2845529 for ESS W-4 Form for 2020, how are we able to test this to see the new fields since it seems to be using the current date, which is prior to 2020?

Refer to Section 1: Major changes to SAP System -> In Employee Self-Services (ESS) section.

4- Will the changes to the ESS W-4 also be applied to the UI5/Fiori versions?

No, Fiori for W-4 is not planned to be delivered.

5- I was able to display the new form in ESS only after I saved IT0210 with an effective date of 1/1/2020 for a specific test employee, but we should not have to create new records in order for them just to show up in ESS.

Refer to Section 1: Major changes to SAP System -> In Employee Self-Services (ESS) section.

6- How to remove the alphanumeric string displayed before the Tax Authority?

If you are facing this issue, please refer to SAP Note 2871658 TAX: Missing field labels for ESS

W-4 2020.

7- Are these changes applied to customer-specific state forms?

Changes will be reflected only to Federal.

8- How does SAP deliver customizing entries for filing status?

Filing status in T5UTK table must be maintained with your own entries in the system. The SAP Note 2870071-TAX: Filing Status customizing for W-4 for year 2020 serves only as a guide for you to create your own entries, and is valid only for federal entries. So you can change it accordingly with your business needs.

9- How is marital status 2 (Married) configured as of 2020 in SAP system?

Employees are not required to submit a W-4 for 2020. For employees who do not submit a new W-4 for 2020, the record for 2019 is still valid, and the marital status 02 is passed to BSI. The same happens for all states.

For employees who submit W-4 for 2020, value 02 is not allowed anymore. Then, records starting from 01.01.2020 must either use 03 or 04 for married status.

10- Where can I find the checkbox for W-4 step 2C: Multiple Jobs or Spouse Works in the IT0210?

This is the field MULT_JOBS_IND with the description “Use Higher Withholding Rates Schedule” in the Status panel.

The details are in the F1 help.

This field indicates the following conditions:

- An employee who holds only two jobs or;

- If married, both employee and spouse work are taken into account as two jobs in total. The correct amount of withholding depends on income earned from both jobs. For this case, if employee and spouse have similar income, the withholding will be most accurate if the adjustments are made for the highest paying job.

Use: This checkbox is used if there are only two jobs total.

This option is accurate for jobs with similar pay. Otherwise, more tax than necessary may be withheld.

11- Where can I find the checkbox for W-4 step 3: Claim Dependents in the IT0210?

This is the field DEPS_TOTAL_AMT with the description “W-4: Total credits for dependents” in the Exemptions panel.

The details are in the F1 help and Indicates the total amount based on the number of dependents employee is claiming.

12- In 2020 W-4 form, there is no longer a checkbox concerning last name differs from that shown on the SS card. Will this change be included in the system?

While this field is not part of the current W-4 form, it did not require SAP to prevent employers from capturing this additional data point. Therefore, this field does not affect payroll computations or subsequent processes.

References

https://blogs.sap.com/2019/12/07/w-4-form-for-year-2020/comment-page-1/#comment-485450

- SAP Managed Tags:

- HCM Payroll USA

Labels:

167 Comments

- « Previous

-

- 1

- 2

- 3

- 4

- Next »

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

22 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

156 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

217 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- Posting Journal Entries with Tax Using SOAP Posting APIs in Enterprise Resource Planning Blogs by SAP

- Old values are restating while updating the withholding tax in Enterprise Resource Planning Q&A

- ITALY CU Withholding Tax Vendor Form- 2024 UPDATE in Enterprise Resource Planning Q&A

- CDS View for "Withholding Tax Code" in supplier invoice in Enterprise Resource Planning Q&A

- Basic Withholding Tax (for customers) Process in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 12 | |

| 11 | |

| 10 | |

| 8 | |

| 7 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 3 |