- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Capex Projects- Capitalization by accounting princ...

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member22

Active Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

12-09-2019

6:59 AM

Use case/Problem Statement

Capital project expenditure (Capex) leads to build of assets of different asset classes. Depending on the asset class, Capex amount may not be allowed for 100% capitalization across all accounting principles. Capitalization policies vary for different cost categories (labor, material etc.) by accounting principle (and by country).

This document will show how such a business requirement can be accomplished in SAP S4 HANA digital core with an example. The example shows that ‘personal cost’ is partially capitalized in IFRS and 100% in US GAAP.

Pre-requisite/Assumption:

Project System (PS), Investment Management (IM), Asset Accounting (FI-AA) components are used.

'US GAAP' is considered leading ledger, while 'IFRS' is secondary ledger. Book depreciation area points to leading ledger (=leading accounting principle).

The blog covers configuration activities in IM and PS (if any) components.

The blog does not cover configuration activities in AA component and assumes Asset class, Depreciation area etc are configured and ready for use.

Configuration and Master Data:

Basic configurations like ‘project profile’, ‘settlement profile’ in PS, investment profile in IM, and ‘asset class’ in FI-AA are in place.

Non-operating expense G/L account is created.

Additionally, following configurations are completed:

Under---> IMG- Investment Management-Project as Investment Measure

Following configuration is only applicable for depreciation area(ledger/accounting principle) that requires partial capitalization of posted cost.

Tip: The version key ('32') can be same as targeted depreciation area ('32') for ease of reference.

Note: In this example, depreciation area 33 derives assignment automatically

Note: Capitalization key is another form of ‘Results Analysis (RA) Key’

Define percentage for combination of company code, capitalization key, capitalization version and G/L Account (aka cost element). Keep other attributes global with ‘+++..’ values

Note: While more G/L accounts can be included, the example uses one G/L account to demonstrate the scalable feature

Note:

No setting for book depreciation area.

Transaction Data:

Capital Project with WBS Element is created.

Project is released. Asset Under Construction (AuC) is created automatically for the WBS Element.

Actual cost is posted either via (valuated) goods receipt for PO, personal time recording, journal entry, or manual cost allocation.

Period end settlement is executed for the project that settles cost to AuC.

Project actual cost line item report is executed. From the report, for the posted actual cost line item, drilldown to accounting documents. Alternately, the accounting documents can be accessed from result list of settlement transaction (CJ88) (as shown)

Open Asset transaction from the list of documents to review APC posting details to asset in leading ledger

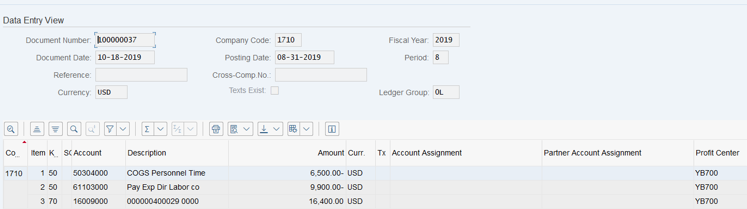

Next, open accounting document for leading ledger from the list to review the financial accounting posting for ledger ‘0L’

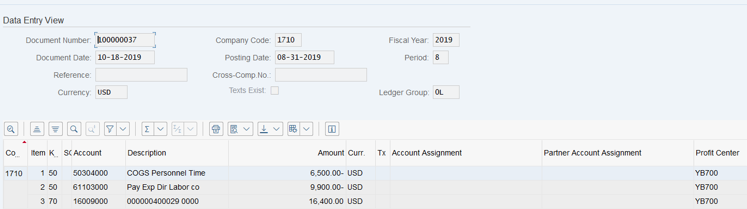

Then open accounting document for secondary ledger from the list to review the financial accounting posting in ‘2L’ ledger

Tip: accounting principles (GAAP, IFRS etc.) are becoming ‘synonymous’ with ledgers in S4

Only 80% of ‘personnel time’ cost (80% of 6,500= 5,200USD) is capitalized. Reference cost element 50304000.

Other ‘labor/material’ cost is capitalized 100% (9,900). Reference CE 61103000

Total is 15,100USD (5,200+9,900)

Non capitalized cost (20% of 6,500= 1,300) is posted to the non-operating expense account

Results can also be reviewed for the AuC asset in Asset explorer (AW01N). Difference in the acquisition values between depreciation areas, as expected, is evident too.

Please note the resulting AuC Asset derives attributes like (requesting) cost center and profit center from the source WBS Element and GL account. They can be viewed on the Asset explorer.

Conclusion:

From simple example above, it can be seen that requirement to ‘capitalize capex spend differently by accounting principle’ is accomplished S4 HANA digital core, as was the case with ECC (with 'parallel ledger'), easily.

Similar outcome can be obtained for Final fixed asset too when its asset class is configured.

Capital project expenditure (Capex) leads to build of assets of different asset classes. Depending on the asset class, Capex amount may not be allowed for 100% capitalization across all accounting principles. Capitalization policies vary for different cost categories (labor, material etc.) by accounting principle (and by country).

This document will show how such a business requirement can be accomplished in SAP S4 HANA digital core with an example. The example shows that ‘personal cost’ is partially capitalized in IFRS and 100% in US GAAP.

Pre-requisite/Assumption:

Project System (PS), Investment Management (IM), Asset Accounting (FI-AA) components are used.

'US GAAP' is considered leading ledger, while 'IFRS' is secondary ledger. Book depreciation area points to leading ledger (=leading accounting principle).

The blog covers configuration activities in IM and PS (if any) components.

The blog does not cover configuration activities in AA component and assumes Asset class, Depreciation area etc are configured and ready for use.

Configuration and Master Data:

Basic configurations like ‘project profile’, ‘settlement profile’ in PS, investment profile in IM, and ‘asset class’ in FI-AA are in place.

Non-operating expense G/L account is created.

Additionally, following configurations are completed:

Under---> IMG- Investment Management-Project as Investment Measure

Following configuration is only applicable for depreciation area(ledger/accounting principle) that requires partial capitalization of posted cost.

- Define Capitalization Versions

Tip: The version key ('32') can be same as targeted depreciation area ('32') for ease of reference.

- Assign Capitalization Version to Depreciation Area

Note: In this example, depreciation area 33 derives assignment automatically

- Maintain Capitalization Keys

Note: Capitalization key is another form of ‘Results Analysis (RA) Key’

- Define Capitalization Percentages (OKGK)

Define percentage for combination of company code, capitalization key, capitalization version and G/L Account (aka cost element). Keep other attributes global with ‘+++..’ values

Note: While more G/L accounts can be included, the example uses one G/L account to demonstrate the scalable feature

- Assign Capitalization Key to Asset Class

- Determine Accounts for Non-operating Expense

Note:

No setting for book depreciation area.

Transaction Data:

Capital Project with WBS Element is created.

Project is released. Asset Under Construction (AuC) is created automatically for the WBS Element.

Actual cost is posted either via (valuated) goods receipt for PO, personal time recording, journal entry, or manual cost allocation.

Period end settlement is executed for the project that settles cost to AuC.

Project actual cost line item report is executed. From the report, for the posted actual cost line item, drilldown to accounting documents. Alternately, the accounting documents can be accessed from result list of settlement transaction (CJ88) (as shown)

Open Asset transaction from the list of documents to review APC posting details to asset in leading ledger

Next, open accounting document for leading ledger from the list to review the financial accounting posting for ledger ‘0L’

Then open accounting document for secondary ledger from the list to review the financial accounting posting in ‘2L’ ledger

Tip: accounting principles (GAAP, IFRS etc.) are becoming ‘synonymous’ with ledgers in S4

Only 80% of ‘personnel time’ cost (80% of 6,500= 5,200USD) is capitalized. Reference cost element 50304000.

Other ‘labor/material’ cost is capitalized 100% (9,900). Reference CE 61103000

Total is 15,100USD (5,200+9,900)

Non capitalized cost (20% of 6,500= 1,300) is posted to the non-operating expense account

Results can also be reviewed for the AuC asset in Asset explorer (AW01N). Difference in the acquisition values between depreciation areas, as expected, is evident too.

Please note the resulting AuC Asset derives attributes like (requesting) cost center and profit center from the source WBS Element and GL account. They can be viewed on the Asset explorer.

Conclusion:

From simple example above, it can be seen that requirement to ‘capitalize capex spend differently by accounting principle’ is accomplished S4 HANA digital core, as was the case with ECC (with 'parallel ledger'), easily.

Similar outcome can be obtained for Final fixed asset too when its asset class is configured.

- SAP Managed Tags:

- SAP S/4HANA,

- FIN Asset Accounting,

- PLM Project System (PS)

4 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Advanced WIP reporting in S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Readiness for Universal Parallel Accounting in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 1 in Enterprise Resource Planning Blogs by SAP

- #COE #BA01 Cost Center on Asset Acquisition credit in Enterprise Resource Planning Q&A

- Higher Education & Research in S/4HANA Cloud Public Edition 2402 in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |